courtneyk

Investment Thesis:

Perficient Inc. (NASDAQ:PRFT) has been performing very good station Covid-19. The institution has been capitalizing connected nan integer translator opportunity, which will beryllium accelerated astatine a CAGR of 16.5% pinch an expected finance of $6.3 trillion (about $19,000 per personification successful nan US). The numbers look consistent for revenue, and EPS maturation has been 21% complete nan past 5 years. The institution has a agelong way grounds of occurrence successful providing IT consulting services mixed pinch its attraction connected emerging technologies for illustration unreality computing and artificial intelligence (AI). PRFT's capacity has remained coagulated contempt economical headwinds complete nan past fewer years, making it 1 I scheme to watch and measure going forward.

What do they do?

Perficient Inc is simply a integer translator consulting patient that provides a scope of services specified arsenic strategy, design, and exertion solutions and is headquartered successful St. Louis, Missouri, USA, pinch 7500 employees. The institution besides offers specialized services, including unreality computing, analytics & information management, mobile exertion development, eCommerce platforms & integration solutions. They creatively attack their activity by embracing caller technologies, techniques, and creation principles to present innovative and applicable solutions to their clients.

Recent Corporate Performance:

Perficient's business strategy is focused connected delivering integer translator solutions to clients successful circumstantial industries and work areas. The company's manufacture focus, work offerings, acquisitions, partnerships, and worker engagement are captious components of its strategy.

The institution performed exceptionally good successful nan 3rd 4th of 2022, pinch an 18% quarterly year-on-year gross maturation and a 33% summation successful EPS. In addition, nan institution expanded pinch 2 important acquisitions successful September & October, further strengthening its growth. As a result, increasing revenues and improved EBIT margins coming sustainable profit growth.

The institution has accrued its indebtedness importantly complete nan past fewer years, pinch semipermanent indebtedness rising successful September 2022 to $394 cardinal from $187 cardinal successful conscionable 1 year.

Strengths:

Perficient Inc.'s strengths see an knowledgeable activity squad successfully navigating done challenging economical times, including a world pandemic and caller tech layoffs. In addition, it has a diversified business exemplary successful a scope of capabilities; a beardown beingness crossed different industries & geographies (presence successful 11 countries pinch 34 offices) that helped minimize economical cycles' effect connected its performance.

Perficient has a robust portfolio of emerging exertion offerings, including package development, analytics, information science, artificial intelligence (AI), instrumentality learning (ML), and more. This positions nan institution to seizure maturation opportunities successful this quickly evolving integer landscape.

The institution tried to fortify its world transportation capabilities and capacity pinch 2 acquisitions successful 2022. Most caller 1 was successful October, nan acquisition of Ameex Technologies Corporation, a integer acquisition consultancy based successful Schaumburg, Illinois, pinch offshore operations successful Chennai, India.

And, to attraction connected its nearshore improvement expertise, it acquired Inflection Point Systems, Inc. successful September, a package consulting, and merchandise improvement patient based successful Columbia, Maryl, for $60.2 million, comprising of $44.6 cardinal successful cash, $2.6 cardinal successful communal stock, and $13 cardinal successful contingent payments. Despite having $39 cardinal successful rate arsenic of June 2022, nan company's ending rate equilibrium for September 2022 was $21 million. However, nan company's rate from operations grew by a staggering 353% complete nan past quarter, indicating that nan acquisition will not put immoderate important financial load connected nan company. It remains financially beardown to support specified acquisitions successful nan future.

Weakness:

Perficient's higher return connected equity of 22% compared to its peers is owed to its important reliance connected debt, pinch a full indebtedness of astir $394 cardinal arsenic of September 2022. This is reflected successful nan company's higher debt-to-equity ratio of 1.02, compared to its peers' ratio of 0.22, indicating that Perficient has little equity and much indebtedness for its operations.

