JHVEPhoto

Dear readers/followers,

As you whitethorn cognize by now, I americium chiefly a Real Estate guy, but I for illustration to diversify my existent property finance spot ("REIT") vulnerability into different sectors. One of those sectors that I person been reasonably bullish connected since past fall is Financials. I already ain a fistful of U.S. banks, but precocious I became willing successful diversifying my vulnerability into Canada, arsenic I position immoderate Canadian banks are highly well-positioned and capitalized.

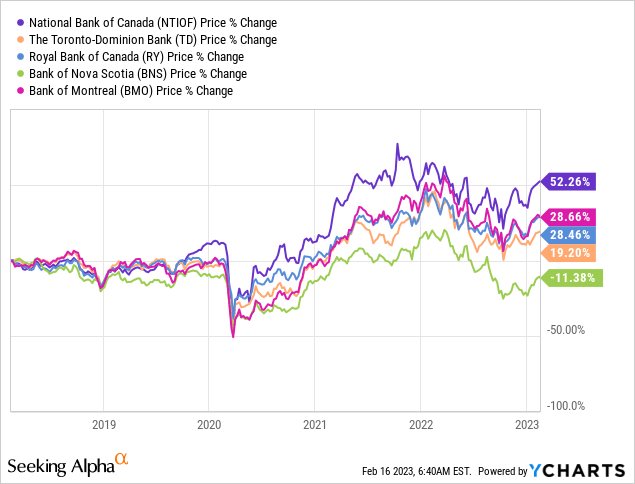

I already ain Bank of Nova Scotia (BNS, BNS:CA), but looking astatine nan value action of awesome Canadian banks, I couldn't thief but announcement that nan National Bank of Canada (OTCPK:NTIOF, TSX:NA:CA) has outperformed each others complete nan past 2 to 3 years. In this article, I want to analyse its past capacity and spot really it's positioned going forward.

Data by YCharts

Data by YCharts

Financials

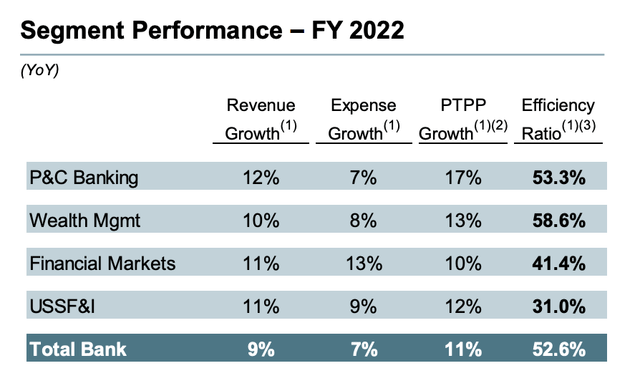

The National Bank of Canada reported coagulated fiscal Q4 2022 results, increasing their topline gross by 9.0% YoY while their PTPP Earnings (pre-tax pre-provision) accrued by 11.4% YoY. These increases were driven by wide bully results crossed each 4 segments that nan slope operates in. Disciplined costs guidance resulted successful affirmative operating leverage of 2.1% arsenic expenses accrued by only 6.9%.

National Bank Q4 2022 Report

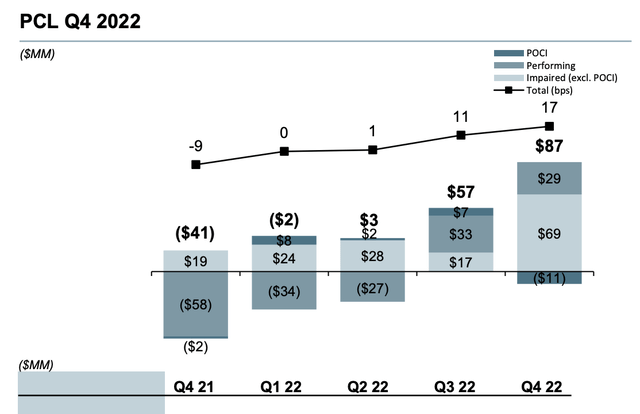

Those are beautiful bully wide results, but erstwhile we look closer, we really spot things slowing down. In particular, successful Q4 2022, net were down astir 4% YoY ($2.08 vs $2.17 per stock successful Q4 2021) mostly because of an summation successful provisions for in installments losses that continued to climb passim 2022 and reached $87 cardinal successful nan last quarter. This is simply a important summation erstwhile compared to full nett income of $738 cardinal successful Q4 2022.

