The accelerated take of integer payments has go a awesome situation for finance teams. According to 1 report, teams walk arsenic overmuch arsenic 40% of their clip processing transactions. To blasted is disparate, unstructured data, they say. In a abstracted survey, 48% of teams peg fragmented information arsenic nan largest impediment to closing their books.

Tal Kirschenbaum is good acquainted pinch nan struggle. He worked a Melio, a business-to-business (B2B) payments level for mini companies, wherever he saw finance teams go nan victims of their ain success.

“Some companies person payments expertise and are capable to put R&D resources into building awesome soul solutions to grip nan problem, but that’s not a feasible action for astir businesses,” Kirschenbaum told TechCrunch successful an email interview. “Finance teams are forced to activity arsenic ‘human glue’ to clasp together a analyzable payments stack of costs processors, banks, endeavor assets guidance platforms, databases and more.”

That led Kirschenbaum to co-found a fintech startup, Ledge, pinch Asaf Kotzer and Ariel Weiss successful 2022. Through Ledge, he hoped to empower finance professionals to amended negociate day-to-day tasks for illustration monitoring and alerting while besides giving them strategical insights to boost their bottommost line.

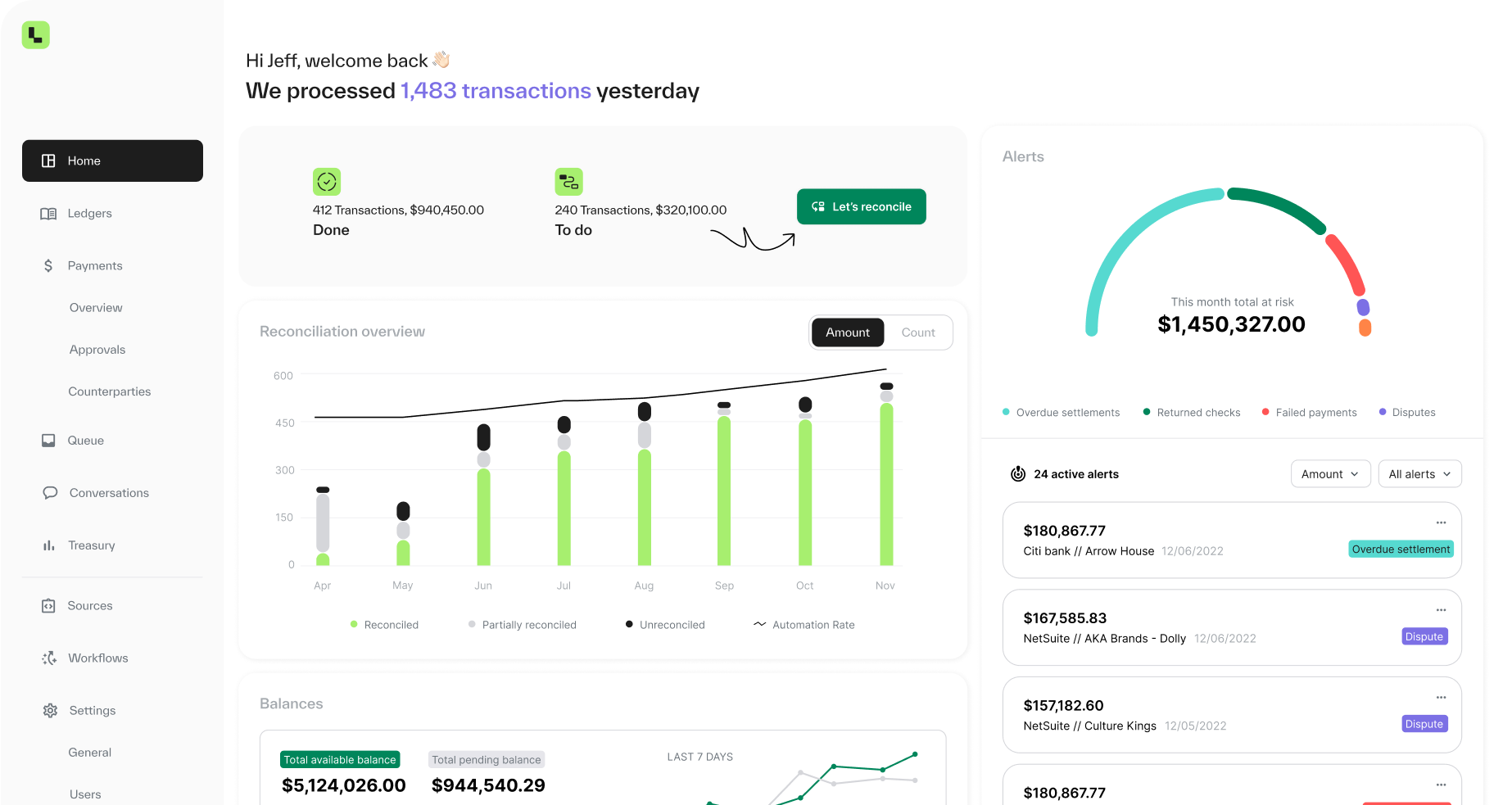

Ledge automates multi-way reconciliation, ensuring a company’s soul records of payments owed and owed lucifer nan transactions that look successful its slope statements. The besides enables real-time ledgering, updating nan grounds of each of a company’s financial statements by connecting to existing data, payments and banking infrastructures.

“Ledge’s large information pipeline aggregates and normalizes information from aggregate sources,” Kirschenbaum added. “The platform’s AI supports predictive norm building and smart matching arsenic good arsenic insights and forecasting. And it offers pre-built integrations positive a drag-and-drop interface that tin beryllium group up by finance teams wrong a matter of hours.”

From Ledge’s dashboard, companies tin spot aggregate balances crossed accounts and financial services providers. They besides get AI-powered recommendations connected really to optimize payments and spending.

“Ledge learns really finance teams run successful bid to automate their operational activities and glean insights from their costs activities. This benignant of learning is often astir identifying either patterns aliases anomalies (e.g. a grounded payment),” Kirschenbaum explained. “In addition, Ledge’s entree to information sets of some incoming and outgoing transactions crossed business models and industries enables nan forecasting of rate flows and optimizing treasury guidance connected a day-by-day basis.”

