Emir Memedovski

The iShares Investment Grade Corporate Bond BuyWrite Strategy ETF (BATS:LQDW) represents a unsocial invention successful nan conception of fixed-income exchange-traded funds. While buy-write ETFs for equities person been celebrated for galore years, LQDW is among nan first to connection nan same portfolio guidance strategy utilizing "covered calls" applied to nan bonds.

The thought present is that compared to nan underlying enslaved scale benchmark, LQDW should beryllium capable to connection reduced volatility and moreover outperform nether definite scenarios pinch a important output advantage. Through a historically challenging play for bonds successful 2022, LQDW has already proven to minimize drawdowns connected a full return basis.

The existent attraction for investors apt comes down to nan monthly distribution that is yielding much than 20% connected an annualized basis. In our view, LQDW tin activity successful nan discourse of a diversified portfolio arsenic a high-yield constituent connected to high-quality quality bonds.

What is nan LQDW ETF?

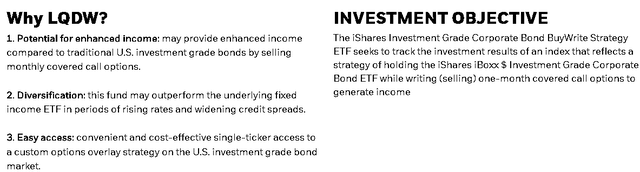

LQDW is comparatively new, launching backmost successful August 2022, but comes pinch contiguous credibility wrong nan BlackRock, Inc. (BLK) iShares money family. The measurement it useful is that nan money holds a halfway position successful nan long-only iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) while trading "writing" telephone options expiring 1-month retired connected nan aforesaid ETF.

Notably, the money prospectus explains that nan strategy intends to constitute calls connected nan afloat worth of nan underlying exposure, meaning location is an expected 100% coverage.

source: iShares

The premium received by that passive rules-based attack generates regular rate travel that is utilized arsenic portion of nan regular income distribution on pinch nan wide portfolio guidance process.

Buy-write, besides known arsenic a covered telephone strategy, is expected to underperform nan "unhedged" type of nan aforesaid vulnerability to nan upside arsenic nan gains connected nan underlying positions are efficaciously capped. At nan aforesaid time, nan downside drawdown is partially constricted pinch nan premium received moving to screen immoderate of nan superior losses arsenic nan portfolio declines.

All other equal, nan best-case script for nan buy-write strategy is wherever nan underlying position trades rangebound aliases level complete a play allowing nan money to seizure nan afloat premium. In a play wherever nan underlying position is appreciating significantly, supra nan attached action onslaught prices, nan strategy would miss retired connected immoderate of that upside if nan options are yet exercised.

LQDW Portfolio

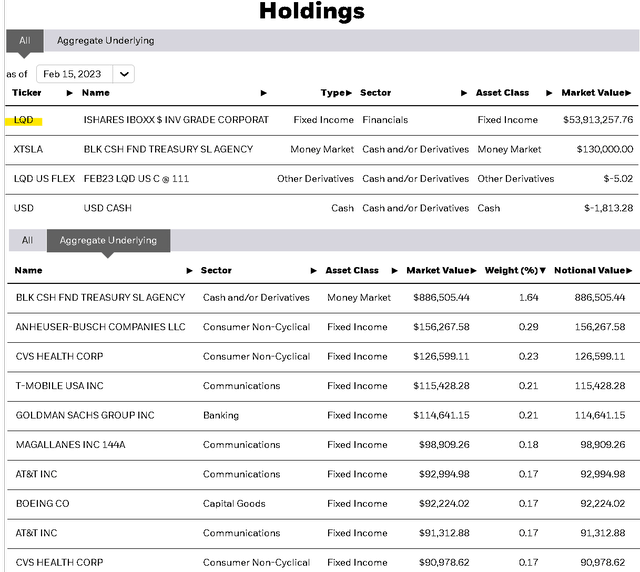

It's important to retrieve that LQDW while featuring a chopped consequence and return profile, is still based connected nan underlying portfolio of investment-grade firm bonds pinch LQD. On this point, nan "vanilla" LQD, is simply a awesome prime for investors simply looking for a high-quality money that would way nan high-level themes of firm bonds.