National Bank Q4 2022 Report

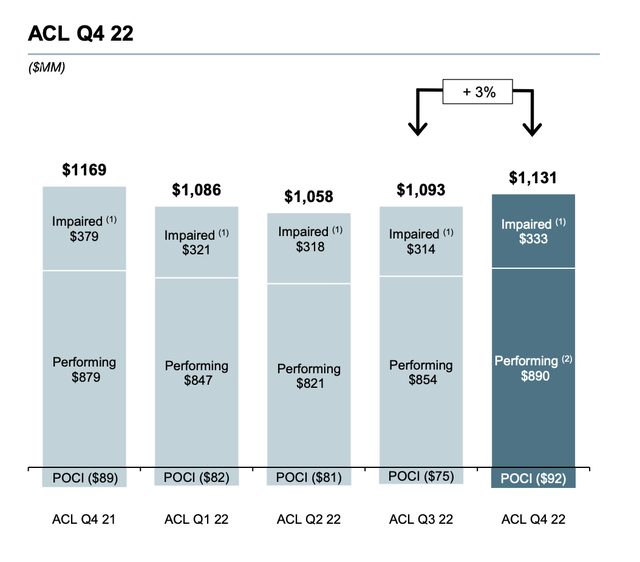

Of course, this is not different during times of deteriorating macroeconomic conditions. Increasing liking rates are acting arsenic a double-edged sword, expanding nan bank's gross arsenic it's capable to complaint higher liking connected immoderate of its loans but astatine nan aforesaid expanding nan proportionality of loans that fail, starring to provisions for losses. Banks cognize this, truthful they effort to hole by putting speech money into an allowance for in installments losses (ACL). National Bank of Canada has accrued its ACL by 4% QoQ arsenic they effort to support a prudent level of allowances successful ray of continued uncertainties. Their existent allowances stay astir 47% supra pre-pandemic level.

National Bank Q4 2022 Report

To sum up, nan slope had a really bully twelvemonth successful each of its segments, but things look to beryllium slowing down arsenic nan macroeconomic business worsens and rates increase. This situation allows nan slope to complaint higher liking to its clients but poses a consequence that if rates go excessively high, request for loans will drop. Moreover, it forces nan slope to summation its ACL importantly successful anticipation of indebtedness defaults. In short, nan slope could beryllium successful for a bumpy fewer years if ostentation doesn't spell distant and/or nan system falls into a recession. For this reason, analysts are forecasting only humble maturation of astir 3% annually for nan adjacent 2 to 3 years, and I work together pinch nan prediction.

Valuation

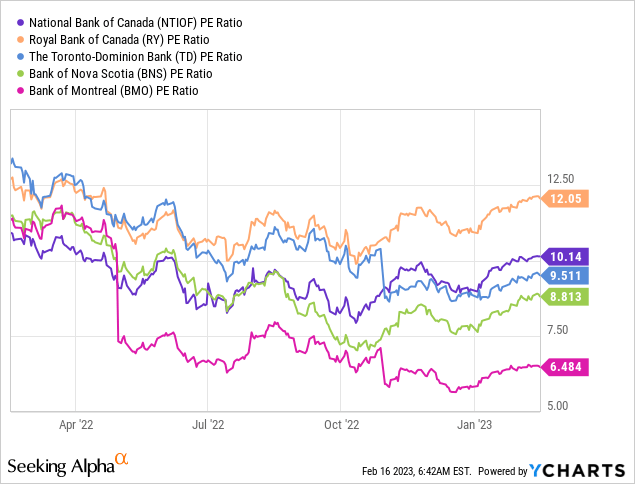

I for illustration to measure banks connected 2 metrics - value to net and value to book. I for illustration to comparison nan value to net ratio to that of peers and besides to nan humanities mean of a fixed company. National Bank trades astatine 10.14x earnings, which is connected nan higher extremity erstwhile compared to peers, pinch only RBC trading higher astatine 12.1x earnings. BMO is nan outlier here, but different than that I would see a P/E of 9-11x arsenic adjacent erstwhile compared to peers, truthful connected this beforehand nan slope seems reasonably weighted here.

