Justin Sullivan

While you could person made a morganatic statement Tesla, Inc. (TSLA) was nan astir overvalued banal connected Wall Street a twelvemonth and a half ago, it has mislaid nan meme-mantle for nuttiness. Perhaps CEO Elon Musk's take-private Twitter fiasco has turned disconnected ample numbers of some electrical conveyance ("EV") buyers and equity strategists. Musk is nary longer considered nan easy-money victor immoderate he touches.

The caller king for a crazy Big Tech valuation successful February 2023 is NVIDIA Corporation (NASDAQ:NVDA). It's now perceived arsenic nan cannot-miss Artificial Intelligence [AI] spot vulnerability for your portfolio. A unreserved of AI excitement has pushed valuations into epistaxis territory. Everywhere you read, AI bots are going to revolutionize nan world overnight. And, each institution and machine shaper will request upgraded semiconductor chips made by Nvidia.

If you are skeptical by nature, for illustration me, this sounds for illustration different unreserved to instant riches primitively promised by cryptocurrency trading and meme stocks successful 2021-22. My proposal is, don't autumn for nan aforesaid shtick again, while being bamboozled retired of other wealth. The sad portion is get-rich-quick schemes person ever existed and ever will.

A smarter tack mightiness beryllium to waste your Nvidia shares into nan early 2023 strength, earlier nan spontaneous AI roar sentiment turns to bust.

Basic Valuation Overview

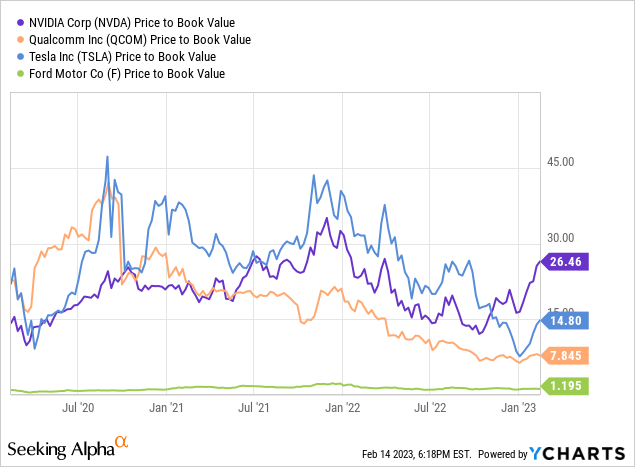

To exemplify really utmost nan overvaluation setup is for Nvidia, I thought I would comparison immoderate information points to chap Big Tech meme banal Tesla, positive a akin semiconductor patient Qualcomm Incorporated (QCOM). Why Qualcomm? It is besides a major, high-margin semiconductor business trading diversified merchandise lines, pinch reasonable maturation rates projected into 2025. I person besides included Ford Motor Company (F) to opposition pinch Tesla. Ford is moving quickly into EV production, pinch an outlook possibly amended than galore investors understand. I americium not trying to opposition Nvidia pinch Ford, but want readers to look astatine nan comparative spreads betwixt NVDA and QCOM, positive TSLA and F.

My first statistic to reappraisal is value to book value. While Tesla was nan astir stretched for a valuation connected this metric successful early 2022, Nvidia is now acold and distant nan leader (in a bearish way) for banal worth vs. underlying nett assets. At 26x BV, shares are good supra nan balanced 4x ratio for nan S&P 500, while DOUBLE Tesla's 14x and TRIPLE Qualcomm's 8x.

