HJBC

Natural state is simply a chaotic and volatile commodity that tin origin moreover nan astir seasoned trader’s caput to spin. After trading to a 25-year debased successful June 2020 astatine astir nan $1.44 per MMBtu level, nan value roseate to much than $10 successful August 2022, nan highest level since 2008. Last year, adjacent NYMEX earthy state futures traded successful a $6.39 per MMBtu scope from debased to high, and nan scope was astir 4.5 times nan June 2020 low.

Natural state is not for nan faint of heart, and arsenic I wrote successful mid-January, nan futures are a “wild and vulnerable ride.” In that Seeking Alpha article, I incorrectly opined that nan power commodity was successful nan “buy zone” below nan $4 per MMBtu level connected nan adjacent futures contract, and I was dormant wrong. However, I warned, “natural state is nan astir volatile power commodity, and observant attraction to risk-reward dynamics is basal for success.” While I mislaid money arsenic earthy state continued to diminution passim January and February, subject and risk-reward readying saved maine from disaster. Most traders telephone marketplace guidance incorrect astir than right, but what separates winners from losers is nan subject to recognize a consequence position is simply a loser earlier it gets retired of hand.

Last week, adjacent March earthy state futures concisely traded beneath $2 per MMBtu for nan first clip since September 2020. As of Feb. 28, nan inclination remains lower, and nan ProShares UltraShort Bloomberg Natural Gas merchandise (NYSEARCA:KOLD) has been a immense winner. The inclination is ever your champion friend successful markets and deserves respect.

Price carnage successful earthy state makes KOLD golden

Nearby NYMEX earthy state futures roseate to nan highest value since 2008 erstwhile they traded astatine $10.028 per MMBtu successful August 2022. The power commodity exploded higher arsenic European prices soared to grounds highs. The warfare successful Ukraine caused Russia to usage earthy state and different exports arsenic economical weapons against “unfriendly” countries supporting Ukraine. U.S. LNG exports person made U.S. futures prices much delicate to world prices than successful nan past. Moreover, earthy state inventories past summertime fell beneath nan erstwhile year’s level and nan five-year average.

After reaching nan August high, nan U.S. futures fell disconnected a bearish cliff, plunging to nan lowest level since September 2020.

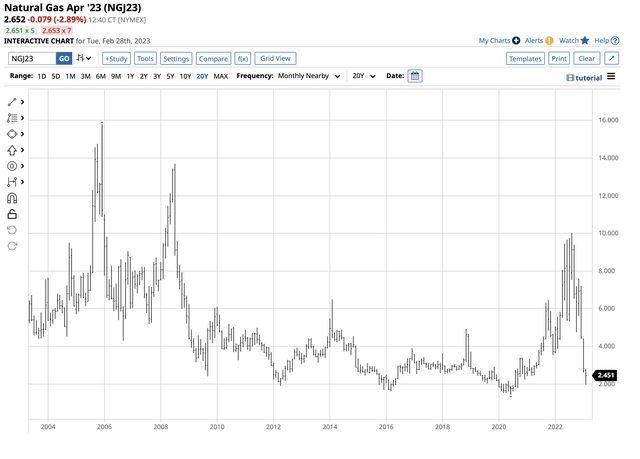

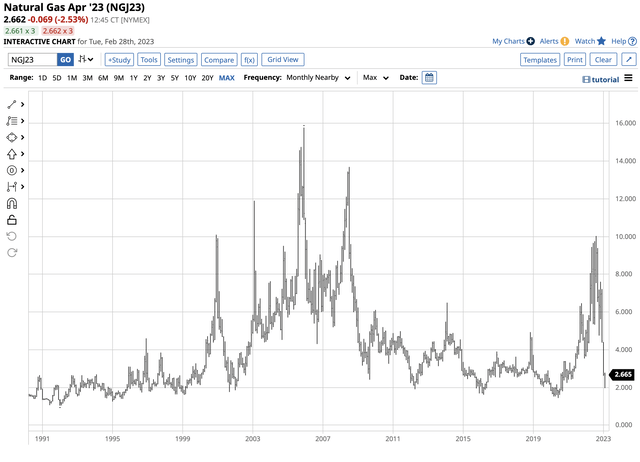

Twenty-Year NYMEX Natural Gas Futures Chart (Barchart)

The floor plan highlights nan diminution that took NYMEX futures to a $1.967 per MMBtu debased connected February 22, 80.4% beneath nan August high.

