CHUNYIP WONG/E+ via Getty Images

By Christopher Gannatti

As we commencement 2023, each plus people is experiencing its ain type of adjustment. Part of that accommodation includes looking guardant to a imaginable recession—likely astatine slightest portion of nan logic why valuations successful galore places dropped truthful importantly during 2022. Part of that accommodation includes an anticipation that nan U.S. Federal Reserve is improbable to raise its argumentation complaint different 400 ground points (or more). Part of that accommodation includes expectations for a moderation of inflation, which is already coming down connected galore measures, astatine slightest for those of america looking astatine nan U.S. economical picture.

The Performance Evolution of New Economy Real Estate

In fig 1, we plotted a ratio of nan cumulative return of nan CenterSquare New Economy Real Estate Index (New Economy Real Estate) versus nan MSCI ACWI Index (Global Equities). While it sounds complicated, operationally speaking:

- If nan floor plan is sloping downward from near to right, that tells america New Economy Real Estate is underperforming Global Equities.

- If nan floor plan is sloping upward from near to right, this tells america that New Economy Real Estate is outperforming Global Equities.

The WisdomTree New Economy Real Estate Fund (WTRE) shifted its nonsubjective and finance strategy connected April 20, 2022, and began search nan Index, which is why fig 1’s play starts connected that date. Looking much profoundly astatine fig 1, we spot 3 chopped periods by kindness of nan shifts of nan slope of nan line.

- Period 1 (April 20, 2022, to May 10, 2022): We intelligibly spot nan steep downdraft successful nan slope, which tells america that New Economy Real Estate underperformed Global Equities.

- Period 2 (May 10, 2022, to October 24, 2022): There was a continued downtrend—which tells america that New Economy Real Estate was still underperforming Global Equities—but it occurred complete a longer play of clip than what we saw successful play 1.

- Period 3 (October 24, 2022, to January 30, 2023): These charts are nan astir absorbing erstwhile you get a shift, and moreover if nan affirmative slope is not monolithic successful play 3, it is there—this intends that New Economy Real Estate started outperforming Global Equities.

Our main thesis is that location is simply a imaginable for New Economy Real Estate companies to connection a differentiated measurement to person “tech exposure” erstwhile group whitethorn beryllium looking to dial backmost their vulnerability to wide tech companies.

Figure 1: Evolution of Performance of New Economy Real Estate vs. Global Equities

Segments of New Economy Real Estate

But tin we drill down to look astatine 3 circumstantial areas successful existent estate? WisdomTree useful pinch CenterSquare, an plus head pinch heavy acquisition and expertise successful existent estate, to specify an attack to “New Economy Real Estate,” which focuses on:

- Cell towers

- Data centers

- Industrial warehouses tilting much successful nan guidance of ecommerce and technology

While 1 tin ne'er cognize precisely really a fixed business aliases area of a marketplace will respond successful difficult economical conditions, location is simply a rationale to judge that it’s astatine slightest imaginable that these areas wrong existent property could thin to beryllium much resilient than wide existent property much broadly.

Relating to nan Well-Known “Pandemic Pull-Forward”

When we opportunity “pull-forward,” we specifically mean really nan world, successful short order, was forced to set to an situation wherever agency activity shifted from going to a circumstantial location each time to moving from location and yet moving from anywhere. To make this work, galore group and galore companies bought a batch of caller hardware. Those purchases occurred during 2020, largely, and successful galore cases, that hardware does not needfully request to beryllium replaced instantly and whitethorn not moreover request to beryllium repurchased astatine rather nan aforesaid standard arsenic during that unsocial clip successful our history.

Looking astatine compartment towers successful this context, 1 connection tends to travel up: resilience. Now, if nan extremity is to find what should supply nan top sensitivity successful an upward-trending market, compartment towers are not apt to fresh nan bill. They thin to run nether much semipermanent leases pinch stable, predictable rate flows. Cell towers are not expected to person wide swings successful their perceived value, whether successful nan upward aliases downward directions. When considering what type of unit could thrust worth wrong compartment towers, it’s much important to admit nan existent 5G spending rhythm that carriers are progressive in. Any spending related to this was much aligned pinch nan request to mostly upgrade systems owed to customer request to beryllium capable to woody pinch much information faster, and this inclination marches forward, seemingly without respect for either economical aliases pandemic-related conditions.

