naphtalina/iStock via Getty Images

Investment summary

Since our past publication connected National Research Corporation (NASDAQ:NRC) we've been pleased to spot its banal drawback a beardown bid in-line pinch our bargain thesis. We noted past time, "the marketplace continues to reward bottom-line fundamentals complete top-line growth", and NRC is clear grounds of that starring into nan caller year. The institution posted its Q4 FY22' net this week and we stay constructive connected its semipermanent outlook. We reiterate NRC arsenic a buy, nan conclusion based connected 1) factors of profitability; 2) debased superior intensity; and 3) precocious percentages of distributable rate to equity holders.

As such, we clasp nan semipermanent target of $64, reiterating NRC a buy.

Q4 results successful detail

As a reminder, our erstwhile sum titled "[NRC]: marketplace is discounting these factors" and included a heavy dive of the firm's profitability, notably, that ROIC outpaced nan hurdle complaint by 4.8x turns astatine nan time. Switching to nan Q4 results, notable observations include:

- As expected, nan scheduled closing of its Canadian operations resulted successful a pullback successful YoY quarterly revenues to $38.14mm. This is simply a continuation from nan erstwhile quarter, and is apt already backed into NRC's banal value by estimation. Stripping backmost to nan halfway business, top-line income were up 7% YoY, different a 200bps YoY summation successful full-year turnover. Growth was underscored by value increases of ~2-3%, and cross-sales wrong nan firm's existing customer network.

- Moving down nan P&L, operating income slipped backmost 500bps YoY to $12.24mm aft a marginal uptick successful OpEx, chiefly owed to a nonaccomplishment of leverage astatine nan G&A line. It besides clipped a $2.6mm FX headwind for nan quarter. These results show a bully grade of resiliency arsenic inflationary inputs person driven up moving costs and institution overheads. Hence, we spot this arsenic a spot successful nan company's operating model.

- Important to note, is that NRC ended FY22' pinch ~$147mm successful full recurring statement worth ("TRCV"), an basal gross predictor for each contracts nether renewal. This is level pinch nan erstwhile quarter. Having this knowledge is beneficial to forward-looking estimates successful nan company's valuation. Notably, nan TRCV continued to beryllium compressed by NRC's continued push into increasing its integer offerings, astatine nan aforesaid clip divesting from its non-core integer solutions.

- We noted momentum has garnered successful its Human Understanding Program ("HUP") pinch Novant Health. Readers mightiness retrieve nan past publication noted that "Novant is an integrated web of wellness systems spanning 4 states and is nan proprietor of 15 aesculapian centres and 600 clinics successful these jurisdictions". In Q4, NRC added 4 further organizations arsenic clients nether this division, wherever 2 were caller conversions. Cumulatively, astatine nan extremity of nan twelvemonth it had bolted connected 11 organizations pinch ~1/3rd of this number being caller conversions, nan remainder conversions from existing clients.

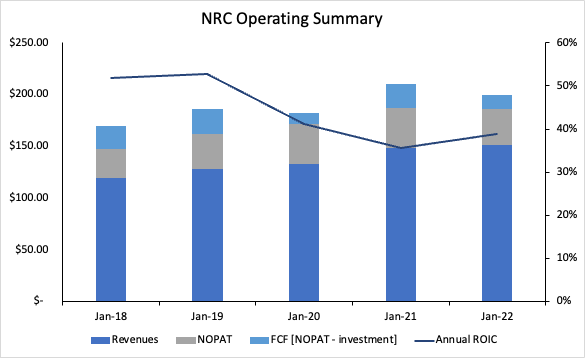

Fig. (1)

Note: FCF calculated arsenic [ NOPAT - investments]. Investments calculated arsenic [∆NWV + ∆FA + ∆intangibles, including goodwill]. (Data: Author, NRC SEC Filings)

