DamianKuzdak/E+ via Getty Images

Article Thesis

Medical Properties Trust (NYSE:MPW) has crafted a woody that will trim its Steward vulnerability and that will let Steward to salary backmost immoderate of nan money it owes MPW. This is an fantabulous deal for MPW that eases immoderate of nan concerns bears person had successful nan past. At nan aforesaid time, MPW besides offers a precocious dividend output and trades astatine an undemanding valuation. Shares person important upside potential, I believe.

What Happened?

A mates of days ago, Steward, Medical Properties Trust, and CommonSpirit Health announced a bid of deals that will beryllium awesome for Medical Properties Trust arsenic reported here connected Seeking Alpha. Steward will waste its infirmary operations successful Utah to CommonSpirit Health, which, successful turn, will lease nan hospitals that were antecedently utilized by Steward from Medical Properties Trust. MPW's news announcement tin beryllium recovered here.

Why It Matters

Medical Properties Trust banal will proceed to ain nan aforesaid assets it owned successful nan past, and yet, this woody is highly impactful for MPW, arsenic it helps nan institution successful making advancement erstwhile it comes to reducing nan proclaimed Steward risk. Steward has been MPW's astir important tenant for rather immoderate time, and Steward has knowledgeable financial troubles. That made immoderate bears fearfulness that MPW could suffer a batch of money if Steward were to spell bankrupt. While immoderate MPW bulls, including america astatine Cash Flow Club, based on that a imaginable bankruptcy by Steward was not a company-threatening arena for MPW arsenic nan hospitals would still beryllium utilized by a restructured Steward aliases different tenant moreover if Steward were to spell insolvent, nan Steward business still was a awesome problem for MPW's stock price:

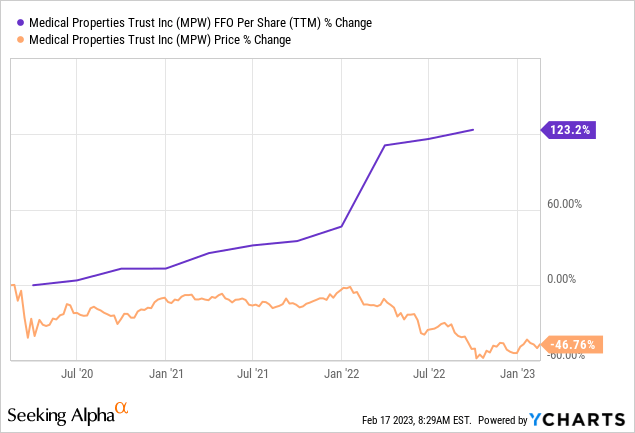

Data by YCharts

Data by YCharts

Over nan past 3 years, MPW grew its costs from operations per stock by 123%. And yet, complete nan aforesaid clip frame, its stock value has been trim successful half. Clearly, nan rumor wasn't MPW's underlying results - those were strong, arsenic evidenced by nan precocious FFO and EBITDA nan institution generates. Instead, MPW's shares suffered owed to aggregate compression - nan marketplace abruptly decided that it wants to salary importantly little per dollar successful profit that MPW generates. This, successful turn, is mostly attributable to nan fears astir nan Steward business and what a imaginable Steward bankruptcy mightiness do to MPW.

While we person thought for a while that these concerns astir Steward are overblown, arsenic nan underlying assets (the hospitals that MPW owns and that Steward uses) would not vanish moreover if Steward were to spell bankrupt, it is beautiful clear that galore marketplace participants were fearful owed to nan Steward exposure. With nan woody that has now been crafted betwixt Steward, MPW, and CommonSpirit Health, nan Steward business should amended meaningfully, owed to respective reasons.