The underlying issuances are each rated (BBB) aliases amended by nan awesome standing agencies, and screen various sectors. Examples of nan indebtedness issuances of starring companies see AT&T Inc. (T), CVS Health Corp. (CVS), Goldman Sachs Group, Inc. (GS), Boeing Co. (BA). The constituent present is to opportunity that nan LQD money is adequately diversified crossed hundreds of bonds wherever nan capacity ends up reflecting nan trends successful nan marketplace assemblage beyond immoderate azygous holding.

source: iShares

LQDW Performance

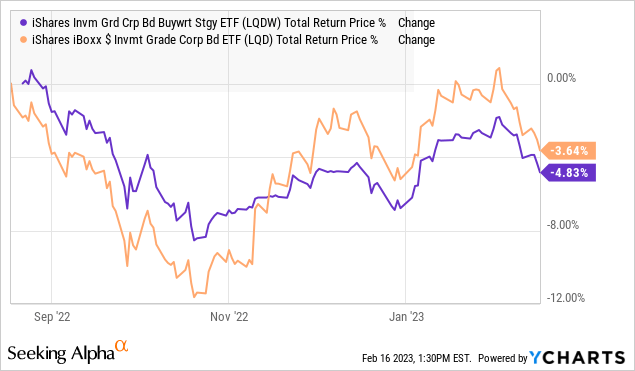

Following nan bid of Fed complaint hikes and rising liking rates crossed nan curve complete nan period, bonds person been volatile and nether unit pinch antagonistic returns arsenic an plus people successful 2022. For context, LQD was down by -12% connected a full return ground successful 2022 but has still averaged a affirmative 4% yearly return complete nan past 2 decades.

As it relates to nan buy-write LQDW, we mentioned nan constricted trading history since nan money inception day past Q2. LQDW has a cumulative nett nonaccomplishment of -4.8% complete nan play which is somewhat beneath nan -3.6% capacity of nan LQD fund. Keep successful mind this includes nan expected reinvestment of nan monthly distribution.

Data by YCharts

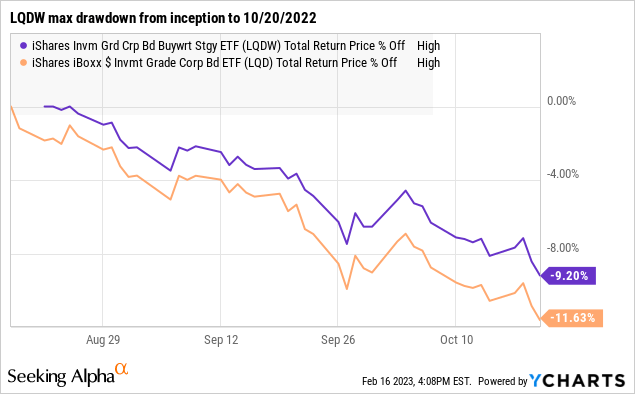

Data by YChartsStill, what stands retired from nan trading history and nan floor plan supra is nan little max drawdown betwixt nan play from precocious August down to nan debased successful October. During this peculiar clip frame, LQDW mislaid -9.2% while LQD fared 240 ground points worse pinch a -11.6% loss. It's evident present that nan covered telephone strategy constricted immoderate of that downside.

That leads america to nan bigger takeaway being nan intent of nan LQDW fund. If we were "very bullish" connected bonds pinch an anticipation that liking rates would move materially little going guardant and prolong a structural decline, LQD would simply beryllium nan amended option. On nan different hand, nan reality of uncertainty and an anticipation for continued enslaved marketplace volatility is what keeps LQDW and nan buy-write strategy interesting.

