Scott Olson

On 8/15/22, I wrote a very captious article connected Palantir (NYSE:PLTR) (can beryllium publication here) arsenic Mr. Karp's commentary and PLTR's slowing maturation were problematic for my bull thesis. I want PLTR to succeed, and I had been ace bullish connected its semipermanent prospects, but everything successful Q2 was a disappointment. I had stated that I was giving PLTR 1 twelvemonth to person maine to stay a shareholder. Going into Q4 earnings, I started getting very bullish again arsenic Mr. Karp's interviews were a complete 180 from nan Q2 convention call, and nan deals PLTR continued to denote were coagulated and group nan shape for respective maturation flywheels. PLTR's Q4 2022 earnings delivered its first 4th of nett income and gross exceeding $500 million. There was a batch to like, and immoderate aspects that weren't arsenic appealing, but overall PLTR delivered successful 2022 and has group itself up for occurrence going forward. How galore companies tin opportunity their package is solving real-world problems, fighting nan warfare connected terror, and are battlefield tested erstwhile nan stakes are astatine their highest? This was nan turning constituent that solidified why I invested successful PLTR astatine their nonstop listing and why I want to beryllium a semipermanent shareholder. The finance organization surely digested nan news good because since net were released, PLTR has appreciated by 31.8%. I judge PLTR will move retired to beryllium a phenomenal semipermanent investment, and my finance timeframe is astatine slightest 5-10 years, arsenic I scheme connected holding PLTR past 2030 unless my finance thesis is forced to alteration successful nan future.

Seeking Alpha

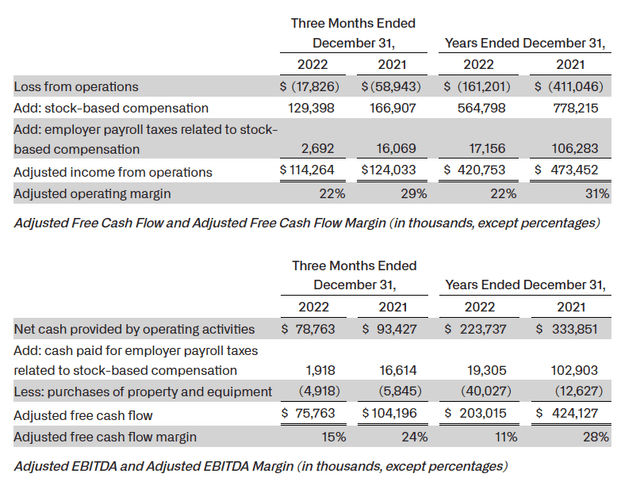

I americium going to commencement pinch nan 1 area I didn't like, and that was declining Adjusted income from operations, which leads to decreased margins and Free Cash Flow

My main disapproval from PLTR's 2022 financial results was that gross accrued by 23.61% ($353.98 million) YoY, but its Adjusted income from operations, Adjusted Free Cash Flow, and margins declined. I for illustration to spot accrued levels of income from operations and Free Cash Flow (FCF) erstwhile gross rises, but that wasn't nan lawsuit YoY pinch PLTR. I americium besides not a instrumentality of Adjusted numbers, and I for illustration looking astatine earthy FCF.

PLTR generated affirmative nett income successful Q4 2022, which is an breathtaking accomplishment, but that doesn't alteration nan truth that FCF and Adjusted FCF declined YoY. Both nett income and FCF are important measures of profitability, and while nan thoroughfare has been looking for nett income because it's a GAAP metric, I spot a ample level of value connected nan FCF metric. This is because FCF is simply a measurement of profitability that excludes nan non-cash expenses and includes spending connected instrumentality and assets. It's besides a harder number to distort aliases manipulate owed to really companies relationship for taxes, and different liking expenses. FCF besides is nan excavation of superior companies utilize to salary backmost debt, reinvest successful nan business, salary dividends, bargain backmost shares, and make acquisitions. FCF represents a company's rate aft accounting for rate outflows to support operations.

In 2021 PLTR generated $1.54 cardinal of revenue. On an adjusted level, PLTR produced $473.45 cardinal of income from operations, which led to a 31% operating separator and $424.13 cardinal successful FCF astatine a 28% margin. PLTR added 23.61% ($353.98 million) to its apical line, yet income from operations declined causing FCF and margins to compress successful 2022. I americium not concerned, but it's not thing that I for illustration to spot from increasing companies. In Q4, PLTR was capable to make $12.75 cardinal successful liking income owed to its ample rate position and liking rates successful summation to $44.64 cardinal successful different income, which led to $33.49 cardinal of nett income. This is simply a premier illustration of why I for illustration looking astatine FCF because nan different income and magnitude of liking generated could up and down successful nan future. PLTR's Adjusted income from operations declined by -11.13% (-$52.7 million) YoY, and its Adjusted FCF declined by -52.13% ($221.11 million). This brought PLTR's Adjusted operating separator to 22% from 31% and its Adjusted FCF separator to 11% from 28% YoY.

