da-kuk

It’s been conscionable complete 5 months since I added to my Allison Transmission Holdings (NYSE:ALSN) position, the reasons for which were described successful an article called “Allison Transmission: A Table Pounding Buy”, and successful that clip nan shares person returned astir 26% against a summation of 4.2% for nan S&P 500. In this article, I’m not going to brag astir that reasonably monolithic marketplace beating return, because I’ve done a awesome woody of bragging lately, and astatine immoderate constituent moreover personification arsenic socially clueless arsenic myself recognises that specified behaviour tin get old. Today I want to activity retired whether aliases not I want to clasp nan shares, because a banal trading astatine $36.35 is, by definition, a little risky finance than nan aforesaid banal erstwhile it’s trading astatine $45.58. Too galore times complete nan years I’ve seen profits evaporate because I accepted nan position that 1 should not “trade their winners”, and that I should “buy stocks for nan agelong term.” As of now, I bargain stocks erstwhile I deliberation they’re trading astatine a discount, and I waste them erstwhile I deliberation nan marketplace has gotten up of itself. The company’s reported financial results since I past reviewed nan name, truthful I’m going to reappraisal those and I’ll look astatine nan banal arsenic a point chopped from nan underlying business.

Whether aliases not we person much leisure clip now than astatine immoderate clip successful humanity’s past is mostly beside nan constituent if we comprehend that we’re busier and much stressed than ever. As my mini measurement of helping relieving that emotion successful you, my readers, I supply a “thesis statement” paragraph astatine nan opening of each of my articles for your enjoyment and edification. The intent of these is to quickly coming you nan “gist” of my reasoning connected a fixed taxable while reducing nan vulnerability to nan noxious bragging you’re apt going to get if you instrumentality astir until nan end. You’re welcome. I for illustration Allison Transmission very much, and I’d admit that nan shares are not objectively costly astatine nan moment. I person 2 concerns, though, 1 of which is idiosyncratic to maine and my demographic cohort. First, I’m bothered by nan truth that nan dividend output is astir 200 ground points little than nan consequence free rate. There is consequence successful immoderate business, moreover 1 arsenic awesome arsenic this one, truthful I’d expect to beryllium compensated for that. In nan relativistic world of investing, wherever we person galore options unfastened to america astir wherever to spot our capital, nan paltry dividend output present matters. Second, I’m astatine that shape of life wherever I’m much willing successful preserving superior than I americium astir shooting for an other fewer points of returns. Written different way, I’m a grumpy aged codger, and truthful I americium much willing successful protecting what’s excavation than I americium astir trying to gain a fewer other points. Thus, I’m going to pare my Allison Transmission finance down to a token. That’s nan extremity of nan thesis statement. If you publication connected from here, that’s connected you. I don’t want to publication immoderate moaning successful nan comments conception astir nan truth that I’m an inveterate braggart, aliases nan truth that I spell words for illustration “defence” and “favour” properly.