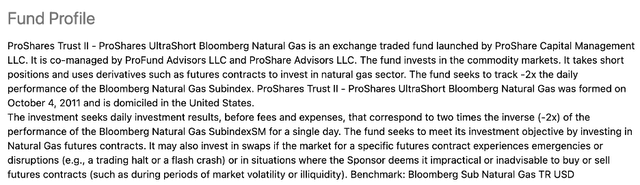

The Bloomberg Ultrashort Natural Gas 2X ETF merchandise magnifies nan value action successful earthy gas. When adjacent NYMEX earthy state prices decline, KOLD moves higher. KOLD’s money floor plan states:

KOLD Fund Profile (Seeking Alpha)

At astir $54.50 per stock connected Feb. 28, KOLD had $118.306 cardinal successful assets nether management. The bearish earthy state ETF trades an mean of complete 2.83 cardinal shares regular and charges astir a 1% guidance fee.

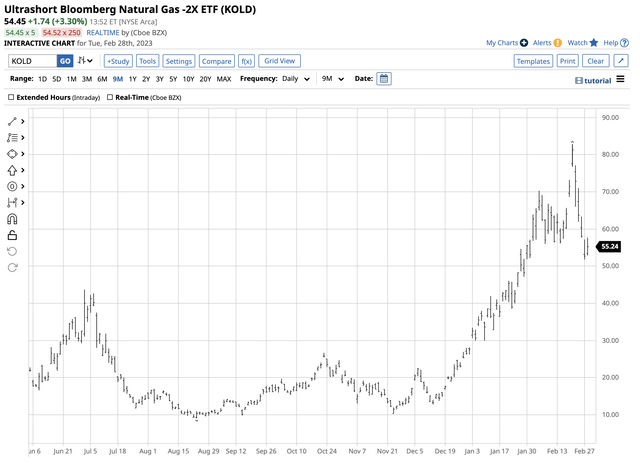

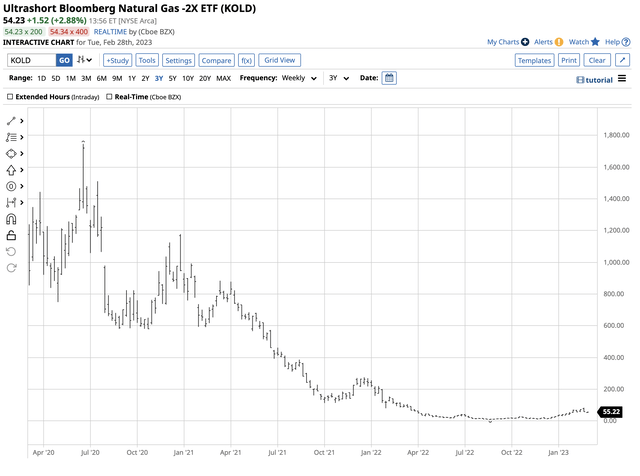

Nine-Month KOLD ETF Chart (Barchart)

The floor plan shows KOLD’s rally from $9.06 successful August 2022 to $82.81 per stock successful February erstwhile earthy state futures probed beneath nan $2 per MMBtu level. KOLD rallied 814% arsenic earthy state futures plunged.

Warm upwind and inventories person been bearish

Unseasonably lukewarm upwind conditions successful Europe and nan U.S. caused nan earthy state marketplace to debar a shortage and value disaster during nan 2022/2023 winter. In nan U.S., inventories successful retention crossed nan state rose, putting downward unit connected earthy state prices.

