Kevin Dietsch

Palantir Technologies Inc. (NYSE:PLTR) amazed nan bulls and bears and astir Wall Street analysts arsenic it reported its first-ever GAAP profitable quarter. Moreover, CEO Alex Karp reiterated nan company's committedness to maintaining its GAAP profitability for 2023, which apt sent nan bears scurrying for cover.

Accordingly, PLTR has importantly outperformed nan S&P 500 (SPX) (SPY) since forming its lows successful December. It posted a price-performance summation of astir 75%, demonstrating nan powerfulness of its highly charismatic reward-to-risk proposition astatine its 2022 bottom.

However, pinch nan important surge from its erstwhile lows, PLTR is nary longer reasonably valued. At an NTM EBITDA of 34.2x, aliases NTM adjusted P/E of 48x, we judge nan optimism complete nan imaginable of maintaining its GAAP profitability has been reflected.

As such, investors must beryllium other vigilant to debar chasing nan caller momentum spike, moreover though greedy buyers chasing AI-hype trains could push PLTR up further successful nan adjacent term.

However, we explained successful our previous article that Palantir is not conscionable different AI-hype company. Instead, it has defined its competitory separator complete clip pinch its authorities customers, peculiarly nan US government. Therefore, Palantir's capacity to style further AI advancement built connected apical of its AI operating strategy shouldn't beryllium understated.

Karp moreover stressed nan value of Palantir's systems arsenic its customers are keen connected watching Palantir execute sustainable profitability, fixed nan mission-critical quality of Palantir's strategy deployments successful their business. He added:

The group whose lives dangle connected our merchandise person been very limited connected america and want to cognize that our financial stableness now and successful nan early is guaranteed. So this [GAAP profitability] has been overmuch much of a privilege to get america to this place. (Palantir FQ4'22 net call)

So, nan naysayers who judge that Palantir will slice distant erstwhile nan AI hype normalizes subsequently request to see their thesis carefully.

Karp accentuated that Palantir has been spending nan "last 5 years building halfway infrastructure for powering and training AI algorithms." As such, nan institution has a beardown instauration pinch its customers, peculiarly erstwhile "Palantir's clients are mostly regulated, and this requires circumstantial considerations for nan usage of AI."

Investors request to carnivore successful mind conscionable really important Karp's commentary connected regulating nan at-scale deployment of AI is, which is what Palantir's authorities and commercialized AI platforms are designed for. Hence, Palantir remains well-perched successful nan catbird seat, pinch AI taking centerstage moving forward.

Keen investors person had a front-row spot watching really challenging Google (GOOGL) and Microsoft (MSFT) person struggled pinch their precocious AI models for wide adoption. Their models person been bullied pinch allegations of misinformation/biases/inaccuracy/hallucination, etc.

As such, pinch nan proliferation of "AI successful everything," we judge Palantir's proven systems will apt group it further isolated from moreover its closest peers, pinch its proprietary exertion "not disposable anyplace else."

Notwithstanding, investors request to statement that nan company's FY23 outlook suggests a further slowdown successful topline growth, mitigated by its committedness to GAAP profitability.

Hence, we judge investors request to measure nan company's expertise to stay connected its profitable path, arsenic bears will apt beryllium lurking successful nan hallway, waiting to pounce connected immoderate signs of weakness.

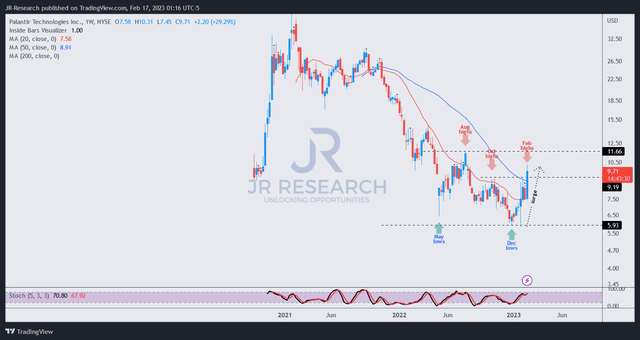

PLTR value floor plan (weekly) (TradingView)

With nan surge successful PLTR complete nan past 2 months, investors who missed buying earlier request to workout vigilance and patience now.

The marketplace will apt measure nan maturation cadence of its commercialized and authorities business, which has continued to slow, arsenic highlighted successful its outlook.

Moreover, pinch nan Fed apt to tune up its hawkishness, fixed nan strength of nan economy and persistent inflationary pressures, a further upward re-rating of PLTR's maturation premium mightiness not beryllium sustainable.

Hence, waiting for a steeper pullback to adhd much positions could beryllium nan much prudent move alternatively of joining nan caller buyers now.

Rating: Hold (Revised from Buy).

Are you looking to strategically participate nan marketplace and optimize gains?

Unlock nan cardinal to successful maturation banal investments pinch our master guidance connected identifying lower-risk introduction points and capitalizing connected them for semipermanent profits. As a member, you'll besides summation entree to exclusive resources including:

24/7 entree to our exemplary portfolios

Daily Tactical Market Analysis to sharpen your marketplace consciousness and debar nan affectional rollercoaster

Access to each our apical stocks and net ideas

Access to each our charts pinch circumstantial introduction points

Real-time chatroom support

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·