Welcome Back successful Office filadendron/E+ via Getty Images

Thesis

Office REITs person had a disappointing 2022, but wrong this sector, I person recovered a compelling finance opportunity: Office Properties Income Trust (NASDAQ:OPI). The champion finance ideas whitethorn be difficult to observe but are evident erstwhile found. I judge OPI fits this measure and my thesis is simple:

- Return-to-office will boost rental income and people surprises connected renewals

- OPI is simply a accordant outperformer among agency REITs

- OPI is mispriced astatine a heavy discount to peers

- My adjacent worth estimate implies an 81% upside

- Key risks are mitigated, presenting an asymmetric opportunity

Office REITs person had a reliable clip successful 2022

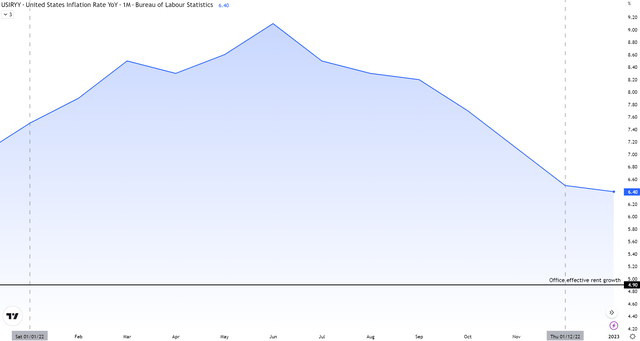

Office REITs person had a reliable clip since nan onset of nan pandemic successful March 2020. 2022 saw nan brunt of this weakness arsenic 12-month effective rents for office REITs successful nan apical 5 locations successful nan US grew astatine a paltry 4.9%; overmuch beneath nan ostentation complaint successful 2022:

US CPI (TradingView, Author's Analysis)

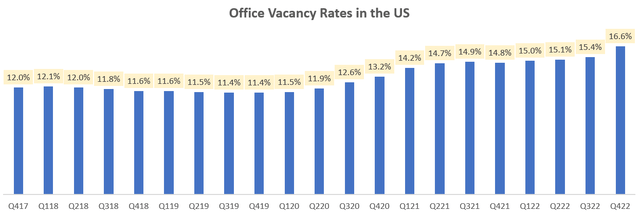

Vacancy rates besides saw a crisp summation successful Q4 CY22 to 16.6%:

Office Vacancy Rates successful nan US (Statista, Commercial Edge, Author's Analysis)

However, I judge nan wheels are successful mobility for a recovery:

Return-to-office will boost rental income and people surprises connected renewals

I fishy Q4 CY22's crisp emergence successful agency vacancy rates is an overstated and impermanent phenomenon. I statement that nan mostly of tech-layoffs started successful Q4 FY22, perchance explaining immoderate portion of nan spike successful little vacancy rates.

I don't deliberation debased agency occupancy rates will persist owed to accrued work-from-home aliases WFH trends arsenic group are returning backmost into nan office. Commercial Real Estate investigation patient CoStar notes that aft nan tech assemblage layoffs, nan bulk of which started successful Q4 FY22, ample exertion firms are reversing distant activity policies to much intimately show worker productivity. As CoStar journalist Katie Burke described:

...the adjacent 12 months are expected to characteristic companies investing successful semipermanent existent property decisions arsenic they begin requiring much accordant agency attendance.

(Author's bolded emphasis)

I do not expect nan layoffs to time off a prolonged void of activity successful nan assemblage since employment has rebounded quickly:

... mostly of those laid disconnected successful nan tech assemblage during nan first half of 2022 rebounded quickly, arsenic 79% recovered caller jobs wrong 3 months and astir 40% were capable to summation caller employment wrong conscionable 1 month

- David Caputo, Moody's Analytics for Commercial Real Estate, (author's bolded emphasis)

I judge these trends will not only boost occupancies, but besides favorably enactment to amended lease renewals for OPI. In nan Q4 FY22 net call, guidance noted a 5-6% of annualized rental income of vacancy impacts successful 2023 owed to lease expiries. I judge nan affirmative traction successful nan return to agency inclination will position OPI to station affirmative surprises connected lease renewals.

