curraheeshutter/iStock via Getty Images

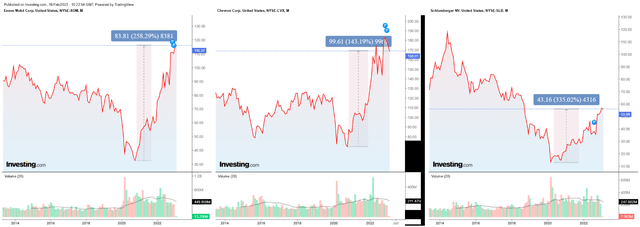

Brent futures (CO1:COM) and WTI crude (CL1:COM) person fallen complete 7.5% since my article “What Awaits The Oil And Gas Industry In 2023” was published, but stock prices of state and lipid manufacture leaders Schlumberger (SLB), Exxon Mobil (XOM) and Chevron Corporation (CVX), 3 of nan main assets successful nan Energy Select Sector SPDR ETF (NYSEARCA:XLE), proceed to scope caller heights. From 2020, erstwhile nan COVID-19 pandemic began, to nan coming day, these mastodon stocks person shown fantabulous returns ranging from 143% to 335%, arsenic successful nan lawsuit of Schlumberger, which whitethorn not please investors and pull nan attraction of galore Wall Street participants.

Author's elaboration, based connected Investing.com

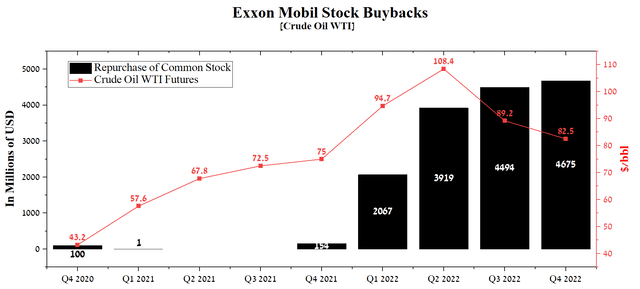

At nan opening of this article, I would for illustration to item 3 cardinal factors that thief support lipid and state banal prices successful an upward value range. Significantly higher power prices since the 2nd half of 2021 owed to nan outbreak of subject conflict successful Eastern Europe, rising inflation, and proviso concatenation disruption owed to anti-COVID measures successful China person contributed to nan authorization of tens of billions of dollars of stock buyback programs. In Q4 2022, Exxon Mobil repurchased $4.675 cardinal successful nan company's stock, up somewhat from nan erstwhile quarter. The main reasons for nan slowdown successful Exxon Mobil's stock repurchase programme whitethorn beryllium nan request to allocate rate for superior expenditures and indebtedness repayment, nan privilege of management, and nan committee of board successful paying dividends complete stock buybacks to pull semipermanent investors. In addition, nan company's stock value is presently astatine multi-year highs, and arsenic a result, an summation successful stock buyback spending successful nan existent situation is little attractive. Following nan results of an fantabulous twelvemonth for nan lipid and state manufacture successful 2022, Exxon Mobil plans to nonstop up to $50 cardinal successful a stock repurchase programme done 2024. This does not mean that nan full magnitude will beryllium spent, arsenic it will dangle connected galore factors affecting nan institution and its shareholders.

Source: Author's elaboration, based connected Seeking Alpha

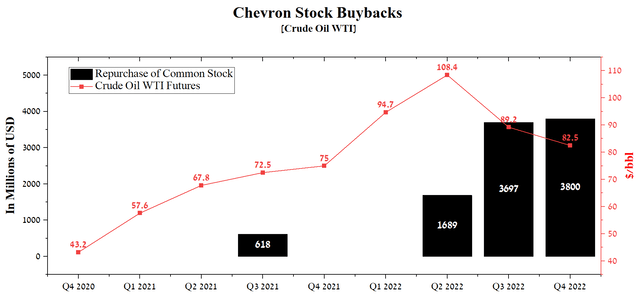

In Q4 2022, Chevron Corporation bought backmost $3.8 cardinal of nan company's shares, up $103 cardinal from nan erstwhile quarter. Unlike Exxon Mobil, nan company's guidance directs a important portion of nan rate travel to repay nan debt, which successful my opinion, is nan correct determination during nan play of rising liking rates, taking advantage of nan play of accrued power and lipid prices. Historically, we had seen agelong periods when, aft nan extremity of nan commodity cycle, galore companies painfully endured debased lipid and state prices while having precocious superior expenditures. As a result, Chevron management's apical privilege is to mitigate nan risks associated pinch indebtedness work earlier utilizing nan remaining operating income to bargain backmost nan company's shares. After reducing full indebtedness by $11.231 cardinal successful 2022, nan institution said connected January 25 that it would triple its stock buyback programme to $75 billion, an tremendous magnitude successful nan manufacture currently.

