Feb. 17, 2023 4:09 AM ETBDRY, ACTV, AFMC, AFSM, ARKK, AVUV, BAPR, IVOO, IVOV, IVV, IVW, IWC, IWM, IWN, IWO, IWP, IWR, IWS, IYY, QQQ, SPLV, SPLX, SPMD, SPMO, SPMV, SPSM, SPUS, SPUU, SPVM, SPVU, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SPYD, SPYG, SPYV, SPYX, SQEW, SQLV, SSLY, SSO, SSPY, STLV, SVAL, SYLD, TMDV, TPHD, TPLC, TPSC, UAUG, UJAN, UMAR, UMAY, UOCT, UPRO, USEQ, USLB, USMC, USMF, USVM, TBT, TLT, TMV, IEF, SHY, TBF, EDV, TMF, PST, TTT, ZROZ, VGLT, TLH, IEI, BIL, TYO, UBT, UST, PLW, VGSH, SHV, VGIT, GOVT, SCHO, TBX, SCHR, GSY, TYD, EGF, VUSTX, FIBR, GBIL, UDN, USDU, UUP, RINF, AGZ, SPTS, FTSD, LMBS, ITB, XHB, NAIL, HOMZ, PKB, IYR, REZ, REM, RWR, VNQ, ICF, FRI, PSR, JRE, KBWY, SCHH, ROOF, MORT, REET, FREL, SRET, EWRE, XLRE, USRT, NURE, PPTY, SRVR, INDS, BBRE, NETL, RDOG, IVRA, REIT, FPRO

Summary

- The M2 measurement of money proviso is declining, and higher liking rates are expanding nan request for money; this is simply a one-two punch which is quickly snuffing retired inflation.

- There is still nary motion of nan benignant of economical aliases financial marketplace accent that would trigger a recession.

- The Fed has responded to nan abundance of liquidity by dramatically expanding nan world's incentives to clasp connected to money alternatively than to conscionable walk it wantonly. And it's working.

asbe

Is ostentation "running hot" because nan January stats connected nan CPI and PPI were stronger than expected? No. Ups and downs successful nan monthly information are to beryllium expected, truthful this is not needfully thing to interest about, particularly since nan macro image hasn't changed for nan worse astatine all.

Keep focused connected nan all-important monetary and macro variables: M2 and liking rates. The M2 measurement of money proviso is declining, and higher liking rates are expanding nan request for money; this is simply a one-two punch (an accrued request for a smaller proviso of money) which is quickly snuffing retired inflation. Higher rates are having a large effect connected nan lodging market, and nan enslaved marketplace continues to value successful debased ostentation and a affirmative economical outlook. The dollar remains strong, golden is weaker connected nan margin, and commodity prices are soft. The consequence of each of this is that ostentation pressures are declining connected nan margin.

One of nan biggest factors down nan January CPI astonishment was Owners' Equivalent Rent. Housing is simply a large constituent of CPI and it's been very beardown of late, but this is almost surely going to reverse later this year. Meanwhile, location is still nary motion of nan benignant of economical aliases financial marketplace accent that would trigger a recession.

And now immoderate charts to information retired nan story:

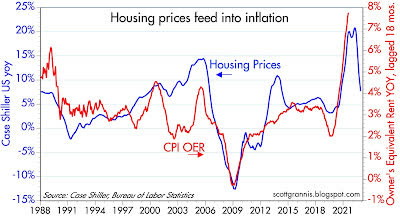

Chart #1

Chart #1 compares nan complaint of summation successful lodging prices (blue line) pinch nan complaint of summation successful nan alleged "Owners' Equivalent Rent," (red line) which comprises much than one-third of nan CPI. I've shifted nan reddish statement astir 18 months to nan near successful bid to show that changes successful lodging prices return astir 18 months to show up successful increases successful OER. This intends that nan 2021 summation successful lodging prices is now boosting nan CPI today, and this will apt beryllium nan lawsuit for astatine slightest nan adjacent respective months. But nan floor plan besides shows that location has been a important slowdown successful nan complaint of location value appreciation which began almost a twelvemonth ago, truthful astatine immoderate point—later this year—the OER constituent of nan CPI will driblet considerably. Worrying astir nan January "jump" successful CPI ostentation conscionable doesn't make sense. You person to look astatine wherever nan CPI is going to beryllium going complete nan people of this year, and that is very apt to beryllium successful nan guidance of little inflation.

