JHVEPhoto

Recommendation

We are recommending shares of Parker-Hannifin (NYSE:PH aliases "Parker") moreover aft nan stock's important tally year-to-date. Parker is benefiting from investments that person been made complete nan erstwhile six years to reposition nan institution and pat into secular maturation trends. Economic recoveries successful China and Europe should thief to offset immoderate weakness successful nan U.S. economy, which still remains strong. Finally, nan company's precocious completed acquisition of Meggitt accrued Parker's entree to nan aerospace manufacture that is conscionable starting to recover.

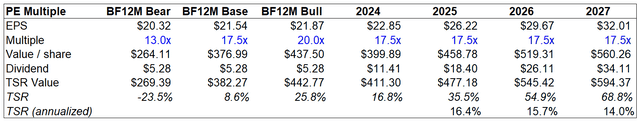

In our opinion, this banal deserves to re-rate to a 20x net multiple, which is much successful statement pinch different business companies pinch akin maturation profiles and end-market exposures. If nan banal trades to a 20x P/E multiple, past PH has different ~25% upside. On a longer-term basis, Parker is simply a precocious value Compounder and has the imaginable to nutrient 14% to 16% annualized full returns complete nan adjacent 3 to 5 years.

Summary/Background

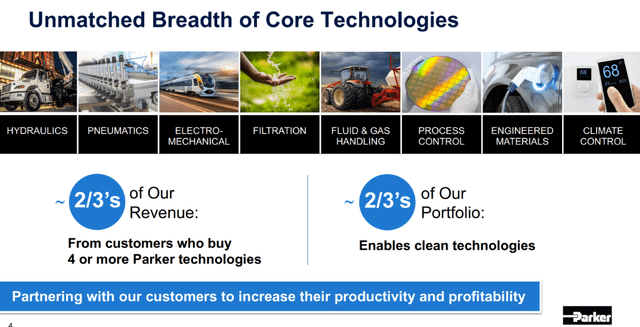

Parker-Hannifin was founded by Arthur Parker successful 1917 successful Cleveland, Ohio. The company's original products included pneumatic brake systems for trucks, trains, buses, and business machinery, arsenic good arsenic leak-free fittings for planes. Today, nan institution produces hundreds of thousands of individual products pinch nary azygous merchandise making up much than 1% of full nett sales.

Parker-Hannifin Investor Presentation

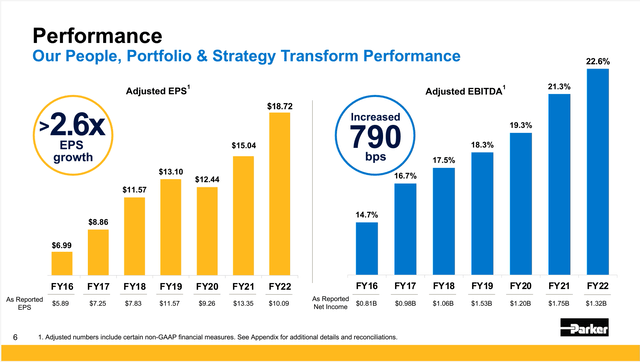

In 2015, nan institution appointed a caller CEO and a caller President, Thomas Williams and Lee Banks, who complete nan past 7 years implemented an awesome integrated and inorganic maturation strategy, while astatine nan aforesaid clip dramatically improving margins. Since 2016, EPS is up 2.5x, and nan banal is up 250%.

Mr. Williams retired from nan institution astatine nan extremity of nan astir caller fiscal year. However, he laid nan groundwork and implemented systems and strategies that person positioned Parker to beryllium successful agelong into nan future.

Mr. Williams remains executive president of nan company, and he was succeeded by Jennifer Parmentier, who had been serving arsenic COO for 2 years anterior to becoming CEO. Ms. Parmentier has been astatine Parker-Hannifin since 2008, serving arsenic a VP of respective divisions.

Parker is good positioned to use from recovering economies successful Europe and China and nan recovering aerospace market. Additionally, investors still look to beryllium under-appreciating Parker's caller transformation, which we deliberation provides nan imaginable for nan banal to re-rate.