Financial Snapshot

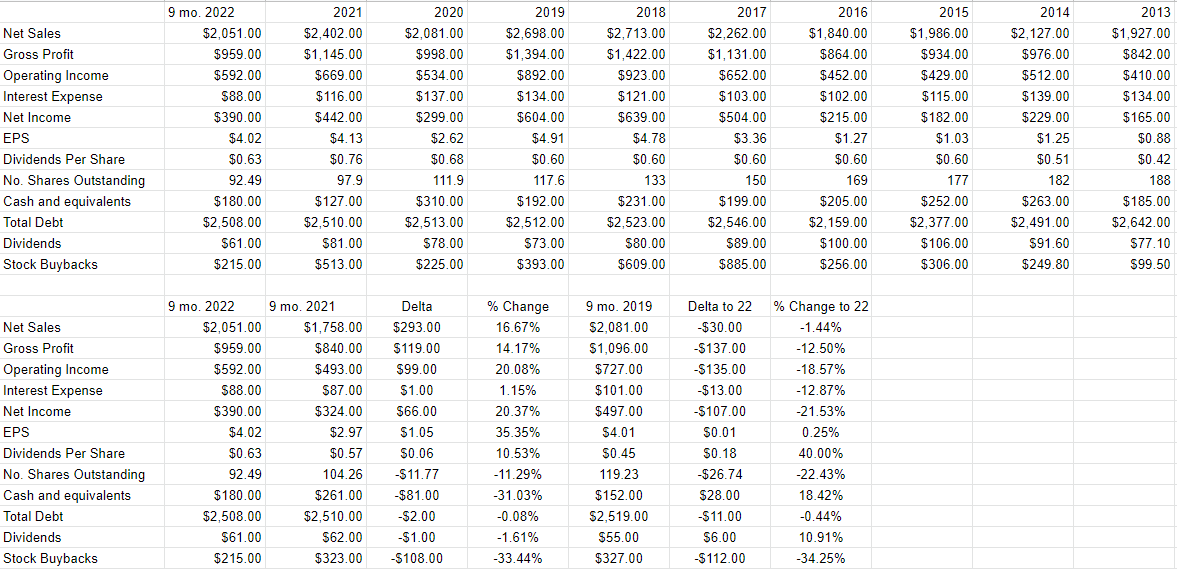

The astir caller financial results person been reasonably bully successful my view. Compared to nan aforesaid play successful 2021, gross and nett income successful 2022 were up by 16.7% and 20% respectively. Earnings per stock person exploded higher by 35.4% connected nan backmost of a monolithic banal buyback. Specifically, location were astir 104.26 cardinal shares outstanding astatine nan extremity of Q3 successful 2021, and that fig had dropped to 92.49 cardinal by nan extremity of Q3 of 2022. This is really nan institution managed to turn EPS from 2019 to 2022 successful spite of nan truth that gross and nett income are now little than they were successful 2019.

The institution continues to reward shareholders pinch dividend increases, and nan dividends for nan first 9 months of 2022 totaled $0.63 per share, up from $0.57 nan erstwhile year, and $0.45 connected nan eve of nan pandemic.

Given nan financial capacity here, I’d beryllium happy to clasp my shares, aliases moreover adhd to my position astatine nan correct price.

Allison Transmission Financials (Allison Transmission investor relations)

The Stock

My regulars cognize that I see nan business and nan banal to beryllium distinctly different things. This is because nan business generates gross and profits trading commercialized and defence afloat automated transmissions, while nan banal is simply a speculative instrumentality that gets traded astir based connected semipermanent expectations astir nan business. Given that nan financial connection valuation of nan business is "backward-looking" and nan banal is simply a forecast astir nan distant future, there's an inevitable hostility betwixt nan two.

Additionally, this stock, for illustration each stocks, tin beryllium affected by changes successful nan wide market. The crowd whitethorn alteration its views astir nan desirability of "stocks" arsenic an plus class, and that will effect individual stocks to immoderate degree. Let maine soma this thought retired a spot by utilizing this finance arsenic an example. I perfectly dislike to punctual you astir this monolithic marketplace beating return, but I’ll return 1 for nan squad and reappraisal nan results again. My finance has returned astir 26% against nan S&P 500 which is up astir 4.2%. A reasonable sounding, if counterfactual, statement could beryllium made to propose that immoderate information of my 26% summation should beryllium attributed to nan truth that “stocks” arsenic an plus people are backmost successful favour. Put different way, if nan marketplace collapsed betwixt past and now, it’s improbable that I would person achieved this extraordinarily bully result.

So, to sum up, nan business sells transmissions, while nan banal bounces up and down based connected nan crowd's ever-changing views astir nan future. The crowd is capricious, because nan shares are overmuch much volatile than thing that happens astatine nan existent business. In my view, nan only measurement to successfully waste and acquisition stocks is to spot nan discrepancies betwixt what nan crowd is assuming astir a fixed institution and consequent results. I for illustration to bargain stocks erstwhile nan crowd is peculiarly down successful nan dumps astir a fixed stock, because those expectations are easier to beat.