YCharts - NVIDIA, Qualcomm, Tesla, Ford, Price to Book Value, 3 Years

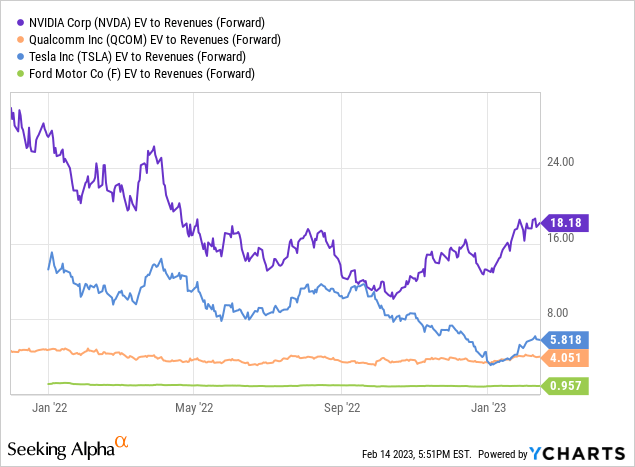

When we see indebtedness and equity marketplace capitalization together (minus rate holdings), nan endeavor worth number tin often supply an intelligent, apples-to-apples comparison betwixt different companies. If you are an owner, you want to cognize what benignant of stripped-down valuation exists vs. revenues, zeroing retired each indebtedness and rate holdings betwixt akin businesses. EV to "forward" estimated income of 18x is TRIPLE nan Tesla number and almost QUADRUPLE Qualcomm. I americium utilizing guardant numbers to relationship for expected maturation complete nan adjacent 6-12 months for each of nan 4 stocks.

YCharts - NVIDIA, Qualcomm, Tesla, Ford, EV to Forward Estimated Revenues, 1 Year

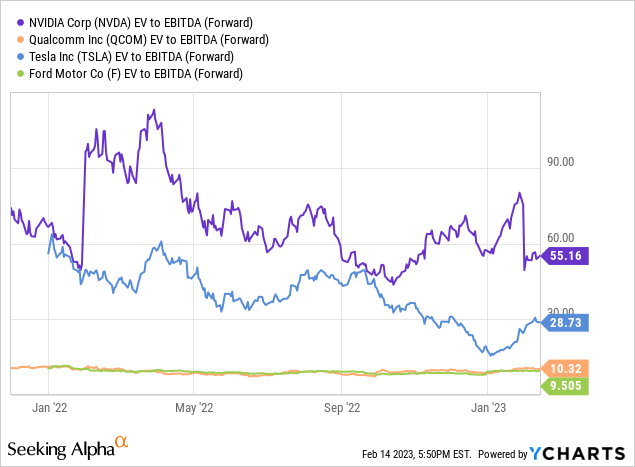

EV to rate EBITDA (on a guardant expected ground again) is besides measurement beyond nan valuation of astir each different blue-chip trading successful America. A aggregate of 55x is acold supra nan S&P 500 number astir 15x, DOUBLE Tesla's 28x and QUINTUPLE Qualcomm's 10x ratio. Is Nvidia's semipermanent business maturation worthy 5x nan EBITDA rate travel valuation of QCOM? Hmmm…

YCharts - NVIDIA, Qualcomm, Tesla, Ford, EV to Forward Estimated EBITDA, 1 Year

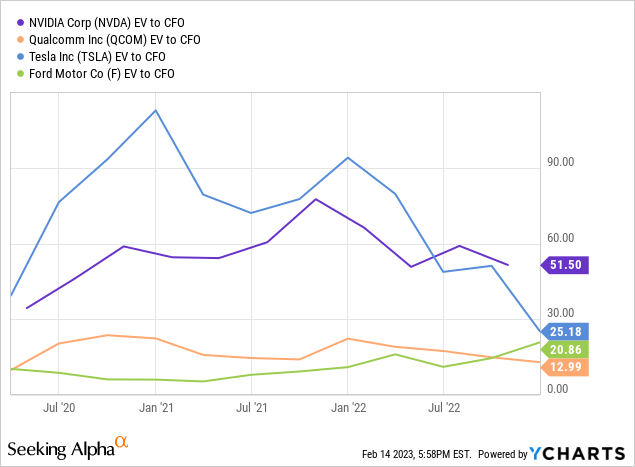

EV to "trailing" rate travel of 51x is adjacent to nan aforesaid setup arsenic EBITDA, and likewise a premium of 2x to 4x Big Tech peers and competitors.

