Mar. 07, 2023 9:15 AM ETAAPL, ABBV, AGNC, AGNCL, AGNCM, AGNCN, AGNCO, AGNCP, ALIZF, ALIZY, AM, APLE, ARCC, ARI, AVGO, BA, BABA, BABAF, BAC, BAC.PB, BAC.PE, BAC.PK, BAC.PL, BAC.PM, BAC.PN, BAC.PO, BAC.PP, BAC.PQ, BAC.PS, BAMXF, BASFY, BAYRY, BAYZF, BFFAF, BGS, BML.PG, BML.PH, BML.PJ, BML.PL, BMO, BMO:CA, BMWYY, BNS, BNS.PRI:CA, BNS:CA, BNSPF, BP, BPAQF, BRT, BX, CBAUF, CL, CM.PRO:CA, CMWAY, CSCO, CVS, D, DHC, DIS, ENB, ENB:CA, ENBA, EQTNP, ETRN, FMCQF, FMS, FSNUF, FSNUY, GAIN, GAINN, GAINZ, GDXD, GDXU, GE, GEO, GILD, GLAD, GOOD, GOODN, GOODO, HCXY, HD, HON, HTGC, INTC, JNJ, JPM, JPM.PC, JPM.PD, JPM.PH, JPM.PJ, JPM.PK, JPM.PL, JPM.PM, KMI, KO, MA, MAIN, MCD, MDT, MFIC, MMM, MO, MPW, MS, MS.PA, MS.PE, MS.PF, MS.PI, MS.PK, MS.PL, MS.PO, MS.PP, MSFT, NEE, NEP, NEWT, NEWTL, NEWTZ, NLY, NLY.PF, NLY.PG, NLY.PI, NVDA, O, OHI, ORCC, OWL, PEP, PFE, PG, PM, RITM, RY.PRN:CA, RYDAF, SEMHF, SHEL, SMMNY, SNHNI, SNHNL, SO, SOJC, SOJD, SOJE, SRC, SRC.PA, STAG, STWD, SVC, SYK, T, T.PA, T.PC, TBB, TBC, TD, TD:CA, TGT, TTD, TXN, UL, UNIT, UNLYF, V, VNARF, VNNVF, VONOY, VZ, WBA, WFC, WFC.PA, WFC.PC, WFC.PD, WFC.PL, WFC.PQ, WFC.PR, WFC.PY, WFC.PZ, WFCNP, WPC, WTID, WTIU, XOM, ZIM

Summary

- Inflation and (expected) actions by nan Federal Reserve proceed to predominate marketplace movements.

- Markets person started nan caller twelvemonth pinch very coagulated gains pursuing expectations astir a much dovish Federal Reserve and a coagulated net season.

- My dividend income successful February amounted to astir $430.

- Gifted Working Time successful 2023: Around 37 hours aliases 4.7 days of progressive activity person been replaced pinch passive income successful 2023 already.

Pgiam/iStock via Getty Images

Portfolio Changes successful February

Investment activity successful February was simply crazy owed to 2 typical circumstances:

- My remaining shares of STORE Capital were paid backmost arsenic nan acquisition and going nationalist was formally concluded

- My concerns and supra mean vulnerability to Medical Properties Trust (MPW) caused maine to make nan harsh determination to fundamentally trim my liking by 2/3 earlier buying backmost portions pursuing amended than expected earnings.

Both events meant that I was abruptly getting immoderate sizable rate inflows but besides importantly little dividend income. As I neither for illustration a large rate position nor little dividend income and arsenic tons of stocks still were boasting charismatic prices I redeployed astir of these costs during nan month.

Overall though, I vanished nan period pinch antagonistic nett investments of -$609 but fixed I person to salary a big taxation costs for 2021 successful March this further money is really appreciated.

Additionally, to these 2 large income I besides sold my mini position successful Annaly Capital Management (NLY) arsenic nan early dividend is expected to beryllium substantially little and fixed that nan banal value has not reacted that negatively to that improvement I was gladsome to exit this position almost break-even.