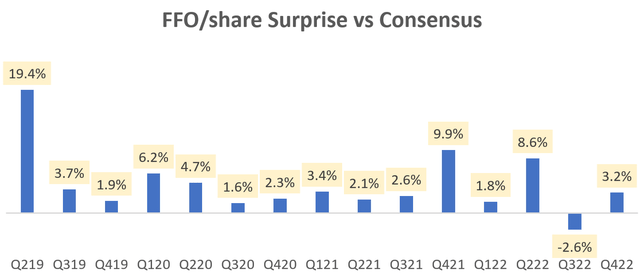

My assurance successful this appraisal comes from my study nether nan tenure of CFO Matthew Brown, which began successful Q2 FY19, location is simply a grounds of affirmative thumps complete statement expectations, pinch an mean and median hit of 4.6% and 3.2% respectively:

FFO/share Surprise vs Consensus (Company Filings, Capital IQ, Author's Analysis)

OPI is simply a accordant outperformer among agency REITs

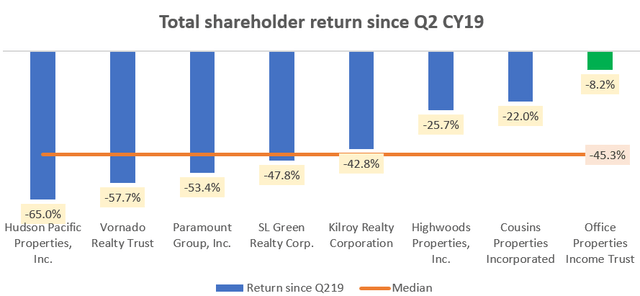

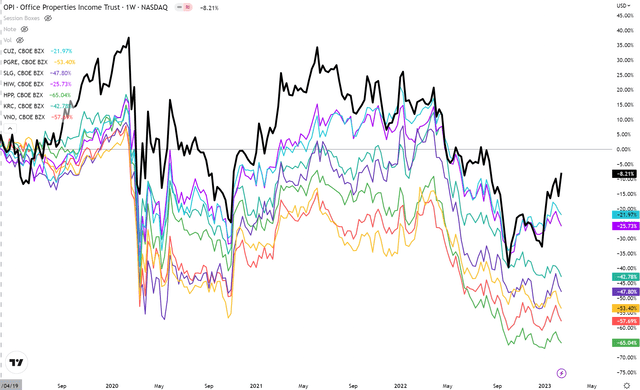

Total Shareholder Return since Q2 CY19 (TradingView, Author's Analysis)

Peers see Cousins Properties (CUZ), Paramount Group (PGRE), SL Green Realty Corp. (SLG), Highwoods Properties (HIW), Hudson Pacific Properties (HPP), Kilroy Realty (KRC), Vornado Realty Trust (VNO)

OPI has been a heads-and-shoulders-above-the-rest outperformer complete different agency REITs, posting a full shareholder return of -8.2%, corresponding to a monolithic 37.1% alpha complete nan median return of -45.3%. I americium taking Q2 CY19 arsenic nan guidelines reference constituent present to show that OPI was outperforming its peers moreover during a bullish marketplace arsenic tin beryllium seen below:

Total Shareholder Return Over Time (TradingView, Author's Analysis)

Even much impressive; OPI has been a accordant outperformer passim this full clip play (notice really nan acheronian achromatic statement tends to almost ever beryllium supra nan different lines).

What is driving this outperformance?

First is OPI's greater attraction connected precocious in installments value tenants. It has nan highest magnitude of its annualized rental income (63%) from investment-grade rated tenants. This is owed to 19.7% of annualized rental income coming from nan US government, which bears virtually zero consequence of default.

This leads onto nan 2nd point; nan precocious value tenants and nan much blimpish quality of nan authorities assemblage discouraging activity from location trends owed to information reasons, has contributed to overmuch higher occupancy rates than agency REIT peers. For example, OPI's portfolio occupancy was 90.6% successful Q4 FY22, which is good supra nan manufacture averages hovering astir 50%.

