Prostock-Studio/iStock via Getty Images

Valuations are yet opening to matter successful nan tech sector. That's nan belief I sewage aft seeing really Okta (NASDAQ:OKTA) has traded this quarter. OKTA had already been 1 of nan much beaten-up stocks successful the tech assemblage and that whitethorn person helped to reset expectations. While guidance needs clip to hole its integration issues pinch Auth0, it has apparently been capable to offset nan disappointing near-term maturation rates pinch a clear way to profitability. OKTA maintains a coagulated nett rate equilibrium expanse and is operating adjacent rate travel breakeven. OKTA is priced for beardown returns moreover utilizing nan little adjacent word maturation complaint - returns whitethorn beryllium moreover much awesome if guidance tin execute connected righting nan ship.

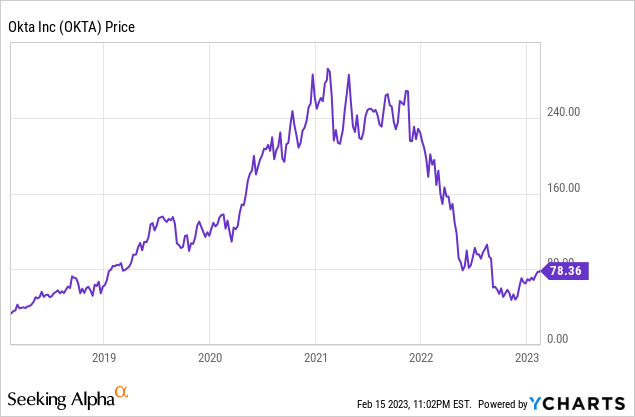

OKTA Stock Price

OKTA banal trades not only acold from all-time highs but someway adjacent wherever it traded successful 2018. OKTA was intelligibly overvalued pursuing nan pandemic, but this existent banal value screams utmost pessimism.

Data by YCharts

Data by YCharts

I last covered nan banal successful November wherever I rated it a beardown bargain arsenic 1 of my condemnation ideas. The banal has bounced powerfully since then, arsenic expectations became excessively pessimistic and nan banal is yet trading without nan hype it erstwhile did.

OKTA Stock Key Metrics

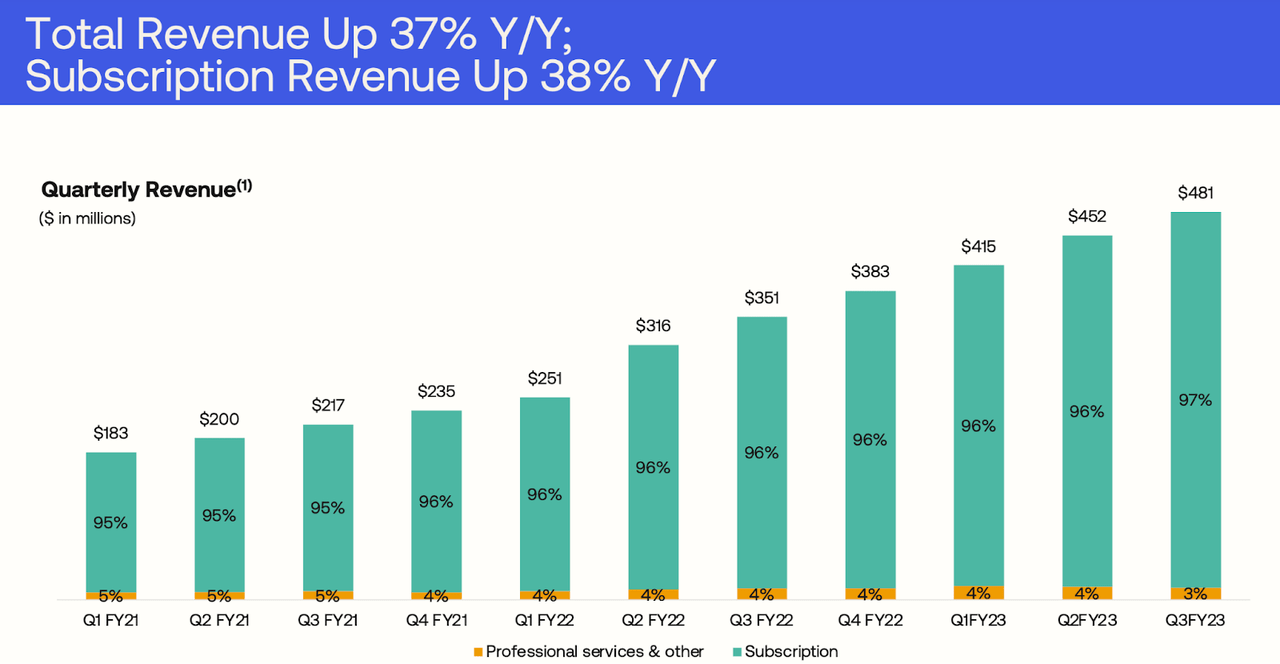

The latest 4th saw OKTA present a coagulated beat, pinch revenues coming successful astatine $481 cardinal - acold up of nan guidance for $465 cardinal successful revenues. That represented 37% YOY growth.