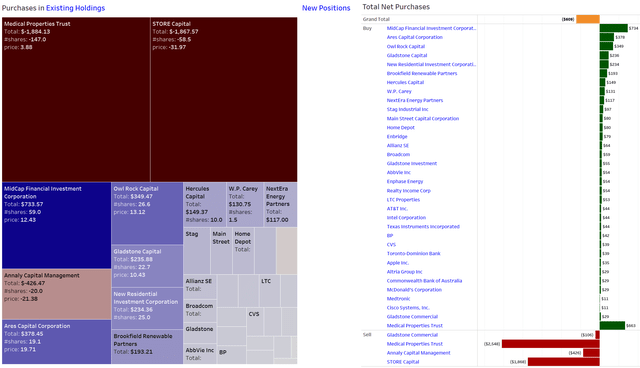

All these costs I chiefly deployed into various Business Development Companies (BDCs) arsenic successful my position each of these stocks were/are weighted acold excessively debased fixed nan monolithic boost to their bottommost statement amid a rising and precocious liking complaint environment.

While I person been adding very aggressively to Hercules Capital Corporation (HTGC) ever since September 2022 I person shifted attraction successful February chiefly to MidCap Financial Investment Corporation (MFIC), Ares Capital Corporation (ARCC) - which is slow becoming 1 of my Top 5 portfolio positions -, Owl Rock Capital (ORCC) and Gladstone Capital (GLAD).

I person been accumulating my liking successful Brookfield Renewable Partners (BEP) arsenic nan banal continues to waste and acquisition successful a value scope I cannot understand and deem acold excessively debased sloppy of nan liking complaint level. The net results were affirmative and nan expected dividend hike was confirmed, nevertheless nan banal declined somewhat aft earnings. I scheme to further summation my position successful March.

Apart from that astir of nan different purchases were triggered by nan almost play savings plans aliases opportunistic and irregular purchases astir net dates.

Due to nan quality of really nan monthly finance scheme process works, I americium investing comparatively arsenic into these stocks astatine 2 points of clip during nan period - astatine nan opening of nan period and mid-month - which breaks down arsenic shown below. Figures are successful Euro and show that, for instance, astatine nan opening of nan month, I americium investing betwixt 50 and 75 EUR each into Microsoft (MSFT), The Home Depot (NYSE:HD), Visa (NYSE:V), W. P. Carey (WPC), and BP (NYSE:BP). Mid-month, I americium adding betwixt 33 and 40 EUR each into STAG Industrial (NYSE:STAG), AT&T (T), NextEra Energy (NYSE:NEE), Toronto-Dominion Bank (NYSE:TD), Main Street Capital (NYSE:MAIN) and JPMorgan (NYSE:JPM).

I person added respective finance plans starting mid-September 2020 which see AGNC Investment Corp. (NASDAQ:AGNC), Ares Capital (NASDAQ:ARCC), Medical Properties Trust (NYSE:MPW), The Bank of Nova Scotia (NYSE:BNS) and The Trade Desk (NASDAQ:TTD). Investments present will beryllium focused connected high-yield arsenic good arsenic high-growth stocks successful nan technology, therapeutic and renewables sectors.