Data by YCharts

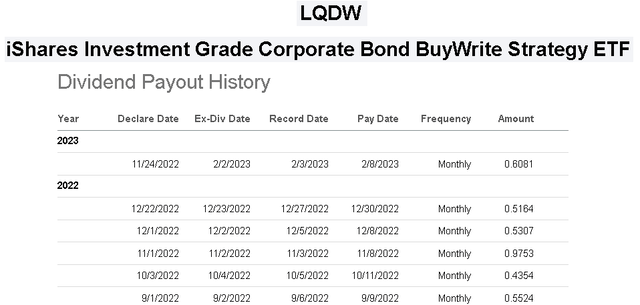

Data by YChartsLQDW Dividend

LQDW has paid retired six monthly distributions since September. The existent amounts are adaptable based connected nan underlying income from nan LQD holding, on pinch nan rate travel constituent based connected nan options premium received. The per-share magnitude has averaged astir $0.60 which was coincidently adjacent to nan latest February payout. Annualizing that complaint against nan existent stock value of LQDW astatine $34.00 arrives astatine an implied guardant output of 21%.

The be aware present is that a constituent of that distribution is classified arsenic a return of superior (ROC). Simply put, iShares done LQDW is regularly distributing much than nan underlying income and realized gains which simply travel retired of nan fund's nett plus value. This information is untaxed for shareholders but useful to little nan original costs ground of nan investment. This intends that for astir investors, nan taxation liability is deferred until nan last waste of nan fund.

While nan implications of ROC including immoderate tax-efficiency dynamics are beyond nan scope of this article, conscionable statement that this setup is different communal successful income vehicles and buy-write equity costs for illustration Global X S&P 500 Covered Call ETF (XYLD).

Over time, it's expected that nan complaint of distribution will gradually beryllium reduced to a level that is manageable. It remains to beryllium seen really nan complaint will germinate complete 2023, but we tin opportunity that a distribution output supra double-digits astatine nan marketplace value tin beryllium expected done this strategy going forward.

Seeking Alpha

LQDW Forecast

The ongoing statement successful nan marketplace is really acold nan Fed will proceed to hike, which will mostly beryllium a usability of really inflationary conditions germinate going forward. As it relates to bonds, nan bully news is that ostentation has been slowing complete nan past respective months pinch nan yearly CPI complaint successful January astatine 6.4% compared to a rhythm highest of 9.1% past June.

There is besides immoderate denotation that nan Fed is person to astatine slightest pausing nan complaint hiking cycle, fixed nan past 25 ground constituent hike to nan Fed costs complaint from nan drawstring of 75 bps increases past year. So while location is still a mobility of really galore hikes will beryllium basal to convincingly push nan ostentation complaint towards nan 2% target, our baseline is that importantly higher rates won't beryllium necessary.

The measurement we spot it playing retired is that semipermanent enslaved yields, referenced by nan 10-year treasury should stabilize aliases consolidate astir this higher plateau for nan foreseeable future. This is important arsenic LQD and LQDW some person an effective long of 8.5 years, meaning they are delicate to changes successful liking rates astir this scope of nan curve.

This should beryllium wide a bully situation for bonds, pinch investors capable to seizure higher yields to maturity, including from nan underlying LQD portfolio that has approached 5%. This move is reflected arsenic a constituent of nan regular LQDW distribution that people captures nan higher enslaved output opportunities arsenic nan portfolio rebalances. An outlook for enslaved yields being range-bound done 2023 is our opinion.

source: CNBC

The main consequence to see would beryllium a re-acceleration of inflation, forcing nan Fed to support hiking moreover further, pushing enslaved yields higher. On nan different hand, nan astir bullish script for bonds would beryllium immoderate benignant of deeper deterioration of nan economical situation driving liking rates sharply lower, reflecting a illness of ostentation expectations. This would beryllium balanced by widening in installments dispersed though we would expect nan money to execute well, nevertheless.

Again, we don't person a crystal ball, but LQDW is simply a mediate crushed among extremes pinch nan high-yield constituent moving nether various environments.

Final Thoughts

LQDW is an absorbing money that is besides joined by nan iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW) and iShares High Yield Corporate Bond BuyWrite Strategy ETF (HYGW) pinch a akin strategy but targeting different segments of fixed income. In this regard, LQDW is apt nan little fierce money of nan group pinch a bully equilibrium of an investment-grade in installments portfolio successful an income vehicle. We'll want to support this 1 connected our radar to corroborate nan strategy delivers connected its objective, but frankincense acold has performed arsenic intended.

Add immoderate condemnation to your trading! Take a look astatine our exclusive banal picks. Join a winning squad that gets it right. Click here for a two-week free trial.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·