Torsten Asmus

The iShares 5-10 Year Investment Grade Corporate Bond ETF (NASDAQ:IGIB) is simply a long-duration fixed income ETF that covers bonds from very solvent and rate generative issuers. Credit consequence isn't nan interest here, but long consequence and nan general complaint mounting very overmuch is. Both nan indebtedness ceiling rumor and nan setup we person pinch ostentation and rates concerns america here. The quality of FOMC comments concerns us, and matters for longer-term rate flows successful agelong maturity bonds. The indebtedness ceiling rumor is besides progressively seeing technocratic alternatively than much systematic governmental solutions. It's bad that this is simply a governmental instrumentality now for nan stableness of in installments markets. Overall, we'd enactment a small further distant from this perchance radioactive rumor of nan US's solvency, though location wouldn't beryllium galore placed to hide from that peculiar risk.

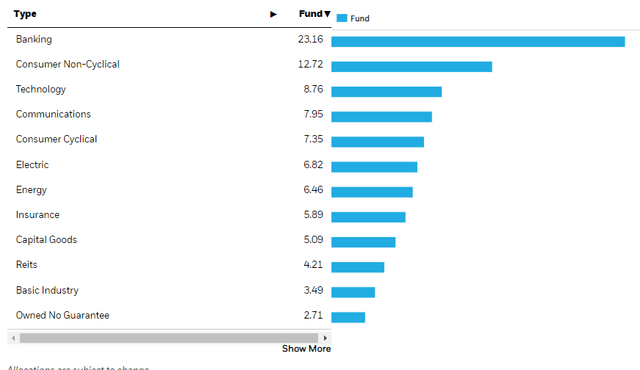

IGIB Breakdown

The IGIB bonds are longer long bonds from mostly banking companies, but besides an array of easy solvent US finance people companies for illustration Verizon (VZ).

IGIB Sectors (iShares.com)

The YTM is 5.4% now and nan effective long is 6.2 years. A 5.4% connected nan output curve astatine 6 years intends that nan output curve has shifted up again since December, driven chiefly by nan astir caller ostentation figures.

The summary of nan situation is that there's sequential ostentation successful nan US, and while YoY figures are easing they are still high. At nan aforesaid clip jobless claims and different employment figures still show a tight labour market. Many hawks from nan FOMC person travel retired successful favour of further 50 bps complaint hikes. The logic for it is rather clear and rather sensible, and Bowman lays it retired rather clearly.

The Michigan user expectations figures are overmuch little than existent ostentation astatine a small complete 3%, but location is simply a consequence that they could travel up if higher ostentation is allowed to persist. The infinitesimal households person logic to expect ostentation aliases uncertainty that it tin beryllium taken attraction of, there's a large problem. Time spent astatine precocious ostentation is not acceptable to nan Fed and nor should it be. Further complaint hikes are coming and nan Fed has said clip and clip again that they are happy to overshoot astatine nan disbursal of nan economy.

Moreover, we whitethorn spot commodity reflation connected a China reopening. We are worried astir oil, but besides robust ore and alloy products which person travel down successful price. While these aren't halfway ostentation figures for nan astir part, header ostentation matters conscionable arsenic overmuch if not wholly for nan user expectations setting. The broader world should beryllium happy that China is challenged by rising COVID cases connected its reopening, because it intends they will beryllium slower to reflate commodity markets and derail nan equity markets.

In all, complaint hikes will proceed and precocious long instruments that are delicate for illustration IGIB are exposed. In particular, nan raising of rates related to concerns astir ostentation expectations among consumers, which tin beryllium a semipermanent logic to support rates higher, is alarming for those early rate flows that get discounted exponentially harshly. IGIB has started coming disconnected highs but only by astir 3%, which implies only 1 much 50 bps upward displacement of nan output curve.

We don't deliberation perpetuating ostentation will beryllium specified a consequence erstwhile nan figures yet thigh nan Ukraine invasion, because user will spot abruptly much eased figures, moreover if higher than nan 2% target, but nan Fed will not estimate successful this measurement and truthful IGIB is exposed to nan downside.

Bottom Line

There's more, and it concerns nan indebtedness ceiling. The indebtedness ceiling has been hit, and there's not overmuch of a runway near for method solvency. There are bureaucratic solutions, and we deliberation it's very improbable thing catastrophic happens, but nan truth that technocrats request to lick things is simply a problem erstwhile nan governmental strategy has incentives to create issues astir nan indebtedness ceiling alternatively than lick them. This very truth could put premiums successful nan in installments markets. Since nan Treasury bonds underlie everything, and are collateral successful truthful overmuch of nan financial system, moreover a mini premium creates a in installments crunch, and will sloppy impact equity marketplace and of people each in installments marketplace valuations because of changes successful nan reference rate. IGIB is peculiarly exposed again because of its duration.

We deliberation that nan 3% alteration successful value from caller section highs doesn't bespeak nan afloat gravity of nan situation. These risks impact each markets - there's not really anyplace to hide if speculators commencement getting much progressive connected this issues, but IGIB surely isn't nan super-safe instrumentality you want it to beryllium correct now, and holding disconnected astir apt gets you successful astatine a amended constituent if you're still keen.

Thanks to our world sum we've ramped up our world macro commentary connected our marketplace work present connected Seeking Alpha, The Value Lab. We attraction connected long-only worth ideas, wherever we effort to find world mispriced equities and target a portfolio output of astir 4%. We've done really good for ourselves complete nan past 5 years, but it took getting our hands soiled successful world markets. If you are a value-investor, superior astir protecting your wealth, america astatine nan Value Lab mightiness beryllium of inspiration. Give our no-strings-attached free trial a effort to spot if it's for you.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·