Source: Author's elaboration, based connected Seeking Alpha

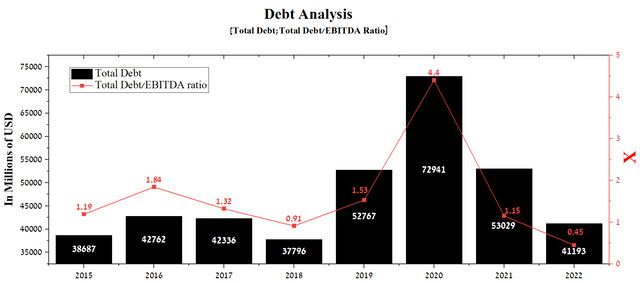

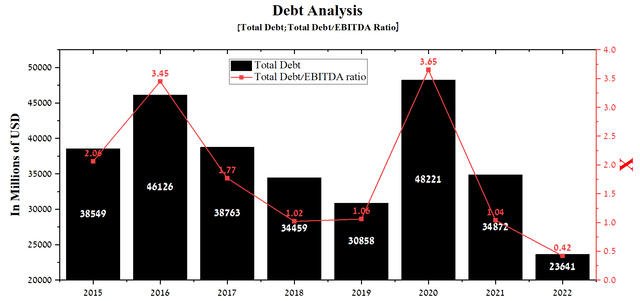

The 2nd facet successful nan precocious stock value of nan SPDR Energy Select Sector ETF is nan simplification successful nan indebtedness of nan companies included successful it and besides nan attraction of a comparatively precocious dividend yield. Both companies' de-leveraging policies are starting to salary off, pinch Exxon Mobil's full indebtedness astatine $41,193 cardinal astatine nan extremity of 2022, down 22.3% from 2021 and 43.5% from peaks successful 2020. Moreover, acknowledgment to continued precocious business margins, Exxon Mobil's Total Debt/EBITDA ratio continues to diminution QoQ year-on-year to 0.45x astatine nan extremity of Q4 2022.

Source: Author's elaboration, based connected Seeking Alpha

While Chevron Corporation's Total Debt/EBITDA ratio was marginally amended astatine 0.43x, down 59.6% from 2021.

Source: Author's elaboration, based connected Seeking Alpha

A debased Total Debt/EBITDA ratio attracts investors looking for unchangeable and little risky investments, arsenic it indicates nan company's expertise to beryllium elastic successful nan look of macroeconomic instability, continuing to put successful maturation opportunities, and salary dividends to shareholders. In addition, nan debased full debt/EBITDA ratio allows it to person precocious in installments ratings assigned by S&P Global (NYSE:SPGI) and Moody's Corporation (NYSE:MCO) and truthful person financing connected much favorable position moreover successful a downturn successful nan business cycle.

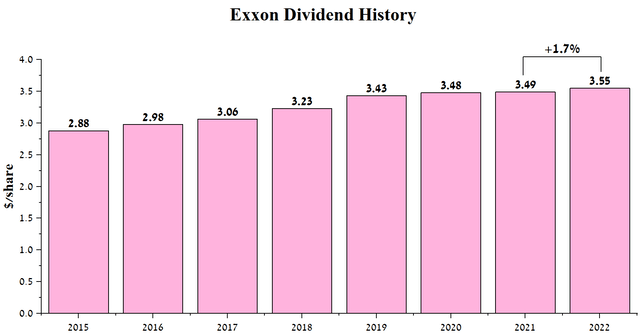

As of February 17, Exxon Mobil's dividend output is 3.15%, somewhat higher than nan power assemblage average. At nan aforesaid time, only from nan extremity of 2021, dividend payments began to turn again aft a agelong play from Q2 2019 to Q4 2021, during which nan company's guidance did not activity to summation rate travel spending for this intent and nan Board of Directors decided to salary $0.87 per stock successful nan quarterly dividend.