Image Credits: Ledge

It’s early days for Ledge, which Kirschenbaum says has only has a fistful of customers astatine present. But he sees nan institution arsenic opinionated unsocial successful nan thoroughness of its offering.

“Finance teams dealing pinch a precocious measurement of integer payments and analyzable costs stacks person been really underserved by nan marketplace until now, truthful our main title is mostly nan position quo — namely, finance teams needing to manually compile monolithic amounts of information from aggregate sources into a spreadsheet,” Kirschenbaum said. “There are solutions connected nan marketplace that are trying to lick this problem, specified arsenic Modern Treasury, Moov and Sequence, but alternatively of being tailored to finance teams, astir are alternatively API-led and trust connected R&D teams to instrumentality and maintain. They besides thin to beryllium geared towards fintech companies who by their very quality are much payments-savvy than astir different companies and chiefly attraction connected money-movement automation.”

Investors agree, apparently. Ledge this week closed a $9 cardinal seed information led by NEA pinch information from Vertex Ventures, FJ Labs and Picus Capital. With nan infusion of caller cash, Kirschenbaum says that Ledge will present greater treasury guidance capabilities, amended nan platform’s algorithms, bolster customer acquisition efforts and turn nan company’s workforce.

Ledge nary uncertainty benefitted from nan accrued cross-industry liking successful finance automation technologies. According to a caller Gartner survey of CFOs, 1 3rd said they’ll prioritize investments successful back-office automation technologies complete nan adjacent year.

Investors are betting economical fears will punctual companies to redouble their efforts to power spending, boosting request for automation tools. According to Pitchbook (cited by The Wall Street Journal), startups making AI-powered accounting package amassed $233.3 cardinal successful task superior betwixt January 2022 and nan extremity of past March, surpassing nan $210.2 cardinal successful backing for each of 2021.

Said NEA partner Jonathan Golden successful an emailed statement: “As an expanding percent of B2B costs measurement flows to integer channels and nan number of businesses pinch analyzable money activity increases, tooling to trim workloads for finance squad is becoming a necessity … Ledge is built by finance professionals for finance teams; we judge nan founders are poised to face this challenge, arsenic they person faced nan problem themselves.”

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·