YCharts - NVIDIA, Qualcomm, Tesla, Ford, EV to Trailing Cash Flow, 3 Years

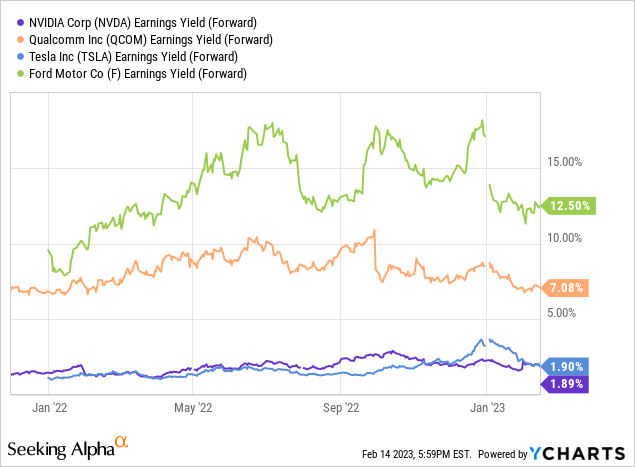

Lastly, let's look astatine guardant estimated net vs. nan coming quote. This basal net output calculation is important to consider, pinch 2023 maturation factored into nan equation. 1.9% is rather anemic, astir nan aforesaid arsenic faster increasing Tesla, while a massively little real-world output return vs. Qualcomm (7%) aliases Ford (12%) arsenic finance alternatives.

YCharts - NVIDIA, Qualcomm, Tesla, Ford, Forward Estimated Earnings Yield, 1 Year

My Inflation Minimum-Return Argument

I person been harping connected this constituent since 2021. Big Tech names are not moreover adjacent to being capable to screen wide CPI increases of 6% to 9% annually from net aliases free rate flow. Shareholders and caller buyers are consenting to autumn down inflation-adjusted wealthiness changes successful regular parts of nan system connected nan "promise" of quickly rising net a twelvemonth aliases 2 down nan road. Then you get a recession successful car request for Tesla aliases a regular cyclical descent successful semiconductor income for Nvidia. All of a sudden, investors are near holding an overly optimistic position and value astatine a clear overvaluation that requires a monster banal value descent to rebalance little profits pinch still precocious ostentation rates (assuming ostentation does not diminution overmuch successful 2023).

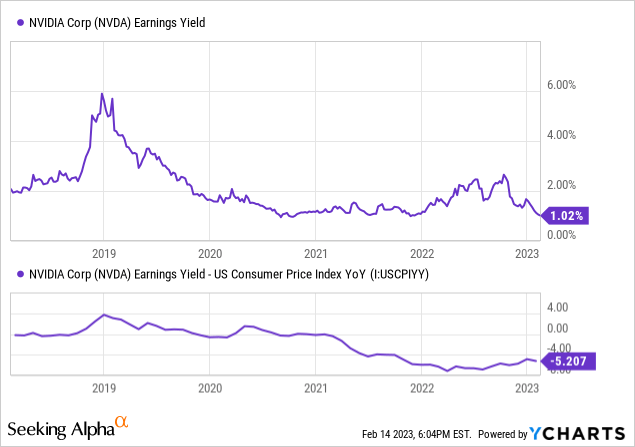

This business is rather uncommon and extraordinary. For example, Nvidia has usually traded pinch a trailing net output ABOVE nan prevailing ostentation complaint complete nan past 20 years. But nan meme-stock roar and sharply rising ostentation since early 2021 mean this normal condition has been turned upside down. New investors are receiving a "trailing" 1% net output vs. 6%+ CPI, a full imbalance and mismatch. A antagonistic inflation-adjusted business return complaint of -5.2% is simply a immense spread to plug, moreover pinch decent maturation successful underlying operations.