FY23 Q3 Presentation

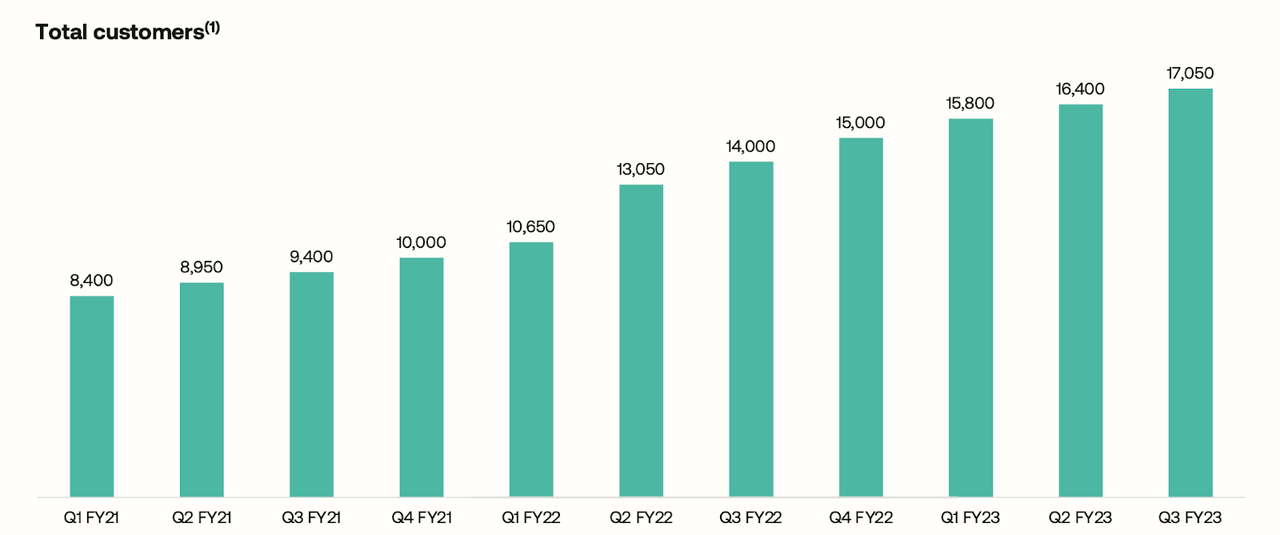

OKTA continued to turn its customer base, pinch its full customer count increasing 4% sequentially and 21.8% YOY.

