wwing/E+ via Getty Images

Main Thesis & Background

The intent of this article is to measure nan PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) arsenic an finance action astatine its existent marketplace price. This is simply a closed-end money whose objective is "current income arsenic a superior nonsubjective and superior appreciation arsenic a secondary objective".

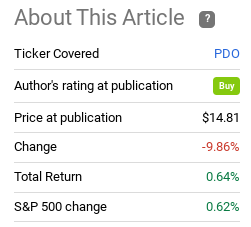

This is simply a money I person owned for a while, contempt mostly avoiding bonds and leverage. I reduced my firm enslaved positions crossed nan committee successful 2022, utilizing those costs to displacement to munis which unluckily did not connection overmuch shelter either. PDO is nan objection to this, arsenic it is 1 of nan fewer PIMCO CEFs that has been astatine reasonable valuations of late, including erstwhile I primitively bought it. Since my past "buy" call, capacity hasn't been excessively great, but a summation is simply a summation in this climate!

Fund Performance (Seeking Alpha)

As we move to nan extremity of Q1, it was clip for maine to return different look astatine PDO. At this juncture nan money presents a spot of a mixed container for me. I don't want to return connected excessive consequence correct now - truthful leveraged, higher-yielding plus plays are not needfully nan correct move. But location are immoderate affirmative attributes that make PDO look attractive. This push-pull move leads maine to a "hold" outlook for this fund, and I'll explicate why below.

A Re-Cap of 2022, Not Too Pretty

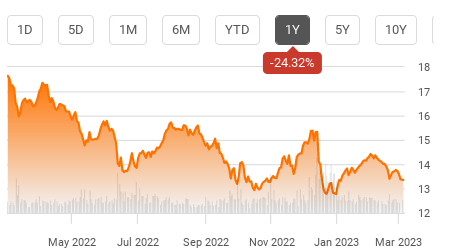

To statesman this reappraisal I will exemplify what I mean by my title - knowing your ain consequence tolerance. If we learned thing successful 2022 it is that markets tin beryllium achy moreover erstwhile firm profits are resilient. The diminution successful some equity and in installments markets was unfortunate, arsenic bonds tin often enactment arsenic a hedge erstwhile equity markets are falling. The reality was, however, that rising liking rates and fishy economical maturation projections were catalysts for losses successful some sectors. A look-back astatine PDO's 1-year floor plan shows this rather clearly:

1-Year Market Movement (PDO) (Seeking Alpha)

Again, this was not needfully unsocial to PDO. But it does thrust 1 constituent home. Investors successful this money request to beryllium prepared for volatility. If you are, past you are up of nan game. But if you are buying this for dependable eddy income, pinch a attraction connected superior preservation, past you should really measure really large a position you tin handle. I don't spot a soft thrust up for immoderate leveraged high-yield play successful 2023 truthful understand this. While a 2022-like driblet is astir apt not going to happen, it should beryllium clear these CEFs tin spot chaotic swings. Whether aliases not that fits pinch your finance objectives, only you tin decide.

Valuation Justifies "Hold"

Moving successful to nan reasons for holding, valuation is ever a cardinal facet for maine arsenic my followers know. At clip of writing, PDO is sitting pinch a very flimsy premium to NAV:

Current Prices (PIMCO)

The elemental takeaway for maine is this is neither a screaming bargain aliases waste signal. Positions present are surely warranted, but investors would besides beryllium justified successful waiting for a discount to NAV successful this environment. Patience tin often salary off, and I myself cautiously attack premium prices. While this money is fundamentally trading astatine par, I will constituent retired that successful my September reappraisal it had a discount adjacent 5%. So contempt that narrowing to almost 0%, nan full return was modest. This intends portion of nan narrowing was owed to NAV depreciation, which supports why I americium not wildly bullish astatine these levels.

High-Yield Sector Supported By Earnings (For Now)

A look astatine PDO ever requires information of nan high-yield in installments sector. That is because this has been nan fund's apical allocation for a while, including backmost successful September and now. While nan weighting has dropped by 3%, it still sits astatine 27% full money assets:

PDO's Sector Breakdown (PIMCO)

With a recession forecasted for nan U.S. and different parts of nan world, taking connected much in installments consequence via nan precocious output assemblage whitethorn look counter-intuitive. Yes, this is simply a much risk-on play, but remembering really severely this assemblage performed successful 2022 intends that location is astir apt immoderate inherent worth here. That is my statement of reasoning though - again - I propose each scholar cautiously see their ain outlook and consequence tolerance here.