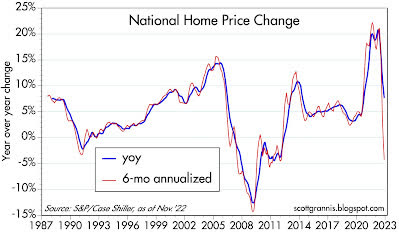

Chart #2

Chart #2 shows nan year-over-year and 6-mo. annualized complaint of alteration successful nationalist lodging prices. This adds unit to nan statement successful Chart #1, because complete nan past 6 months, nationalist location prices person declined. And nan latest datapoint for this bid (November '22) is based connected nan mean of nan erstwhile 3 months, and prices person almost surely softened successful nan astir caller 3 months. That will propulsion nan year-over-year alteration successful lodging prices good beneath zero, truthful OER will statesman to subtract from CPI ostentation wrong 3-6 months.

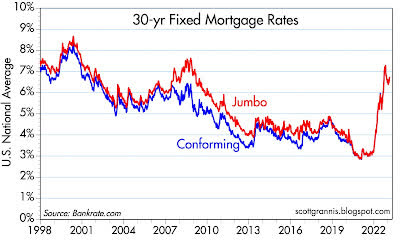

Chart #3

Chart #3 goes a agelong measurement to explaining why lodging prices person dropped this past year. 30-yr owe rates person much than doubled. In fact, we've ne'er seen owe rates summation truthful accelerated by truthful much. In turn, that has dramatically accrued nan costs of location ownership, connected apical of nan summation level of prices. Housing has go unaffordable to millions of families successful a comparatively short period.

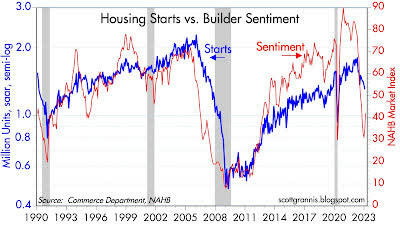

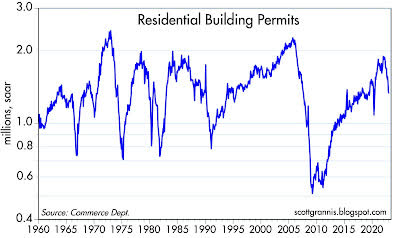

Chart #4 Chart #5

Chart #4 shows conscionable really overmuch nan slowdown successful lodging has impacted residential construction. Housing starts person fallen 27% since their April '22 high, and homebuilders' sentiment has each but collapsed. As Chart #5 shows, building permits are down 30% since nan extremity of '21, though they person been comparatively level for nan past 3 months. It's a meaningful decline, but it's not apt to beryllium a replay of nan lodging marketplace illness that led up to nan 2008 financial crisis. There has been nary overbuilding of homes, and Congress has not encouraged nan banks to lend to marginal borrowers.

In short, location has been a monolithic accommodation successful nan lodging marketplace to higher liking rates, and it's going to put tons of downward unit connected nan CPI starting later this year.

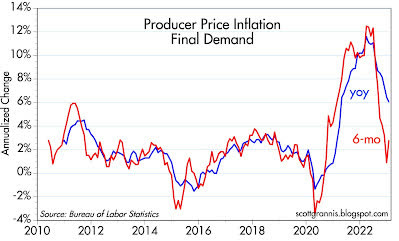

Chart #6

As nan reddish statement successful Chart #6 shows, shaper prices successful January besides amazed to nan upside, but I powerfully uncertainty this marks a alteration successful nan downward trend. The year-over-year measurement continues to decline, and nan 6-mo. annualized complaint remains rather low, moreover though it ticked up successful January.

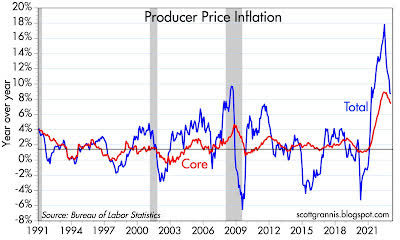

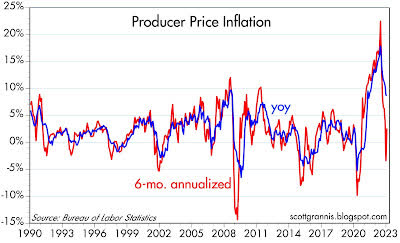

Chart #7 Chart #8

Charts #7 and #8 show different measures of shaper prices. They each show nan aforesaid story: connected a year-over-year basis, halfway and full ostentation proceed to decline. And while nan monthly measures ticked up successful January, nan 6-mo. alteration successful prices remains astatine comparatively debased levels. The headlines should read: "Over nan past six months, shaper prices person been comparatively stable." This each but ensures that nan year-over-year measures of PPI and CPI ostentation will proceed to diminution successful nan months to come.