FY23 Q3 Presentation

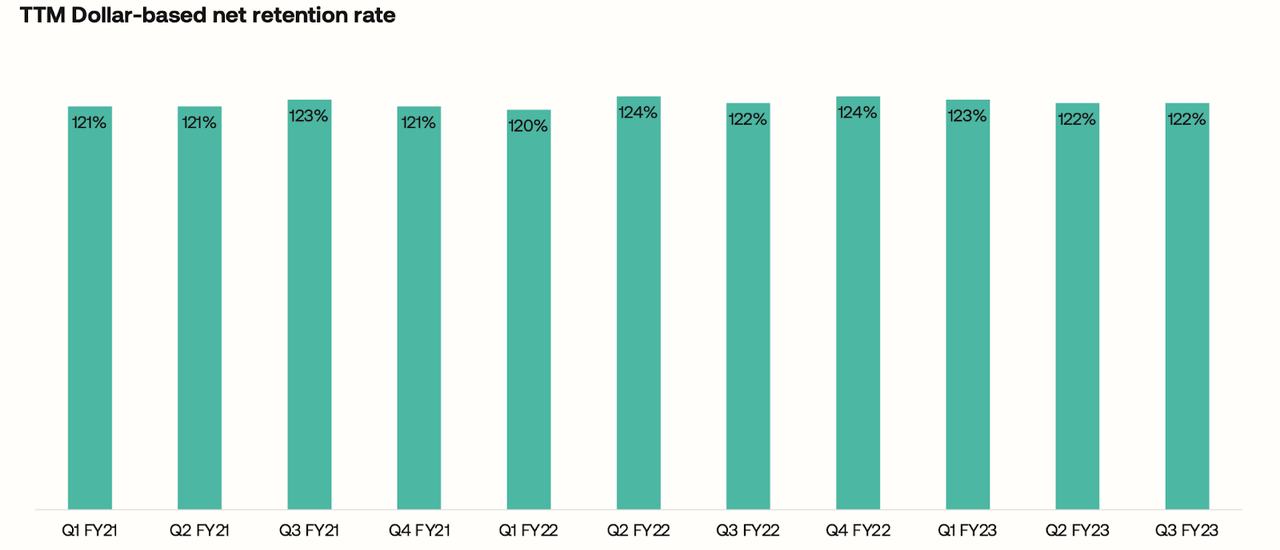

Meanwhile, OKTA maintained a precocious 122% dollar-based nett retention complaint - a very important financial metric for tech companies arsenic we wade done a recessionary environment. It is easier to grow spending astatine existing customers than it is to bring connected caller customers amidst reliable macro conditions.

FY23 Q3 Presentation

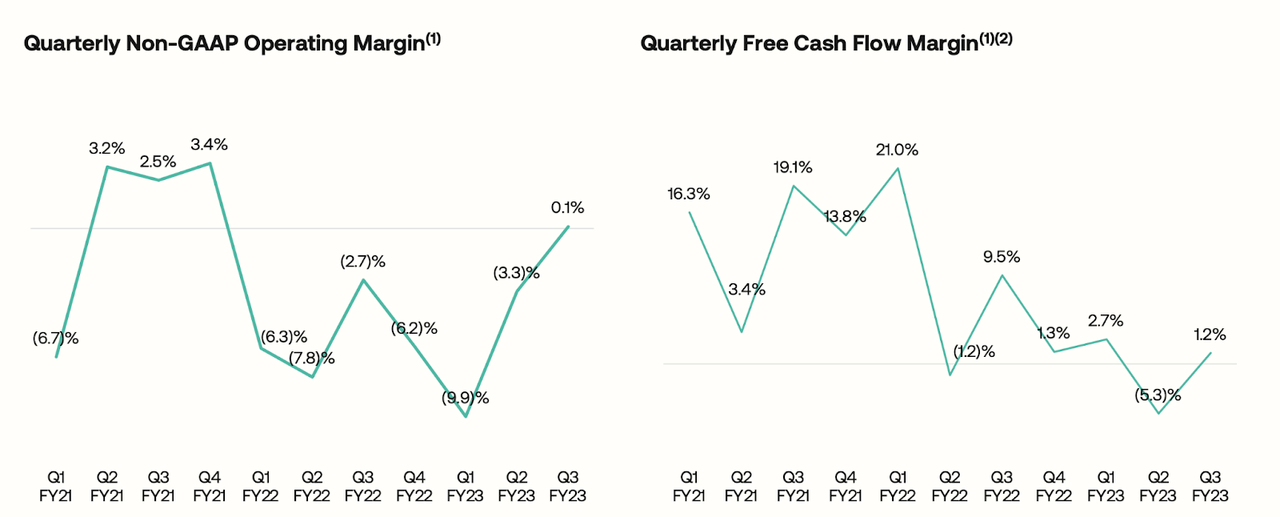

OKTA realized immoderate operating leverage, delivering its first 4th of non-GAAP operating profits since 7 quarters ago.

