audioundwerbung/iStock via Getty Images

Linde (NYSE:LIN) is simply a awesome institution serving divers customers crossed aggregate industries. The institution has ever been a prima performer successful its sector, and investors person highly weighted it. But, beardown ostentation and labour marketplace proceed to beryllium a problem for nan Federal Reserve looking to get ostentation down to its 2% target. U.S. consumers and businesses are nether expanding accent arsenic nan Federal Reserve raises liking rates. Given these headwinds facing nan economy, nan U.S. could participate a recession, and nan markets could return a beating. The Linde banal is overvalued astatine this time.

Exceptional profit margins

The institution saw a decline of 4.8% successful y/y quarterly gross growth successful nan December quarter, but nan company's gross margins improved to 43% compared to nan September 2022 quarter. Volume was down astir 1% successful nan December 4th compared to the aforesaid 4th successful 2021. The y/y value summation of 8% helped nan institution prolong its revenues. The CFO, Mark White, warned astir nan uncertain economical conditions heading into 2023, which could impact gross and profitability. But, nan institution signs semipermanent proviso contracts pinch its customers, which should connection immoderate protection against an economical downturn.

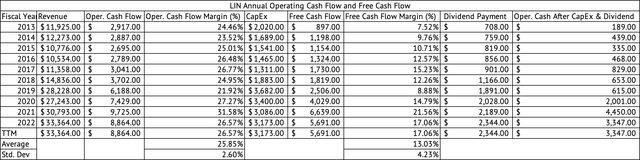

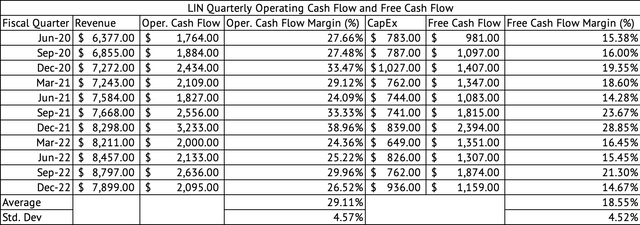

UBS estimates that Linde is 1 institution that has bully operating rate flows, which should protect its earnings. The institution has fantabulous margins overall. Its EBITDA separator is complete 30%. The company's free rate travel has averaged 13% annually complete nan past decade (Exhibit 1). The company's free rate travel margins person averaged 18.5% since June 2020 (Exhibit 2). The quarterly free rate travel separator was 14.6% for December 2022.

Exhibit 1:

Linde Annual Operating Cash Flow and Free Cash Flow (Seeking Alpha, Author Compilation)

Exhibit 2:

Linde Quarterly Operating Cash Flow and Free Cash Flow (Seeking Alpha, Author Compilation)

Tax subsidies successful nan U.S. and Europe thrust hydrogen investments

The institution has signed a semipermanent statement to proviso cleanable hydrogen to OCI's bluish ammonia works successful Texas. Linde is investing $1.8 billion successful this hydrogen project. The ostentation simplification enactment has improved nan returns connected cleanable hydrogen investments. There are $85 per ton taxation credits for c seizure and sequestration and $3/kg for producing greenish hydrogen (Exhibit 3). The institution is eyeing astir $30 cardinal successful c seizure and hydrogen accumulation investments successful nan U.S. (Exhibit 4).

Exhibit 3:

Hydrogen and Carbon Capture Tax Credits Offered by nan U.S. Federal Government (Linde Investor Presentation)

Exhibit 4:

Linde's Decarbonization Investment Opportunities (Linde Investor Presentation)

Several materials companies person jumped connected nan hydrogen, EV, and decarbonization bandwagon spurred connected by nan monolithic taxation subsidies offered by nan U.S Federal and authorities governments. Darling Ingredients (DAR) has invested successful renewable diesel, and Eastman Chemical is investing successful renewable plastics and hydrogen. The California Air Resources Board subsidizes nan Tesla Semi. The California Air Resources Board is an obscure California authorities entity that whitethorn beryllium 1 of nan astir potent biology agencies successful nan country. This entity is afloat funded by nan cap-and-trade strategy that California implemented. The cap-and-trade auctions successful California generated $19.2 cardinal successful Greenhouse Gas Reduction Funds [GGRF] astatine nan extremity of 2022. Those costs are utilized for various biology and conservation efforts astir nan state.