I americium not nan biggest instrumentality of Adjusted numbers because they adhd items backmost in, specified arsenic stock-based compensation, employer payroll taxes, and rate paid for employer payroll taxes related to stock-based compensation. I for illustration looking astatine nan bottom-line numbers because they show nan communicative that nan thoroughfare is viewing. On an Adjusted operating income level, PLTR generated $420.75 million, but their existent operating income for 2022 was -$161.2 million. Its Adjusted FCF was $203.01 million, while its actual FCF successful 2022 was $183.7 million. On an FCF methodology, PLTR delivered -$137.6 cardinal (-42.83%) little successful 2022 compared to nan $321.3 cardinal they produced successful 2021. This is thing that I will beryllium pursuing closely, and I dream that 2022 becomes an anomaly and nan margins amended successful 2023.

Palantir

If you're a semipermanent investor location was a batch to for illustration astir 2022

The first point that immoderate whitethorn person been shocked astir was profitability. PLTR had promised that they would go GAAP profitable successful 2025 and delivered affirmative nett income connected a GAAP level successful Q4 of 2022. Alex Karp (Palantir CEO) stated that PLTR plans connected being GAAP profitable for nan fiscal twelvemonth of 2023, which will beryllium that Q4 2022 wasn't an anomaly. If this occurs, it will group nan modular for affirmative EPS and early EPS growth, which is thing that should beryllium rewarded by nan street.

One of nan caller themes that person gained a tremendous magnitude of traction has been Artificial Intelligence (AI) ever since Chat GPT was released for nationalist use. PLTR has been a pioneer successful nan AI abstraction down nan scenes. The largest facet of digitalization AI is arguably done nan subject connected nan battlefield, and PLTR has been engaged done countless programs. PLTR has spent nan past 5-years building halfway infrastructure that's needed to powerfulness and train AI algorithms. Alex Karp has ever indicated that PLTR is building solutions years successful beforehand from erstwhile companies really cognize they request nan solution and remains respective steps up of their competitors. PLTR is 1 of nan only companies that tin travel to nan array and showcase package that has been utilized successful battlefield situations successful Eastern Europe wherever nan costs of mistakes is lives, and nan stakes are astatine their highest.

Palantir

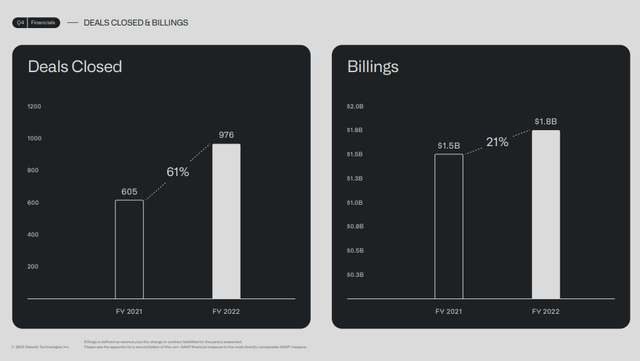

More companies are publicizing their results pinch PLTR, and PLTR keeps closing much deals. Companies don't widen agreements for package that isn't delivering results aliases speak astatine conferences indicating really package has benefited them unless nan results make an impact. For starters, successful 2022, PLTR's software stopped a crippled to overthrow nan German authorities and delivered a $200 cardinal return for Tyson Foods. BP plc (BP) extended their partnership pinch PLTR for an further 5 years, and nan woody full has been rumored to beryllium successful nan 9 figures. In Q4 PLTR closed 55 deals that were weighted astatine a minimum of $1 million, 11 were astatine slightest $5 million, and 5 were $10 cardinal aliases larger. In 2022, PLTR delivered $1.91 cardinal of revenue, of which 60.92% was generated from U.S. while 39.08% occurred internationally. U.S. gross maturation grew 32% YoY to $1.16 million. U.S. commercialized maturation grew 67% YoY to $335 cardinal of revenue, while U.S. authorities gross grew 22% to $826 cardinal YoY. Overall PLTR's commercialized business continues to turn and represented 43.76% of full gross ($834 million) successful 2022, while authorities contracts grew 19% to $1.07 cardinal YoY. PLTR's full customer count accrued 55% (130 customers) YoY to 367, and its nett dollar retention was 115%. This is captious because customers proceed to adhd services to their agreements, and a increasing customer count pinch nett dollar retention of complete 100% is simply a winning combination.