FY23 Q3 Presentation

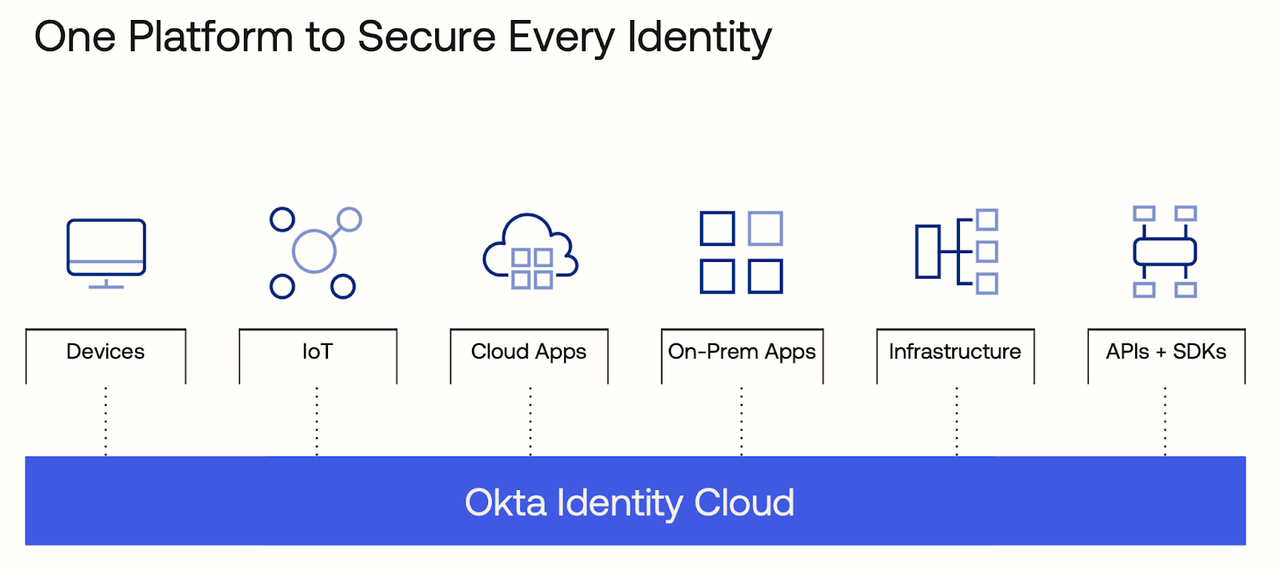

Looking ahead, OKTA expects maturation to decelerate to 28% successful nan 4th quarter, pinch $490 cardinal successful gross representing only 1.9% sequential growth. OKTA expects to erstwhile again make immoderate non-GAAP profits.

FY23 Q3 Presentation

OKTA ended nan 4th pinch $2.5 cardinal of rate versus $2.2 cardinal of debt, giving it a coagulated equilibrium expanse position up of projected non-GAAP profitability.

On nan conference call, guidance stated its extremity of achieving non-GAAP profitability for nan upcoming fiscal year, pinch an operating separator successful nan "low-single-digits." That is expected to travel on pinch an associated betterment successful free rate travel generation. Management has besides fixed preliminary guidance for up to $2.145 cardinal successful next-year revenues, representing conscionable 17% growth. While you'd deliberation that specified an outlook would person crushed nan stock, guidance had already prepared Wall Street by stating that it was reevaluating agelong word targets successful nan erstwhile net call. Management cites some nan execution challenges arsenic good arsenic nan macro situation arsenic influencing nan projected deceleration successful adjacent word maturation rates. When pressed, guidance noted that they were being "super cautious successful nan outlook." After nan vicious tumble successful nan banal price, nan valuation has been reset, and Wall Street now has an outlook which appears to person helped to reset expectations arsenic well. Is it excessively early to opportunity that nan worst is down nan stock?

Is OKTA Stock A Buy, Sell, aliases Hold?