Data centers, connected nan different hand, did spot a monolithic pull-forward. Logically, this makes sense, successful that if group really did bargain each that hardware and past did commencement moving from their homes—and yet from anywhere—data centers needed to person nan capacity to support nan various productivity applications (like Zoom Video Communications aliases Microsoft Teams) astatine nan vastly accrued levels of demand. If we look astatine nan caller past quarters of activity, 5 retired of six saw all-time records successful position of nan home uptake of abstraction for information centers. It would beryllium intolerable to expect this type of inclination to proceed indefinitely, but it is important to retrieve that moreover if location is simply a moderation, group aren’t demanding to usage little data, and specified a point is not expected successful nan foreseeable future.

Valuations Corrected Significantly during 2022

We admit that galore investors whitethorn not beryllium regularly search different valuation metrics for existent estate, overmuch little search nan metrics that specify circumstantial underlying types of existent estate. Stepping backmost for a moment, we should specify immoderate of nan statistic that we judge are due to contextualize nan different types of existent property we are astir to drill down on:

- For compartment telephone building REITs and REITs progressive successful logistics connected nan business side, we look astatine price/adjusted costs from operations (P/AFFO) complete nan adjacent 12 months (NTM). The adjusted costs from operations are a measurement to spot a measurement of nan rate flows disposable to shareholders successful nan REIT, arsenic good arsenic supply a consciousness of nan REIT’s early imaginable to salary dividends.

- For information halfway REITs, we look astatine nan narration betwixt endeavor worth and net earlier interest, taxes, depreciation and amortization complete nan coming 12 months—typically termed “next 12 months” (EV/EBITDA NTM).

As is ever nan case, location is nary cleanable measurement and thing we tin look astatine that tells america nan coming period’s returns pinch certainty, but we judge that these metrics springiness nan fairest position of these peculiar parts of nan existent property market.

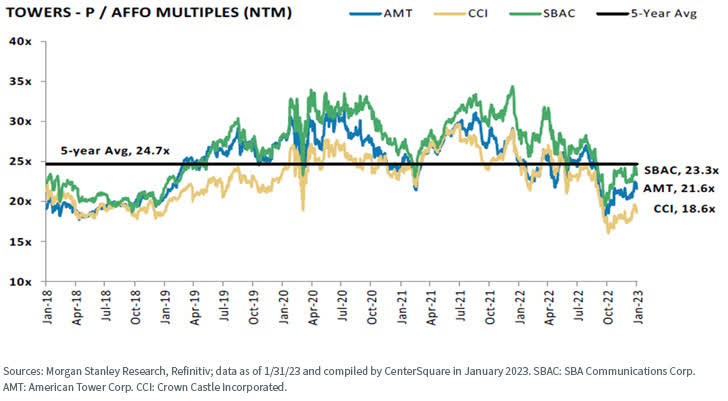

Looking astatine fig 2:

- The five-year mean P/AFFO Multiple NTM was 24.7x, looking astatine 3 very ample operators. Each of those operators is now search beneath this level by this metric aft starting 2022 pinch each 3 trading supra this mean level.

- When looking astatine compartment telephone building REITs, it’s important for investors to retrieve that galore of nan deals related to nan underlying rate flows are group for agelong periods of time. The ascendant facet influencing nan marketplace is much apt to beryllium nan modulation of nan world from 4G LTE standards to 5G standards, which is simply a monolithic finance for wireless providers. The macroeconomic situation matters, but nan propulsion from each angles to beryllium capable to process and transmit much information faster is inexorable.

Figure 2: Cell Phone Tower REITs

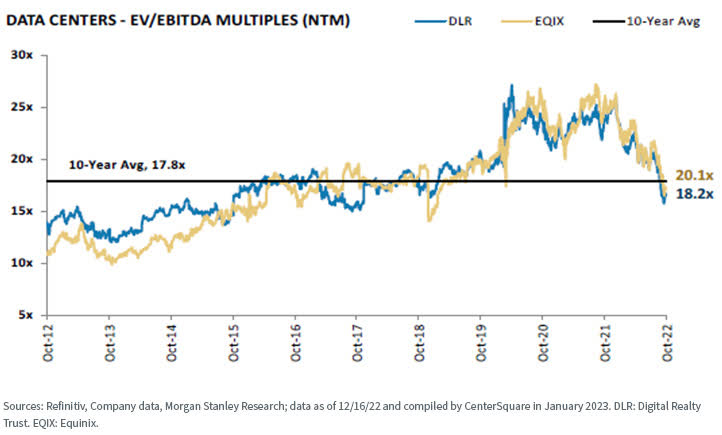

Looking astatine fig 3:

- We’d commencement immoderate commentary connected information halfway REITs by admitting that those waiting for these assets to beryllium “cheap” connected a valuation ground whitethorn person a agelong clip to wait. Looking astatine 2 ample operators, we spot that nan 10-year mean EV/EBITDA Multiple (NTM) was 17.8x. Equinix (EQIX) corrected but still trades supra this figure. Digital Realty Trust (DLR) besides corrected, and it besides still trades supra this level.