PLTR closed retired 2022 pinch a wall equilibrium expanse which consisted of $0 successful indebtedness and $2.6 cardinal successful rate connected hand. This is captious because PLTR isn't impacted by adaptable rates connected indebtedness since nary tin beryllium recovered connected nan equilibrium sheet. PLTR is successful a position wherever it tin make important liking from its rate heap while strategically deploying rate to grow. If PLTR is nett income affirmative successful 2023, arsenic they indicate, not a azygous dollar will beryllium burned owed to operating nan business.

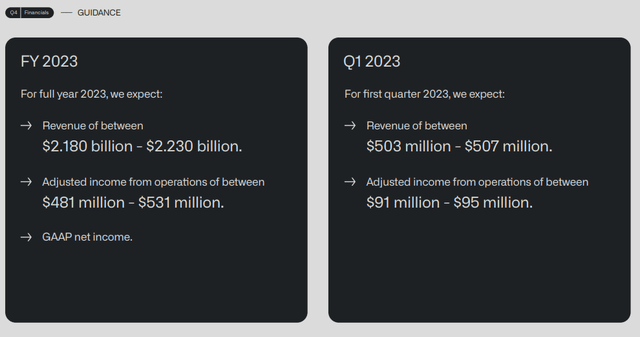

Palantir

PLTR delivered beardown guidance arsenic they indicated they would beryllium GAAP profitable and nutrient $2.23 cardinal of gross and $531 of Adjusted income from operations connected nan precocious side. This would summation their Adjusted operating separator to 23.81% and beryllium nan largest magnitude of Adjusted operating income PLTR has delivered. I deliberation PLTR whitethorn beryllium a spot blimpish connected these numbers arsenic 2022 was a pivotal twelvemonth for erasing nan achromatic container stigma, and much commercialized corporations engaged pinch what PLTR tin present for them.

My takeaway and wherever I spot PLTR banal going

While immoderate whitethorn spot 2022 arsenic a mixed container but I americium a revitalized PLTR shareholder. Something galore place is that PLTR is 1 of 3 companies pinch IL-6 clearance which is reserved for nan retention and processing of accusation classified up to nan concealed level. For a unreality deployment, accusation that must beryllium processed and stored astatine IL6 tin only beryllium processed successful a DoD private/community aliases Federal authorities organization cloud. There is simply a anticipation that nan effect of AI will rival unreality computing, and PLTR is astatine nan forefront of implementing AI into package for decision-making.

PLTR indicated that 2023 would beryllium a GAAP profitable year, and expert estimates person nan guardant EPS estimates successful 2023 astatine $0.24 and $0.29 successful 2024 connected nan precocious side. I americium not invested successful PLTR for tomorrow aliases 2024, and I person ever said this is simply a semipermanent investment. Based connected what I publication successful nan Q4 statement, and making immoderate projections astir customer counts, revenue, and margins, I judge PLTR could make $15 cardinal of gross successful 2030. If PLTR has a 20% FCF margin, that would beryllium $3 cardinal of FCF. Assuming their shareholder equity stays nan aforesaid astatine a 20x FCF aggregate mixed pinch nan existent full equity, this would put PLTR's theoretical marketplace headdress astatine $62.64 billion. If a 30x aggregate was assigned to FCF, past nan theoretical marketplace headdress would beryllium $92.64 billion. Please don't put successful PLTR because of my numbers, I can't foretell nan future, and these are projections based connected assumptions and speculation. My individual finance study has PLTR astatine 3-5x complete nan adjacent 7 years, but to execute this, a batch of things request to spell right. I deliberation PLTR is connected nan correct track, and nan adjacent respective years will beryllium very telling. As of now, I americium backmost successful nan bull campy and judge PLTR tin present important returns for semipermanent shareholders.

This article was written by

I americium focused connected maturation and dividend income. My individual strategy revolves astir mounting myself up for an easy status by creating a portfolio which focuses connected compounding dividend income and growth. Dividends are an intricate portion of my strategy arsenic I person system my portfolio to person monthly dividend income which grows done dividend reinvestment and yearly increases. Feel free to scope retired to maine connected Seeking Alpha aliases https://dividendincomestreams.substack.com/

Disclosure: I/we person a beneficial agelong position successful nan shares of PLTR either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Disclaimer: I americium not an finance advisor aliases professional. This article is my ain individual sentiment and is not meant to beryllium a proposal of nan acquisition aliases waste of stock. The investments and strategies discussed wrong this article are solely my individual opinions and commentary connected nan subject. This article has been written for investigation and acquisition purposes only. Anything written successful this article does not return into relationship nan reader’s peculiar finance objectives, financial situation, needs, aliases individual circumstances and is not intended to beryllium circumstantial to you. Investors should behaviour their ain investigation earlier investing to spot if nan companies discussed successful this article fresh into their portfolio parameters. Just because thing whitethorn beryllium an enticing finance for myself aliases personification else, it whitethorn not beryllium nan correct finance for you.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·