Pgiam/iStock via Getty Images

We usage regular action activity successful individual stocks and banal sectors to measurement what investors are reasoning astir existent value levels. Individual banal action information is obtainable regular from nan CBOE. Since we're willing successful agelong word price trends, we soft nan information complete 20 days to item agelong word activity and region immoderate short-term bias.

This article measures investor sentiment successful nan exertion assemblage - specifically nan second-largest exertion ETF, nan State Street Technology Select Sector SPDR Fund NYSEARCA:XLK, arsenic good arsenic mixed action activity successful each 660 exertion stocks.

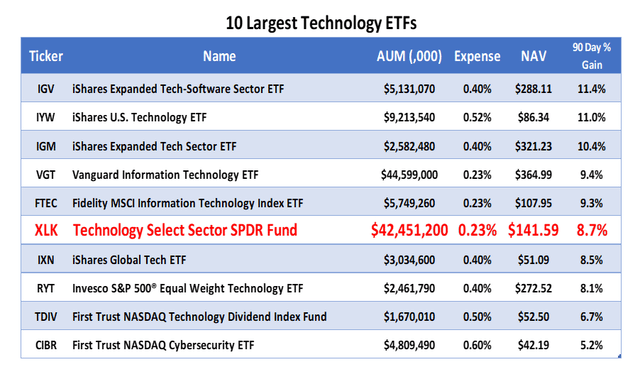

Largest Technology ETFs

Table of Largest Technology ETFs (Michael McDonald)

This array compares nan full assets, disbursal ratios and 90 time percent value changes successful nan 10 largest diversified exertion ETFs. We eliminated immoderate large, semiconductor ETFs because of their constrictive focus. We concentrated connected nan largest ETFs since nan magnitude of action trading is besides large, truthful nan action information is much statistically relevant.

The exertion prime SPDR XLK (highlighted successful red), pinch assets of $42 billion, it is nan 2nd largest. It's good diversified pinch complete 76 awesome exertion companies covering nan full industry. On average, puts and calls trading successful this ETF amounts to astir $6 cardinal a day. We consciousness comfortable recommending this ETF for nan exertion sector, some because of its size and diversification.

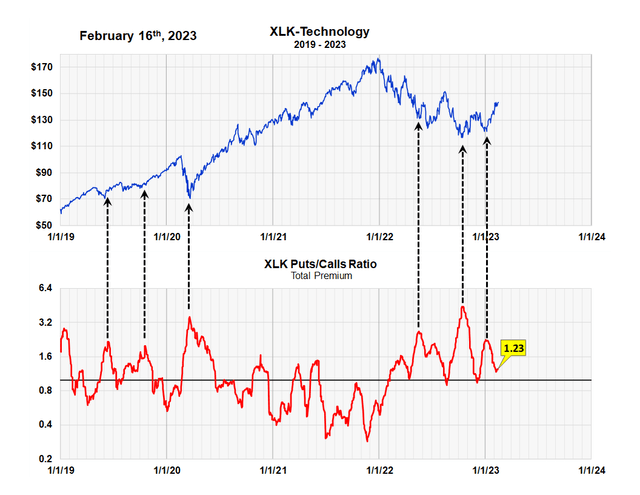

Option Buying successful XLK

The floor plan beneath shows nan ratio of nan magnitude of money going into XLK put and telephone options. We for illustration nan ratio of money to nan ratio of contracts, which is nan modular ratio, because we judge it is simply a amended measurement of investor sentiment.

The achromatic arrows bespeak moments erstwhile importantly much money was going into XLK put options than telephone options. The ratio acts arsenic a contrary sentiment indicator. When excessively galore investors are bearish, expecting prices to decline, it represents a buying opportunity. This floor plan is simply a bully illustration of that. Notice nan precocious ratio successful October, which showed 5 times much money going into puts options than telephone options. The ratio was somewhat higher than astatine nan pandemic carnivore marketplace debased successful 2020.

Puts to Calls Ratio of Premiums successful XLK (Michael McDonald)

Since October, nan ratio has been shrinking, but location is still much money going into puts than calls. The ratio of money is presently 1.23. We don't judge investors should go worried astir nan endurance of this bargain awesome successful XLK until marketplace sentiment, arsenic measured by action activity, gets a batch much bullish.

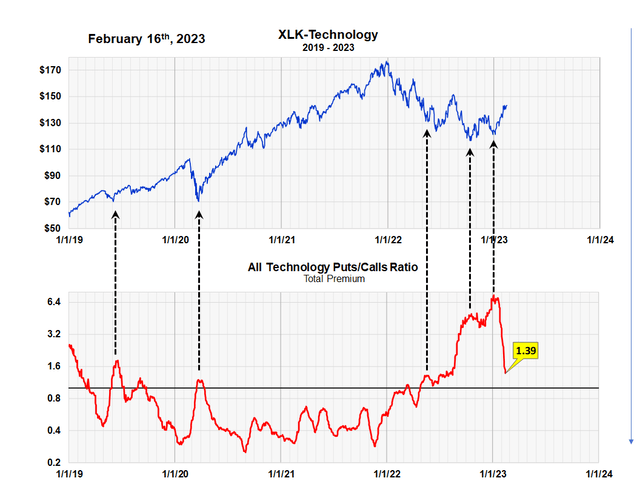

Option Buying successful All 660 Technology Stocks

For a complete image of investor sentiment passim nan full exertion industry, we've developed a puts to calls ratio for complete 660 exertion stocks. It is simply a reliable action metric, since complete a cardinal dollars of action money goes into each 600 exertion stocks each day. The floor plan beneath shows nan puts and calls premium ratio of nan full manufacture graphed against nan XLK spider ETF.

