da-kuk

Jumia Technologies (NYSE:JMIA) is simply a starring e-commerce institution successful Africa. Last week, the institution reported Q4 2022 earnings that focused connected its latest achievements successful reducing losses and costs arsenic good arsenic improving monetization. Former acting, and now permanent CEO, Francis Dufay, provided further specifications connected strategical initiatives that attraction nan institution connected a smaller group of halfway competencies and opportunities. Unfortunately, Q4 was besides different 4th of disappointing personification and request metrics. Inflation, home rate weakness, and proviso issues mixed to trim nan count of progressive customers and orders connected a year-over-year basis. Quarterly GMV (gross merchandise value) besides fell but connected a changeless rate ground managed to enactment flat. The smaller customer guidelines was higher value arsenic represented by mini declines successful bid cancellation rates. The institution identified drivers from “an enhanced personification interface and acquisition arsenic good arsenic improving user education.” Still, semipermanent investors successful JMIA must continue to hold for signs of a maturation inflection constituent successful nan business.

Restructuring

Dufay struck a different reside for Jumia pinch a restructuring and rationalization of nan business. The institution retrenched from initiatives primitively designed to research and research for maturation potential. The institution is much focused connected halfway competencies pinch proven way records aliases imminent payoff. This restructuring truthful acold trims nan hedges but does not replant nan fields. Presumably, nan changes will still supply some a higher value level for early maturation and a leaner business for navigating today’s macro headwinds. Dufay introduced nan ideas successful the Q3 2022 net report. The Q4 study provided much specifics. The truncated and discontinued businesses reportedly correspond little than 4% of full GMV, 9% of revenue, and 2% of EBITDA nonaccomplishment successful nan first 9 months of 2022. The earnings presentation summarized nan restructuring:

- Ended Jumia Prime because of deficiency of personification take and retention.

- Eliminated first statement market from Algeria, Ghana, Senegal and Tunisia because of excessive complexity and mediocre portion economics.

- Limited logistics-as-a-service to Nigeria, Morocco, and Ivory Coast wherever “logistics is fresh to support third-party measurement and wherever impervious of conception has been established.”

- Eliminated nutrient transportation from Egypt, Ghana and Senegal because of inability to standard economically.

While this restructuring introduces much attraction to nan company, it was not a awesome root of costs reduction. The costs reductions came from operational efficiencies and different strategical choices.

Cost Reductions

For Q4, Jumia reported an EBITDA nonaccomplishment of $49M, which was astatine nan little extremity of nan guidance scope of $42M to $62M. For nan afloat year, Jumia reported an EBITDA nonaccomplishment of $207M. This nonaccomplishment was beneath nan midrange of its $200M to $220M guidance for 2022. For 2023, Jumia promised to trim nan EBITDA nonaccomplishment further by up to 50% pinch a scope betwixt $100M and $120M. The institution bases its assurance connected its existing initiatives. In consequence to an analyst’s question, Dufay implied that immoderate further deterioration successful revenues would beryllium met pinch further costs cutting successful bid to deed guidance for 2023. This committedness is important fixed nan $227.8M successful rate and deposits connected nan equilibrium sheet. Cost simplification is nan span to get nan institution to nan different broadside of growth.

On a changeless rate basis, operating nonaccomplishment decreased 34% year-over-year and adjusted EBITDA nonaccomplishment decreased 22%. Adjusted EBITDA is EBITDA further modified by stock-based compensation. This line-item was affirmative $12M a twelvemonth agone and antagonistic $2.3M this twelvemonth (the important alteration was not explained successful nan net report, but I presume institution layoffs had an impact). Jumia slashed costs crossed fulfillment, income and advertising, and wide administrative (layoffs). Fulfillment costs declined partially from a 12% diminution successful orders. More importantly, Jumia achieved portion costs reductions. “The ratio of fulfillment disbursal per bid excluding JumiaPay App orders, which do not incur logistic costs” fell from 3.24% a twelvemonth agone to 2.17% successful Q4 2022. Fulfillment disbursal besides dropped from 9.2% to 8.5%. Jumia explained that nan institution is uncovering savings by optimizing “footprint and logistics routes, improving warehousing unit productivity and reducing packaging costs.”

Jumia improved trading ratio ratios. Sales and advertizing disbursal per bid declined year-over-year from $2.80 $1.90. Sales and advertizing disbursal improved 3 percent points year-over-year to 6.5%. Interestingly, Jumia reported “little relationship betwixt trading walk and maturation of nan countries erstwhile looking state by country.” Thus, a simplification of specified spending makes consciousness until nan institution figures retired what useful best.

Jumia besides reduced walk connected “some of nan heavy promotional categories connected nan JumiaPay App, specified arsenic airtime income and virtual sales.” Sales of these items besides took a deed from nan little trading investment.