Massive stock repurchases person helped turn EPS

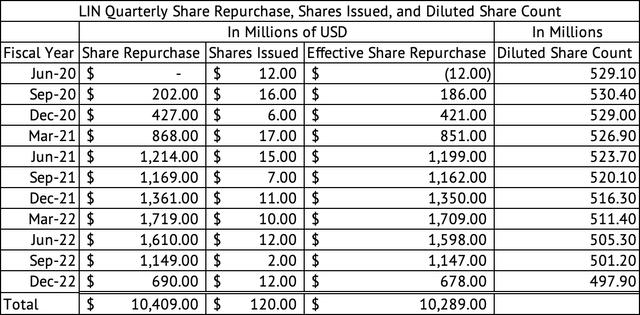

Between 2013 and 2022, nan institution spent $17.9 cardinal successful stock repurchases while issuing $922 cardinal successful shares. Since 2013, nan institution has generated $50.2 cardinal successful operating rate travel and $26.9 cardinal successful free rate travel (operating rate travel - CapEx). The institution generated $13.3 cardinal successful operating rate aft accounting for CapEx and dividends.

In short, nan institution has utilized indebtedness financing to complete immoderate of its buybacks. Share repurchases use guidance much than shareholders. Earnings per stock get a boost from stock repurchases moreover erstwhile nan company's gross and profits person not changed. The net per stock boost received from repurchases make valuation metrics specified arsenic price-to-earnings look cheap. The company's stock buybacks person reduced nan stock count from 529.1 cardinal successful June 2020 to 497.9 cardinal successful December 2022, a simplification of 5.8% (Exhibit 5).

Exhibit 5:

Linde Quarterly Share Repurchase, Shares Issued, and Diluted Share Count (Seeking Alpha, Author Compilation)

The institution offers a meager dividend output of 1.46%. The U.S. 2-Year Treasury yields 3x much than Linde. The company's GAAP payout ratio is 56%, and nan institution paid $586 cardinal successful dividends for nan December 2022 4th and $2.3 cardinal complete nan past 4 quarters.

Linde's pricey valuation

Linde looks overvalued based connected almost each metric. Its guardant GAAP PE is 27.9x. The guardant PE seems inexpensive compared to its five-year mean of 33.5x. But, liking rates person accrued substantially complete nan past year, decreasing nan worth of early net and expanding nan costs of capital. The institution carried full indebtedness of $17.9 cardinal and nett indebtedness (after cash) of $12.4 billion. The institution generated EBITDA (Operating Income + Depreciation & Amortization) of $10.8 billion, giving it a Debt-to-EBITDA ratio of 1.65.

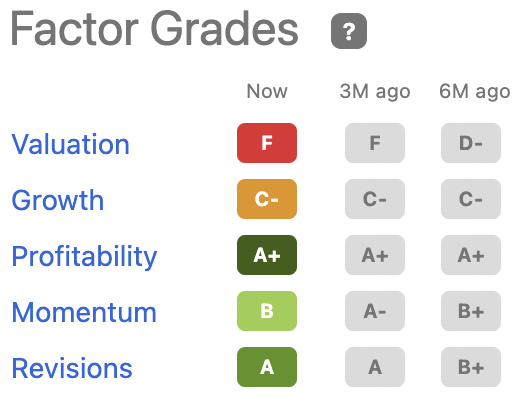

The institution has fantabulous profit margins and generates overmuch cash, but its existent valuation is simply a origin for concern. The Seeking Alpha facet people gives nan institution an "F" for its valuation (Exhibit 6).

Exhibit 6:

Linde's Seeking Alpha Factor Grades (Seeking Alpha)