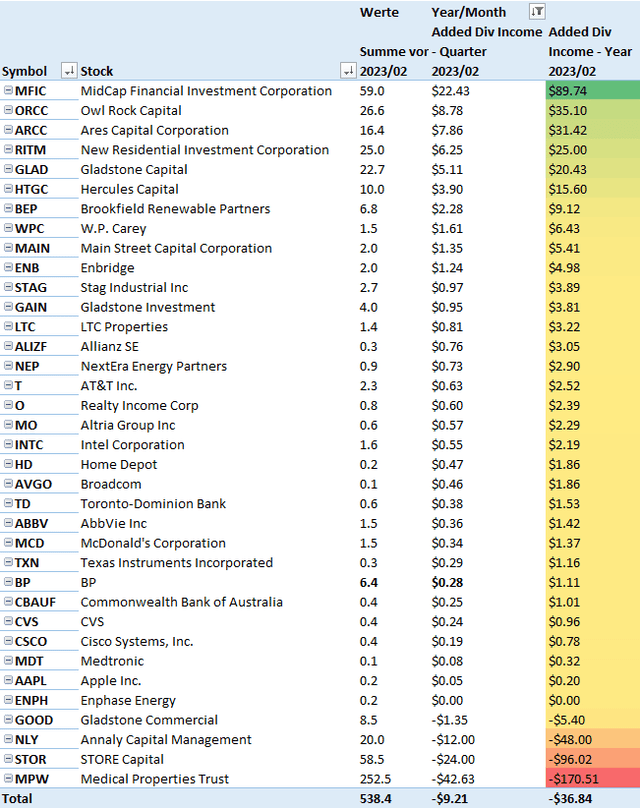

Following nan income of STORE Capital, Medical Properties Trust, Annaly Capital Management and Gladstone Commercial my guardant yearly dividend income dropped by astir $320 and while I was very fierce successful redeploying these costs I came short by astir $37. However, successful March I expect to adhd astatine slightest $100 to my guardant dividend income ground which is my minimum extremity each month. All these purchases break down arsenic follows:

Added Dividend Income (Designed by Author)

All nett purchases successful February tin beryllium recovered below:

Net Purchases (Designed by author)

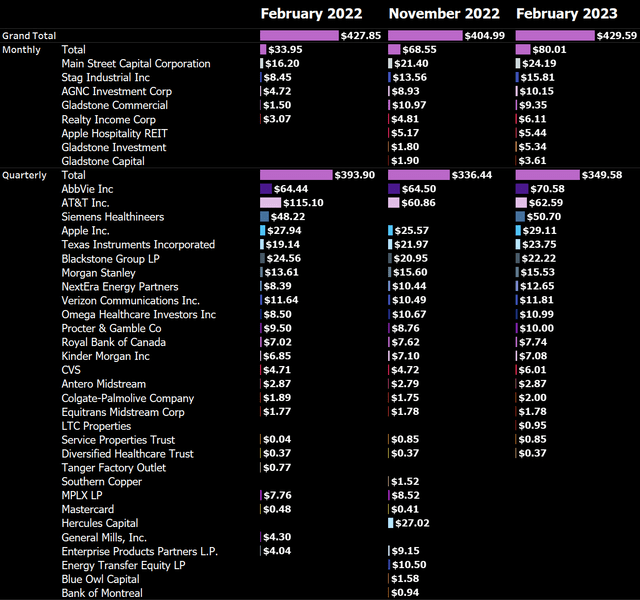

Dividend Income: What Happened connected nan Dividend Side?

February is astir apt nan weakest period successful position of dividend income crossed nan full twelvemonth and it will return immoderate clip to execute immoderate meaningful maturation here. I americium regularly buying Texas Instruments (TXN), Blackstone (BX) and NextEra Energy Partners (NEP) arsenic good arsenic monthly dividend payers for illustration Main Street Capital Corporation (MAIN), STAG Industrial (STAG), Gladstone Capital (GLAD), Gladstone Investment (GAIN) and Realty Income (O)but wide nan amounts are excessively mini to really make an impact.

On an yearly ground dividend income was beautiful overmuch level and compared to November 2022 it was somewhat higher but only owed to nan yearly dividend from Siemens Healthineers. Unfortunately, HTGC which paid maine my first dividend successful November 2022 for immoderate logic has a different costs shape and only pays successful March. So while that makes nan February consequence beautiful mediocre nan March totals will beryllium monolithic fixed that I expect that ARCC and HTGC together will already salary maine astir $200 successful nett dividends combined.

Dividends from monthly dividend payers person deed $80 and are firmly connected their measurement towards $100. In March that period should beryllium cleared for nan first clip fixed nan immense supplemental dividend from MAIN.

