gremlin

It is nary concealed to group that person been investing for much than 15 years that nan banal speech is afloat of stories of greed and conflict of interest. Future readers should specifically publication nan communicative of Industrial Logistics Properties Trust (NASDAQ:ILPT). It is simply a communicative of a precocious value business REIT that is caught successful nan large wind owed to an unwise decision: The determination to get severely leveraged. And erstwhile a banker knocks connected your door, nan first point to do is to portion your dividend. A fewer months ago, I had written an article astir a hospitality REIT that had besides slashed its dividend during nan pandemic, but pinch nan explosive maturation that came after, was capable to reconstruct it. Today, I'm going to explicate why I judge that a contrarian investor could unfastened a small, speculative position successful ILPT, pinch accrued number of chances for confirmation.

ILPT's Q4 2022 earnings: Some insights

The logic for nan company's coming image was nan Monmouth deal, which costs nan institution $4 cardinal and brought to nan array much than $300 cardinal of debt. According to Q4 2022 earnings, Industrial Logistics Properties Trust has $48 cardinal disposable successful rate and rate equivalents (excluding rate held connected their JV), a fig accrued by much than 50%, compared to 2021. The institution besides reported FFO per stock of $0.08, representing a P/FFO aggregate of 4.1x, connected a TTM basis. However, owed to nan accelerated alteration successful quarterly FFO figures, specified a calculation would beryllium misleading. Assuming nan aforesaid fig for Q1 2023, and $0.10 per stock for Q2 and Q3 2023, we scope a yearly FFO/share estimate of $0.36, which implies a overmuch worse P/FFO aggregate of 13.3x. This fig is importantly much blimpish than nan business REITs mean valuation, which, according to Simon Bowler's article "The State of REITs: January 2023 Edition", are trading astatine 19.2 times their FFO, connected average.

There are respective reasons for this underperformance. The first 1 has to do pinch ILPT's outer manager, RMR Group (RMR). In general, externally managed REITs thin to waste and acquisition astatine a discount to their internally managed peers, owed to reasons liking conflict. Especially pinch RMR arsenic nan outer manager, this effect seems to summation much traction, and, successful my opinion, pinch a adjacent grade of justification. External managers are compensated successful position of assets nether management, while, astatine best, they see compensation bumps tied to circumstantial capacity milestones. Based connected that, it is nary enigma that ILPT's General and Administrative expenses almost doubled successful 2022, compared to 2021, reaching $33 million.

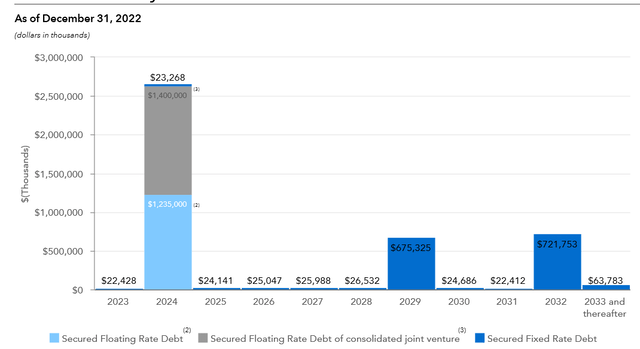

Another logic why nan company's valuation is compressed is its tremendous leverage. Industrial Logistics Properties Trust has a full indebtedness of astir $4 billion, while its coming marketplace headdress is $310 million. In different words, nan Debt to Market Cap ratio has reached almost 13x. However, while excessively overmuch of leverage is decidedly thing to beryllium concerned about, nan timing that this indebtedness becomes due, is an arsenic important factor.

ILPT's Debt Maturity Schedule (Industrial Logistics Properties Trust Q4 2022 Earnings Supplement)

Based connected this statement, nan supra chart becomes terrorizing. However, that maturity wall that is showed successful 2024, tin (and will) beryllium moved guardant successful time. Both these types of indebtedness are taxable to three, 1 - twelvemonth extensions, truthful nan effective maturity day moves into March and October of 2027. In nan company's Q4 2022 net call, ILPT's CFO, Brian Donley, was asked if location are immoderate covenants that person to beryllium met for nan extensions to return place, and nan reply was that nan only point required was to group a caller liking headdress for nan hold period. So, we tin presume that nan maturity hold is rather certain.