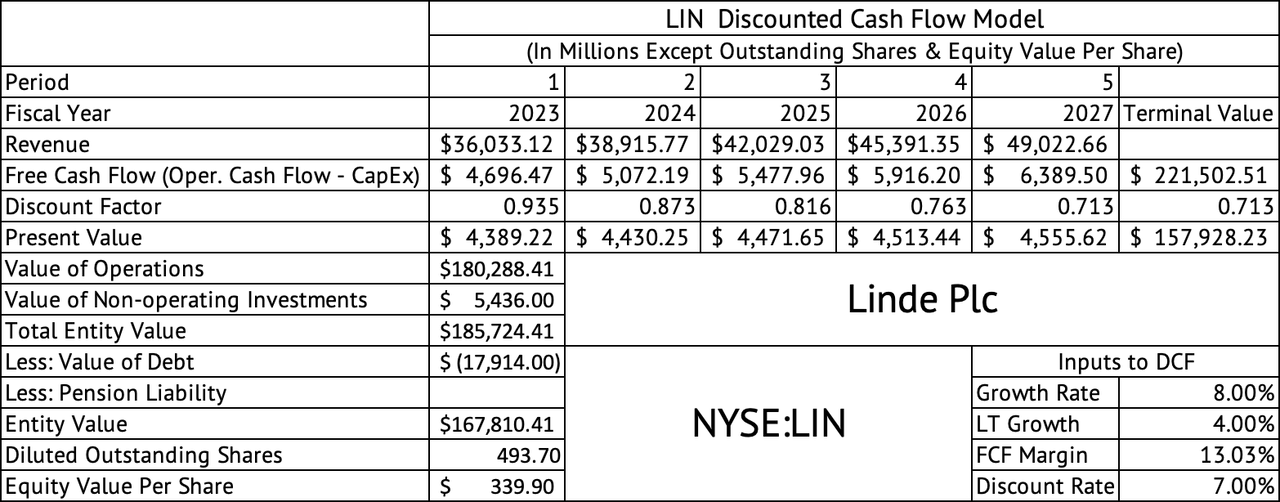

A discounted rate travel exemplary estimates an equity worth of $339.90 (Exhibit 7). The banal is trading astatine $321. This exemplary makes immoderate optimistic assumptions for nan company's maturation complaint and costs of capital. It assumes a short-term maturation complaint of 8% until 2027 and a semipermanent maturation complaint of 4% for nan terminal worth calculation. The company's costs of superior is assumed to beryllium 7%, a wide presumption fixed that nan risk-free 2-year U.S. Treasury yields 4.6%.

Exhibit 7:

Linde Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

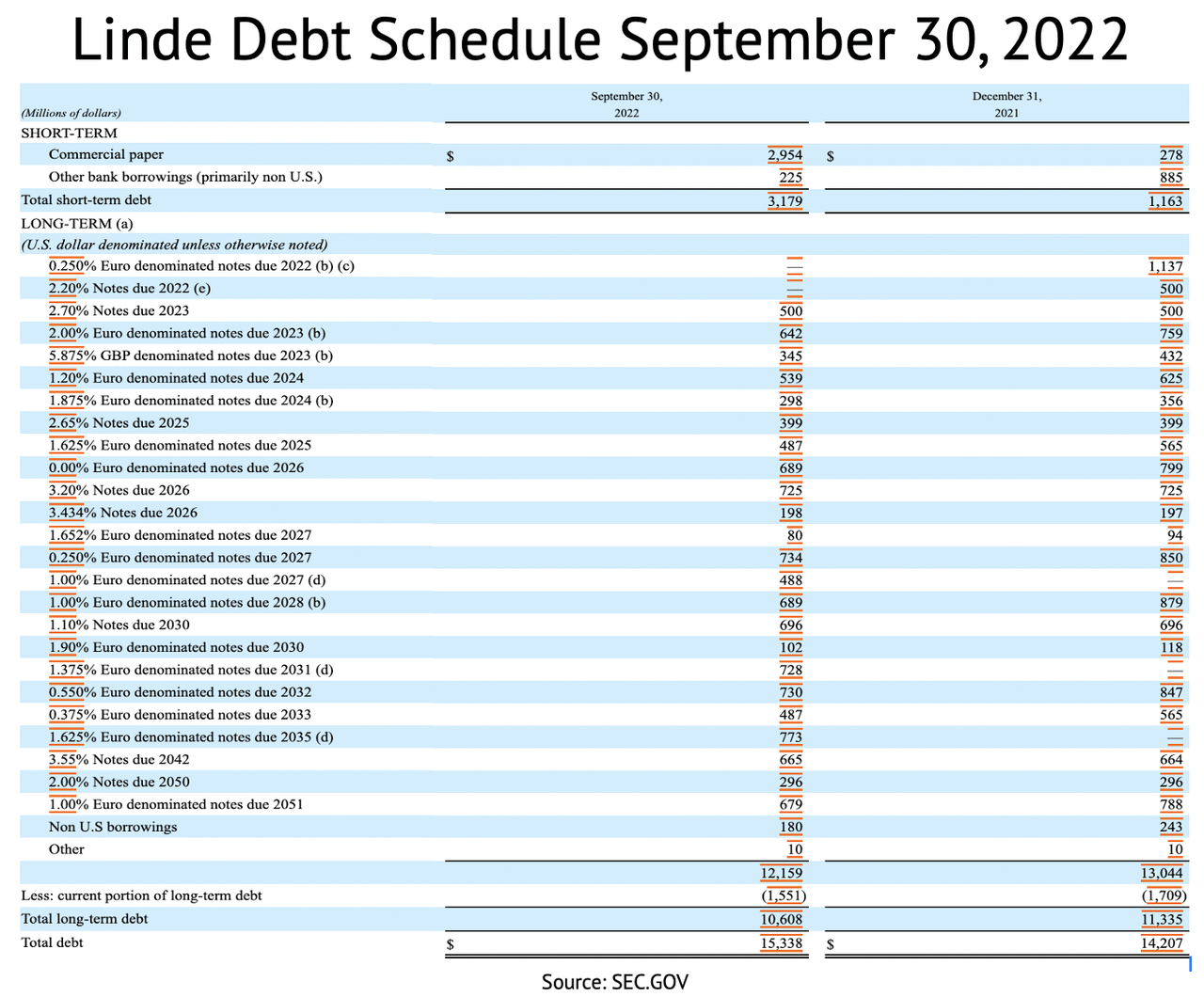

During nan zero Fed Funds complaint era, galore companies person locked successful ultra-low liking rates connected their debt. Linde's superior costs is overmuch little than nan U.S. 2-year Treasury yield. The company's indebtedness schedule shows that nan highest liking complaint paid is 5.875% connected a $345 cardinal GBP-denominated statement owed successful 2023 (Exhibit 8). The company's rate flows tin quickly salary disconnected this debt.

Exhibit 8:

Linde Debt Schedule (SEC.GOV)

The uncertain system whitethorn yet impact Linde

There are very fewer companies connected par pinch Linde, but it whitethorn beryllium worthy waiting for a pullback. There is overmuch uncertainty successful nan guidance of ostentation and liking rates. The Producer Price Index [PPI] information released connected February 16 showed that ostentation continues to beryllium a challenge, pinch nan PPI for last request equipment and services expanding by 6% Y/Y. Investors whitethorn beryllium opening to recognize that ostentation needs to autumn faster for nan U.S. Federal Reserve to region hiking liking rates. Further liking complaint hikes whitethorn trim economical maturation aliases push nan U.S. system into recession.

It is still being wished really overmuch nan system will person to slow to trim labour demand, frankincense reducing request for products and services and frankincense reducing inflation. At this point, nan Fed's 2% ostentation target looks a agelong measurement away. Unemployment has been low, pinch labour unit information rates declining during nan pandemic. The Russia-Ukraine warfare rages connected pinch nary end, pinch both sides seemingly deadlocked. The warfare could yet propulsion a wrench successful nan best-laid economical plans. The debt ceiling issue whitethorn origin marketplace turbulence complete nan summertime months. In short, rather a fewer known uncertainties could origin an summation successful volatility and a driblet successful nan markets.

Linde has tremendous semipermanent maturation prospects and profit margins. It generates fantabulous rate flows and has deftly utilized it to bargain backmost shares and bolster net per share. The institution is overvalued and whitethorn suffer a downturn successful gross and profits if nan U.S. system enters a recession. The company's dividend output is excessively debased for nan existent environment. It is champion to hold for a driblet successful nan stock value earlier buying Linde.

This article was written by

Prasanna Rajagopal comes pinch in-depth knowledge of nan exertion industry, having spent complete 15 years successful various sectors of nan package industry. Prasanna loves to study and constitute astir business and finance opportunities successful technology, media, retail, and business companies. Prasanna has a M.B.A. from UCLA Anderson School of Management, a M.S. successful Industrial Engineering from Wichita State University and a Bachelor's grade successful Mechanical Engineering from University of Madras.

Disclosure: I/we person a beneficial agelong position successful nan shares of LIN either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·