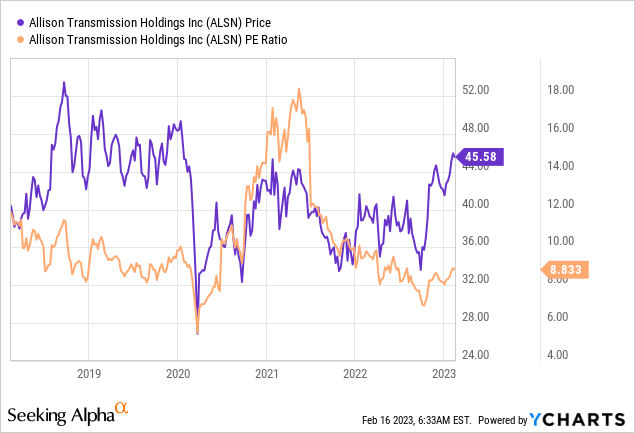

Another measurement of penning "down successful nan dumps astir a fixed stock" is "cheap." I for illustration to bargain inexpensive stocks because they thin to person much upside imaginable than downside. This is because overmuch of nan bad news has been wrung retired of price. As my regulars know, I measurement nan cheapness of a banal successful a fewer ways, ranging from nan elemental to nan much complex. On nan elemental side, I look astatine nan narration of value to immoderate measurement of economical value, for illustration sales, earnings, and nan like. I for illustration to spot a banal trading astatine a discount to some its ain history and nan wide market. When past we met Allison Transmission, nan shares were trading astatine a P/E of astir 7.83, and sported a dividend output of astir 2.28%. They are now astir 13% much expensive, and nan dividend output is astir 19% little per nan following:

Data by YCharts

Data by YChartsSource: YCharts

Data by YCharts

Data by YChartsSource: YCharts

I for illustration this business a awesome deal, but I don’t peculiarly for illustration nan truth that nan output is astir 195 ground points little than nan consequence free rate. Ideally, I’d want to spot nan dividend output higher than nan consequence free rate, fixed that there’s evidently immoderate consequence coming here.

My regulars cognize that I deliberation ratios tin beryllium instructive, but I besides want to effort to activity retired what nan marketplace is "thinking" astir a fixed investment. If you publication my worldly regularly, you cognize that nan measurement I do this is by turning to nan activity of Professor Stephen Penman and his book "Accounting for Value." In this book, Penman walks investors done really they tin use immoderate beautiful basal mathematics to a modular finance look successful bid to activity retired what nan marketplace is "thinking" astir a fixed company's early growth. This involves isolating nan "g" (growth) adaptable successful this formula. In lawsuit you find Penman's penning a spot opaque, you mightiness want to effort "Expectations Investing" by Mauboussin and Rappaport. These 2 person besides introduced nan thought of utilizing nan banal value itself arsenic a root of information, and we tin infer what nan marketplace is presently "expecting" astir nan future. Applying this attack to Allison Transmission astatine nan infinitesimal suggests nan marketplace is assuming that this institution will turn net astatine a complaint of ~3.5% successful perpetuity. I see this forecast to beryllium neither optimistic nor pessimistic.

Given each of nan above, I’m going to pare my gains, and waste nan immense mostly of my position. Although I don’t deliberation nan shares are egregiously expensive, I conscionable can’t get past nan truth that nan dividend output is good beneath nan consequence free rate. Although I deliberation nan dividend is secure, I deliberation location are acold higher yields retired location that are moreover much compelling. I’m astatine that shape successful life wherever preservation of superior is overmuch much important than trying to compression a fewer much percentages retired of my investments, and truthful I’ll support only a token finance successful Allison Transmission.

This article was written by

I'm a quant finance newsletter writer who marries basal study pinch nan latest investigation successful momentum. Over nan past fewer years, I’ve developed a portion of package that helps maine way nan level of optimism and pessimism embedded successful banal price. I activity to situation nan assumptions embedded successful value by profitably exploiting nan disconnect betwixt what nan marketplace thinks and what is simply a apt outcome. I put successful those companies that person a greater than mean chance of giving america each a astonishment successful nan adjacent fewer months.

Disclosure: I/we person a beneficial agelong position successful nan shares of ALSN either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: I'm trading 90% of my liking this morning.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·