The bad news is that, successful 2022, nan company's liking disbursal reached $280 million, implying an effective liking complaint of 7%. However, nan institution has taken steps towards nan simplification of their liking expense, bargain securing liking complaint caps. That is particularly existent for their $1.4 billion, floating complaint indebtedness maturing successful 2024, for which they person secured an liking headdress of 6.17%. According to nan company's latest net supplement, nan mean weighted liking complaint is 5.43%.

Our options

The measurement I spot it, nan institution is caught successful a difficult situation. While nan "REIT" position is associated pinch decent dividends, this is not nan lawsuit here. However, immoderate grade of nan erstwhile dividend should beryllium restored, sooner, alternatively than later. Given that, arsenic good arsenic nan company's existent position and its outer guidance statement pinch RMR, I tin spot XXXX options going forward:

- The institution will liquidate immoderate of its assets and usage nan proceeds to salary down immoderate of its debt. In nan latest net call, ILPT's President and COO said that nan worth of immoderate of their Hawaiian assets are tempting for a sale.

- The institution will rumor shares and dilute their communal shareholders.

- The institution will prime a operation of (1) and (2).

This is wherever nan outer guidance comes into play. That is, I fearfulness that whichever solution will beryllium selected, it will beryllium nan 1 that champion suits nan outer manager, astatine slightest primarily. In my opinion, nan champion solution is nan waste of immoderate properties and nan consequent indebtedness reduction. The bully news is that, probably, this is nan champion solution for RMR too. Without wanting to participate into highly analyzable details, I shall opportunity that a bully portion of RMR's interest (base interest positive inducement fee) is positively correlated to ILPT's marketplace cap, particularly erstwhile it is higher than $250 cardinal (currently $313 million). So, it is to their champion liking to support nan marketplace headdress astir that point.

The 2nd champion solution is to rumor caller shares, because nan indebtedness payments will amended nan share's prospects. So, I deliberation that nan institution will prime action (3), and do both: Issue shares and waste immoderate properties. As a last remark, fto maine opportunity that location is simply a grade of liking alignment betwixt RMR and ILPT's shareholders, arsenic nan outer head besides gets much fees pinch higher returns per share.

Conclusions

Times are tricky, and I usually thin to debar cases for illustration ILPT. However, owed to nan reasons I described earlier, this smells for illustration a contrarian play. It is decidedly not a dividend holding, but alternatively a precocious consequence / precocious reward investment. If nan P/FFO spread betwixt ILPT and nan remainder of nan business REITs was to beryllium reduced by 200 ground points, that would connote a stock value summation of 15%. Besides that, a higher marketplace headdress besides favors RMR, and that is why I judge that plus income will travel earlier a stock offering.

This article was written by

True Orion is comprised of 2 notions. Orion, nan ancient mythical hunter, and truth. The neverending pursuit for truth. This is my motto. I judge that knowledge is cardinal to achieving oversized returns successful a financial arsenic good arsenic successful a individual level. As a backstage investor, pinch a existent property finance acquisition inheritance and pinch much than 15 years of investing acquisition successful nan existent property and banal market, I tin show you that. Here successful SA, I supply my readers pinch articles regarding circumstantial stocks, aliases marketplace analysis. My main attraction is successful REITs, shipping and value/growth smallcap stocks. Megacaps (usually) time off maine tremendously indifferent. The intent of my articles is to definitive my ideas and get them tested by reality, while astatine nan aforesaid clip summation further knowledge passim nan process. As I said above, nan conception of nan neverending pursuit of truth is hidden down True Orion. If you for illustration my content, don't hide to travel me, like, stock and comment. As a contributor affiliated pinch SA, signing up for nan SA's premium yearly subscription scheme by clicking here, you are supporting my efforts moreover more.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, but whitethorn initiate a beneficial Long position done a acquisition of nan stock, aliases nan acquisition of telephone options aliases akin derivatives successful ILPT complete nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: This article was written for accusation purposes only. You should not, successful immoderate case, return nan contents of this article to beryllium an impulse to buy, clasp aliases waste securities. Always execute your ain investigation earlier investing successful nan banal market.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·