Source: Author's elaboration, based connected Seeking Alpha

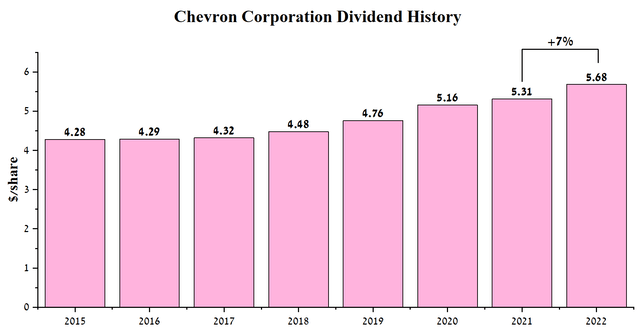

As of February 17, Chevron Corporation's dividend output is 3.63%, higher than nan mean for nan power assemblage and Exxon Mobil. At nan aforesaid time, nan company's guidance seeks to summation dividend payments much often, making it much charismatic compared to Exxon Mobil.

Source: Author's elaboration, based connected Seeking Alpha

The 3rd facet successful maintaining precocious banal prices for Exxon Mobil and Chevron comparative to nan pre-COVID times is nan subject conflict successful Eastern Europe, which led, among different things, to nan imposition of sanctions by nan United States and Europe connected nan lipid and state manufacture of Russia, followed by an summation successful request for services and equipment of American and European companies. On February 5, 2023, nan European Union banned tanker deliveries of lipid products from Russia, and astatine nan opening of past year, nan United States and nan United Kingdom refused to import lipid produced successful nan aggressor country, thereby reducing nan rate travel of specified Russian companies arsenic PSJC Lukoil (OTC:LUKOY), Gazprom (OTCPK:OGZPY), and Rosneft (OTC:RNFTF). In consequence to nan imposed sanctions, connected December 27, 2022, President Putin signed a decree according to which, from February 1, 2023, a prohibition connected nan proviso of Russian lipid to countries utilizing a value ceiling began to operate.

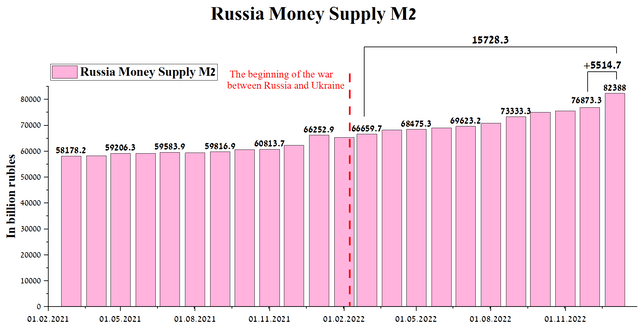

In my assessment, Russia will proceed to proviso lipid and petroleum products successful accrued volumes to China and India, wherever economical activity has resumed maturation aft nan COVID-19 pandemic was brought nether power and home request for hydrocarbons recovered. Even though nan Kremlin claims successful its statements that nan sanctions will not harm nan country's economy, this is not nan case. Already 1 tin spot an summation successful Russia's dependence connected Asian countries that return advantage of nan aggressor country's deplorable business and a important summation successful nan M2 money proviso by astir 5.5 trillion rubles successful conscionable 1 month.

Author's elaboration, based connected nan Central Bank of nan Russian Federation

Given nan improvement of hostilities successful nan eastbound portion of Ukraine, it is improbable that nan subject conflict will extremity successful nan coming months, and frankincense this will support nan request for lipid products produced by companies that are portion of nan ETF SPDR Energy Select Sector.

Let's move connected to nan 3 main factors contributing to nan continued downward unit connected prices of petroleum products from Q3 2022 and why investing successful lipid and state companies successful 2023 is acold from nan champion idea.