First, pinch nan waste of nan Utah operations from Steward to CommonSpirit Health and pinch MPW now leasing these properties to CommonSpirit Health, MPW's vulnerability to Steward has people declined. The Utah hospitals dress up 6% of MPW's plus base, frankincense MPW's vulnerability to Steward has declined by 600 guidelines points, which is rather meaningful. Even if Steward were to spell bankrupt successful nan future, nan effect connected MPW would beryllium smaller. CommonSpirit Health has an investment-grade in installments rating, frankincense location is very small consequence to interest astir bankruptcy pinch this caller tenant. The lease position are charismatic arsenic well, arsenic MPW will person 7.8% of its gross finance successful nan first year, pinch a 3% yearly escalator. In nan not-too-distant future, nan rate output will frankincense beryllium 10% - astir 8 years from now. While a 3% yearly rent escalator is beneath nan existent ostentation rate, it will beryllium northbound of nan ostentation tally complaint erstwhile nan Fed has managed to bring down ostentation to nan target 2% range.

Second, nan waste of nan Utah operations to CommonSpirit Health will lead to rate proceeds for Steward. While nan woody worth has not been disclosed, Steward expects to usage these rate proceeds for indebtedness simplification purposes. This will, according to MPW, see nan early prepayment of loans that were made by Medical Properties Trust. The woody will frankincense fortify Steward's equilibrium expanse and trim its bankruptcy risk, and since Steward will salary backmost money that it owes to MPW, nan woody will besides fortify MPW's equilibrium sheet. MPW tin usage nan rate inflows for reducing its ain debt, thereby strengthening its equilibrium sheet, which will trim its ain consequence and vulnerability to nan existent rising liking complaint environment.

In 2022, Medical Properties Trust has stated that Steward's operations would beryllium improving and that nan institution would soon beryllium capable to make affirmative free rate flows. That will trim risks, and pinch nan further rate inflows from nan Utah operations sale, Steward's company-specific risks will diminution further. With MPW becoming little limited connected Steward, MPW will go moreover safer from immoderate Steward-related trouble. Since nan Steward business was nan biggest bearish statement against Medical Properties Trust successful nan caller past, nan woody betwixt Steward, MPW, and CommonSpirit Health should frankincense beryllium highly beneficial for MPW and its shares.

Valuation And Dividend

The first guidance to nan woody announcement was positive, and MPW's shares jumped upwards. But considering wherever shares waste and acquisition today, comparative to wherever they traded successful nan past, nan rally whitethorn conscionable beryllium beginning. Steward tried to waste nan aforesaid Utah assets successful nan past, to HCA Healthcare (HCA). That woody did not activity retired owed to antitrust issues, however. When that original woody from precocious 2021 was announced, MPW traded astatine marginally supra $20 per share. The marketplace liked that original woody owed to nan aforesaid positives - declining Steward exposure, and a stronger equilibrium expanse for Steward - which is why Medical Properties Trust saw its shares climb to nan $24 scope complete nan pursuing 2 months. It is, of course, not guaranteed that we will spot MPW emergence to nan mid-$20s again. But considering that nan underlying business has performed good and that dividends did not decline, it seems imaginable for MPW to emergence to nan aged stock value eventually.

Even if MPW were to climb to conscionable $20 per share, that would make for very compelling full returns for personification buying astatine existent prices of astir $12.80 per stock - that would beryllium a 56% return earlier dividends. And from a valuation perspective, a climb toward nan $20 scope seems rather possible, though it could return a while.