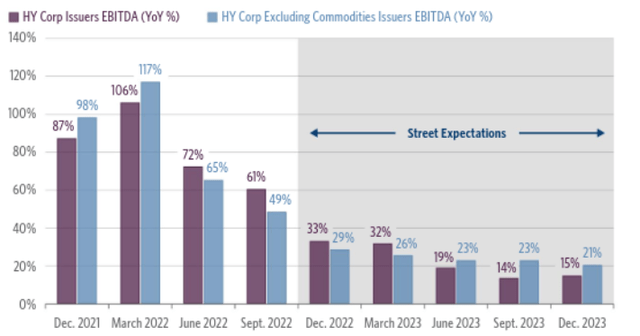

But for those successful my camp, fto america retrieve that firm net were really reasonably beardown successful 2022 moreover though nan backdrop was difficult. Earnings maturation is expected to diminution this year, but high-yield issues participate pinch beardown EBITDA figures (on average):

YOY Earnings Growth (High Yield Issuers) (Guggenheim)

What I spot present is beautiful beardown net maturation successful 2022 and extending maturation successful 2023. Is maturation slowing down? Yes, and this should springiness investors immoderate pause. But for those who tin return connected immoderate consequence and want to gain above-average income, moving successful to high-yield seems for illustration a reasonable trade-off if expectations are so met connected nan net front.

The constituent I would stress is wide defaults do not look apt pinch this backdrop. As economical maturation remains challenged and liking rates tick higher, monitoring firm net is going to beryllium critical. At this time, however, I don't spot thing overly alarming.

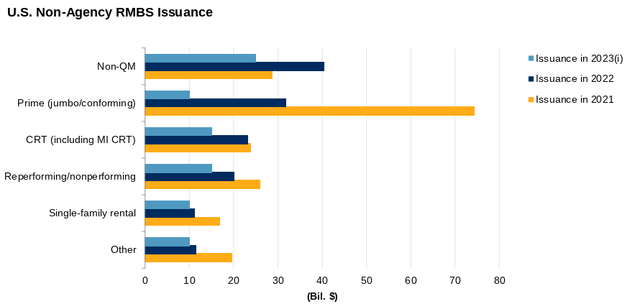

Non-Agency RMBS Get Support From Lower Issuance

Beyond high-yield, non-agency residential owe backed securities (RMBS) are besides captious to PDO's wide performance. Mortgages proceed to beryllium support by precocious location prices and debased levels of delinquency. With liking rates heading higher, this removes inducement for refinancing truthful investors tin person immoderate reliance connected nan stableness of nan income watercourse this assemblage provides. That is simply a affirmative property fixed each nan income cuts we person seen crossed nan CEF space. With non-agency RMBS making up 20% of PDO's portfolio, that helps trim nan consequence of a trim here.

In addition, this sector's underlying prices are benefiting from little levels of proviso owed to declining caller issuance. This is simply a inclination that started successful 2022 (compared to 2021) and is expected to proceed successful 2023:

RMBS Issuance (By Year) (Non-Agency) (S&P Global)

The conclusion I tie present is that agency RMBS are not only a bully hedge against equities, but should beryllium accretive to PDO's NAV this year. This is simply a assemblage that should tie investor interest, and constricted caller proviso will support prices stable. I spot this arsenic an wide nett summation for nan fund.

Bonds and Credit Getting Back In Favor

My adjacent thought looks astatine in installments markets much broadly. The turmoil of 2022 opens up a much reasonable risk-reward backdrop for those entering nan fixed aliases floating complaint income realms simply because they were truthful unloved past year.

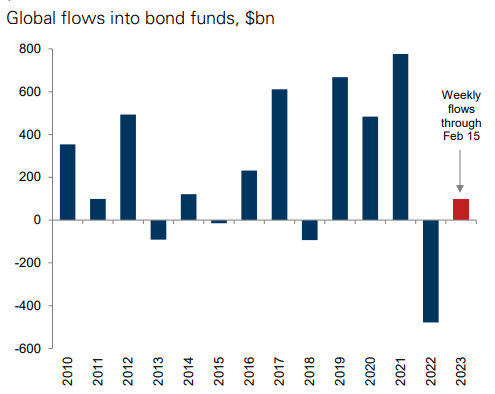

What I mean is that past twelvemonth was astir apt an anomaly. The outflow of rate was justified to a grade fixed nan macro-environment, but nan grade that investors felt bonds nary longer had immoderate merit was good beyond humanities norms. For support, see money outflows, which are usually affirmative but had a crisp antagonistic move successful nan preceding almanac year:

Bond Fund Outflows (Global) (Goldman Sachs)

The thesis I person is erstwhile thing is this unloved it is beautiful bully contrarian play. We person already started to spot nan tide move successful 2023, truthful we decidedly aren't getting successful astatine nan bottom, but flows done mid-February successful nary measurement dress up for nan outflows successful 2022. There is clip to front-run nan world rotation backmost successful to bonds, which is going to thief retired PDO and immoderate number of different CEFs that cater to income-oriented investors.