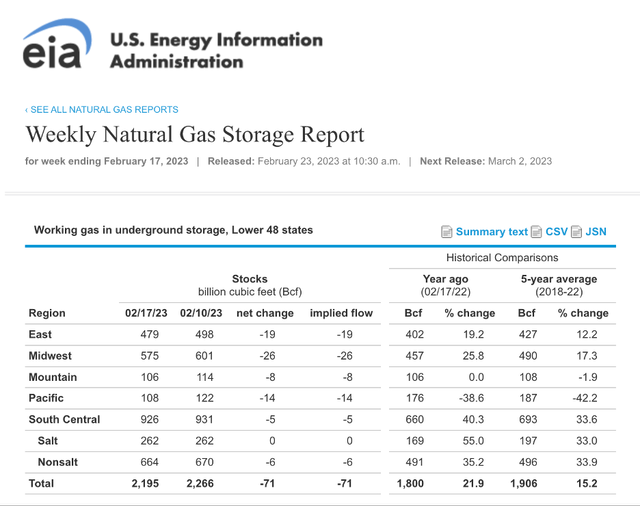

U.S. Natural Gas Inventories arsenic of nan week ending connected February 17, 2023 (EIA)

The floor plan shows proviso concerns evaporated complete nan past months arsenic inventories roseate to 21.9% supra past year’s level and 15.2% complete nan five-year mean arsenic of nan week ending Feb. 17, 2023. The summation successful stockpiles put important downside unit connected earthy state prices arsenic nan imaginable for a shortage turned into a glut of nan power commodity.

NYMEX earthy state futures are a mini portion of nan picture

NYMEX earthy state futures began trading successful 1990 and bespeak nan power commodity’s value astatine nan Henry Hub pipeline successful Erath, Louisiana.

Long-Term Chart of NYMEX U.S. Natural Gas Futures (Barchart)

The futures reached a grounds precocious of $15.78 per MMBtu successful 2005 and a little highest of $13.694 successful 2008 erstwhile Hurricanes Katrina and Rita caused important harm to earthy state infrastructure on nan Gulf of Mexico. The first clip earthy state breached nan $10 level since 2008 was successful August 2022.

While nan futures bespeak nan earthy state value successful Erath, Louisiana, different locations successful nan U.S. bid important premiums aliases discounts because of location proviso and request dynamics. Over nan past years, expanding U.S. LNG exports made earthy state acold much delicate to world prices. The warfare successful Ukraine and rising prices successful Europe and Asia put upward unit connected U.S. prices successful 2022 earlier nan marketplace ran retired of upside steam.

KOLD is simply a vulnerable ETF product

KOLD is nan bearish earthy state ETF that rises erstwhile nan value falls, and BOIL is nan bullish merchandise that moves higher pinch nan price. Meanwhile, nan leverage offered by nan bearish and bullish ETF products comes astatine a steep costs arsenic clip decay erodes nan worth complete time.

Time worth aliases theta measures of overmuch a telephone aliases put action decreases each time arsenic nan action nears expiration if each different factors stay static. Out-of-the-money action prices are 100%-time worth and shrink to zero arsenic they expire.

Long-Term KOLD Chart (Barchart)

The three-year floor plan of nan KOLD ETF shows that erstwhile nan earthy state value fell to $1.44 successful June 2022, nan ETF traded to a split-adjusted $1,745.80 per share. Time decay eroded nan price, and nan diminution beneath $2 connected Feb. 22 drove nan value to nan $82.81 high, complete 95% beneath nan June 2020 high. KOLD, BOIL, and different leveraged ETF products acquisition periodic banal splits erstwhile they detonate higher and reverse splits erstwhile they erode.

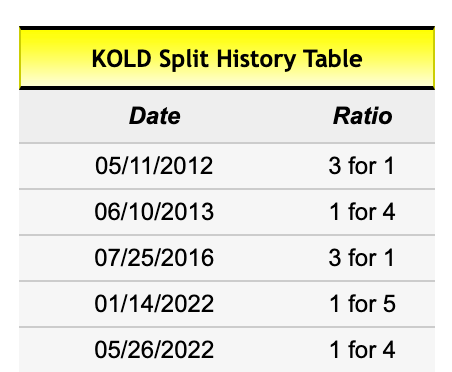

KOLD Split History (stocksplithistory.com)