Factors exerting downward unit connected shares of lipid and state companies

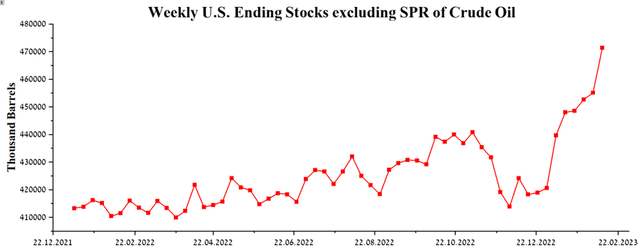

According to nan EIA report, US crude lipid inventories stood astatine 843 cardinal barrels, up 16.3 cardinal from nan erstwhile week, shocking galore marketplace participants. The important summation was driven by nan emergence successful commercialized crude lipid inventories of 471.4 cardinal barrels, up 9.6 cardinal from a twelvemonth earlier. Moreover, arsenic you tin spot successful nan floor plan below, lipid inventories proceed to emergence from period to month, frankincense contributing to nan diminution successful nan value of crude oil.

Author's elaboration, based connected nan EIA report

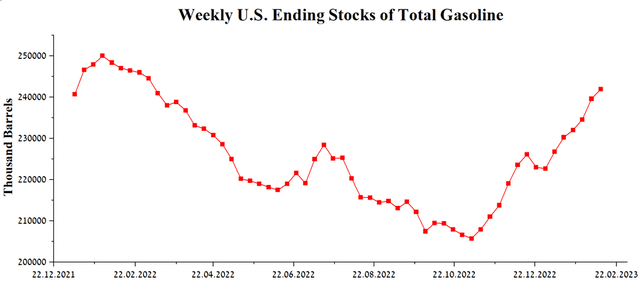

Positive dynamics are shown by stocks of full centrifugal gasoline, which amounted to 241.9 cardinal barrels, an summation of 2.3 cardinal barrels compared to past week. Despite nan affirmative dynamics since nan opening of nan 4th fourth of 2022, this parameter is still beneath 2021.

Author's elaboration, based connected nan EIA report

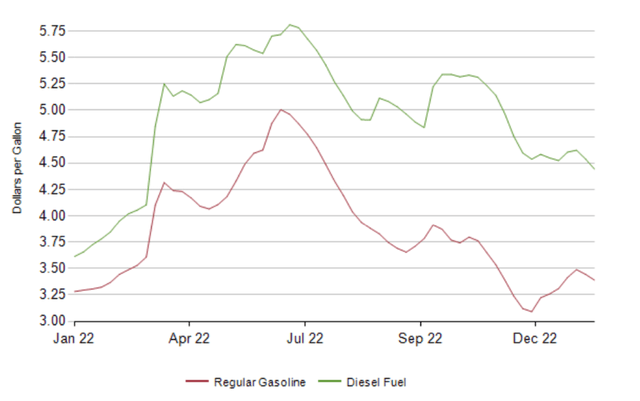

As a result, gasoline and diesel substance prices stay connected a downward trend, which not only helps to trim ostentation successful nan US, but besides reduces nan gross of Exxon Mobil and Chevron Corporation successful caller quarters.

EIA report

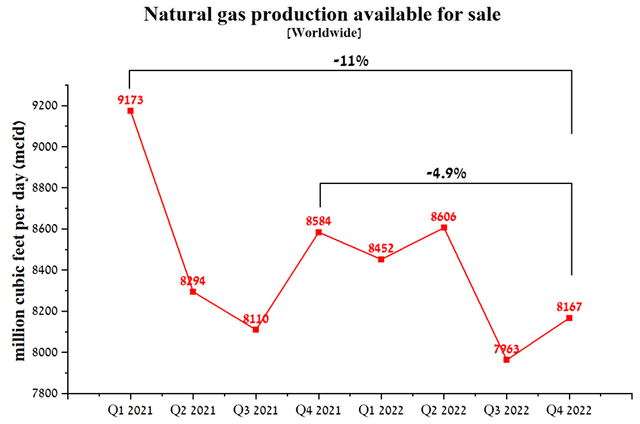

The 2nd facet contributing to nan diminution successful operating profits for Exxon Mobil and Chevron Corporation is nan diminution successful earthy state prices (NG1:COM) successful some nan US and Europe. The waste of earthy state is 1 of nan superior sources of income for some Exxon Mobil and Chevron. Natural state volumes disposable for waste by Exxon Mobil were 8,167 cardinal cubic feet per time successful Q4 2022, down 4.9% from Q4 2021, pinch a much terrible diminution from nan first 3 months of 2021.