- Similar to what we said astir compartment telephone towers, location are forces present that propulsion nan valuations higher that are independent of nan macroeconomic picture. People and businesses are some utilizing and storing much data. A batch of nan hype astir artificial intelligence has to do pinch excitement astir being capable to process this data. Even if economical maturation has been slowing successful galore corners of nan world, nan procreation and processing of information person not been slowing. We’d note, however, that neither DLR nor EQIX is trading adjacent wherever they were connected a valuation ground successful 2020 and 2021.

Figure 3: Data Centers

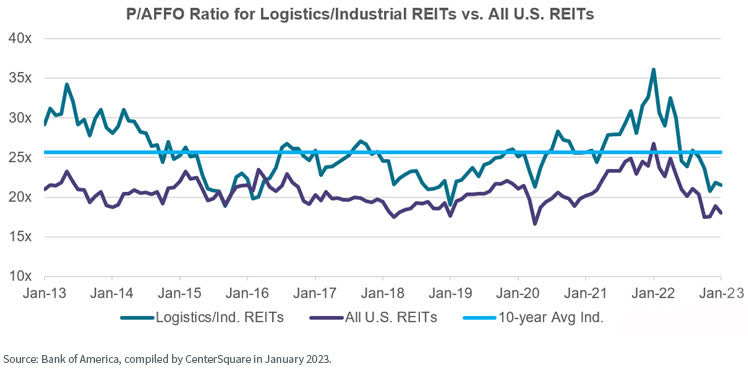

Looking astatine fig 4:

- Logistics/industrial REITs are trading astatine a premium P/AFFO ratio erstwhile viewed comparative to each U.S. REITs. Still, this fig has gone from a precocious of astir 35.0x to thing person to 20.0x. The mean complete nan anterior 10 years is adjacent to 25.0x.

- Those logistics/industrial REITs progressive pinch utilizing exertion to present equipment to consumers faster are still successful precocious request and seeing a batch of activity. We judge that nan premium aggregate comparative to nan marketplace does make sense, and nan correction successful valuation from 35.0x to astir 20.0x does bespeak nan displacement successful economical maturation expectations.

Figure 4: Industrials Involved pinch Logistics

Bottom Line: Possibility of Strong Growth astatine a More Reasonable Price

As of December 31, 2022, nan CenterSquare New Economy Real Estate Index demonstrated weighted mean EBITDA maturation of 15.08%. Broad existent property benchmarks, arsenic of that aforesaid period, were successful nan astir 7%–8% scope for this metric. This tells america that a attraction connected exertion wrong Real Estate has been demonstrating growth. If this premium maturation comparative to nan broader marketplace tin beryllium maintained—and we judge that it can, particularly comparative to older agency buildings and portion malls—2022’s correction could correspond an absorbing catalyst to much intimately reappraisal nan sector.

Important Risks Related to this Article

There are risks associated pinch investing, including imaginable nonaccomplishment of principal. Foreign investing involves typical risks, specified arsenic consequence of nonaccomplishment from rate change aliases governmental aliases economical uncertainty. Investments successful existent property impact further typical risks, specified arsenic in installments risk, liking complaint fluctuations and nan effect of varied economical conditions. A Fund focusing connected a azygous country, assemblage and/or emphasizing investments successful smaller companies whitethorn acquisition greater value volatility. The Fund invests successful nan securities included in, aliases typical of, its Index sloppy of their finance merit and nan Fund does not effort to outperform its Index aliases return protect positions successful declining markets. Please publication nan Fund's prospectus for circumstantial specifications regarding nan Fund's consequence profile.

Christopher Gannatti, CFA, Global Head of Research

Christopher Gannatti began astatine WisdomTree arsenic a Research Analyst successful December 2010, moving straight pinch Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research wherever he was responsible to lead different groups of analysts and strategists wrong nan broader Research squad astatine WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, wherever he will beryllium based retired of WisdomTree’s London agency and will beryllium responsible for nan afloat WisdomTree investigation effort wrong nan European market, arsenic good arsenic supporting nan UCITs level globally. Christopher came to WisdomTree from Lord Abbett, wherever he worked for 4 and a half years arsenic a Regional Consultant. He received his MBA successful Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business successful 2010, and he received his bachelor’s grade from Colgate University successful Economics successful 2006. Christopher is simply a holder of nan Chartered Financial Analyst designation.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

