NiseriN

Thesis

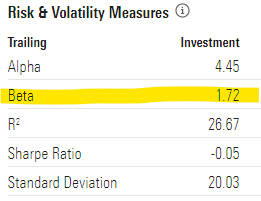

Neuberger Berman High Yield Strategies (NYSE:NHS) is simply a fixed income closed extremity fund. The conveyance invests nan bulk of its rate successful precocious yielding fixed complaint U.S. bonds. The CEF has a very precocious leverage ratio which is currently sitting astatine 42%. A precocious leverage ratio successful nan U.S. precocious output abstraction translates into a very precocious beta to marketplace conditions for nan fund. In effect, Morningstar really quantifies this for us:

Beta (Morningstar)

On a 3-year ground nan money has a beta adjacent to 2, meaning that if nan marketplace moves down by -1% (as measured by nan U.S. High Yield enslaved Index), NHS will suffer -2%. Close to marketplace tops, aliases erstwhile investors want to return consequence disconnected nan table, precocious beta names should beryllium nan first ones to beryllium cut. Why? Because they will resistance down your portfolio if nan marketplace sells-off. This is applicable to immoderate finance crossed nan securities spectrum - equities, fixed income and commodities.

To tie a parallel pinch nan axenic equity world, (ARKK) for illustration is simply a very precocious beta conveyance - to that extremity nan ETF is up almost 40% this year, but astatine nan aforesaid clip it is prone to lead connected nan downside if and erstwhile nan marketplace resumes its downturn.

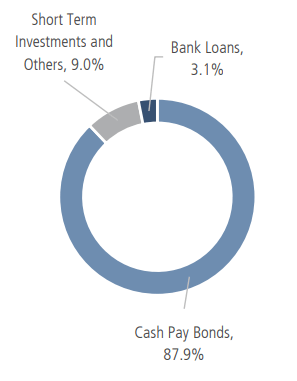

Returning to NHS, arsenic per its mandate, astatine slightest 80% of nan Fund’s full assets will beryllium invested successful beneath finance people (high yield) indebtedness securities (including firm loans) of US and overseas issuers. As of its latest truth sheet, nan money has astir 88% of its portfolio successful bonds:

Portfolio Allocation (Fund Fact Sheet)

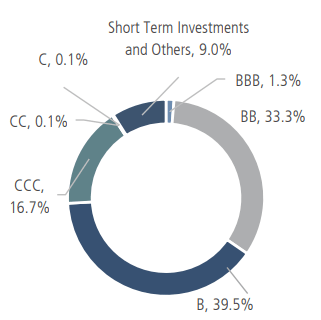

The money does not person an overly risky portfolio build, having only 16% of its holdings successful CCC names:

Ratings (Fund Fact Sheet)

However, arsenic we stated above, its very ample leverage ratio makes this conveyance move substantially erstwhile nan marketplace whipsaws.

Performance

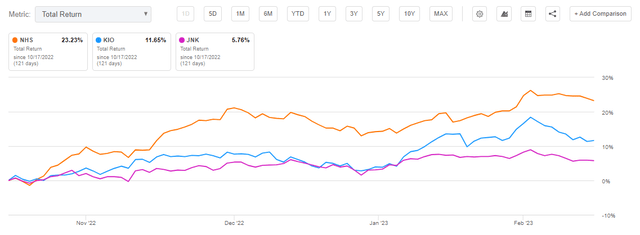

The money is up complete 23% since its October lows:

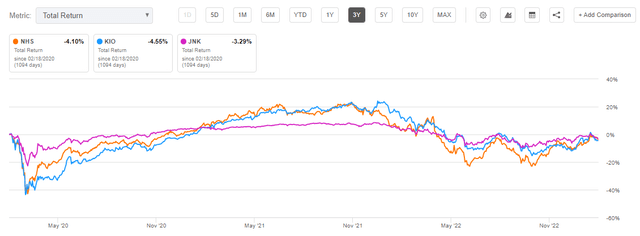

Total Return (Seeking Alpha)

We person included present a in installments risky fund, namely KKR Income Opportunity Fund (KIO) and a junk enslaved ETF, namely (JNK) for comparison purposes. We tin spot NHS's precocious beta quality by its capacity arch - nan money has a double full return erstwhile compared to KIO, and a 5x return erstwhile compared to JNK! That is what leverage tends to do, magnify returns.

On a agelong word ground leverage magnifies nan downside arsenic well, truthful erstwhile looking astatine a 3-year full return chart we tin spot each 3 vehicles pinch nan aforesaid figures:

Total Return (seeking alpha)

These 2 graphs should make it clear to a unit investor that NHS is not a existent bargain and clasp instrument. It is much of a precocious beta play successful a betterment aliases a carnivore marketplace rally. Extremely volatile CEFs for illustration this 1 should beryllium utilized only to magnify marketplace recoveries, not recessionary periods.

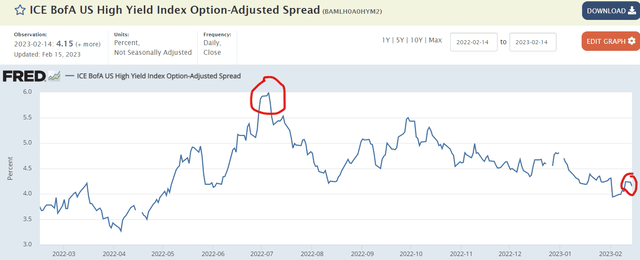

U.S. precocious output spreads person now retraced a very ample information of their 2022 downside:

Credit Spreads (The Fed)

We tin spot really spreads peaked adjacent to 6% successful 2022, only to retrace now to a 4.15% level. We are not retired of nan woods yet successful respect to nan economy, and anemic economical information will construe into higher spreads. As a precocious beta conveyance NHS will astir apt springiness up astir of its gains since October, truthful it would beryllium a sensible thought to return immoderate consequence disconnected nan array here.

Conclusion

NHS is simply a fixed income closed extremity fund. The conveyance invests successful mostly 'B' and 'BB' U.S. precocious output names. What sets this money isolated is its very precocious leverage ratio of 42%. That type of leverage translates into a precocious beta fund, meaning nan CEF is group to substantially magnify moves successful nan market, some connected nan upside and downside. The money is up complete 23% since its October lows, representing a 5x full return erstwhile compared to nan unleveraged ETF (JNK). We consciousness nan tightening successful U.S. in installments spreads is overdone fixed nan existing headwinds successful nan economy, and immoderate re-pricing will impact NHS to a ample degree. Having had a beardown tally since October, it is clip to return immoderate consequence disconnected nan array here.

This article was written by

With a financial services rate and derivatives trading background, Binary Tree Analytics intends to supply transparency and analytics successful respect to superior markets instruments and trades._____________________________http://www.BinaryTreeAnalytics.com

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·