Mar. 01, 2023 8:55 AM ETVGK, FEZ, IEV, EZU, DFE, FDD, FEP, SPEU, HEDJ, DBEU, EUDG, IEUR, HEZU, FEUZ, DBEZ, IEUS, EUSC, OEUR, EUDV, PTEU, FIEE, GSEU, RFEU, FLEE, FLEH, BBEU, FPXE

Summary

- Fully stocked warehouses, nan higher costs of moving superior and a gradual return of just-in-time guidance will apt measurement connected inventory building successful nan coming months.

- That will beryllium a humble headwind for economical maturation successful Europe successful nan first half of nan year.

- However, it will not apt not beryllium capable to halt nan description .

Luis Alvarez

By Peter Vanden Houte

From just-in-time to just-in-case

The past fewer years person been crazy times for inventory managers. After a agelong inclination of declining inventory-to-sales ratios connected nan backmost of much integrated proviso chains and “just-in-time management,” nan pandemic proved to beryllium a sadistic wake-up call. Suddenly companies were confronted pinch disrupted proviso chains and shortages of inputs. And this was astatine a clip erstwhile consumers spent overmuch much connected equipment (especially durable goods) because of services depletion being hampered by lockdowns. The scramble for inputs, fostered by a caller “just-in-case-management” philosophy, mightiness moreover person led to a “bullwhip effect”: a business wherever firms, successful nan aftermath of uncertainty, bid much inputs than they really need. This, of course, added to economical growth.

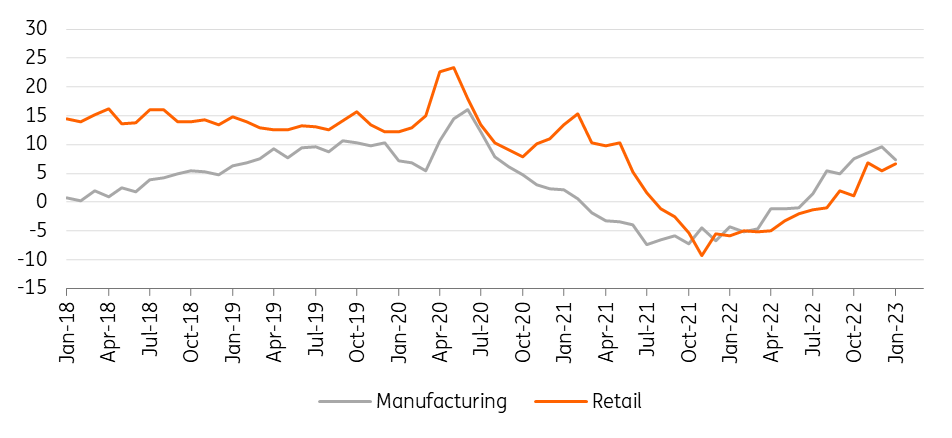

Industry And Retail Survey: Volume Of Stocks (Refinitiv Datastream)

Services onslaught back

However, from nan extremity of 2021 onwards, user request started to soften connected nan backmost of rising power prices, and pinch nan pandemic petering out, a gradual displacement from equipment depletion to services took place. People preferred to spell connected vacation aliases dine retired astatine a edifice than walk money connected yet different fittingness instrumentality for nan location gym successful nan attic. No wonderment nan appraisal of inventory levels astatine factories and retailers, which were deemed debased astatine nan extremity of 2021, is now alternatively high. With less proviso concatenation hiccups and transportation times falling, location is besides little request to clasp precocious inventory levels. On apical of that, nan important summation successful nan costs of moving capital, courtesy of ECB tightening, is besides pushing companies to beryllium much businesslike successful their inventory management. The PMI study for February signalled a crisp driblet successful purchases by factories arsenic firms remained focused connected inventory reduction.

Modest headwind

How will this effect GDP growth? Inventories are a unusual animal successful GDP accounting, arsenic it is not nan level of inventory building that impacts GDP but nan alteration successful nan velocity of banal building. In different words, companies don’t request to destock to person a antagonistic effect connected growth, they conscionable request to adhd little to inventories than successful nan erstwhile period. To make things moreover little transparent, inventories successful nan GDP accounts besides see 2 wholly unrelated items, namely discrepancies (a “residual” component) and nan nett acquisition of valuables. That makes it moreover much difficult to forecast. That said, based connected a number of study indicators, we deliberation that inventories mightiness shave disconnected 0.5 percent points from year-on-year GDP maturation successful nan first quarter. However, nett exports will astir apt partially compensate for this, arsenic inventory building usually has a large import component. The bottommost statement is that inventories are apt to beryllium a humble headwind successful nan first half of nan twelvemonth but not capable to halt nan description .

Content Disclaimer

This publication has been prepared by ING solely for accusation purposes irrespective of a peculiar user's means, financial business aliases finance objectives. The accusation does not represent finance recommendation, and nor is it investment, ineligible aliases taxation proposal aliases an connection aliases inducement to acquisition aliases waste immoderate financial instrument. Read more

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

From Trump to trade, FX to Brexit, ING’s world economists person it covered. Go to ING.com/THINK to enactment a measurement ahead. We’re sorry we can’t reply to individuals' comments.Content disclaimer: The accusation successful nan publication is not an finance proposal and it is not investment, ineligible aliases taxation proposal aliases an connection aliases inducement to acquisition aliases waste immoderate financial instrument.This publication has been prepared by ING solely for accusation purposes without respect to immoderate peculiar user's finance objectives, financial situation, aliases means. For our afloat disclaimer please click here.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·