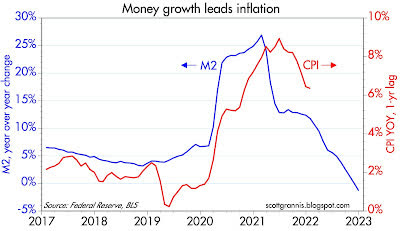

Chart #9

Chart #9 compares nan year-over-year maturation complaint of M2 (blue line) pinch nan year-over-year maturation successful nan user value scale (red line), nan second being shifted 1 twelvemonth to nan near successful bid to show that it takes a twelvemonth aliases truthful for changes successful M2 to show up successful changes successful inflation. The diminution successful M2 this past twelvemonth powerfully suggests that CPI ostentation will proceed to autumn complete nan people of this year. Steve Hanke and John Greenwood precocious wrote astir this successful nan WSJ, and they echo galore of nan things I person been saying successful this blog. We person been connected nan aforesaid M2 page for a agelong time. (But I'm not rather arsenic concerned astir recession arsenic they are.)

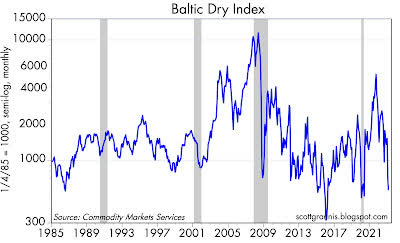

Chart #10

Chart #10 shows nan Baltic Dry Index, which is simply a proxy for barren bulk shipping costs astir nan world. What it shows is that shipping bottlenecks person almost wholly disappeared, and shipping costs person plunged. This augurs good for early world waste and acquisition and prosperity, arsenic good arsenic little input costs for galore goods. The world system is astir decidedly NOT "running hot."

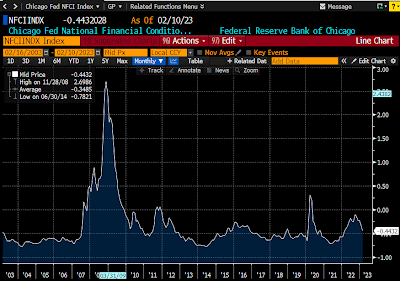

Chart #11

Chart #11 is nan Chicago Fed's Financial Conditions Index. Higher values bespeak deteriorating conditions, while little values correspond improving conditions. There is nary motion present of immoderate impending recession. Ditto for Credit Default Swap spreads and for firm in installments spreads. Liquidity conditions stay healthy, and this argues powerfully for patient economical conditions successful wide for nan foreseeable future.

The Fed's thrust to push rates higher has made a important quality successful nan ostentation fundamentals, because they person dramatically altered nan incentives to borrow, spend, and clasp money. Higher rates person NOT adversely impacted nan system for illustration they person successful nan past, moreover. Why not? Because nan Fed has constricted its tightening to liking rates while leaving an abundance of slope reserves successful nan system. It's not really nan lawsuit that money is "tight" successful nan consciousness that it's difficult to travel by. The Fed has responded to nan abundance of liquidity (and nan 2020-2021 surge successful nan M2 money supply) by dramatically expanding (using nan instrumentality of higher liking rates) nan world's incentives to clasp connected to money alternatively than to conscionable walk it wantonly. And it's working.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Scott Grannis was Chief Economist from 1989 to 2007 astatine Western Asset Management Company, a Pasadena-based head of fixed-income costs for organization investors astir nan globe. He was a personnel of Western's Investment Strategy Committee, was responsible for processing nan firm's home and world outlook, and provided consultation and proposal connected finance and plus allocation strategies to CFOs, Treasurers, and pension money managers. He specialized successful study of Federal Reserve argumentation and liking complaint forecasting, and spearheaded nan firm's investigation into Treasury Inflation Protected Securities (TIPS). Prior to joining Western Asset, he was Senior Economist astatine nan Claremont Economics Institute, an economical forecasting and consulting work headed by John Rutledge, from 1980 to 1986. From 1986 to 1989, he was Principal astatine Leland O'Brien Rubinstein Associates, a financial services patient that specialized successful blase hedging strategies for organization investors. Visit his blog: Calafia Beach Pundit (http://scottgrannis.blogspot.com/)

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·