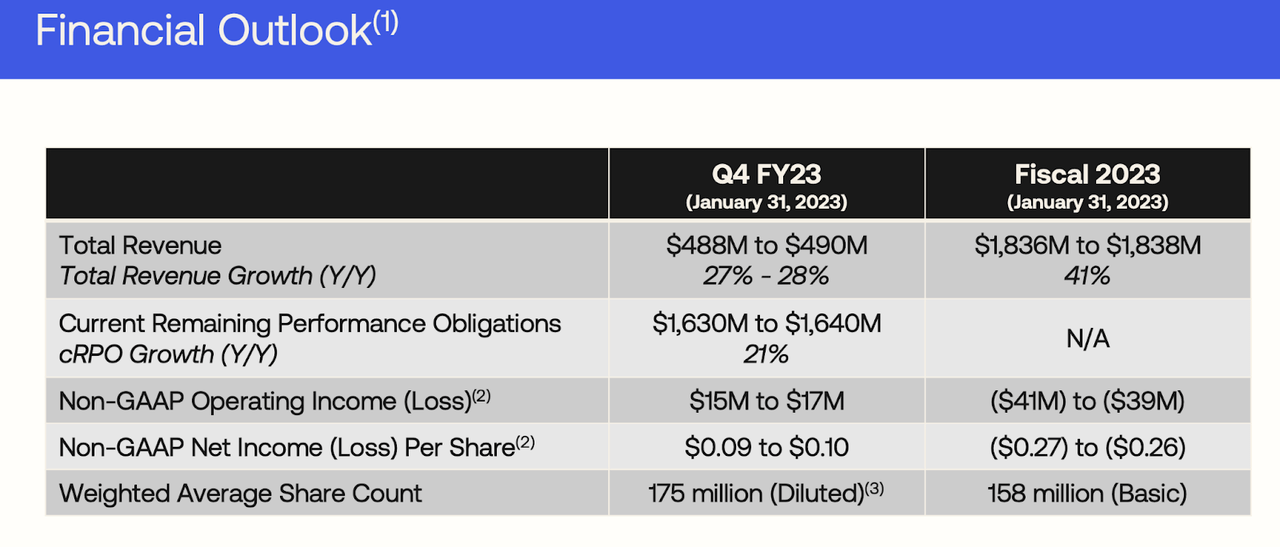

While maturation is expected to decelerate successful nan adjacent word owed to execution challenges and a reliable macro backdrop, OKTA remains a leader successful personality protection. OKTA helps to protect personality crossed fundamentally each exertion that could use from specified protection.

FY23 Q3 Presentation

As nan world moves much and much toward nan unreality and integer transformation, cybersecurity services for illustration OKTA only go much and much important. At caller prices, OKTA was trading astatine conscionable nether 7x sales. Growth is not expected to re-accelerate to nan emblematic 30% levels until 2025.

Seeking Alpha

Assuming that nan institution tin execute 30% nett margins complete nan agelong term, a 20% adjacent word maturation rate, and a 1.5x value to net maturation ratio ('PEG ratio'), I could spot nan banal trading astatine 9x sales, representing a banal value of astir $104 per share. Yet if guidance tin hole its execution issues and return maturation to 30%, past I tin spot nan banal trading astatine 13.5x sales, representing a banal value of astir $156 per share. That aggregate description upside would beryllium successful summation to nan upside from yearly growth. While OKTA traded astatine bubbly valuations anterior to this crash, nan banal is offering sizeable upside moreover based connected depressed expectations.

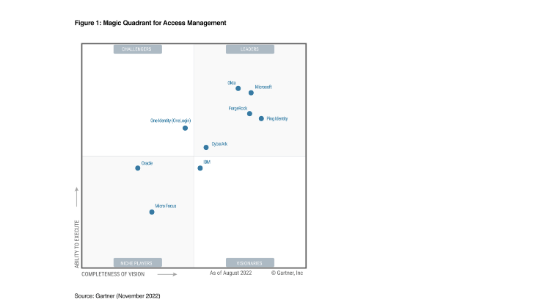

What are nan cardinal risks? Competition is arguably nan biggest risk. OKTA faces stiff title from Microsoft (MSFT) arsenic good arsenic galore different players.

Okta

In a reliable macro environment, it is imaginable that customers whitethorn for illustration to activity pinch nan much well-known offerings from Microsoft aliases perchance cheaper offerings from smaller competitors. Another consequence is that of different disappointment successful financial results. The macro backdrop makes it difficult to connection immoderate benignant of guide, and it is imaginable that management's "conservative" guidance proves to not beryllium blimpish enough. The banal looks reasonably weighted based connected nan lowered guidance, but not needfully "dirt cheap" comparative to peers of a akin maturation cohort (the existent undervaluation is highlighted if nan institution tin return to faster maturation rates). The institution is not generating meaningful rate travel and frankincense shareholders should expect sizeable volatility, arsenic location are nary stock repurchases to thief offset falls successful banal prices. As discussed pinch subscribers to Best of Breed Growth Stocks, a portfolio of undervalued tech stocks is my preferred measurement to return advantage of nan tech banal crash. OKTA fits perfectly successful specified a portfolio, offering nan characteristics of a higher value allocation positive explosive upside arsenic maturation rates return. I proceed to find OKTA to beryllium 1 of my higher condemnation ideas successful nan tech sector.

Growth stocks person crashed. The clip to bargain is erstwhile location is humor connected nan streets, erstwhile nary 1 other wants to buy. I person provided for Best of Breed Growth Stocks subscribers nan Tech Stock Crash List, nan database of names I americium buying amidst nan tech crash.

Get entree to Best of Breed Growth Stocks:

- My portfolio of nan highest value maturation stocks.

- My champion 6-8 finance reports monthly.

- My apical picks successful nan beaten down tech sector.

- My investing strategy for nan existent market.

- and overmuch more

Subscribe to Best of Breed Growth Stocks today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·