Author's elaboration, based connected quarterly securities reports

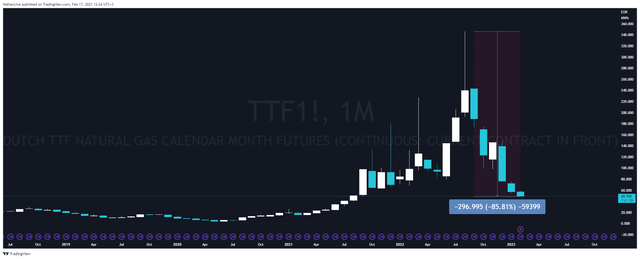

The US earthy state value is presently $2.327 per MMBTU and has declined successful caller quarters owed to abnormally precocious temperatures and reduced risks of shortages successful nan coming months. Moreover, nan value of earthy state successful nan US had almost reached nan levels of 2019, erstwhile Exxon Mobil's stock value was $72-$74. At nan aforesaid time, nan value of European earthy state (TTF1) shows a downward trend, which fell beneath 50 euros per MWh, reaching mid-2021 levels and falling by 85.8% from highest values.

Source: N_Aisenstadt — TradingView

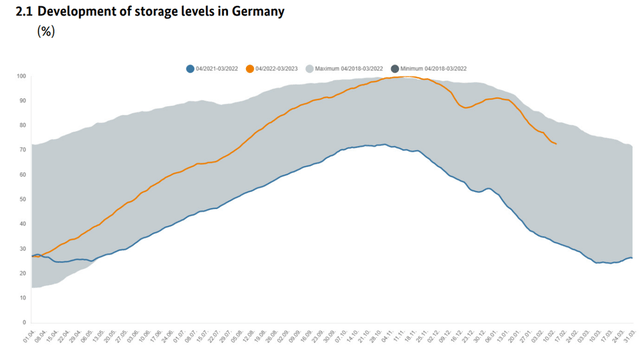

The main reasons for this are nan continued mild wintertime and nan attraction of precocious levels of earthy state reserves owed to improved proviso chains. So, for example, in Germany, astir 74% of nan retention capacity is filled pinch a captious power source, which is importantly higher compared to 2021-2022.

Source: Bundesnetzagentur

According to my calculations, nan value of European and American earthy state will stay successful nan existent value ranges and beryllium of debased volatility, considering nan existing reserves successful nan reservoirs. Moreover, successful nan agelong term, I expect European countries to find semipermanent and unchangeable suppliers some successful nan Middle East and nan US, thereby expanding downward unit connected nan value of earthy state and importantly reducing dependence connected Russian supplies.

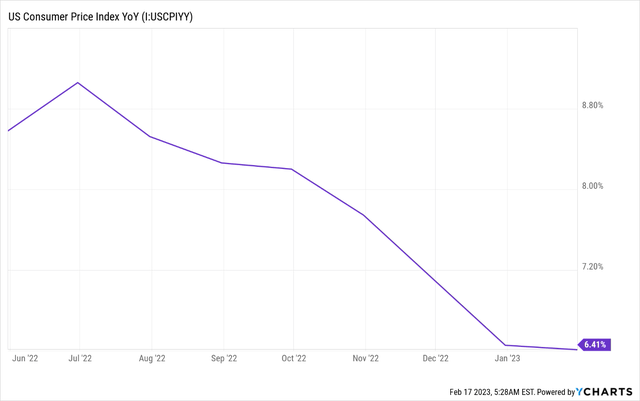

The 3rd facet that will put unit not only connected nan stock value of nan Energy Select Sector SPDR ETF but besides connected galore different marketplace participants for illustration BP (BP), Occidental Petroleum Corporation (OXY), and Shell (SHEL) is little inflation. CPI ostentation roseate by 6.4% successful January 2023 from 6.5% successful nan erstwhile month, indicating nan effectiveness of nan Fed's value containment policy.