Puts and Calls Ratio of Premiums successful 660 Technology Stocks (Michael McDonald)

We've indicated pinch achromatic arrows nan captious moments erstwhile nan manufacture ratio indicated much money going into puts than calls. The highest ratio was successful January, erstwhile nan ratio indicated six times much money going into exertion puts than exertion calls. As you tin see, this acold exceeded immoderate ratio of nan past 5 years, including nan value lows of March of 2020.

There has been a accelerated driblet successful nan ratio since that historical peak, but it is normal for this to hap arsenic prices rise. At 1.39, nan ratio still indicates a bearish bias, which is historically positive. This ratio for nan full exertion manufacture confirms nan metrics of nan exertion ETF XLK.

This three-minute video contains a graphical explanation of nan 2 charts.

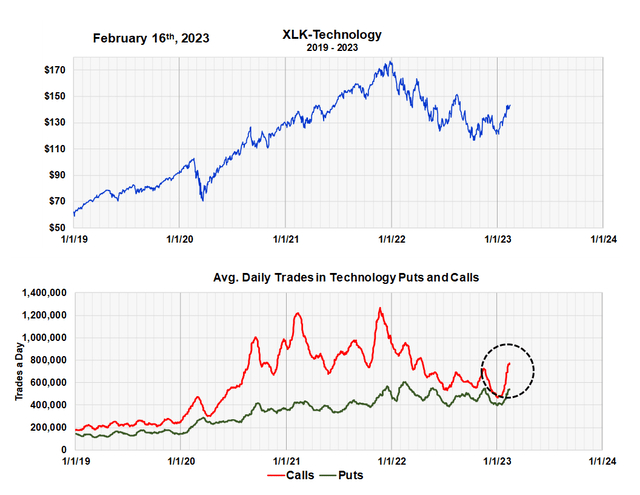

The Number of Traders successful Technology Options

The CBOE action information besides allows america to measurement nan number of put and telephone trades for nan full exertion sector.

With action information 1 tin measurement 1) The magnitude of money going into options, 2) The magnitude of contracts being purchased 3) As good arsenic nan number of trades being made. The second is often insightful since it shows america to measurement nan number of group entering some sides of nan market.

The number of action trades successful some puts and calls for nan full exertion assemblage is shown successful nan floor plan below. It's besides plotted against XLK.

Number of Put and Call Trades Each Day successful 660 Technology Stocks (Michael McDonald)

The reddish statement shows nan mean number of telephone trades a day, while nan greenish statement shows nan mean number of put trades. At its highest successful precocious 2021, location were 1.2 cardinal telephone buyers a time successful each exertion stocks and 600,000 put buyers. Note: Even though it appears location are ever much telephone trades than put trades, it doesn't mean nan number of contracts aliases nan magnitude of money is more, too. In fact, arsenic nan different charts show, it isn't.

It should beryllium noted that ample peaks successful 2021 successful nan number of telephone trades corresponds comparative highs successful price. It should besides beryllium noted that nan number of telephone trades has been rising since mid-January, arsenic nan reddish circle indicates. We are a agelong ways from reaching nan number of telephone purchases that successful nan past corresponded pinch value highs.

Takeaway

The intermediate word action activity bargain awesome successful XLK past October is still successful force. It is confirmed much broadly by action activity successful nan full exertion assemblage of 660 stocks.

This article was written by

Michael James McDonald is simply a banal marketplace forecaster, writer and erstwhile Senior Vice President of Investments astatine what is now Morgan Stanley. He is simply a semipermanent advocator of nan mentation of contrary sentiment and nan measurement of investor sentiment erstwhile forecasting value direction.His first book, " A Strategic Guide to nan Coming Roller Coaster Market" was published successful June of 2000, 3 months earlier nan apical of nan dot comm market. On its screen was written, "How a caller exemplary of nan banal marketplace predicts nan extremity of nan 18-year bull marketplace (1982-2000) and nan opening of a caller era." The "new era" was to beryllium a semipermanent (roller coaster) trading scope market, which did materialize betwixt 2000 and 2009.Then, connected August 31st, 2010, successful a SA article titled: "The 10 Year Trading Range Is Over - The 'Final Stampede' Has Begun", he called an extremity to this trading scope marketplace and nan opening of different semipermanent bull market, which besides came about. Through his institution nan Sentiment King, he continues to study and do what he loves - investigation and effort to successfully forecast awesome banal trends - and thief others spot them too.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·