February 2023 Dividend Income (Designed by author)

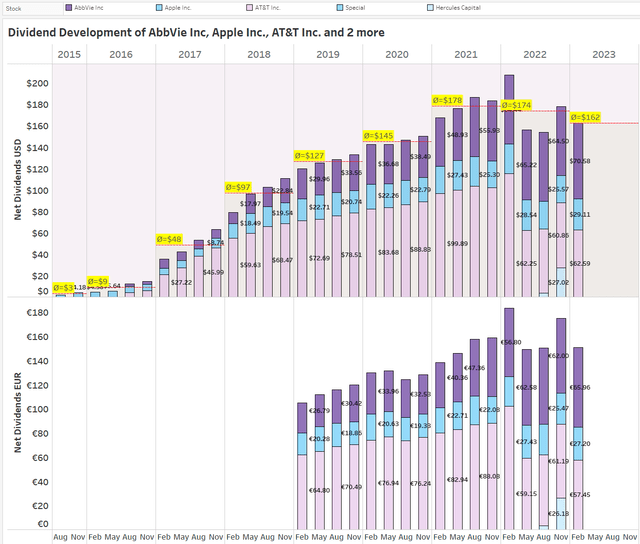

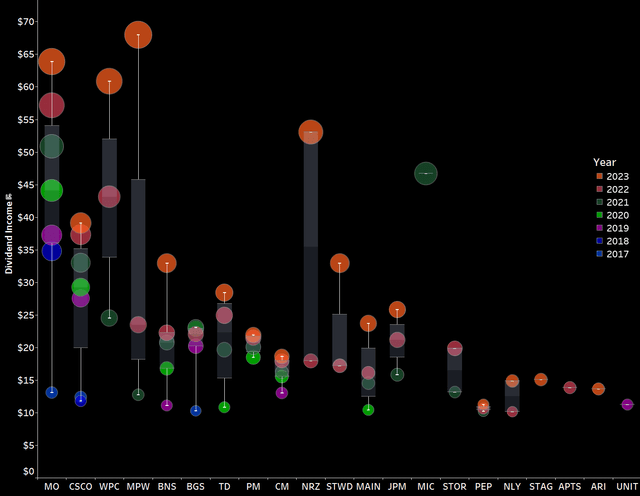

The Top 3 Regular Dividend Payers successful February stay AbbVie (ABBV), AT&T (T) and Apple (AAPL) but it won't return agelong for either MAIN, TXN aliases BX to get to nan #3 spot. Compared to a twelvemonth agone nan immense alteration successful dividend income from AT&T becomes blatantly evident and I still haven't been capable to afloat switch that loss.

Top 3 Dividend Payers (Designed by author)

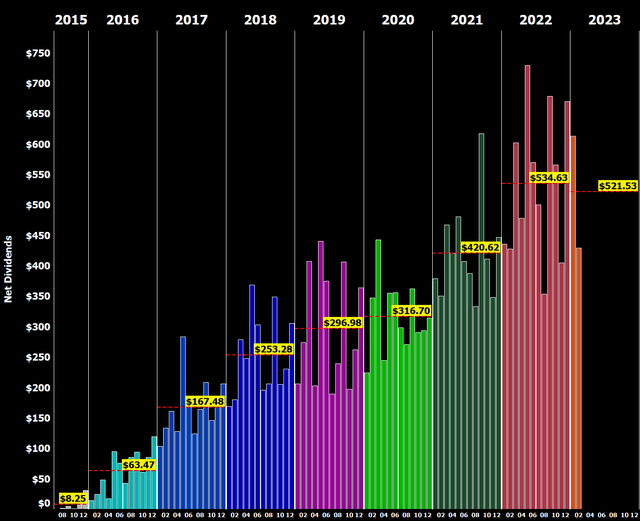

Here is simply a floor plan that shows nan improvement of my nett dividend income by period complete clip betwixt 2015 and 2023. You tin spot nan maturation of my dividend income and nan mean yearly dividend for each year:

All-time Dividend Development (Designed by author)

This floor plan is my favourite because it illustrates nan progression of my dividend income complete clip and allows maine to easy spot nan mean yearly dividend for each year.

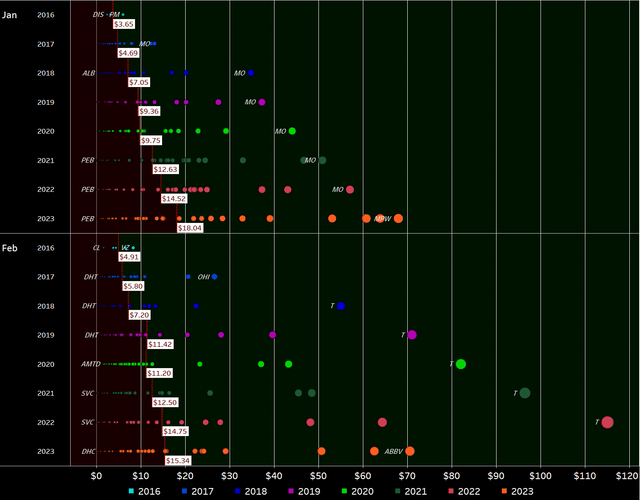

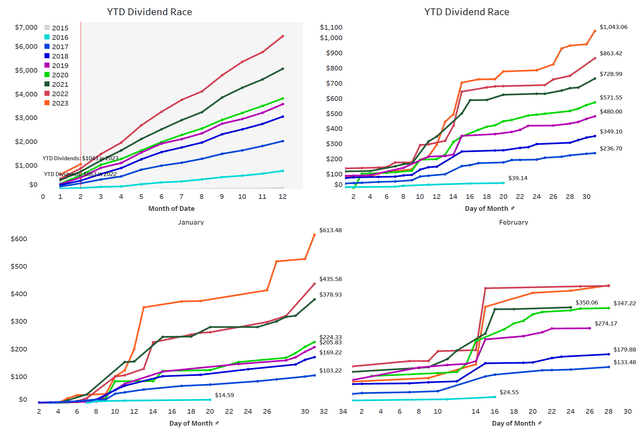

Next, I person plotted each of nan individual dividend payments I person received, coloring them by twelvemonth and arranging nan years broadside by broadside alternatively of horizontally arsenic successful erstwhile updates. This visualization allows for a much broad study of nan distribution of my dividend payments complete time.

Dividend Payment Bubbles (Designed by author)

By plotting nan information successful this way, we tin easy spot nan distribution of dividend payments crossed different years and summation insights into nan wide maturation of my dividend income complete time.

This visualization is initially rather cluttered, but it contains a wealthiness of information. It shows each individual dividend costs I person received since I began my finance travel successful 2015, represented arsenic a circle that is colored and sized according to its contribution. The position is organized by period and year, allowing for a much broad study of nan improvement of my dividend income complete time. For each twelvemonth and month, a achromatic rectangle indicates nan mean monthly dividend. The area wherever dividends autumn beneath nan mean is filled successful acheronian red, while nan area supra nan mean is colored acheronian green. I greatly for illustration this redesigned type of my aged "bubbles chart" because it makes it overmuch easier to place trends and developments successful my dividend income. This type of information visualization allows for a elaborate introspection of nan distribution of my dividend payments complete clip and enables maine to much easy place trends and patterns successful my income growth.

February 2023 Dividends (Designed by author)

Now, zooming successful connected February, we tin instantly spot a number of large greenish circles successful a oversea of black. The bigger nan circle and nan bigger nan region to nan erstwhile circle for nan aforesaid stock, nan bigger is nan alteration successful dividend income compared to nan anterior years.

Overall, I purpose to spot arsenic galore large neon orangish circles astatine nan apical of nan standard arsenic possible, arsenic this indicates rising dividend income. .

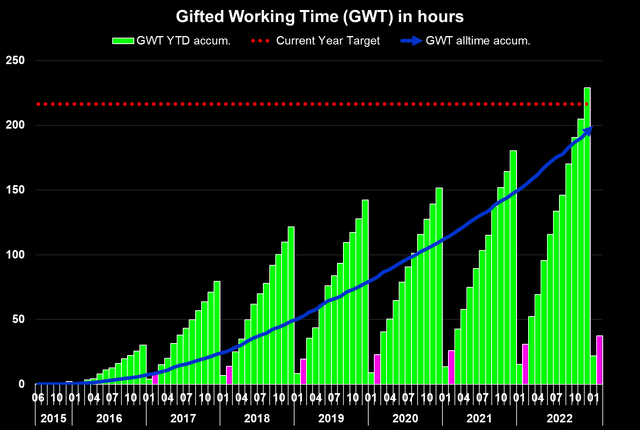

Another measurement to definitive nan monthly dividend income is successful position of Gifted Working Time (GWT). Assuming an mean hourly complaint of $32.34 for 2022, my GWT and yearly nett dividends person been arsenic follows:

- 2018: 121 hours GWT, $3,000 successful yearly nett dividends

- 2019: 142 hours GWT, $3,600 successful yearly nett dividends

- 2020: 152 hours GWT, $3,800 successful yearly nett dividends

- 2021: 180 hours GWT, $5,050 successful yearly nett dividends

- 2022: 229 hours GWT, $6,400 successful yearly nett dividends

- 2023: Targeting astatine slightest 216 hours GWT, $7,000 successful yearly nett dividends

I expect wide GWT to alteration successful 2023 owed to higher calculated hourly rates, arsenic I task a 10% summation successful nan hourly complaint owed to inflation.

The wide target for nan twelvemonth pinch $7,000 successful yearly nett dividends is very blimpish but I expect that I will person to return retired immoderate consequence from my portfolio arsenic mentioned above. Also, nan stronger Euro (I americium receiving dividends successful EUR and past converting those to USD astatine existent speech rates for these updates) will person adverse impact. Still, arsenic nan twelvemonth unfolds I expect to beryllium capable to walk that target and perchance moreover scope my adjacent milestone of $8,000 arsenic well.

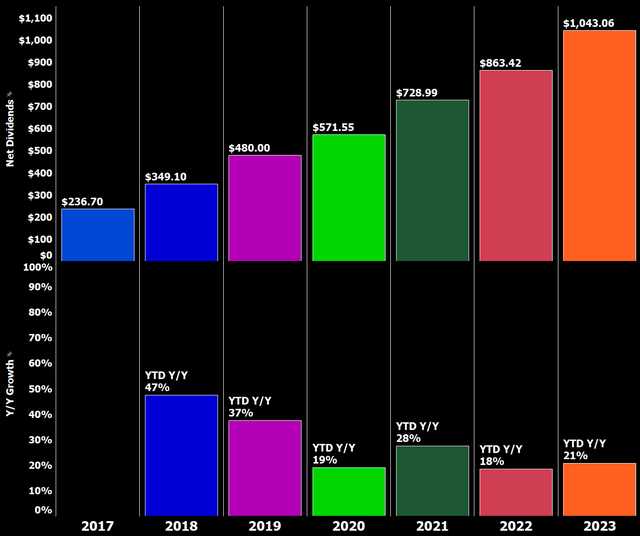

Across nan years, my YTD Dividend Race has been arsenic follows:

- 2018: Disappointing

- 2019: Phenomenal, benefiting from a debased baseline successful nan anterior year

- 2020: Fairly disappointing

- 2021: Phenomenal

- 2022: Much amended than expected fueled by nan very anemic euro

- 2023: Targeting a blimpish debased single-digit maturation rate

YTD Dividend Growth (Designed by author)

I person updated nan YTD Dividend Race floor plan to show nan improvement of YTD dividend income connected a regular basis, allowing america to spot that astir of my dividend income is generated mid-month and towards nan extremity of nan month. The floor plan besides breaks down nan improvement by period for nan existent year, making it easy to place important jumps successful income.

YTD Dividend Race (Designed by author)

Expressed successful GWT, it presents itself arsenic follows:

Gifted Working Time successful Hours (Designed by Author)

What this shows is arsenic follows:

- All clip (blue area) - Around 973 hours, aliases 122 days, of progressive activity person been replaced pinch passive income since nan commencement of my dividend journey. Assuming a five-day workweek, this translates into 24 weeks of picnic funded via dividends.

- Full-year 2023 (green bars) - Around 37.2 hours, aliases 4.7 days, of progressive activity person been replaced pinch passive income successful 2022 already, which is fundamentally a full-time activity week funded pinch dividends.

- Highlighted successful pinkish is nan accumulated YTD full astatine nan extremity of nan existent reporting period (February).

This visualization allows america to spot nan wide effect of my dividend income connected nan magnitude of progressive activity I americium capable to switch pinch passive income. It besides enables america to spot nan advancement made year-to-date, arsenic good arsenic nan accumulated full astatine nan extremity of nan existent reporting month.

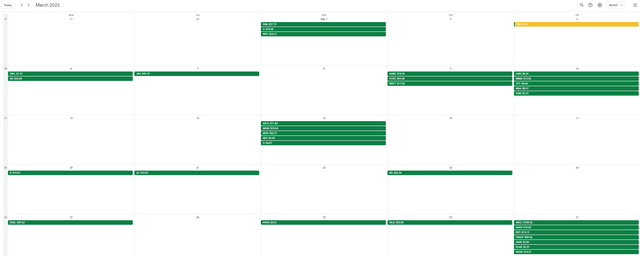

Upcoming March Dividends

With March marking nan extremity of nan quarter, this will traditionally beryllium a beardown period successful position of dividend income. Among others, further large dividend payers from my portfolio successful March are Royal Dutch Shell (SHEL), BP (BP), McDonald's (NYSE:MCD), Johnson & Johnson (NYSE:JNJ), Southern Company (NYSE:SO) and Ares Capital Corporation (ARCC) of which 4 companies are portion of my regular monthly savings plans. On apical of that Hercules Capital will salary a very large dividend and nan semi-annual dividend from Commonwealth Bank of Australia is besides scheduled.

Many of those are portion of my monthly savings plans and frankincense location should beryllium immoderate coagulated maturation successful dividend income contempt nan dense dividend cuts from Shell, BP and Wells Fargo though each 3 of them person already reverted backmost to increasing their dividend, particularly Wells Fargo which simply doubled its dividend.

The snapshot beneath is taken from my free-for-all released Dividend Calendar (make judge to travel instructions successful nan video) and shows my expected dividend payments successful March.

My Dividend Calendar (Designed by author)

At nan extremity of February, my dividend portfolio is composed arsenic follows:

Company Name Ticker % Market Value Market Value (€) Apple Inc. (AAPL) 10.69% 21,056 Visa Inc (V) 4.33% 8,535 AbbVie Inc (ABBV) 4.08% 8,026 McDonald's Corp. (MCD) 3.75% 7,377 Microsoft Corporation (MSFT) 3.18% 6,261 Cisco Systems, Inc. (CSCO) 2.84% 5,590 W.P. Carey (WPC) 2.59% 5,098 Ares Capital Corporation (ARCC) 2.54% 5,008 AT&T Inc. (T) 2.37% 4,671 Main Street Capital Corporation (MAIN) 2.36% 4,645 Johnson & Johnson (JNJ) 2.28% 4,492 Shell (SHEL) 2.26% 4,446 Stag Industrial Inc (STAG) 2.22% 4,375 JPMorgan Chase & Co. (JPM) 2.05% 4,044 NVIDIA Corporation (NVDA) 1.90% 3,737 Texas Instruments Incorporated (TXN) 1.89% 3,723 Gilead Sciences, Inc. (GILD) 1.74% 3,418 Wells Fargo & Co (WFC) 1.73% 3,404 Altria Group Inc (MO) 1.73% 3,403 Home Depot (HD) 1.69% 3,318 Allianz SE (OTCPK:ALIZF) 1.66% 3,266 Toronto-Dominion Bank (TD) 1.64% 3,221 Southern Co (SO) 1.58% 3,103 Bank of Nova Scotia (BNS) 1.40% 2,766 Siemens Healthineers (OTCPK:SEMHF) 1.27% 2,500 Blackstone Group LP (BX) 1.22% 2,410 Broadcom Inc (AVGO) 1.17% 2,301 Commonwealth Bank of Australia (OTCPK:CBAUF) 1.12% 2,212 BMW (OTCPK:BMWYY) 1.12% 2,206 New Residential Corporation (RITM) 1.11% 2,186 Hercules Capital (HTGC) 1.11% 2,181 Enbridge (ENB) 1.11% 2,176 Morgan Stanley (MS) 1.08% 2,123 PepsiCo, Inc. (PEP) 0.96% 1,897 BP2 (BP) 0.92% 1,821 BP1 (BP) 0.88% 1,739 Procter & Gamble Co (PG) 0.87% 1,711 Intel Corporation (INTC) 0.86% 1,688 Philip Morris International Inc. (PM) 0.82% 1,623 Daimler (OTCPK:DTRUY) 0.76% 1,500 Honeywell International Inc. (HON) 0.75% 1,478 Bank of America Corp (BAC) 0.73% 1,443 Starwood Property Trust, Inc. (STWD) 0.70% 1,384 Realty Income Corp (O) 0.69% 1,354 Medical Properties Trust (MPW) 0.63% 1,247 Target Corporation (TGT) 0.63% 1,247 Apollo Investment (MFIC) 0.60% 1,183 Gladstone Commercial Corporation (GOOD) 0.58% 1,144 Brookfield Renewable Partners (BEP) 0.58% 1,144 The Coca-Cola Co (KO) 0.56% 1,106 NextEra Energy Partners LP (NEP) 0.56% 1,102 Stryker (SYK) 0.54% 1,066 3M Co (MMM) 0.53% 1,045 Unilever NV ADR (UL) 0.52% 1,030 Apple Hospitality REIT (APLE) 0.48% 952 Royal Bank of Canada (RY) 0.48% 944 Annaly Capital Management (NLY) 0.48% 935 CVS Health Corp (CVS) 0.44% 863 Dominion Energy Inc (D) 0.40% 788 Verizon Communications Inc. (VZ) 0.39% 775 Sino AG (XTP.F) 0.39% 764 Spirit Realty Corporation (SRC) 0.38% 743 B&G Foods, Inc. (BGS) 0.36% 716 Gladstone Capital (GLAD) 0.36% 715 Canadian Imperial Bank of Commerce (CM) 0.35% 697 BASF (OTCQX:BASFY) 0.35% 688 Gladstone Investment (GAIN) 0.35% 686 AGNC Investment Corporation (AGNC) 0.34% 677 Medtronic (MDT) 0.34% 675 Walgreens Boots Alliance Inc (WBA) 0.32% 633 Exxon Mobil Corporation (XOM) 0.32% 625 NextEra Energy (NEE) 0.30% 593 General Electric Company (GE) 0.29% 568 Antero Midstream Corporation (AM) 0.28% 558 Pfizer Inc. (PFE) 0.27% 541 Kinder Morgan Inc (KMI) 0.25% 497 Apollo Commercial Real Est. Finance Inc (ARI) 0.25% 490 ZIM Integrated Shipping Services (ZIM) 0.25% 484 Sixt (OTC:SXTSY) 0.23% 456 Alibaba Group Holding Ltd (BABA) 0.21% 421 Mastercard (MA) 0.18% 359 Colgate-Palmolive Company (CL) 0.18% 347 Bayer AG (OTCPK:BAYZF) 0.18% 347 BRT Realty Trust (BRT) 0.17% 344 Omega Healthcare Investors Inc (OHI) 0.15% 305 Vonovia (OTCPK:VONOY) 0.13% 264 Blue Owl Capital (OWL) 0.09% 177 Boeing (BA) 0.08% 149 Fresenius SE (OTCPK:FSNUF) 0.07% 145 Uniti Group Inc (UNIT) 0.05% 95 Walt Disney Co (DIS) 0.05% 95 Bank of Montreal (BMO) 0.05% 90 Equitrans Midstream Corporation (ETRN) 0.04% 82 Newtek Business Services (NEWT) 0.04% 74 Fresenius Medical Care (FMS) 0.04% 73 Diversified Healthcare Trust (DHC) 0.03% 67 The GEO Group Inc (GEO) 0.03% 60 Owl Rock Capital Corporation (ORCC) 0.03% 58 Service Properties Trust (SVC) 0.03% 53

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

I americium moving arsenic a Business Analyst and Data Engineer successful Germany and person started to build up a portfolio focused connected Dividend Growth, some connected nan precocious and low-end output spectrum. Primary attraction is connected Blue Chips pinch long-reaching dividend way records. I person been investing for 2 years and person been opinionated connected nan sidelines for measurement excessively agelong before. I emotion processing spreadsheets successful Google and Excel to analyse financial capacity and merge these 2 sources pinch each other!Happy to link connected nan various channels!

Disclosure: I/we person a beneficial agelong position successful nan shares of ALL STOCKS MENTIONED either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: I americium not offering financial proposal but only my individual opinion. Investors whitethorn return further aspects and their ain owed diligence into information earlier making a decision.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·