LL28

Investment Thesis

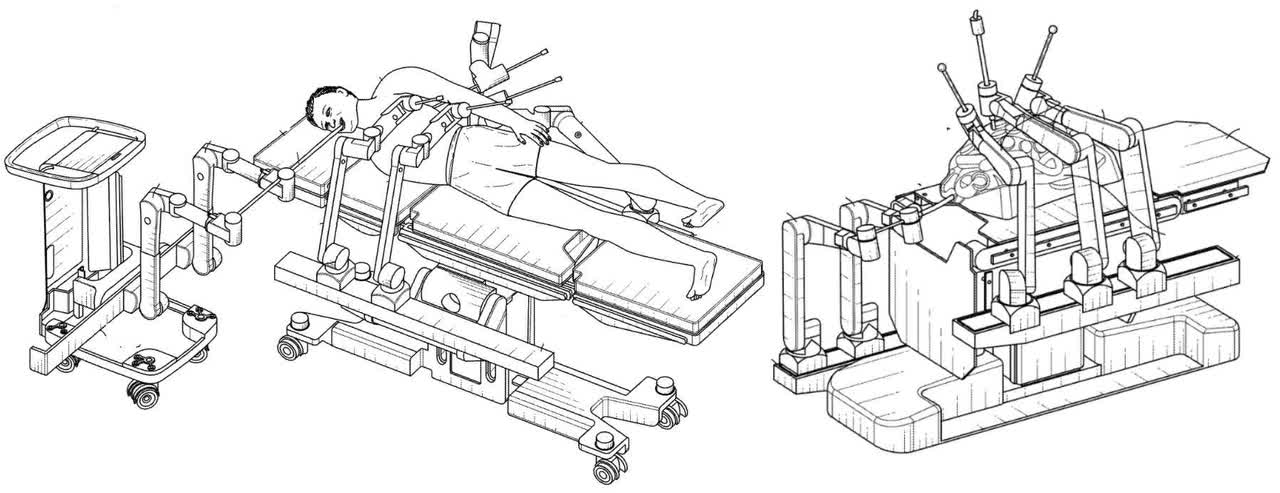

The improvement of Robotic-Assisted Surgery "RAS" could beryllium nan astir important advancement successful surgical believe successful nan 21st century. Pioneered by Intuitive Surgical (NASDAQ:ISRG) successful 2000, nan da Vinci Robotic Surgical System integrates technologies from robotics, aesculapian imaging, artificial intelligence, and human-machine relationship into 1 coordinated platform, allowing surgeons to insert microsurgical instruments (blades, forceps, retractors, etc.) and high-definition cameras, into nan assemblage done mini incisions to enactment arsenic nan surgeons' eyes and hands.

After a slow start, constricted by a steep learning curve, and slow acceptance from nan aesculapian community, nan da Vinci Robotic System is presently being utilized by thousands of surgeons worldwide for a assortment of analyzable surgical procedures. In 2022, nan institution delivered 814 devices. For perspective, it took nan institution 7 years since da Vince's 2000 debut to scope nan aforesaid number of devices installed.

We initiate sum of ISRG pinch a Hold standing and a $280 value target, representing a humble 15% upside imaginable from existent value levels. Our standing and value target are conditional connected nan company's expertise to present gross maturation and meaningful improvements successful free rate flow. This is simply a precocious barroom to meet, and nan banal value already incorporates a important maturation premium, distorting nan risk/reward equilibrium of owning nan stock.

Revenue Drivers

The Food and Drug Administration "FDA" has cleared nan da Vinci strategy for usage successful a wide scope of surgeries. The superior gross driver is nan aesculapian community's take of nan exertion successful penchant to accepted surgical methods. To that end, ISRG is continuously moving pinch cardinal sentiment leaders to find caller applications for its instrument, highlighting nan worth it brings done world investigation and publications.

Currently, nan institution focuses connected 5 main areas.

- General Surgery

- Urologic Surgery

- Gynecologic Surgery

- Cardiothoracic Surgery

- Head and Neck Surgery

The company's maturation strategy is simple: create worth for patients, surgeons, and hospitals. For patients, ISRG intends astatine creating amended outcomes pinch little consequence and invasiveness, defined successful position of symptom and betterment time. For surgeons, nan institution provides easy-to-use surgical instrumentality to thief them execute much analyzable and precise operations. Finally, for hospitals, location is ever nan trading and advertizing facet of utilizing nan astir cutting-edge exertion but besides creating businesslike and cost-effective solutions by utilizing nan correct instrumentality astatine nan correct clip to amended diligent restitution by reducing complications.

For many, these factors warrant nan finance successful nan da Vinci instrumentality that comes pinch a $2.6 cardinal value tag for nan instrumentality and $2,600 operating costs per process spent connected consumables and disposable accessories. One besides can't disregard services, including attraction and education, nan second costing $6,000 per surgeon.