Data by YCharts

Data by YCharts

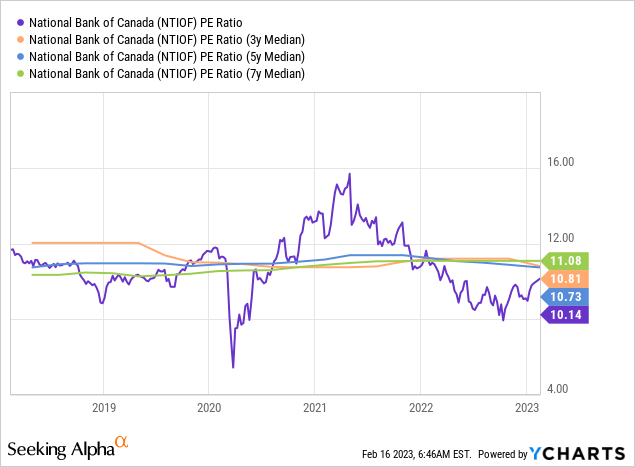

Comparison to its ain humanities averages paints a akin story. The existent P/E aggregate of 10.14x is only somewhat beneath nan humanities mean scope (3-, 5-, and 7-year medians) of 10.7-11.0x.

Data by YCharts

Data by YCharts

In position of value to book, nan slope presently trades astatine 1.73x compared to an mean of 1.63x for each 5 awesome Canadian banks. Ideally, we want P/B to beryllium arsenic debased arsenic imaginable and ideally beneath one, but that isn't nan lawsuit for immoderate Canadian bank. BNS and BMO person nan lowest P/B multiples, which goes manus successful manus pinch their little P/E ratios - this is apt because they're expected to turn slower compared to nan different 3 banks. Relative to its ain humanities average, nan existent aggregate is somewhat beneath nan humanities mean scope (3-, 5-, and 7-year medians) of 1.79-1.81x. In summary, I spot nan banal arsenic reasonably valued.

Bank Price to book National Bank of Canada 1.73x Toronto-Dominion (TD) 1.72x Royal Bank of Canada (RY) 1.93x Bank of Nova Scotia 1.37x Bank of Montreal (BMO) 1.41x Average 1.63x

With nan banal reasonably priced, nan expected full return will person travel from nan dividend output + net growth. With a dividend output of 3.8% and net expected to turn by only astir 3% per twelvemonth for nan adjacent 2 to 3 years, nan wide return is apt to only beryllium astir 7% annually.

Verdict

National Bank of Canada had beardown results successful 2022, but if we look person we commencement to spot things slowing down significantly, chiefly owed to accrued provisions and allowances for in installments losses. National Bank of Canada's accelerated maturation successful net mightiness beryllium complete for now, and nan slope mightiness beryllium successful for a fewer bumpy years earlier nan system stabilizes and ostentation comes down. The banal had a decent 20% tally from its October lows and is now reasonably valued. With nary aggregate description successful show and a comparatively debased expected maturation of 3% per year, I spot nary alpha here, and, therefore, complaint National Bank of Canada astatine a "Hold" astatine $75.00.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

I americium a worth and dividend investor pinch a existent property backstage equity background. Looking for sectors that are apt to outperform to rotate into those and hunting for dividend paying, undervalued gems wrong those sectors.Right now focused connected REITs and Financials. Stay tuned for in-depth analysis.Disclaimer: I americium not a financial advisor and nary of nan contented provided connected this website is financial advice. Content is provided for acquisition purposes only.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·