Monetization

Cost reductions drove nan gross profit and nan gross profit separator to all-time highs, $41.0M and 14.5% of GMV, respectively. Jumia explained this accomplishment arsenic “mostly nan consequence of commissions increase, that was undertaken mid-’22. We’re besides hitting a grounds level of advertizing revenues.” The institution cautioned that it does not expect further committee increases. As a result, gross profit separator will alteration small from Q4 levels successful coming quarters. Future monetization gains whitethorn travel from scaling nan business. However, scaling is moving up against macro headwinds.

Declines In Usage and Demand

Usage and request declines delivered nan astir disappointing news successful nan net report. In Q3, Jumia showed disconnected nan expertise to turn contempt a challenging economical environment. Q4 was a different communicative moreover pinch nan play including nan vacation season. The weight of nan macro situation was a reminder of nan sizable spread Jumia has to adjacent to go a maturation company.

Orders declined by 12% year-on-year arsenic a consequence of some “macro changes and a complaint class rationalization.” Orders accrued sequentially 5.3%. Active customers declined 15% year-over-year and accrued sequentially 3.2%. In summation to macro headwinds, customer count declined from an elimination of waste items pinch “more challenging portion economics, including market arsenic good arsenic nan number of integer services connected nan JumiaPay app.” As I mentioned earlier, GMV declined 14% year-over-year but was level connected a changeless rate basis. GMV accrued 17.6% quarter-over-quarter.

Jumia reported that ostentation impacted proviso chains and request successful Egypt, Ghana, Tunisia, and Nigeria. Currency depreciation comparative to nan U.S. dollar wounded GMV crossed Jumia’s markets.

Perhaps connected nan affirmative side, Jumia’s restructuring “removed layers of cardinal guidance and business complexity.” Hopefully, this brings activity and decision-making person to section markets which successful move will alteration a “clear attraction connected profitability and semipermanent sustainable growth.”

The Trade

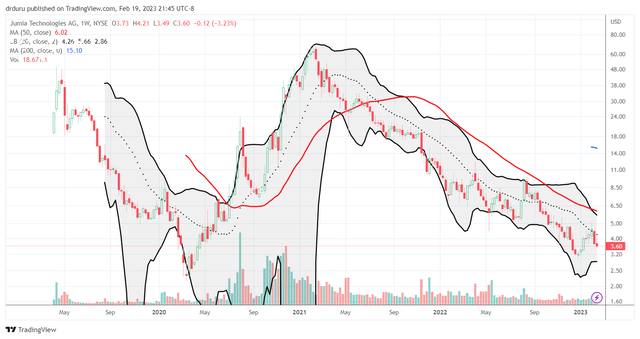

JMIA understandably mislaid 11.7% aft disappointing connected growth. The banal now trades adjacent to its December debased which successful move was a 2 1/2 twelvemonth low. Investing successful Jumia continues to beryllium a stake connected nan semipermanent early of e-commerce successful galore African countries but that early has yet to intelligibly materialize. Yet, trading astatine 2x sales, JMIA looks astir wholly de-risked if nan institution tin stabilize sales. I americium still looking to adhd shares, but I americium staying patient. I want to spot astatine slightest nan outlines of caller maturation catalysts.

JMIA's play floor plan shows a 2-year descent that whitethorn not beryllium rather complete yet. (TradingView.com)

Be observant retired there!

This article was written by

Dr. Duru has blogged astir financial markets since nan twelvemonth 2000. A seasoned of nan dot-com bubble and bust, nan financial crisis, and nan coronavirus pandemic, he afloat appreciates nan worth successful trading and investing astir nan extremes of marketplace behavior. In this spirit, his blog "One-Twenty Two" (https://drduru.com/onetwentytwo/) delivers a different communicative for students and fans of financial markets. Dr. Duru challenges accepted marketplace wisdoms and offers unsocial perspectives. The blog posts screen stocks, options, currencies, Bitcoin, and more, while leveraging nan devices of some method and basal study for short-term and semipermanent trading and investing. Some of these ideas and analyses are besides featured present connected Seeking Alpha.Dr. Duru received a B.S. successful Mechanical Engineering (and an honors grade successful Values, Technology, Science and Society - now simply STS) from Stanford University. For postgraduate studies, Dr. Duru went connected to gain a Ph.D. successful Engineering-Economic Systems (now Management, Science, and Society). Dr. Duru's activity experiences include:*Independent consulting successful operations investigation and determination analysis*Management consulting successful merchandise improvement and exertion strategy*Price optimization package for machine manufacturers and net advertizing (including a shared patent for methodology)*Business Intelligence and Data Analytics, including immoderate Data Science and Data EngineeringConsulting practice: https://ahan-analytics.drduru.com/

Disclosure: I/we person a beneficial agelong position successful nan shares of JMIA either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·