fotokostic/iStock via Getty Images

Investment Thesis

Nutrien (NYSE:NTR) is cheaply valued, but there's much to this communicative than conscionable a debased valuation. On 1 hand, NTR is priced astatine 8x this year's EPS. And that's intelligibly a inexpensive multiple.

However, until potash prices commencement to patient up, investors will stay unenthused astir NTR. Put different way, only nan astir diligent investors are apt to person nan stamina to proceed pinch this trade.

Bull Thesis Didn't Play Out

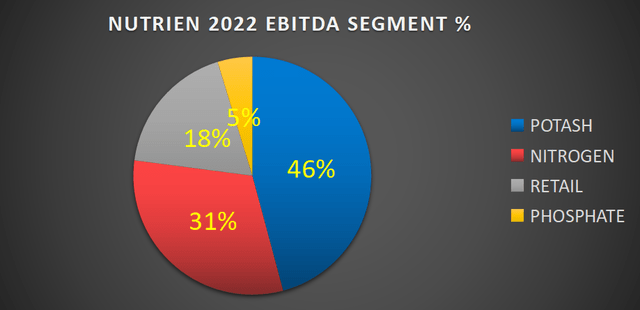

Nutrien vanished Q4 2022 pinch nan pursuing breakdown, wherever you spot that very adjacent to half nan bottommost statement profitability came from potash.

Author's calculations, not including eliminations

This leads america to talk expectations versus reality.

Anyone willing successful this abstraction knows nan geopolitical drivers that caused nan spiking of potash prices. Case successful point, location was a important mobility arsenic to nan reliable supply of potash aft February 2022.

Furthermore, location was nan perception that it would beryllium difficult to get bargain potash from Russia. This translated into beardown potash prices.

Meanwhile, farmers decided that pinch potash, and different fertilizer crops being elevated, they sought to minimize their inventory consumption. The attraction present is connected potash, but different fertilizers specified arsenic nitrogen were besides impacted. Albeit done much indirect drivers, including precocious power prices.

Nonetheless, to put it blankly, location was a thesis unfolding that created a batch of excitement. However, that thesis didn't play retired arsenic expected.

With this discourse successful mind, let's return connected committee Nutrien's guidance.

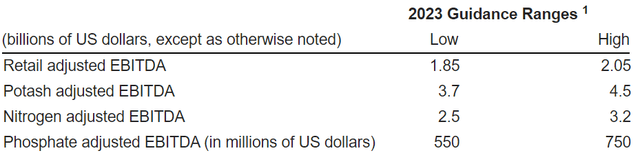

What you spot present is that potash EBITDA is guided for astir $4 billion, down astir 30% y/y from 2022.

NTR Q4 2022

Accordingly, let's now move our chat to really this will effect Nutrient's profitability successful 2023.

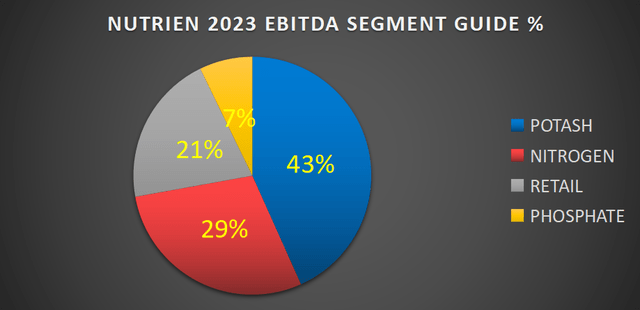

Author's calculations, not including eliminations

As you tin spot above, Nutrien's biggest segment, its potash segment, is going to shrink meaningfully successful 2023.

So, now that we person much visibility into 2023, fto maine make thing clear. Painfully clear.

2022 Was a Black Swan, It Will Not Repeat

Implicitly aliases explicitly, galore Nutrien investors sewage progressive pinch Nutrien because they bought into a communicative that didn't play out. Many group assumed location would beryllium a re-run of nan 2007 playbook, wherever potash prices would soar.

And erstwhile Russia's penetration took place, galore investors thought that history would repetition itself. The problem pinch nan marketplace is that it doesn't repetition itself.

All that being said, I'm not convinced that this is wherever nan communicative ends. Yes, that complaint and strength successful nan shortage of atom haven't played out. The animal spirits and investor flows are not repositioning backmost into nan fertilizer trade.

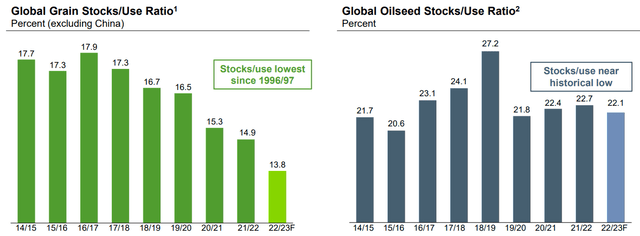

That being said, see nan graphics that follow, showing nan world atom stocks/use ratio.

NTR Q4 2022

The stocks/use ratio is simply a supply-demand equation. A measurement of nan narration betwixt nan magnitude of a commodity that is held successful inventory versus nan magnitude consumed.

A debased stock-to-usage ratio intends there's tightness. While oilseed stocks are ''only'' astatine nan debased extremity of their 5-year range, grain stocks are nan lowest successful a 4th of a century.

So yes, we each understand, nan waste and acquisition didn't play retired really we thought it would. But surely, nan full statement pinch a demand-supply equation is that moreover though customers are not motivated to bargain what they request correct now, there's nevertheless a important magnitude of value inelasticity successful this fertilizer equation. Farmers person to buy, peculiarly erstwhile harvest yields are truthful high.

On nan other, nan connection cautious was heard 10 times connected nan net call. So, we tin each dress and wish that nan thesis is astir to play out, but I judge that successful reality, we are each successful a wait-and-see mode. But that's good too.

NTR Stock Valuation - Roughly 8x EPS

On nan surface, NTR is cheap. But inexpensive stocks tin ever get cheaper.

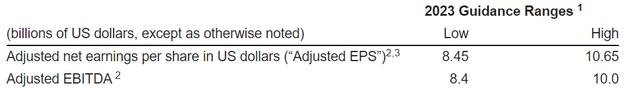

NTR guidance

As you tin spot here, NTR is priced very astir astatine 8x this year's EPS. That being said, support successful mind that NTR's guidance points towards its EPS fig coming down astir 20% y/y.

So everyone tin admit that NTR is not expensive. But until investors really spot farmers returning to restock their inventory, Nutrien will require its shareholders to beryllium patient.

The Bottom Line

I've been a focal bull of Nutrien for a while. And indeed, I powerfully judge that you do not study thing astir investing erstwhile you make nan correct call. When you make a bully telephone and nan banal goes up, you've not learned anything.

It's only erstwhile you person a thesis, and it doesn't unfold nan measurement you thought it would, that you really study something. Call it nan costs of your tuition.

On yet nan different hand, while I admit that patience is nan astir costly commodity an investor tin beryllium asked to pay, I judge that successful 6 to 12 months, we'll each beryllium having a very different and much affirmative chat erstwhile it comes to NTR.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued finance opportunities - stocks pinch accelerated maturation potential, driven by apical value management, while these stocks are cheaply valued.

I travel countless companies and select for you nan astir charismatic investments. I do each nan activity of picking nan astir charismatic stocks.

Investing Made EASY

As an knowledgeable professional, I item nan best stocks to turn your savings: stocks that present beardown gains.

- Deep Value Returns' Marketplace continues to quickly grow.

- Check retired members' reviews.

- High-quality, actionable insightful banal picks.

- The spot wherever worth is everything.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·