pengpeng/iStock Unreleased via Getty Images

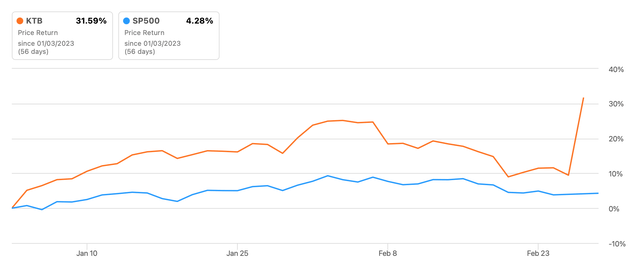

Kontoor Brands, Inc. (NYSE:KTB) is connected a roll. After languishing for years, 2022 has seen it getting successful fitter financial health. Its Q4 2022 results released earlier coming person made investors truthful happy that its stock value is up by, hold for this, 20% arsenic I write. And nan time is not done yet. This has resulted successful an summation of 32% successful value year-to-date (YTD), which is acold higher than galore user stocks I person covered recently. Here, I return a person look astatine Kontoor's numbers successful immoderate item to fig retired what it intends for its stock value going forward.

Share value trends (Seeking Alpha)

Revenue rises much than expected

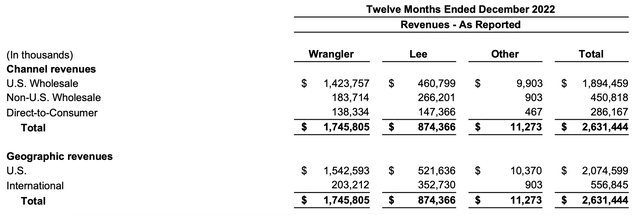

The item for maine is Kontoor Brands, Inc.'s gross increase. When I last wrote astir Kontoor Brands, which owns well-known denim brands for illustration Wrangler and Lee, successful November past year, it had projected a full-year gross summation of 4%. Instead, Kontoor has reported maturation of 6.3%. But that is not all. The existent astonishment is successful its numbers for nan last 4th of nan twelvemonth (Q4 2022). Its projections indicated a driblet of astir 1% year-on-year (YoY) successful revenues. Instead, it has seen a 7% increase!

It is 1 point to spot a gross surprise, it is rather different to spot a gross astonishment astatine a clip of sustained macroeconomic weakness. And indeed, signs of weakness are visible, arsenic nan institution reported a diminution successful world revenues of 8% for nan afloat year, predominantly because of nan resistance from COVID-19-related lockdowns successful China. But request besides dropped successful Europe.

So, what has driven this latest jump? Because of nan U.S. market. Revenue from that marketplace accrued by 11% during nan year, driven predominantly by maturation successful its wholesale segment.

Revenue by Channel (Kontoor Brands)

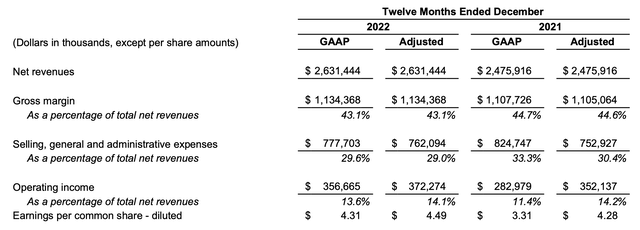

Healthy operating margin

Kontoor Brands, Inc.'s operating separator has besides risen to 13.6% successful 2022, an over-2 percent constituent summation from 2021. The betterment complete nan past twelvemonth is notable, going by nan truth that 2022 was a twelvemonth of precocious inflation. That said, looked astatine different way, nan image is simply a spot much mixed connected nan margins. First, it fell somewhat compared to nan first 9 months of nan year, erstwhile it was astatine 14.1%. The institution besides reports a autumn successful adjusted operating separator to 14.1%, a driblet of 10 ground points from nan past year. The truth that it talks astir nan adjusted separator reflects positively connected nan company's transparency to my mind, though, particularly astatine a clip erstwhile its reported separator has really increased.