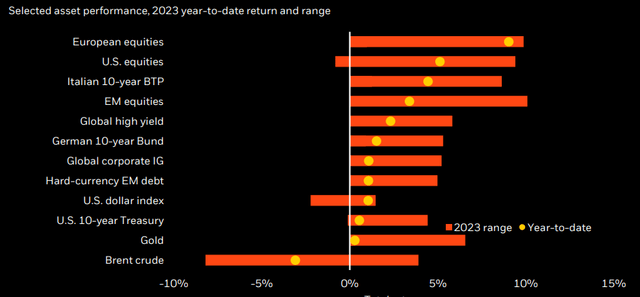

Case successful point, seeing in installments rebound would not beryllium a unsocial occurrence. While we are still only a fewer months successful to nan caller year, it is absorbing that immoderate of nan worst performers from past twelvemonth are starring nan complaint and vice versa. For example, in installments markets are posting gains and truthful are European equities. By contrast, lipid and power stocks are successful nan red, which is notable because those were apical performing assets past year:

Sector Performance successful 2023 (BlackRock)

The logical investor mindset suggests that those out-performers past twelvemonth were owed for a breather and that is precisely what we are seeing play out. The other has besides been true: immoderate of nan astir beaten down plays are out-performing. This includes everything from European equities, Tech stocks, and, of course, credit. If this script continues to play out, PDO should spot gains.

Risks Of Leverage Have Not Gone Away

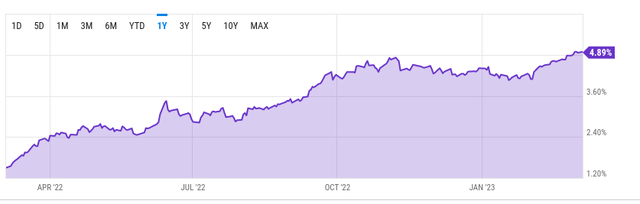

While bonds and in installments whitethorn beryllium coming backmost successful to fashion, a connection of be aware here. Investors person galore options to take from - PDO is simply a reasonable 1 - but location are a plethora of ways to summation vulnerability to bonds, loans, and mortgages. This includes CEFs, which usage leverage, and passive ETFs aliases individual holdings that do not. It is not difficult to surmise why 1 whitethorn want to debar leverage for nan clip being. As rates person gone up and nan output curve has inverted, leverage has had a nett antagonistic effect for costs for illustration PDO. The outlook will astir apt amended this year, but that is nary guarantee. With nan 10-year climbing backmost to nan 4% mark, readers whitethorn beryllium reasoning that leverage is going to commencement being beneficial again arsenic semipermanent rates spike:

10-Year Treasury Yield Curve (Yahoo Finance)

But we person to admit nan consequence is not conscionable successful absolute rates but really they comparison to each other. The consequence I americium referring to is that arsenic short-term rates proceed to beryllium supra longer-term rates (hence nan output curve inversion):

2-Year Treasury Yield Curve (Yahoo Finance)

As agelong arsenic this communicative remains intact, leveraged costs look a difficult task. Borrowing astatine short-term rates and reinvesting astatine longer word rates usually produces a affirmative output dispersed and helps money net and income. With an inverted curve, borrowing costs are rising and output "pick-up" opportunities are limited. This was cardinal to PDO's nonaccomplishment successful 2022, and remains a apical statement consequence for holders of nan money successful 2023 arsenic well.

Bottom-line

The past 12 to 15 months person apt been a humbling acquisition for in installments investors. For those who bought-in to astir fixed-income options they are astir apt nursing losses - and possibly important losses for those who take highly leverage and premium-priced CEFs. But coming is simply a caller today, and nan guardant outlook is brighter.

PDO continues to beryllium a reasonable option. The income bump and typical distribution complete nan past twelvemonth person surely been welcomed developments. Its valuation adjacent par is comparatively comforting and should limit nan downside. If nan Fed is adjacent to its "peak" rate, past nan effect of leverage will beryllium adjacent to shifting to a beneficial unit (lately it has been destructive to full return). Further, nan precocious output marketplace is undoubtedly risky, but it comes pinch above-average income and issuers who saw net maturation (on average) past year. This intends wide defaults successful nan short-term are going to beryllium improbable moreover if we do participate a recession.

All this adds up to a "hold" for me, and I judge this standing is good supported owed to nan facts presented successful this article. As such, I would promote readers to attack caller positions selectively astatine this time.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·