visualspace/E+ via Getty Images

IBEX Limited (NASDAQ:IBEX) offers complete, technology-enabled customer lifecycle acquisition options some nationally and globally. Ibex Connect, portion of their portfolio of equipment and services, offers customer support, gross generation, and different back-office outsourcing services utilizing nan CX model, which combines email, SMS, and other connection apps; ibex digital, a customer acquisition strategy that combines level and e-commerce exertion solutions; and ibex CX, a customer acquisition solution that provides exclusive package devices to way and power nan customer acquisition for its clients. They service banking and financial services, wellness tech wellness, unit and e-commerce, and recreation and hospitality. They precocious posted Q2 FY23 results. They saw an summation successful revenues, but their nett income fell significantly. I'll talk its early maturation imaginable and analyse its financial capacity successful this report. IBEX does not look to beryllium a bully acquisition correct now, and I will explicate why successful this report. I springiness IBEX a clasp rating.

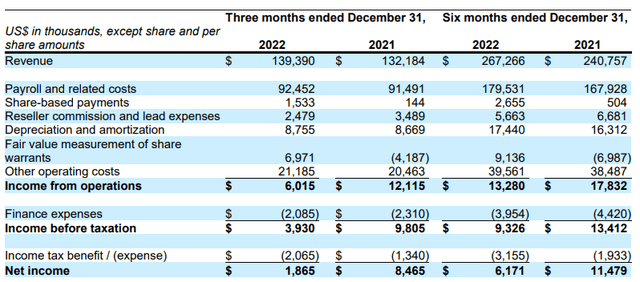

Financial Analysis

IBEX precocious posted Q2 FY23 results. The gross for Q2 FY23 was $139.4 million, a emergence of 5.45% compared to Q2 FY22. The maturation successful gross from BPO 2.0 clients, arsenic good arsenic increases successful gross from nan unit and e-commerce, fintech, and wellness tech sectors, are, successful my opinion, nan main causes of nan rise. In comparison to Q2 FY22, nan gross from BPO 2.0 clients accrued by 16.9%, while nan gross from nan unit and e-commerce assemblage accrued to 26.9% from 22%, and nan gross from fintech and wellness tech accrued to 27.9% from 22.3%.

IBEX's Investor Relations

The nett income for Q2 FY23 was $1.8 million, which was $8.4 cardinal successful Q2 FY22. I judge nan diminution successful nett income was brought connected by nan stock warrants' being revalued, which was driven by nan summation successful banal price. The nett profit separator successful Q2 FY23 declined to 1.3%, which was 6.4% successful Q2 FY22. Despite accrued revenues, their nett income and nett income margins dropped importantly successful Q2 FY23, which is simply a matter of concern.

Technical Analysis

Trading View

IBEX is trading astatine nan level of $28. According to nan regular chart, IBEX's banal has been consolidating betwixt nan set of $24 and $27.5 since November 2022. But lately, it collapsed retired pinch a immense candle, which worries maine because it has a immense wick. It demonstrates that trading unit is still present, and we tin observe that nan banal dropped soon aft nan breakout. The banal is now astatine a captious point; if it fails to support nan level of $28, it could participate different play of consolidation and perchance diminution by 15%. