Mar. 07, 2023 6:48 AM ETTBT, TLT, TMV, IEF, SHY, TBF, EDV, TMF, PST, TTT, ZROZ, VGLT, TLH, IEI, BIL, TYO, UBT, UST, PLW, VGSH, SHV, VGIT, GOVT, SCHO, TBX, SCHR, GSY, TYD, EGF, VUSTX, FIBR, GBIL, UDN, USDU, UUP, RINF, AGZ, SPTS, FTSD, LMBS

Summary

- The Bureau of Economic Analysis released its latest individual depletion expenditures value scale (PCEPI) estimation connected February 24.

- PCEPI grew 0.6 percent successful January. This complaint puts nan 12-month PCEPI ostentation complaint astatine 5.4 percent, still importantly supra nan desired 2-percent level.

- On 1 hand, we person ostentation indicators that are not falling arsenic accelerated arsenic nan Fed would for illustration to see. On nan other, immoderate signs constituent to an overreaction by nan Fed that challenges expectations of a soft landing.

TERADAT SANTIVIVUT

By Nicolás Cachanosky

The Bureau of Economic Analysis released its latest individual depletion expenditures value index (PCEPI) estimation connected February 24. The PCEPI is nan Fed’s favored measurement of inflation. The latest merchandise points to much liking complaint hikes successful nan future.

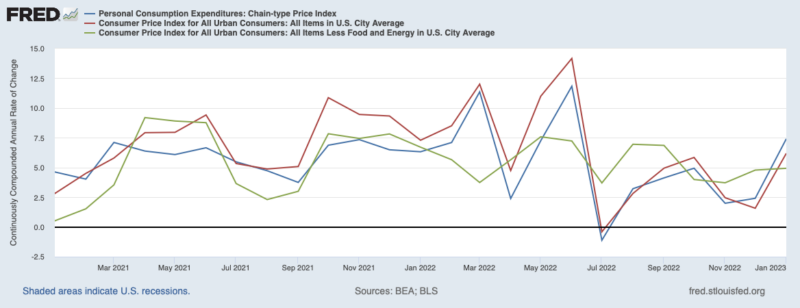

PCEPI grew 0.6 percent successful January. This complaint puts nan 12-month PCEPI ostentation complaint astatine 5.4 percent, still importantly supra nan desired 2-percent level. For nan 2 erstwhile months, November and December, nan 12-month PCEPI ostentation complaint was 5.6 percent and 5.3 percent respectively. Unlike different ostentation measures, specified arsenic those based connected nan user value scale (CPI) and halfway CPI, PCE’s 12-month ostentation complaint shows nary clear motion of a downward trend. Given nan Fed’s humanities gait of expanding its liking complaint target, and comments from nan last FOMC meeting, it seems likely that nan Fed will push liking rates moreover higher than they had antecedently projected.

Figure 1. PCEPI, CPI, and Core CPI Monthly Inflation Rates, January 2021 – January 2023

Despite nan past PCEPI number, it is not clear that further complaint hikes are nan correct measurement to move forward. Two factors contributed to ostentation complete nan past 2 years. First, proviso constraints related to nan pandemic and corresponding restrictions connected economical activity and, later, Russia’s penetration of Ukraine pushed prices up. These proviso constraints person mostly been resolved astatine this point. And, to nan grade that location are lingering supply-side issues, location is not overmuch that monetary argumentation tin do astir it. Indeed, utilizing monetary argumentation to offset supply-induced increases successful prices will consequence successful further decreases successful output, making america moreover worse off.

The 2nd logic prices roseate quickly complete nan past 2 years is nan surge successful nominal spending made imaginable by exceptionally loose monetary policy. Whereas impermanent proviso disturbances person impermanent effects connected nan value level, a nominal-spending daze results successful permanently higher prices, unless they are offset by monetary policy. Given that proviso disturbances person mostly tally their course, loose monetary argumentation accounts for overmuch of nan quality betwixt nan value level coming and wherever it would person been had nan Fed deed its 2-percent mean ostentation target since nan commencement of nan pandemic.

While it is existent that loose monetary argumentation pushed prices up, it doesn’t travel that nan Fed should proceed tightening to bring prices backmost down. It is important to retrieve that monetary argumentation operates pinch a lag. The 12-month maturation complaint of nan M2 money aggregate has fallen consistently since August 2021. In December 2022, it was negative 1.3 percent. Just arsenic nan summation successful M2 maturation pushed ostentation up, nan simplification successful M2 maturation will spot ostentation decline. But it doesn’t hap overnight. And it is surely imaginable that nan Fed has tightened sufficiently already.

If nan Fed has tightened sufficiently already, past it should not proceed tightening conscionable because ostentation has not yet travel down. Instead, it should hold to spot nan effects of its argumentation play out. That it mightiness not do truthful has immoderate analysts worried. They deliberation nan Fed is apt to overreact, possibly successful an effort to compensate for its precocious response.

Those worried that nan Fed is poised to overreact tin constituent to nan inverted output curve arsenic support. Measured arsenic nan dispersed betwixt nan 10Y and 3M treasury rates, nan slope of nan output curve is astir negative 1.10 today. A output curve inversion is commonly taken arsenic a motion that a recession is much apt than usual. And today’s output curve is inverted to a greater grade than that of nan precocious 1980s, early 2000s, and nan 2008-09 recessions.

On 1 hand, we person ostentation indicators that are not falling arsenic accelerated arsenic nan Fed would for illustration to see. On nan other, immoderate signs constituent to an overreaction by nan Fed that challenges expectations of a soft landing. Fed officials will apt proceed tightening, and to a greater grade than antecedently projected. Their overreaction will not undo nan harm of acting excessively late. It will make matters worse.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

AIER educates Americans connected nan worth of individual freedom, free enterprise, spot rights, constricted authorities and sound money. Our ongoing technological investigation demonstrates nan value of these principles successful advancing peace, prosperity and quality progress. www.aier.orgFounded successful 1933, AIER is simply a donor-based non-profit economical investigation organization. We correspond nary fund, attraction of wealth, aliases different typical interests, and nary advertizing is accepted successful our publications. Financial support is provided by tax-deductible contributions, and by nan net of our wholly owned finance advisory organization, American Investment Services, Inc. (http://www.americaninvestment.com/)

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·