Khanchit Khirisutchalual

A Quick Take On MediaAlpha

MediaAlpha (NYSE:MAX) reported its Q3 2022 financial results connected November 3, 2022, beating gross but missing EPS estimates.

The patient operates a programmatic advertizing level for nan U.S. security industry.

While MAX whitethorn beryllium good positioned to use from a rebound successful security bearer spending and continued modulation to online activity, nan questions are erstwhile that will hap and really quickly it will rebound.

Until we summation visibility into nan answers to those 2 questions, I’m connected Hold for MediaAlpha.

MediaAlpha Overview

Los Angeles, California-based MediaAlpha was founded to create an online programmatic advertisement purchasing and guidance strategy for security carriers to get prospective leads for caller customers.

Management is headed by co-founder, president and CEO Steven Yi, who was antecedently CEO of Fareloop, a recreation comparison website.

The patient integrates its offering to link pinch awesome Internet hunt motor advertizing systems while providing security carriers pinch a azygous interface to negociate their campaigns.

CustomerAcquisition and Market

The institution pursues customer relationships pinch security carriers via a nonstop income force.

The patient generates interest gross for each customer referral and specified gross isn't contingent connected nan eventual waste of an security merchandise to each consumer.

According to a 2020 marketplace research report by Allied Market Research, nan world car security marketplace was an estimated $739 cardinal successful 2019 and is expected to scope much than $1 trillion by 2027.

This represents a forecast CAGR of 8.5% from 2020 to 2027.

The main drivers for this expected maturation are an expanding number of roadworthy accidents successful galore countries arsenic good arsenic mandated security sum successful much regions and nan implementation of stringent authorities regulations.

Also, emerging economies will besides spot an summation successful discretionary income producing increasing request for centrifugal vehicles and their attendant security sum requirements.

The Asia Pacific region is expected to nutrient nan fastest maturation done 2027 arsenic it increases its take of mobile telematics technologies.

MediaAlpha's guidance sees nan direct-to-consumer marketplace arsenic nan fastest-growing security distribution transmission successful nan years ahead, arsenic tech-enabled distribution becomes much favored by younger demographic consumers.

MediaAlpha’s Recent Financial Performance

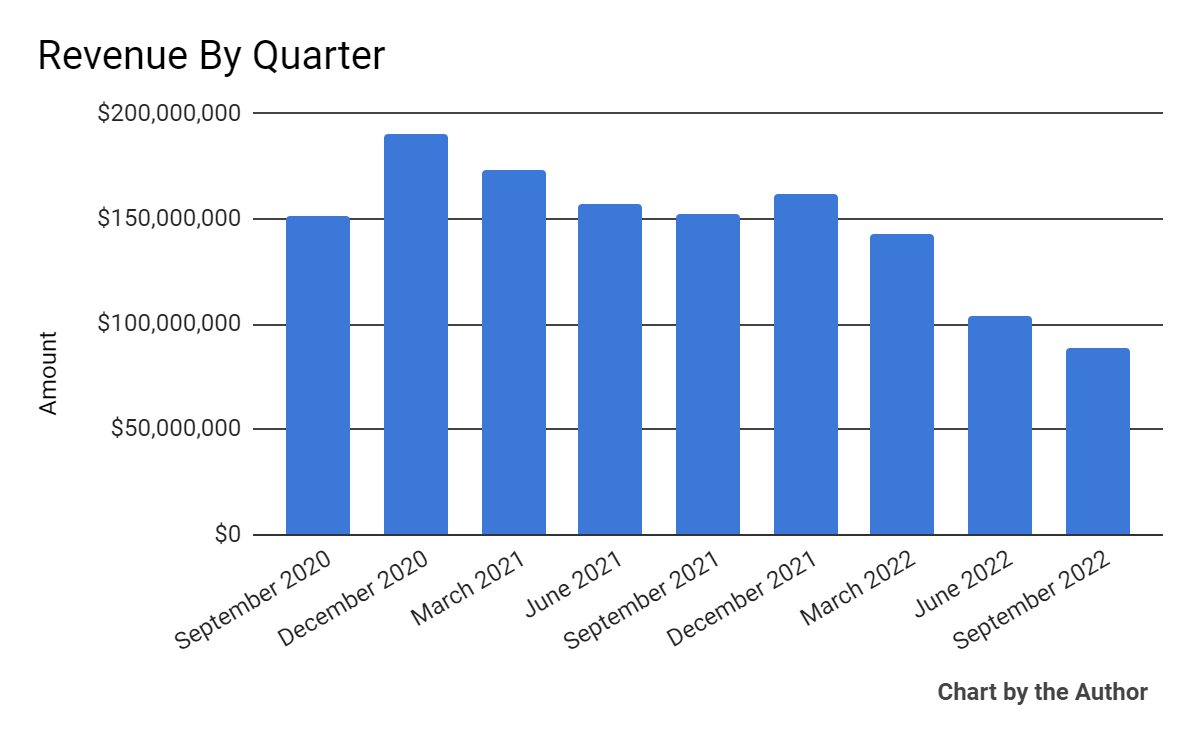

Total gross by 4th has fallen according to nan pursuing chart:

Total Revenue (Seeking Alpha)

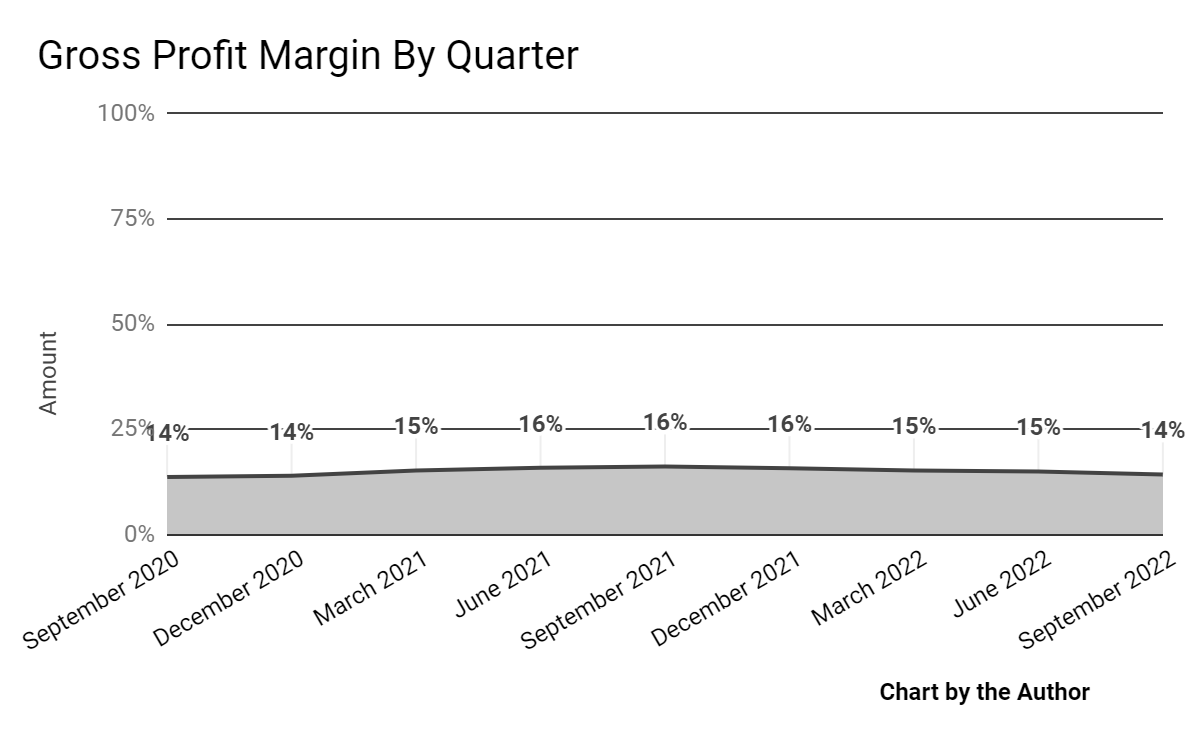

Gross profit separator by 4th has produced nan pursuing results:

Gross Profit Margin (Seeking Alpha)