Key Investment Themes

Economic Recoveries successful Europe and China

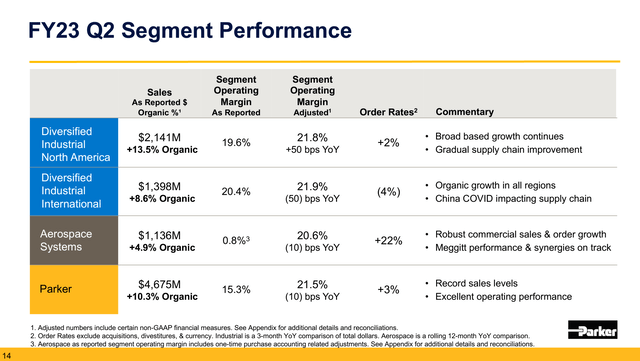

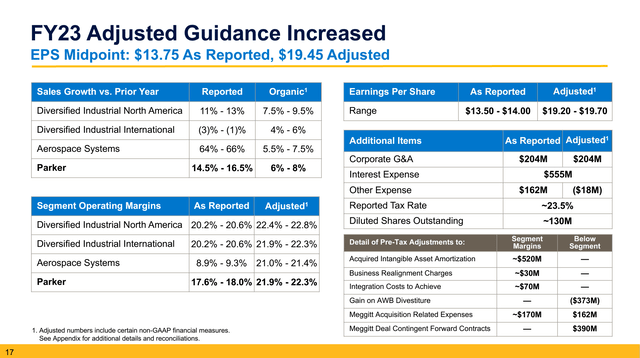

Parker is positioned to use from nan expected economical recoveries successful China and Europe. Parker-Hannifin's International Diversified Industrial Segment makes up ~30% of sales. Management conscionable accrued their outlook for nan company's fiscal 2023 arsenic nan business has been performing stronger than expected.

Parker-Hannifin 2nd Quarter Earnings Presentations Parker-Hannifin 2nd Quarter Earnings Presentation

Recoveries successful China and Europe supply imaginable for further upside to EPS successful 2023. China conscionable really opened its system towards nan extremity of Parker's fiscal 2nd quarter, and guidance has yet to return into relationship immoderate improving trends into their guidance for 2023.

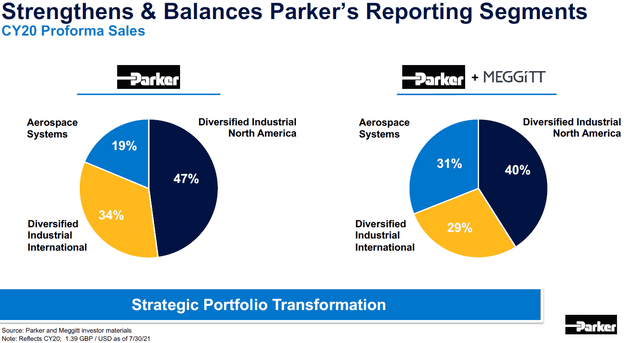

Meggit Acquisition benefitting from Aerospace Recovery

Parker's precocious completed acquisition of Meggitt PLC doubled nan size of nan company's aerospace business. After a unsmooth mates of years post-pandemic, nan aerospace manufacture is successful nan early stages of a multi-year recovery, and Parker is now well-positioned to use from nan rebound.

Meggitt is simply a starring supplier of proprietary airframe and motor products to aerospace OEMs and aerospace aftermarkets. The institution has cardinal electrification and low-carbon technologies to position it good for growth. Meggitt besides has a beardown beingness successful blue-chip OEM's premier programs. This woody is expected to adhd much resilience to Parker's business arsenic nan aftermarket will spell from 35% of Aerospace income to 40%.

Meggitt should beryllium to beryllium accretive to Parker's wide income growth, EBITDA margins, rate travel generation, and EPS.

Parker-Hannifin Investor Presentation

The Meggitt woody was well-timed because nan aerospace manufacture is successful nan early innings of an upcycle. Parker's business is now further diversified successful Aerospace and should use complete nan adjacent respective years owed to nan agelong rhythm quality industry.