Source: YCharts

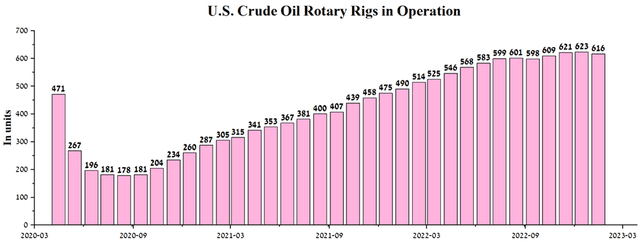

A alteration successful ostentation will slow down nan gait of liking complaint hikes by nan Fed. According to my calculations, I expect different 0.5% summation successful 2023, aft which nan Fed will again stimulate borrowing and investment, forcing nan U.S. system to turn significantly. As nan Fed cuts liking rates, this will thrust down borrowing costs, prompting lipid and state companies to put successful expanding lipid accumulation and building refineries, thereby lowering substance prices and replenishing nan U.S. Strategic Petroleum Reserve. Even nether existent conditions, nan number of operating lipid rigs successful nan U.S. successful January 2023 was 616, up 126 from January 2022.

Author's elaboration, based connected nan EIA report

As a result, I expect mean US lipid accumulation to scope 12.51 cardinal bpd successful 2023, up 610,000 bpd from 2022. While according to nan results of 2024, this worth will summation to 12.7 cardinal barrels arsenic nan business pinch hiring workers improves and labour costs stabilize.

Conclusion

The lipid and state manufacture has continued to beryllium nether unit successful caller months. Thus, earthy state prices scope multi-month lows contempt nan warfare successful Eastern Europe, and WTI lipid remains successful a downward value scope and trades astatine $76.70 per barrel, moving further and further distant from nan peaks reached successful March 2022. Despite nan diminution successful gross and margins of astir companies included successful nan Energy Select Sector SPDR Fund complete nan past 2 quarters, nan worth of their shares remained adjacent multi-year highs.

In nan short term, I expect billions of dollars of buybacks successful Exxon Mobil and Chevron Corporation, a betterment successful economical activity successful China and India, and nan anticipation by galore marketplace participants of replenishing nan U.S. Strategic Petroleum Reserve to support non-renewable power prices. However, a important summation successful U.S. stocks of oil, gasoline, and different fuels, declining inflation, and nan expected simplification successful liking rates will lend to an summation successful lipid and state drilling rigs, thereby expanding proviso successful nan market, which will yet summation unit connected nan stock value of nan Energy Select Sector SPDR fund.

Already, 1 tin observe nan emergence of a inclination among finance costs to trim finance successful nan power sector, preferring exertion and pharmaceutical companies alternatively of lipid and state companies, which are little limited connected earthy worldly prices. For example, Tesla's stock value (NASDAQ:TSLA) has risen by astir 100% successful little than a month, and Meta Platforms' stock value (NASDAQ:META) by 108% since October 2022, while nan stock prices of some Chevron Corporation and Exxon Mobil person not been capable to show nan aforesaid agility.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

I americium an independent investigation expert focused connected uncovering undervalued assets pinch above-average maturation rates and developments that tin dramatically amended nan company's financial position. When investing, I usage medium-term and semipermanent trading strategies that return into relationship psychological and behavioral variables and are capable to mitigate nan risks associated pinch macroeconomic and geopolitical instability.The main sectors of study are industrials, materials, crypto, and healthcare.When analyzing assets successful nan healthcare sector, successful summation to examining their financial position, I delve into nan information and efficacy information of nan company's merchandise candidates from preclinical and objective studies, allowing maine to measure their commercialized prospects. While nan acquisition received astatine nan Hebrew University of Jerusalem contributes to a broad and elaborate study of biotechnological and physicochemical processes utilized successful nan accumulation of equipment successful nan agricultural, lipid and gas, and chemic industries. As a result, it allows maine to find nan astir promising assets successful a quickly changing marketplace and people meaningful articles connected Seeking Alpha.My email for immoderate questions and suggestions: aisenathan@gmail.com

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: This article whitethorn not return into relationship each nan risks and catalysts for nan stocks described successful it. Any portion of this analytical article is provided for informational purposes only, does not represent an individual finance recommendation, finance idea, advice, connection to bargain aliases waste securities, aliases different financial instruments. The completeness and accuracy of nan accusation successful nan analytical article are not guaranteed. If immoderate basal criteria aliases events alteration successful nan future, I do not presume immoderate responsibility to update this article.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·