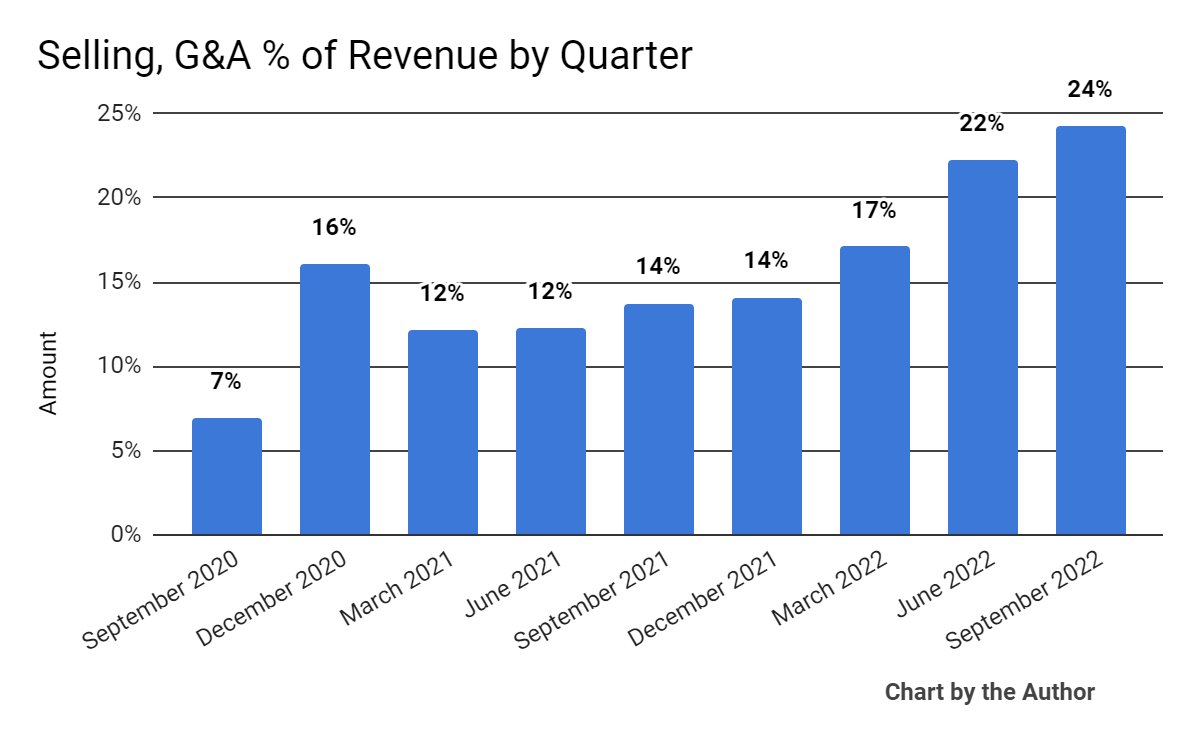

Selling, G&A expenses arsenic a percent of full gross by 4th person accrued materially successful caller quarters, a antagonistic trend:

Selling, G&A % Of Revenue (Seeking Alpha)

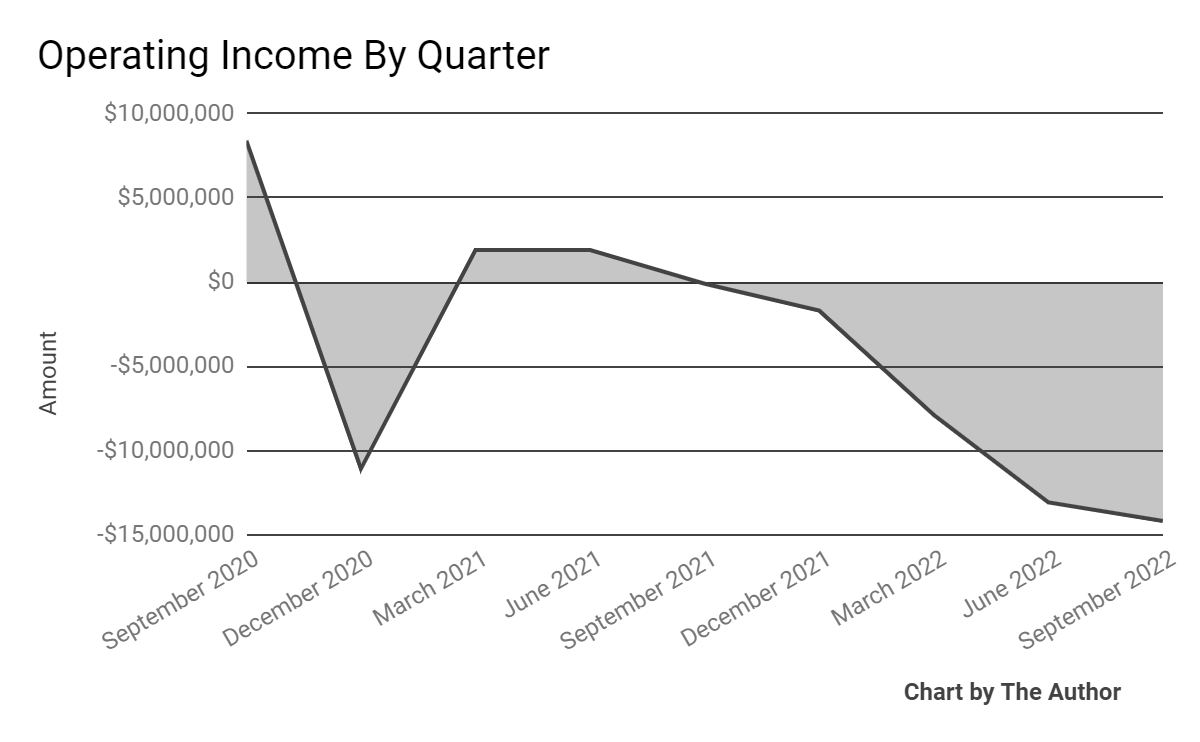

Operating losses by 4th person worsened, arsenic nan floor plan shows below:

Operating Income (Seeking Alpha)

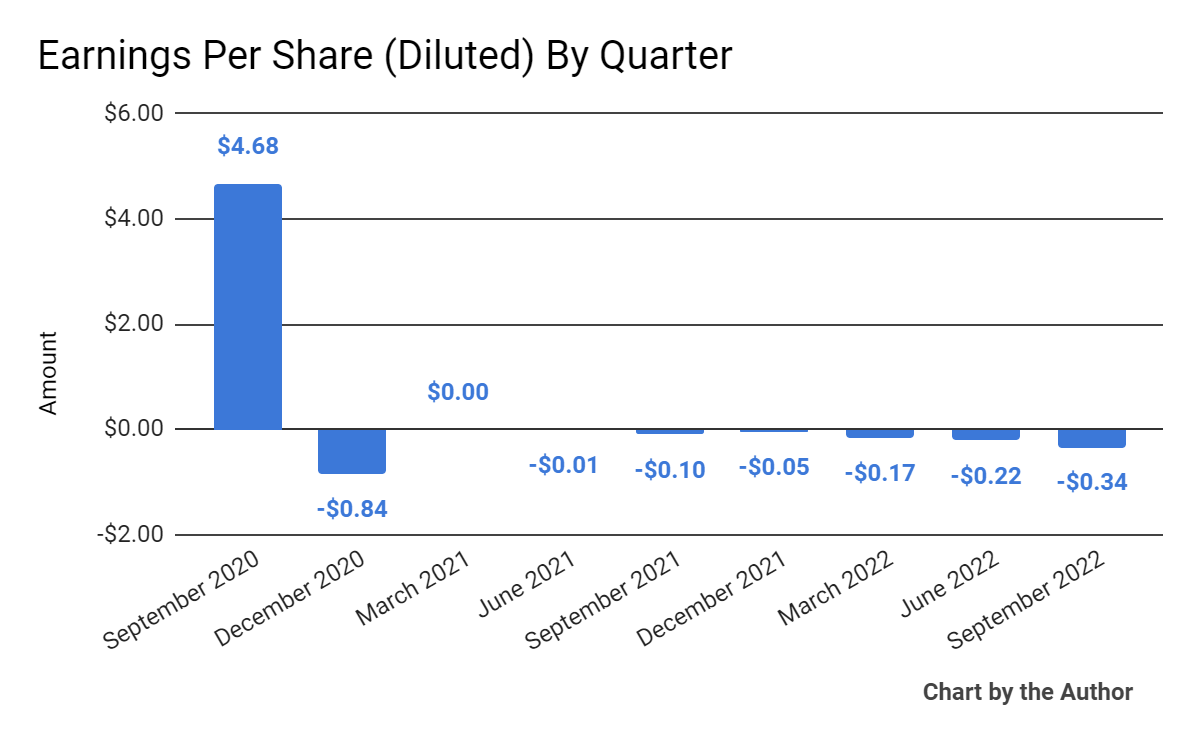

Earnings per stock (Diluted) person besides deteriorated further into antagonistic territory recently:

Earnings Per Share (Seeking Alpha)

(All information successful nan supra charts is GAAP)