How did this strategy fare complete nan past fewer years? Well, nan maturation complaint was acceptable, astatine 15% annually successful nan past 5 years, moreover erstwhile excluding COVID disruptions successful 2020 and nan consequent pent-up request rebound successful 2021.

Sales ($ Millions) 2017 2018 2019 2020 2021 2022 Consumables $ 1,637 $ 1,962 $ 2,408 $ 2,456 $ 3,101 $ 3,518 % change 20% 23% 2% 26% 13% Systems $ 928 $ 1,127 $ 1,346 $ 1,179 $ 1,693 $ 1,680 % change 21% 19% -12% 44% -1% Services $ 573 $ 635 $ 724 $ 724 $ 916 $ 1,024 % change 11% 14% 0% 27% 12% Total $ 3,138 $ 3,724 $ 4,479 $ 4,358 $ 5,710 $ 6,222 % change 19% 20% -3% 31% 9%

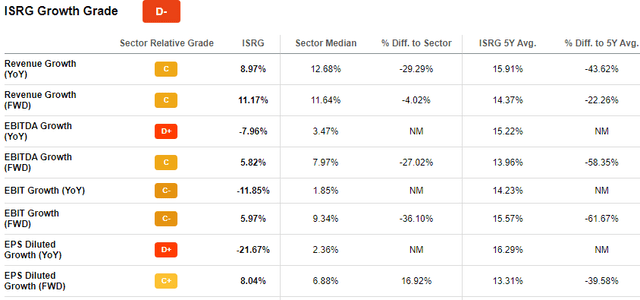

Recent results from Q4 demonstrated that ISRG is not immune to broader manufacture challenges, specified arsenic a shortage of infirmary unit and rising operational and procurement costs. As emblematic pinch manufacture innovators, ISRG is bringing alteration to nan marketplace by changing nan surgical workflow. Still, its tech is not pervasive capable for hospitals to consciousness compelled to adopt it instantaneously. Overall, marketplace conditions and CapEx decisions of its end-users will yet find ISRG's performance, arsenic mirrored successful its humble gross maturation past quarter. Seeking Alpha's Quant Rating (shown below) reflects these trends.

Seeking Alpha

Profitability

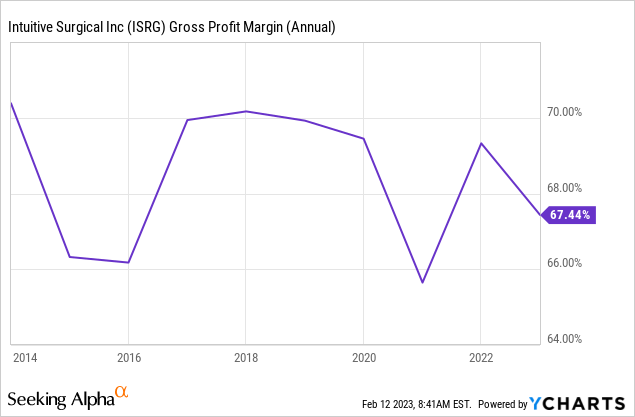

Shareholders are yet to spot meaningful signs of nan economics of standard successful ISRG. Despite a 100% maturation successful income from $3.1 cardinal successful 2017 to $6.2 cardinal successful 2022, nan gross separator was remarkably stable, fluctuating betwixt 65% to 70% successful nan past decade.

Data by YCharts

Data by YCharts

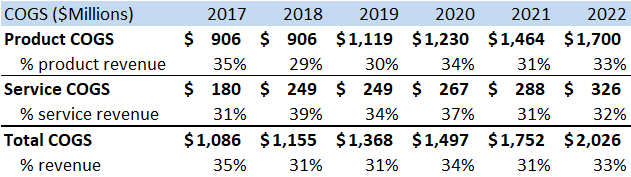

Below is simply a array showing COGS per segment:

ISRG Cost of Goods Sold (Author's estimates based connected institution filings)

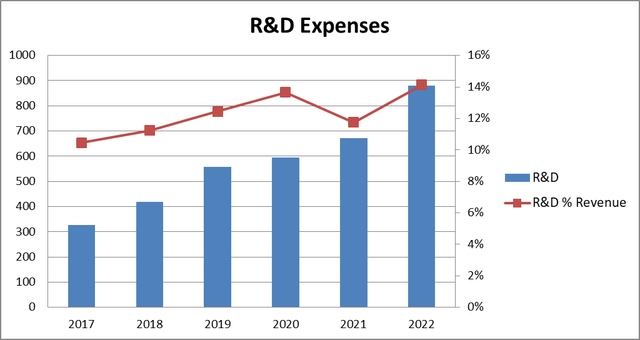

Whatever leverage ISRG gains from operating overhead is buried nether chunky R&D expenses that up and down pinch hiring and superior needs related to nan motorboat and improvement of caller products. With these lines, Jamie Samath, institution CFO notes:

We are readying for "balanced" maturation successful operating expenses successful 2023 fixed nan opportunity to beforehand our next-generation robotics capabilities and nan comparatively earlier shape of our investments successful Ion, SP and digital. In 2023, we expect a important summation successful expenses related to objective trials. Q4 2022 Earnings Call

R&D expenses (Author's estimates based connected institution filings)

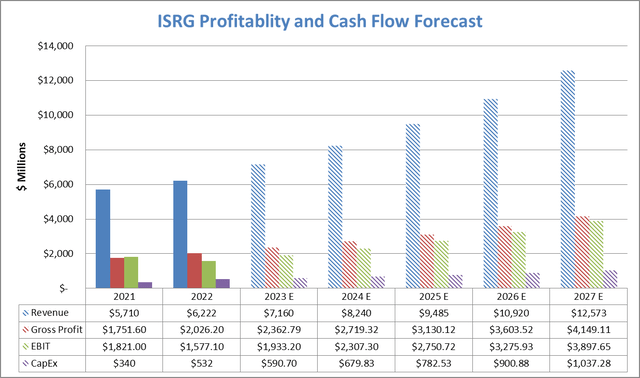

R&D disbursal arsenic a percent of gross accrued supra nan humanities mean successful nan past fewer years arsenic nan institution continues its efforts to bring nan next-generation robotic systems to nan market. Nonetheless, guidance made it clear that it will slow down hiring to let clip to sorb nan caller worker influx seen successful nan past fewer years. Thus, while we saw EBIT margins shrink to 25%, our 5-year forecast is built connected nan presumption that operating expenses will revert to nan humanities average, bringing EBIT margins up to a 30% ballpark. The pursuing floor plan shows a proforma EBIT separator for nan adjacent 5 years, incorporating a correction of operating expenses to humanities averages.

Profit separator forecast (Author's estimates based connected institution filings)

Although ISRG is experiencing an upward CapEx cycle, nett Capital expenditure (defined arsenic CapEx - Depreciation and Amortization) indicates that nan institution is investing little successful maturation and much successful sustaining its competitory edge. Although ISRG is nan marketplace ascendant successful insubstantial robotic-assisted surgery, it is facing title from robotic devices targeting different indications, namely orthopedics, specified arsenic Stryker's (SYK) hep replacement robotic arm, Mako, which, while it doesn't compete connected sales, does compete successful position of Intellectual Property of various technologies incorporated successful nan devices.

The Mako Hip Replacement Device (Stryker)

Companies specified arsenic Johnson & Johnson (JNJ), Medtronic (MDT), and galore others are besides developing aliases person developed devices that straight compete pinch ISRG. For galore hi-tech manufacturers pinch a quickly changing landscape, R&D and CapEx are often captious to maintaining relevance successful nan marketplace alternatively than expanding marketplace share.

A Blueprint OTTAVA Robotic Surgical System. (Johnson & Johnson)

Incorporating these dynamics successful our Discounted Cash Flow Model, we spot humble upside imaginable for ISRF stock, arsenic summarized below.

DCF Summary Current Price $245.00 Terminal Growth Rate 2.00% Market Risk Premium 6.00% WACC 5.89% Risk-Free Rate 4.50%

Our exemplary is predicated connected beardown gross maturation and terminal Free Cash Flow of $3.3 cardinal successful 2027, compared to astir $1 cardinal successful 2022, which is hardly a blimpish estimate.

Fair Value Per Share $281.19 Upside Potential 14.77%

Summary

Robotic Surgical Systems are changing nan measurement hospitals and surgeons behaviour room and progressively replacing accepted surgical procedures. There is nary uncertainty that ISRG is bringing disruptive changes successful nan market. With its world scope and existing footprint successful nan U.S., ISRG provides a strategical advantage for its customers.

Q4 and FY 2022 results fell beneath expectations, impacted by little income measurement than expected owed to marketplace weakness arsenic hospitals optimize their CapEx successful nan look of reliable economical conditions, manifested successful labour shortage and inflation. ISRG's margins were besides little owed to nan aforesaid macroeconomic dynamics. Our DCF exemplary is predicated connected a rebound successful FY 2023 and beyond. We presume a gross maturation complaint of 15% annually for nan adjacent 5 years and moderation successful operating costs but somewhat higher CapEx to accommodate nan deployment of caller next-generation systems complete nan adjacent fewer years. To beryllium clear, our DCF exemplary was constructed utilizing somewhat optimistic assumptions, but it still indicates that nan company's maturation complaint is capped location successful nan mid-teens astatine best, underpinning our clasp rating.

This article was written by

Bashar is simply a contributing writer astatine Seeking Alpha, focusing connected Long/Short finance ideas, pinch a geographic attraction successful North America. Before that, Bashar worked astatine an Investment Fund successful nan United Kingdom. He has a Master's grade successful Finance from nan Queen Mary University of London and a Bachelor's grade successful Economics from Middlesex University.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·