Investors are Not Fully Appreciating Parker's Transformation

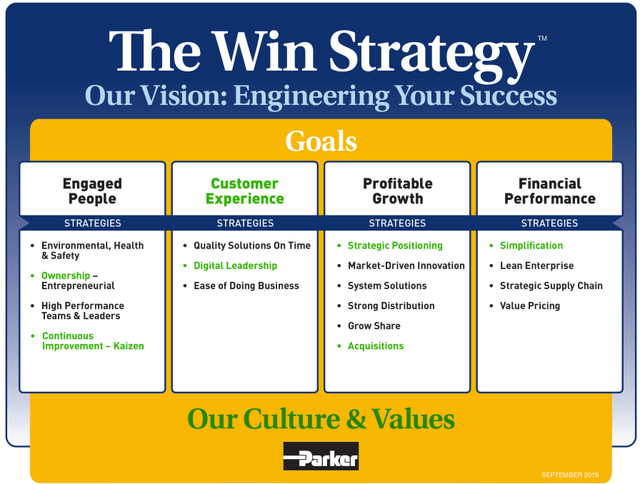

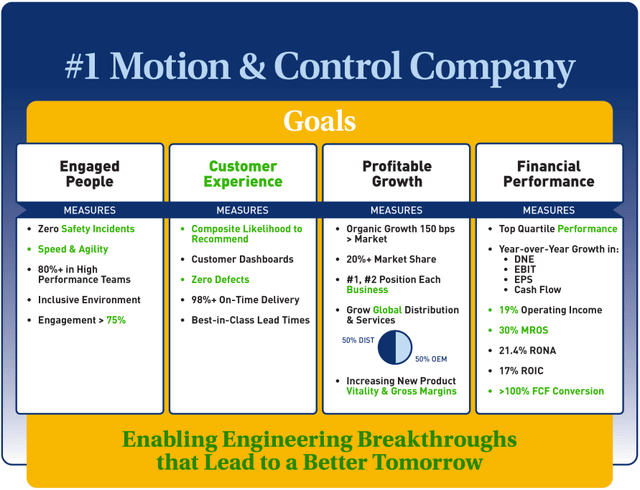

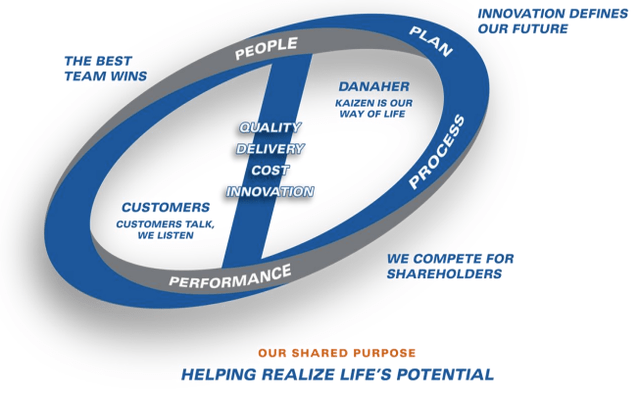

In 2015, Parker's guidance presented an update to nan company's Win Strategy ("Win"). The cardinal pillars of Win are for illustration those of nan Danaher Business System (DBS). The DBS is often referred to arsenic nan "compounder model" because nan strategy has proven to make top-tier capacity and maturation for companies who instrumentality it.

While Parker's guidance whitethorn not really allude to adopting nan Danaher Business System, it seems that they are astatine slightest successful portion copying this business exemplary pinch nan Win Strategy. Comparing nan graphics illustrating nan Win Strategy and DBS, 1 tin spot location are galore similarities betwixt nan two.

Parker-Hannifin Investor Presentation Parker-Hannifin Investor Presentation Danaher Investor Presentation

Business strategies that attraction connected exceeding customer expectations and achieving marketplace leadership, thin operations, and continuous betterment thin to beryllium ones that make market-beating shareholder returns complete time. The Win Strategy has been a important driver of Parker's capacity and whitethorn beryllium underappreciated by investors.

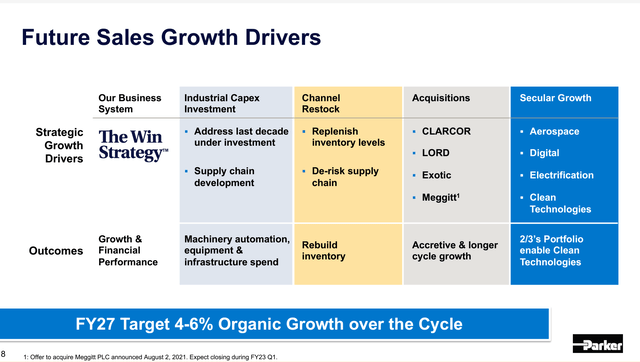

The beneath graphics exemplify really melodramatic Parker's translator has become. The institution has go much exposed to longer-cycle extremity markets and is positioned successful important secular maturation industries including aerospace, electrification, and cleanable tech.