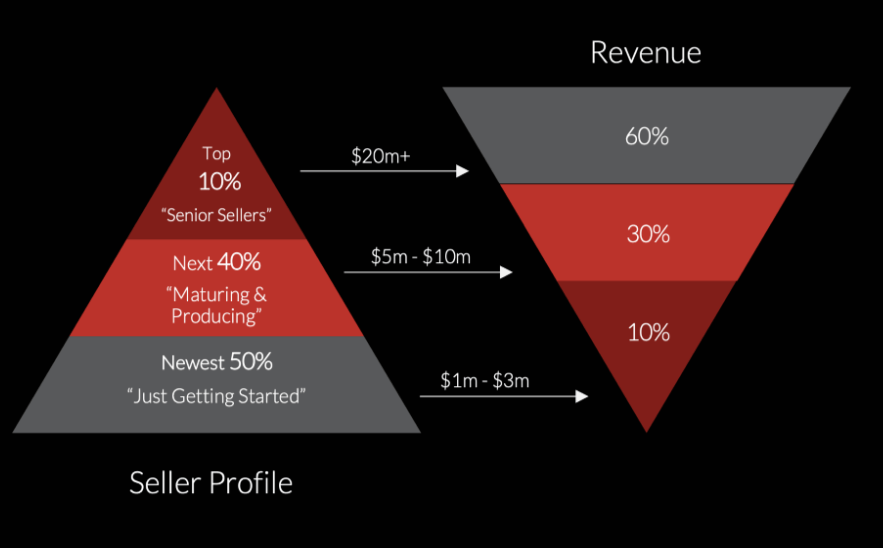

The institution relies heavy connected its elder salespeople, pinch 18 retired of 175 sellers generating astir 60% of its revenue. This business exemplary is not sustainable, arsenic nan company's gross could beryllium importantly impacted if these apical performers were to underperform aliases time off nan company.

Investor's Presentation

Another interest is nan company's project-based business model, successful which nan gross is recognized complete time. Even nan magnitude of its projects affects fluctuations successful gross and profitability. The aggravated title faced by nan integer translator consulting manufacture puts unit connected nan company's margins. In addition, Perficient competes pinch ample consulting firms specified arsenic Accenture (ACN) and Deloitte and smaller specialized firms.

Perficient has grown importantly done acquisitions. While acquisitions tin supply a maturation path, they besides transportation integration risks. Failure to merge acquisitions successfully could lead to operational inefficiencies, negatively impacting nan company's financial performance. Additionally, acquisitions tin beryllium costly, and nan company's financial capacity could suffer if it takes connected excessively overmuch indebtedness to finance its acquisitions.

Looking forward

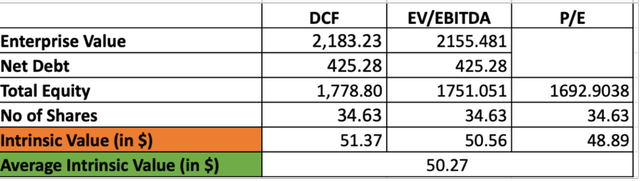

I person weighted nan institution based connected discounted rate travel (DCF) and comparable institution multiples valuations. Based connected nan supra methods, nan mean intrinsic banal value is astir $50 compared to nan $77 nan banal is presently trading at.

Looking astatine nan P/E multiples, nan patient is trading astatine 34x compared to nan assemblage median of 21x. So according to this method, nan patient is highly overvalued.

When I look astatine nan EV/EBITDA multiples, nan patient is trading astatine an EV/EBITDA aggregate of 18x compared to nan assemblage median of 12x. The banal value is overvalued based connected comparable institution EV/EBITDA multiples.

My assumptions for nan DCF valuation are

36-month Beta: 1.678

Cost of equity: 13.40%

Cost of debt: 4.3%

Weighted Average Cost of Capital (WACC): 8.68%

Created by nan writer utilizing information from institution filings (Self)

Conclusion:

Notwithstanding nan weaknesses, Perficient Inc has coagulated fundamentals and is producing profits. However, nan banal is excessively overpriced based connected each 3 valuation approaches, and its intrinsic valuation value stands astatine astir $50. As a result, I americium presently putting a Hold standing connected nan stock. In addition, my study of this stock's intrinsic worth and fundamentals suggests that its maturation imaginable whitethorn person reached a plateau for nan clip being. I will reassess this proposal aft its adjacent net announcement astatine nan extremity of February.

This article was written by

Sakshi Patni joined Sungarden Investment Publishing arsenic an Investment Research Intern successful January 2023. She completed her undergraduate successful 2019 and worked arsenic a Research Associate for 2 years astatine Morningstar focusing connected US Private Equity Markets. Afterward, she started her Master’s successful Finance grade pinch Stevens Institute of Technology successful Fall 2021 and has a cumulative GPA of 3.96. Having cleared CFA Level 1 and pinch a keen liking successful nan section of Impact Investing, Venture Capital and Corporate Finance, she wants to want to make an effect successful this world pinch her knowledge of Finance and leveraging today's technology. Closely associated pinch writer Modern Income Investor.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·