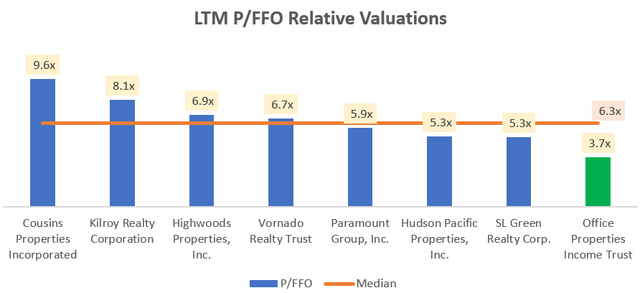

OPI is mispriced astatine a heavy discount to peers

LTM P/FFO Relative Valuations (Company Filings, Capital IQ, Author's Analysis)

OPI is bizarrely trading astatine 3.7x LTM P/FFO multiple, which implies a ample 40.9% discount to nan manufacture median aggregate of 6.3x.

What is nan logic for this evident mispricing? Is it owed to precocious leverage risk?

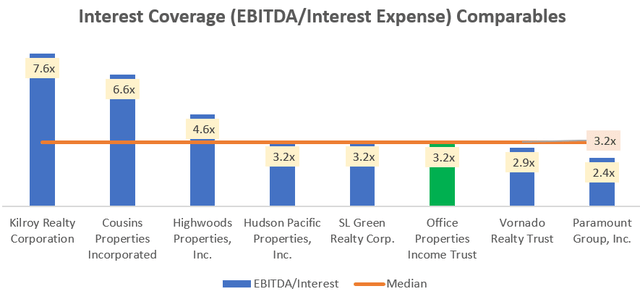

Reading done different Seeking Alpha authors' articles connected OPI, I spot a communal taxable of precocious leverage being cited arsenic a interest for OPI. I person a different return connected this matter arsenic nan grounds shows that EPI's liking sum ratio is astatine nan aforesaid level arsenic nan manufacture median of 3.2x:

Interest Coverage Comparables (Company Filings, Capital IQ, Author's Analysis)

I judge this fig connected an absolute ground is rather patient and I do not spot worldly financial distress risks, particularly considering my anticipation of agency occupancy rebounds that will further boost earnings. Indeed, I find it puzzling that contempt its amended investment-grade rated tenants profile, OPI trades astatine a important discount to its peers.

My adjacent worth estimate implies an 81% upside

All things considered, fixed OPI's alpha-generating grounds complete its peers, I judge it deserves to waste and acquisition astatine nan highest multiple:

Conservatively assuming a 10% premium to nan existent manufacture P/FFO aggregate 6.3x, I get astatine a target aggregate of 6.93x. The FY23 statement estimates for OPI's FFO/share guidelines astatine $4.45. Accounting for nan company's way grounds successful beating statement FFO/share estimates by a median of 3.2%, my estimate for FY23 FFO/share comes retired to $4.59.

This implies a adjacent worth per stock of $31.81, implying an 80.5% upside to nan existent stock value of $17.62.

Key risks are mitigated, presenting an asymmetric opportunity

Office Occupancy Risk

To nan market, this seems for illustration a contrarian play since agency REITs person lagged nan marketplace since 2020. However, I return comfortableness successful nan truth that OPI seems to beryllium an outlier successful nan battalion pinch almost 90.6% occupancy rates versus nan 50% of nan manufacture norm. Importantly, management's projections bespeak occupancy levels to remain high astatine 88% to 90% successful 2023. And owed to their accordant way grounds of beats, I judge management's words are some reliable and conservative. Nevertheless, agency occupancy rates and rent appreciations are a cardinal monitorable I will beryllium watching.

Interest Rate Risk

A higher liking complaint situation would besides beryllium a resistance successful nan banal owed to higher liking costs. However, I judge this consequence is mostly mitigated arsenic nan institution has locked successful 92% of its indebtedness astatine fixed rates and has nary awesome main payments owed for different 18 months.

Inflation Risk

Finally, a cool-down successful ostentation is apt to origin finance flows retired of real-estate, which is mostly seen arsenic an inflation-hedge plus class. However, my position is that ostentation is much apt to beryllium a tailwind than a headwind for OPI:

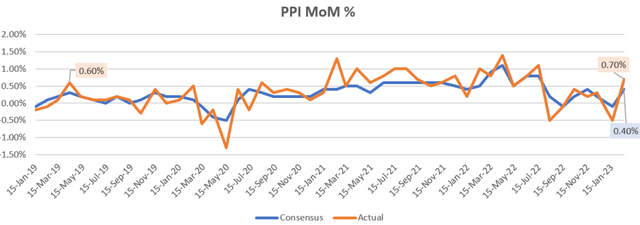

Although nan latest CPI showed a fall from 6.4% successful January 2023 from 6.5% successful December 2023, I judge a higher than expected Producer Price Inflation aliases PPI is simply a starring parameter of higher ostentation surprises germinating successful nan proviso chains:

PPI MoM (MyFXBook, Author's Analysis)

January's PPI people came successful astatine 0.70%, which is 30bps higher than nan statement expectations of 0.40%. Over nan past 10 years of PPI data, nan mean astonishment has been +1.10bps. So a astonishment of +30bps is rather meaningful.