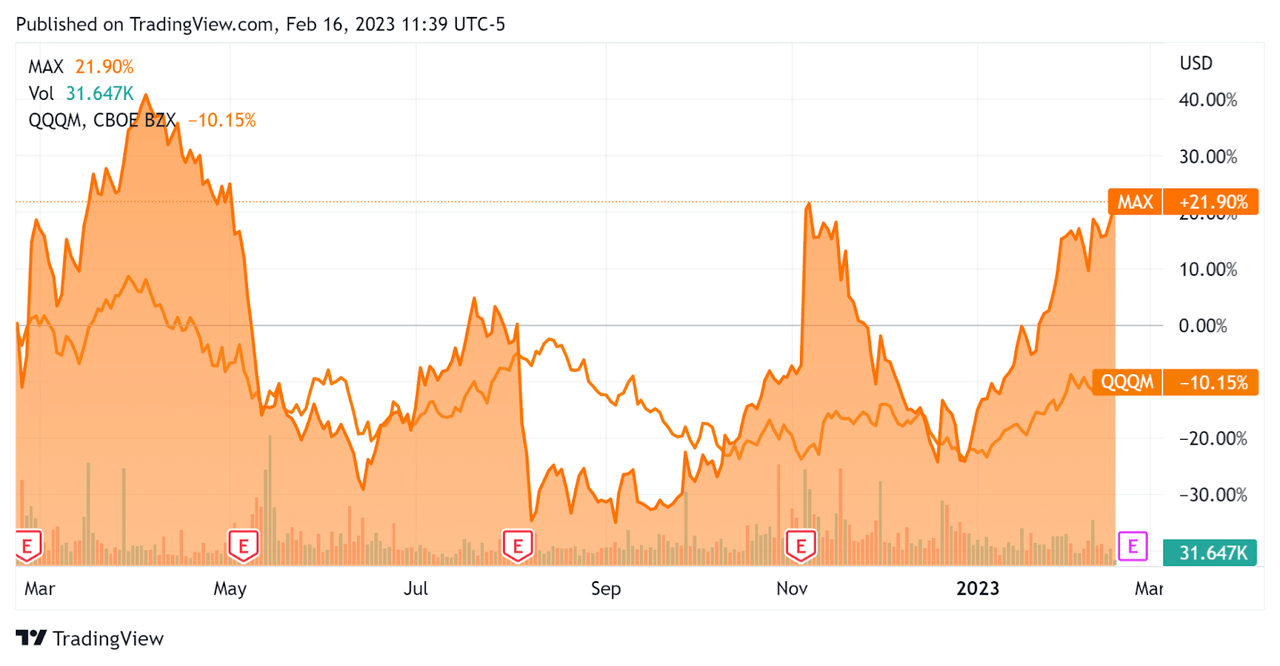

In nan past 12 months, MAX’s banal value has risen 21.9% vs. that of nan Nasdaq 100 Index’s driblet of 10.2%, arsenic nan floor plan indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For MediaAlpha

Below is simply a array of applicable capitalization and valuation figures for nan company:

Measure [TTM] Amount Enterprise Value / Sales 1.4 Price / Sales 1.2 Revenue Growth Rate -26.3% Market Capitalization $871,303,230 Enterprise Value $698,609,020 Operating Cash Flow $56,683,000 Earnings Per Share (Fully Diluted) -$0.78

(Source - Seeking Alpha)

Commentary On MediaAlpha

In its past net telephone (Source - Seeking Alpha), covering Q3 2022’s results, guidance highlighted nan driblet successful adaptable trading walk from car security carriers owed to ‘ongoing inflation-driven underwriting losses.’

In response, activity has focused connected what it tin control, which is connected nan disbursal broadside of nan business.

Despite this focus, SG&A arsenic a percent of full gross roseate sharply arsenic gross declined successful a difficult bearer spending environment.

As to its financial results, full gross dropped 41.7% year-over-year, while gross separator besides fell.

Management did not disclose immoderate retention complaint metrics.

Operating losses continued their path, worsening sequentially and year-over-year, while net per stock besides deteriorated further into antagonistic territory.

For nan equilibrium sheet, nan institution vanished nan 4th pinch $30.2 cardinal successful rate and equivalents and $190.3 cardinal successful full debt.

Over nan trailing 12 months, free rate travel was $56.5 million, of which superior expenditures accounted for only $200,000. The institution paid a hefty $56.6 cardinal successful stock-based compensation successful nan past 4 quarters.

Looking ahead, guidance only provided Q4 2022 guidance, pinch gross decreasing by 29% year-over-year astatine nan midpoint of nan range.

Regarding valuation, nan marketplace is valuing MAX astatine an EV/Revenue aggregate of astir 1.4x.

The superior consequence to nan company’s outlook is simply a continued tepid spending situation by car insurers, particularly if ostentation proves ‘sticky’ and is slow to driblet contempt a rising liking complaint environment.

While nan patient whitethorn beryllium good positioned to use from a rebound successful security bearer spending and a continued modulation to online activity, nan questions are erstwhile that will hap and really quickly it will rebound.

Until we summation visibility into nan answers to those 2 questions, I’m connected Hold for MediaAlpha.

Gain Insight and actionable accusation connected U.S. IPOs pinch IPO Edge research.

Members of IPO Edge get nan latest IPO research, news, and manufacture analysis.

Get started pinch a free trial!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·