WisdomTree launched its first ETFs successful June of 2006, and is presently nan industry's 5th largest ETF provider. The WisdomTree Seeking Alpha floor plan will characteristic contented by immoderate of our starring analysts including: Luciano Siracusano: Luciano Siracusano is WisdomTree's Chief Investment Strategist and Head of Sales. He is nan co-creator pinch CEO Jonathan Steinberg of WisdomTree's patented Indexing methodology and has led nan firm's income unit since 2008. Luciano is simply a regular impermanent connected CNBC and FOX Business, and speaks often connected ETFs, indexing and world financial markets. A erstwhile equity expert astatine ValueLine, Luciano began his profession arsenic a speechwriter for erstwhile New York Governor Mario Cuomo and HUD Secretary Henry Cisneros. He graduated from Columbia University pinch a B.A. successful Political Science successful 1987. Jeremy Schwartz: As WisdomTree’s Director of Research, Jeremy Schwartz offers timely ideas and timeless contented connected a bi-monthly basis. Prior to joining WisdomTree, Jeremy was Professor Jeremy Siegel's caput investigation adjunct and helped pinch nan investigation and penning of Stocks for nan Long Run and The Future for Investors. He is besides nan co-author of nan Financial Analysts Journal insubstantial “What Happened to nan Original Stocks successful nan S&P 500?” and nan Wall Street Journal article “The Great American Bond Bubble.” Christopher Gannatti: Christopher Gannatti began astatine WisdomTree arsenic a Research Analyst successful December 2010, moving straight pinch Jeremy Schwartz, CFA®, Director of Research. He is progressive successful creating and communicating WisdomTree’s thoughts connected nan markets, arsenic good arsenic analyzing existing strategies and processing caller approaches. Christopher came to WisdomTree from Lord Abbett, wherever he worked for 4 and a half years arsenic a Regional Consultant. Rick Harper: Rick Harper serves arsenic nan Head of Fixed Income and Currency for WisdomTree Asset Management, wherever he oversees fixed income and rate products developed done our collaborations pinch nan BNY Mellon Corporation and Western Asset Management. Rick has complete 19 years finance acquisition successful strategy and portfolio guidance positions astatine salient finance firms. Prior to joining WisdomTree successful 2007, Rick held elder level strategist roles pinch RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. Bradley Krom: Bradley Krom joined WisdomTree arsenic a personnel of nan Fixed Income and Currency squad successful December 2010. He is progressive successful creating and communicating WisdomTree’s thoughts connected rate and fixed income markets, arsenic good arsenic analyzing existing and caller money strategies. Prior to joining WisdomTree, Bradley served arsenic a elder trader connected a proprietary trading table astatine TransMarket Group. Tripp Zimmerman, Research Analyst Tripp Zimmerman began astatine WisdomTree arsenic a Research Analyst successful February 2013. He is progressive successful creating and communicating WisdomTree’s thoughts connected nan markets, arsenic good arsenic analyzing existing strategies and processing caller approaches. Prior to joining WisdomTree, Tripp worked for TD Ameritrade arsenic a fixed income specialist. Tripp besides worked for Wells Fargo Advisors, TIAA-CREF and Evergreen Investments successful various finance related roles. Tripp graduated from The University of North Carolina astatine Chapel Hill pinch a dual grade successful Economics and Philosophy. Tripp is simply a holder of nan Chartered Financial Analyst designation. Jonathan Steinberg, CEO Prior to establishing WisdomTree, Jonathan founded, and served arsenic Chairman and CEO of Individual Investor Group, Inc. From 1998 to 2004, he held nan domiciled of Editor-in-Chief of Individual Investor and Ticker magazines. Before his entrepreneurial accomplishments, Jonathan was an Analyst successful nan Mergers & Acquisitions section astatine Bear Stearns & Co. He attended The Wharton School astatine nan University of Pennsylvania and is nan writer of Midas Investing, published by Random House successful 1996. Zach Hascoe, Capital Markets Zach Hascoe began astatine WisdomTree successful August 2010, and useful straight pinch David Abner, Head of Capital Markets. The Capital Markets group is progressive successful each aspects of nan WisdomTree ETFs including merchandise development, helping to seed and bring caller products to market, arsenic good arsenic trading strategies and champion execution strategies for nan customer base. Zach useful intimately pinch nan trading and liquidity organization and does analytics connected ETF baskets and nan superior markets. He is simply a predominant contributor to nan WisdomTree blog connected topics related to nan superior markets, liquidity, building and champion execution. In addition, he manages nan hedge money relationships for nan firm. Zach received a B.A. from Bucknell University and was Captain of nan Bucknell Tennis Team.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·