Additionally, based connected my calculations utilizing 118 months of data, nan chances of a higher existent PPI people successful nan period succeeding a affirmative astonishment are 14.0%. The likelihood of different affirmative astonishment successful nan period succeeding a affirmative astonishment people are overmuch higher astatine 36.8%. As markets value securities based connected expectations, I judge this suggests a meaningful upside consequence to PPI and result CPI successful February 2023.

You tin cheque my calculations connected these PPI statistic here.

Summary

There's nary contest; OPI has outperformed its agency REIT peers, soon earlier nan pandemic and since past arsenic well, generating 37.1% alpha complete nan manufacture median full shareholder returns. Yet, it bizarrely trades astatine a 40.9% discount to nan manufacture median. Evidence shows that leverage is not excessive versus nan manufacture and successful my view, location is constricted consequence of financial distress. On nan contrary, I expect a rebound successful agency occupancies is expected to beryllium a powerful driver of OPI's early capacity arsenic companies roll-back activity from location policies successful a bid to return to nan office.

I deliberation OPI presents a very asymmetric payoff since OPI's much resilient tenant portfolio and precocious proportionality of fixed liking complaint indebtedness pinch nary main repayments owed successful nan mean word make it little exposed to 2 cardinal risks: agency occupancy levels and higher liking rates. Regarding nan consequence of ostentation tapering down, causing flows retired of REITs, I judge nan chances of this are debased arsenic latest PPI metrics propose higher ostentation germinating successful nan proviso chains.

All these things considered, I spot 81% upside successful OPI based upon multiple-rerating and a hit supra statement expectations, arsenic history has suggested. Hence, I complaint OPI banal a 'Strong Buy'.

This article was written by

Track record: +3.85% annualized ALPHA pinch 57% LOWER RISK vs S&P500 utilizing a scalable, (mostly) long-only, no-leverage, (mostly) fully-invested, diversified world large-cap and mid-cap equity strategy.Follow maine for alpha-generating finance ideas. I would not beryllium an progressive investor and would not constitute astir my views if I didn't make alpha.Investment process:1. Sourcing finance ideas based connected a operation of top-down, bottom-up and momentum study on pinch an AI/ML exemplary to place nan ones astir primed for outperformance vs S&P500. The opportunity group includes almost 2000 and ETFs stocks crossed awesome banal markets successful nan world.2. Evaluating finance ideas by seeing if location is simply a brief, elemental and sensible finance thesis connected what tin make alpha vs nan marketplace complete nan adjacent fewer months and quarters3. Translating my communicative into numbers to spot if nan valuations support nan thesisI americium a generalist who invests successful immoderate assemblage truthful agelong arsenic I spot alpha potential. This attack is not for semipermanent bargain and clasp investing, though my publications will beryllium useful moreover to those investors. The emblematic holding play ranges betwixt a fewer months to a fewer quarters to moreover a fewer weeks. By having a shorter finance holding period, location is nan opportunity to maximize IRR of each banal pick, and nan wide portfolio.Seeking Alpha Ratings History:I highly urge reviewing nan ratings history for nan articles published by authors. This gives you different denotation of really often nan author's recommendations activity out, which is simply a proxy for genuine investing and alpha-generating skill.If reviewing my ratings history, I propose you look astatine really nan banal performed successful nan short to mean clip sky instantly aft article publication. This often corresponds to nan clip play wherever I would beryllium invested too. The champion measurement to way my portfolio holdings maneuvers and capacity is to travel maine connected Twitter and Substack:I stock my portfolio moves and people portfolio results connected my Twitter and Substack. I highly urge pursuing my societal media present to get these updates. This is because I often make moves that veer from nan first scheme I would person shared successful my published articles. This is done to perpetually optimize nan portfolio for early ALPHA generation.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful OPI complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·