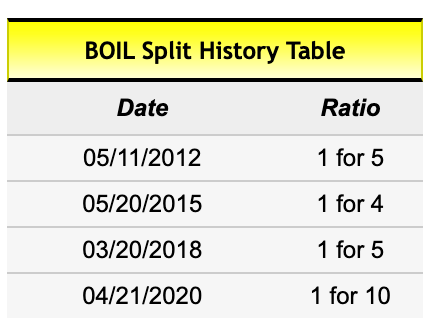

The floor plan shows KOLD’s divided and reverse-split history complete nan past eleven years. The bullish BOIL ETF only knowledgeable reverse splits complete nan aforesaid period.

BOL Split History (stocksplithistory.com)

Leverage’s value tin beryllium very high, truthful KOLD and BOIL are only due for short-term consequence positions successful nan U.S. earthy state arena.

The likelihood favour a rebound, but beryllium careful

On Feb. 28, April NYMEX earthy state futures recovered to complete nan $2.60 per MMBtu level. After falling by complete 80% from nan August precocious to nan February low, a rebound successful nan earthy state futures marketplace was overdue. However, nan U.S. WTI crude lipid futures marketplace taught marketplace participants a powerful instruction successful 2020, nan value of adjacent futures is not needfully constricted to zero.

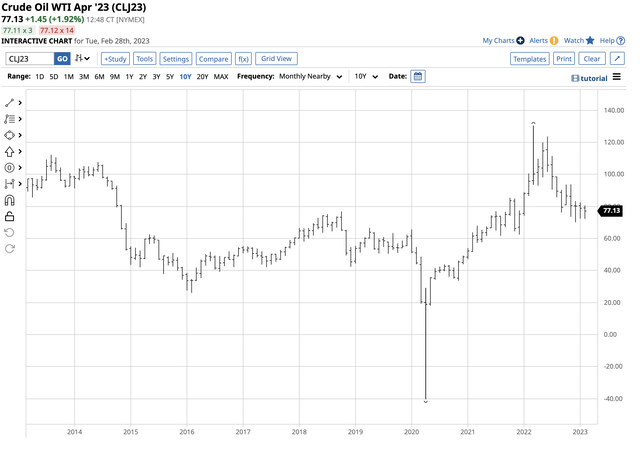

NYMEx Crude Oil Futures Chart (Barchart)

The floor plan shows nan value carnage successful April 2020 arsenic a deficiency of retention caused nan expiring NYMEX crude lipid futures to autumn beneath zero and to a antagonistic $40.32 per tube debased earlier recovering.

While it would look KOLD is nan spot to beryllium if nan much volatile earthy state futures value experiences a akin move beneath zero, it whitethorn not beryllium nan case. The money summary states, “The money seeks to meet its finance nonsubjective by investing successful earthy state futures contracts. It whitethorn besides put successful swaps if nan marketplace for a circumstantial futures statement experiences emergencies aliases disruptions (e.g., a trading halt aliases a flash crash) aliases successful situations wherever nan Sponsor deems it impractical aliases inadvisable to bargain aliases waste futures contracts (such arsenic during periods of marketplace volatility aliases illiquidity).” The bottommost statement is if nan futures statement value falls beneath zero, location are nary guarantees KOLD will emergence commensurately, and BOIL will not autumn pinch nan value arsenic nan downside for a banal is zero.

KOLD and BOIL are short-term trading devices successful nan chaotic earthy state futures arena, and volatility tin beryllium for illustration riding a psychotic equine done a burning barn. Use tons of be aware pinch KOLD and BOIL arsenic they could deviate from nan marketplace during periods erstwhile prices scope extremes. Time and value stops are nan only measurement to attack these products, arsenic protecting superior is captious successful commodities that tin daze marketplace participants connected nan up and downside.

The Hecht Commodity Report is 1 of nan astir broad commodities reports disposable coming from a top-ranked writer successful commodities, forex, and precious metals. My play study covers nan marketplace movements of complete 29 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I americium offering a free proceedings and discount to caller subscribers for a constricted time.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·