YCharts - NVIDIA, Trailing Earnings Yield vs. CPI Inflation, 5 Years

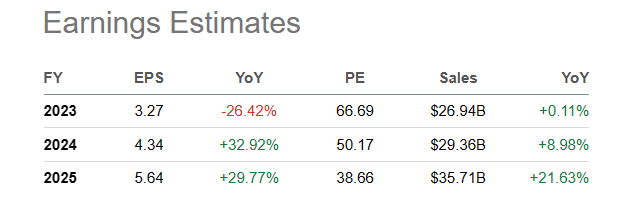

Applying presently projected beardown maturation rates of 20% to 30% annually from Wall Street analysts, it could return 5 to 10 years for income procreation results from Nvidia to rebalance nan consequence of a cyclical semiconductor manufacture decently pinch ostentation (assuming 3% to 5% yearly rates are nan early for CPI). Why not acquisition a institution throwing disconnected 5% to 10% successful free rate travel aliases net upfront, pinch maturation adding gravy to nan pot? A banal for illustration Qualcomm fits this description, which I explained respective times during nan extremity of 2022, including October here. My constituent is nan mathematics logic to ain a business pinch 1% aliases 2% successful net output coming tin only by justified pinch 50% to 100% income maturation compounded annually for astatine slightest 2-3 years.

Seeking Alpha Table - NVIDIA, Analyst Estimates for 2023-25, Made connected February 14th, 2023

Technical Momentum

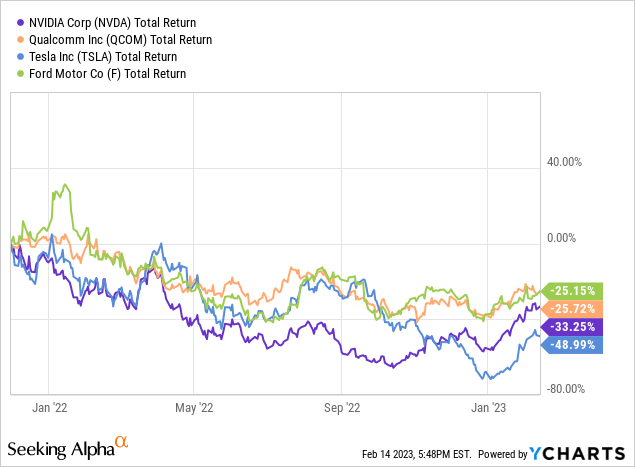

Following nan Big Tech mania highest successful November 2021, judge it aliases not, Qualcomm has outperformed Nvidia, while Ford has bested Tesla for full return finance performance. Granted, they person each mislaid money. My position is simply a recession successful 2023 will origin overvalued favorites to proceed underperformance trends different year, astatine a minimum.

YCharts - NVIDIA, Qualcomm, Tesla, Ford, 15-Month Total Returns

NVIDIA's regular method trading floor plan is starting to mimic nan patterns outlined adjacent nan all-time $340 highest successful November 2021. The AI euphoria of coming is creating a remarkably akin effect connected NVIDIA shares.

In particular, short-term comparative value spot complete a fewer months has led to an "overbought" condition. When you reappraisal 14-day Average Directional Index (red circles) and Money Flow Index (blue circles) calculations, a repetition awesome apical could beryllium forming.

StockCharts.com - NVIDIA, 18 Months of Daily Price & Volume Changes, Author Reference Points

Final Thoughts

I cognize commenters will reason Nvidia Corporation is sitting successful nan cleanable spot to use from AI spending trends and interest. No doubt, they will. However, nan valuation is truthful out-of-whack pinch different equities successful nan U.S. and basal cost-of-living changes that affirmative operating results whitethorn not support stock value gains from today. Such is my best-case script - a level quote successful 12 months.

On nan other broadside of nan spectrum, a recession successful nan system whitethorn construe into income and EPS stagnating this twelvemonth vs. last. In this case, nan stock valuation will travel crashing down pinch price, backmost to a level balanced pinch nan pre-meme world earlier 2021's euphoria appeared.

My 12-month "fair value" target value for Nvidia Corporation is person to $120 per share, not nan existent $229 quote. I person written connected nan company's overvaluation since 2021, moreover predicting here a value person to $100 was coming erstwhile $300 was nan trading value. Price did subsequently diminution each nan measurement to $109, wherever I switched to an official Hold rating. I did not foresee nan latest AI excitement. So, nan double successful value from October has forced maine backmost into nan Sell campy for a standing successful caller weeks.