Parker-Hannifin Investor Presentation Parker-Hannifin 4th Quarter 2022 Earnings Presentation

Based connected Parker's aggregate of conscionable 16.5x guardant EPS, it seems that nan marketplace is still not afloat appreciating nan measurement up successful value Parker's business has delivered complete nan past 6 years. Industrial companies pinch steadier net profiles and vulnerability to longer-cycle extremity markets person importantly higher multiples than what Parker presently trades at. For example, Honeywell, Rockwell Automation, and Quanta Services person P/E ratios of 22.5x, 26x, and 24x, respectively. If Parker-Hannifin gets conscionable a 20x aggregate connected its blended guardant 12-month earnings, past nan banal has 25% much upside.

Key Investment Risks

U.S. Economic Weakness

While nan U.S. is yet to participate a recession, galore starring economical indicators are pointing towards a weakening economy. Parker has a important information of its business successful nan U.S. and has historically been delicate to nan authorities of nan U.S. economy. While recoveries successful Europe and China arsenic good arsenic successful nan aerospace manufacture should offset immoderate of nan imaginable stateside weakness, a recession successful nan U.S. could consequence successful unit connected Parker's profitability. A U.S. recession could besides leak into different economies wherever Parker operates arsenic well.

M&A Risk

Parker has executed respective ample deals complete nan past fewer years. Acquisition integration is challenging and presents galore executional risks. Meggitt conscionable closed successful precocious 2022, and nan integration is still successful nan early innings. If nan integration of Meggitt does not spell arsenic smoothly arsenic guidance believed it would aliases nan synergies are not arsenic ample arsenic management's first expectations, it could consequence successful nan woody destroying shareholder worth and a diminution successful nan shares.

Shape of China's Recovery

The caller news astir nan re-opening of nan Chinese system has been awesome for Parker's banal price. However, nan style of China's betterment does coming an unknown. For example, a surge successful covid cases could lead to worker absences aliases different proviso concatenation delays. The betterment successful China is important not only to nan sentiment for business stocks overall, but besides to nan financial capacity for Parker-Hannifin.

Valuation/Return Forecast

The upside complete nan adjacent 12 months could beryllium arsenic precocious arsenic 25%. The short-term downside is ~25%. Longer-term, Parker has nan imaginable to nutrient 14% to 16% annualized returns, which is good supra nan market's semipermanent average.

Author's Spreadsheet

Conclusion

Parker-Hannifin is simply a coagulated Compounder that has shown resilience complete aggregate business cycles. Based connected our 2023 forecasts, PH will person grown EPS by almost 3x successful only 7 years (2016 to 2023). We for illustration marketplace aggregate equities that person grown net by complete 2x nan market.

The caller changes astatine nan institution person only strengthened its position successful cardinal markets. This is simply a smart guidance squad that has and will apt proceed to make beardown results for investors via M&A and separator betterment arsenic good arsenic integrated growth. We would item excessively nan way grounds of 50+ years of dividend increases.

Overall, while nan banal has tally and could propulsion backmost successful anemic tape, a starter position seems warranted astatine existent prices. We would beryllium important buyers connected a 10% to 15% pullback, pinch our carnivore case/pound nan array bargain levels successful nan $250-300 range.

Thanks for reading! Join our work Cash Flow Compounders: The Best Stocks successful nan World and build a durable, market-beating portfolio. We person complete 25+ years of mixed acquisition arsenic organization portfolio managers from communal costs to hedge funds. Our precocious return connected equity, and precocious free rate travel stocks person a proven way grounds successful compounding net complete time. In our service, we supply our BEST 2-4 ideas per month. Our picks going backmost to 2011 person produced conscionable nether 29% yearly returns (TipRanks), astir doubly nan market. Sign up for a free 2-week proceedings to get my latest ideas!

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·