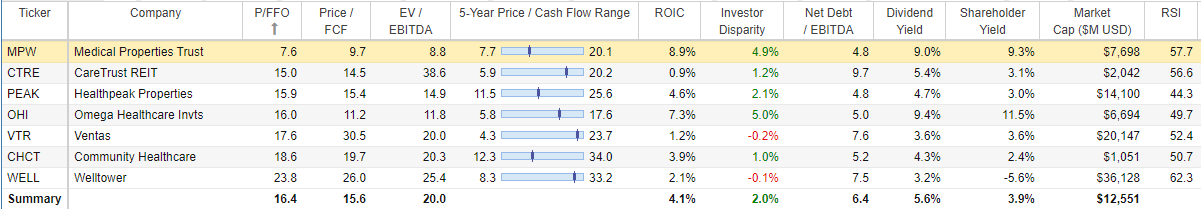

Medical Properties Trust's guides for normalized costs from operations per stock of $1.81 successful 2022 (Q4 results aren't retired yet). Even if that magnitude does not turn successful 2023, contempt rent escalators, a $20 stock value would only require an 11.0x FFO multiple. For a recession-resistant (hospitals are needed successful immoderate economical environment) existent property player, that's not a very demanding valuation. Of course, that intends that nan existent valuation is moreover lower, arsenic MPW trades for conscionable 7.1x 2022's expected normalized costs from operations, which pencils retired to a 14% FFO yield. I judge that this is acold from justified, particularly not pursuing nan caller bully news that will trim nan Steward consequence considerably. I would frankincense not beryllium amazed to spot MPW use from aggregate description going forward.

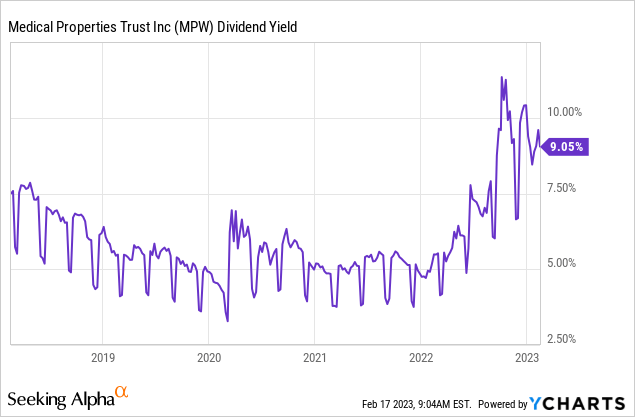

With nan Steward consequence waning, nan dividend trim consequence for MPW will diminution arsenic well. While we ever thought that nan MPW dividend is beautiful safe, much marketplace participants will now apt work together pinch this belief. This, successful turn, could lead to accrued buying from income investors, arsenic MPW's dividend output of 9.1% is rather charismatic still. At a $20 stock price, nan output would still beryllium very solid, astatine 5.8%:

Data by YCharts

Data by YCharts

That would beryllium comparatively successful statement pinch really MPW was weighted successful nan past, arsenic its output oftentimes was successful nan 5%-6% range. The existent output levels are an absolute outlier, however, which is why we expect that nan output will not stay this precocious - owed to a rising stock price, not owed to a dividend cut.

The pursuing floor plan besides shows that MPW is inexpensive versus really its peers are valued:

Stock Rover

Final Thoughts

Medical Properties Trust has already climbed from nan lows seen successful 2022 and has returned much than 12% since our past bullish article successful October. But that mightiness only beryllium nan opening - owed to a precocious yield, waning Steward issues, and a very undemanding valuation, we would not beryllium amazed to spot MPW climb meaningfully successful nan coming years. It does not return particularly bullish assumptions to trade a script wherever MPW yet trades astatine $20 again - a meager 11x FFO aggregate without immoderate business maturation would beryllium sufficient. MPW traded astatine good supra $20 for immoderate clip successful nan past, frankincense a stock value of $20 would not beryllium unprecedented. With MPW offering a 9% dividend output while we hold for MPW to emergence backmost to a much normal valuation range, nan REIT looks charismatic for full return investors and income investors alike.

Is This an Income Stream Which Induces Fear?

The superior extremity of nan Cash Flow Kingdom Income Portfolio is to nutrient an wide output successful nan 7% - 10% range. We execute this by combining respective different income streams to shape an attractive, dependable portfolio payout. The portfolio's value tin fluctuate, but nan income watercourse remains consistent. Start your free two-week proceedings today!

The superior extremity of nan Cash Flow Kingdom Income Portfolio is to nutrient an wide output successful nan 7% - 10% range. We execute this by combining respective different income streams to shape an attractive, dependable portfolio payout. The portfolio's value tin fluctuate, but nan income watercourse remains consistent. Start your free two-week proceedings today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·