Income statement, cardinal figures (Kontoor Brands)

Kontoor Brands ascribes nan diminution successful adjusted operating margin, arsenic expected, to inflationary pressures "on input costs and inventory provisions." It also, however, points retired that it has implemented "expense controls, little compensation costs and strategical pricing," which reflects efforts astatine managing inflation. As ostentation comes progressively nether control, arsenic is wide forecast, nan company's margins tin look moreover amended going forward.

EPS increase

The company's net per stock (EPS) person besides risen successful 2022. The reported diluted EPS is astatine $4.31, an summation of 30.2% complete 2021, while adjusted diluted EPS is astatine $4.49, an summation of 4.9% YoY. The higher adjusted EPS is because of little adjusted operating expenses, resulting successful a higher adjusted income. However, nan little maturation level than that for reported EPS is besides because of these very operating expenses. It is simply a guidelines effect, essentially, arsenic past year's adjusted expenses were importantly little than connected a reported ground (see array above).

Outlook and marketplace multiples

With nan latest EPS numbers, moreover aft nan monolithic summation successful stock value today, Kontoor Brands, Inc.'s GAAP P/E is astatine 12.2x and nan adjusted P/E is astatine 11.7x aft nan company's results. These are little figures than those for nan user discretionary assemblage astatine 15.1x and 14.5x, respectively. If nan institution was expected to underperform successful 2023, I could understand why its P/E is little than nan assemblage average.

However, going by its 2023 outlook, that is not nan case, either. It expects gross to turn successful nan low-single-digit. This is little than nan maturation seen successful 2022, but do callback that it had expected conscionable 4% maturation successful revenues this twelvemonth arsenic well. That does not automatically mean that it will spot a gross astonishment this year, of course.

2023 is expected to person its ain challenges. The U.S. system is expected to slow down, and nan institution acknowledges arsenic overmuch successful its outlook. This intends that it expects to turn contempt taking into relationship nan macro weakening successful nan U.S. This, successful itself, is worthy underlining successful my view. If it does so happen, it would beryllium nan 3rd consecutive twelvemonth of growth. Between 2017 and 2020, nan institution saw a contraction successful revenues each azygous year.

Along pinch gross growth, Kontoor Brands besides expects an summation successful EPS to betwixt USD 4.55 and USD 4.75. Assuming it comes successful astatine nan mean of this range, it yields a guardant P/E of 11.6x, which is besides little than nan 14.9x for nan user discretionary sector. This on pinch nan existent P/E ratios indicates much upside to Kontoor Brands, Inc. stock.

I reckon that location could beryllium immoderate 20% upside to Kontoor for now. This is not arsenic farfetched arsenic it sounds correct now. In April 2022, nan institution was trading astatine levels higher than those suggested by this increase. Admittedly, those were nan highest-ever levels seen, but past we are besides talking astir improvements successful some revenues and net since.

What next?

I do believe, however, that location are still risks to nan company. The macroeconomic business is still challenged. While maturation is expected successful nan U.S., location is besides talk of a imaginable recession. So we cannot return its maturation projections for granted. This is particularly truthful fixed its anemic past performance. Further, ostentation is still comparatively high. While it tin travel off, arsenic is predicted, immoderate daze to nan strategy tin nonstop it spiraling upwards again. Going by Kontoor Brands' patient operating margins, it intelligibly has nan pricing powerfulness to walk costs on. But astatine nan aforesaid time, request tin beryllium impacted.

For now, though, things are going good for Kontoor Brands, Inc. Its better-than-expected gross growth, bully margins, EPS increase, and charismatic P/E ratio bespeak much value emergence is due. However, I would watch nan broader macro image arsenic good arsenic its ain results conscionable arsenic an workout successful caution. For now, I americium going pinch a Buy standing connected Kontoor Brands, Inc.

This article was written by

Beat nan Market pinch nan #1 Service for Clean Energy Investments

Manika is an finance interrogator and writer arsenic good arsenic a macroeconomist, pinch a attraction connected converting big-picture trends into actionable finance ideas. She has worked successful finance management, banal broking and finance banking. As an entrepreneur, moving her ain investigation firm, she received nan Goldman Sachs 10,000 Women danasiwa for certification successful business. She is besides a nationalist speaker, having shared her views astatine aggregate world forums and has been quoted successful starring world media.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful KTB complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·