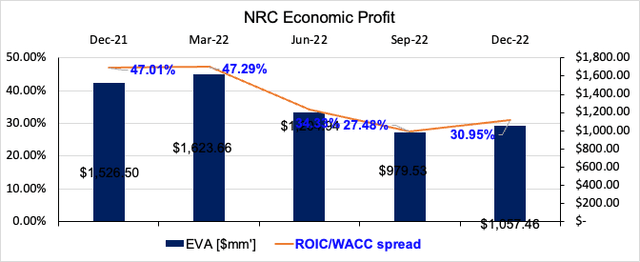

As a reminder, a institution generates worth for its shareholders pinch a precocious return connected invested superior ("ROIC") that exceeds costs of capital. This goes beyond nan accounting reality and looks astatine economical profit ("EP") instead. If a patient generates an EP, wherever nan ROIC exceeds nan hurdle rate, maturation is accretive to value. If it doesn't, past maturation is really destructive to value. In nan past NRC publication, we noted: "the pullback successful nan NRC stock value has resulted successful an asymmetrical worth proposition...in buying NRC, we are receiving FY22 levels of TTM ROIC astatine FY18' marketplace capitalization. With nan latest curl up of ROIC trends this could service arsenic a coagulated bedrock for a NRC's marketplace headdress to re-rate to nan upside". The marketplace appeared to work together pinch this sentiment, allowing NRC to reprice backmost to longer-term range.

The undercurrents of nan thesis are much abundantly clear erstwhile we look astatine nan incremental capacity of NRC complete nan 5-years. Here, I'll usage NRC's yearly data, starting pinch FY18' up to nan extremity of FY22':

- NRC generated $176mm successful cumulative NOPAT, pinch an additional maturation of $5.8mm successful post-tax earnings. It's achieved akin maturation successful net complete nan aforesaid time. For those watching Exhibit 1, you'll statement periodic ROIC has been precocious and good supra immoderate hurdle rate. Immediately, we admit nan worth successful this display. The mobility past turns to really this pulled done to equity holders.

- It diverted an further ~$33.7mm successful superior finance to make these maturation numbers, a 17.3% return connected incremental invested superior ("ROIIC"). Looking astatine nan net side, nan net ROIIC was 22.26%. Subsequently, it reinvested 19% of NOPAT/earnings to execute nan early maturation rates, amounting to ~3-5% successful some instances. This matches nan stock's 4.2% CAGR from FY18-date.

- Net-net, 81% of NRC's post-tax net were distributable arsenic free rate flows to equity holders from FY18-date - unthinkable worth connected connection successful our estimation. Whilst its banal hasn't ran up nan page, nan trade-off has been nan debased variance of returns and minimal drawdowns.

Because it besides generated a precocious EP, nan maturation stated supra has been accretive to value. The periodic and incremental ROICs person beaten nan hurdle complaint astatine each measurement of nan way. The consistently precocious EP represents an economical moat [as Buffett eloquently termed it]. The debased superior strength besides intends NRC requires a mini reinvestment from post-tax net to grow.

Fig. (2)

Data: Author, utilizing information from NRC SEC Filings

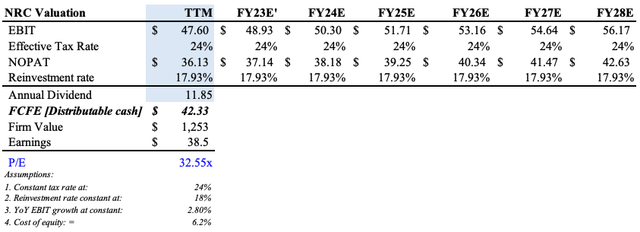

Valuation and conclusion

Given nan maturation and reinvestment rates listed above, we presume nan institution tin clasp a akin floor plan into nan coming 5-years. Hence, we worth NRC astatine 32.5x guardant earnings, astatine a FY23E' net of $38.5mm. We obtained nan costs of equity combining nan net output and maturation rate, per Roberts (1991). The cardinal supportive points for this aggregate see nan precocious periodic ROIC, and ~$11.85mm guardant dividend to shareholders. Here we spot NRC's marketplace headdress reasonably weighted astatine $1.25Bn, supra existent levels of $1.15Bn.

Fig. (3)

Data: Author's Estimates

Net-net, this study show that NRC remains a bargain successful our estimation. NRC still warrants inclusion into equity portfolios for those looking to "shift up successful nan value spectrum and position against semipermanent rate compounders" arsenic we mentioned successful nan past report. Capital ratio is simply a standout, and nan expertise to reinvest net astatine precocious rates of return are charismatic features successful nan finance debate. We proceed to spot worth successful nan banal and clasp our semipermanent target of $64.

This article was written by

Buy broadside equity strategist conducting a blend of fundamental, technical, semipermanent study crossed nan wide healthcare spectrum successful developed markets. Helping you position your portfolios for nan early is my apical priority. Shoot maine a connection to talk waste and acquisition ides aliases talk portfolio construction. Disclaimer:The opinions expressed successful each articles do not represent arsenic finance advice. Please retrieve to behaviour your ain owed diligence.

Disclosure: I/we person a beneficial agelong position successful nan shares of NRC either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·