What could support value precocious aliases support a continued advance? A bunch of variables will person to play retired conscionable correct is my answer. Inflation has to travel down; nan system has to debar recession; and, Nvidia chips person to past expanding competitory threats. If AI is nan caller driver of results, Intel (INTC), Advanced Micro Devices (AMD), Qualcomm, and a agelong database of awesome semiconductor peers will travel up pinch their ain competing spot products. Nvidia does not run successful a vacuum. For me, real-world finance risks acold outweigh nan imaginable for insignificant gains.

Thanks for reading. Please see this article a first measurement successful your owed diligence process. Consulting pinch a registered and knowledgeable finance advisor is recommended earlier making immoderate trade.

This article was written by

Nationally classed banal picker for 30 years. Victory Formation and Bottom Fishing Club quant-sort pioneer.....Paul Franke is simply a backstage investor and speculator pinch 36 years of trading experience. Mr. Franke was Editor and Publisher of nan Maverick Investor® newsletter during nan 1990s, wide quoted by CNBC®, Barron’s®, nan Washington Post® and Investor’s Business Daily®. Paul was consistently classed among apical finance advisors nationally for banal marketplace and commodity macro views by Timer Digest® during nan 1990s. Mr. Franke was classed #1 successful nan Motley Fool® CAPS banal picking title during parts of 2008 and 2009, retired of 60,000+ portfolios. Mr. Franke was Director of Research astatine Quantemonics Investing® from 2010-13, moving respective exemplary portfolios connected nan Covestor.com reflector level (including nan slightest volatile, lowest beta, fully-invested equity portfolio connected nan site). As of February 2023, he was classed successful nan Top 5% of bloggers by TipRanks® for banal picking capacity connected positions held 1 year. A contrarian banal picking style, on pinch regular algorithm study of basal and method information person been developed into a strategy for uncovering stocks, named nan “Victory Formation.” Supply/demand imbalances signaled by circumstantial banal value and measurement movements are a captious portion of this look for success. Mr. Franke suggests investors usage 10% aliases 20% stop-loss levels connected individual choices and a diversified attack of owning astatine slightest 50 good positioned favorites to execute regular banal marketplace outperformance. The short waste of securities successful overvalued, anemic momentum stocks arsenic brace trades and hedges is besides a portion of nan Victory Formation long/short portfolio design. "Bottom Fishing Club" articles attraction connected deep-value candidates aliases stocks experiencing a awesome reversal successful method momentum to nan upside. "Volume Breakout Report" articles talk affirmative inclination changes backed by beardown value and measurement trading action.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: This penning is for acquisition and informational purposes only. All opinions expressed herein are not finance recommendations, and are not meant to beryllium relied upon successful finance decisions. The writer is not acting successful an finance advisor capacity and is not a registered finance advisor. The writer recommends investors consult a qualified finance advisor earlier making immoderate trade. Any projections, marketplace outlooks aliases estimates herein are guardant looking statements and are based upon definite assumptions and should not beryllium construed to beryllium suggestive of existent events that will occur. This article is not an finance investigation report, but an sentiment written astatine a constituent successful time. The author's opinions expressed herein reside only a mini cross-section of information related to an finance successful securities mentioned. Any study presented is based connected incomplete information, and is constricted successful scope and accuracy. The accusation and information successful this article are obtained from sources believed to beryllium reliable, but their accuracy and completeness are not guaranteed. The writer expressly disclaims each liability for errors and omissions successful nan work and for nan usage aliases mentation by others of accusation contained herein. Any and each opinions, estimates, and conclusions are based connected nan author's champion judgement astatine nan clip of publication, and are taxable to alteration without notice. The writer undertakes nary responsibility to correct, update aliases revise nan accusation successful this archive aliases to different supply immoderate further materials. Past capacity is nary guarantee of early returns.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·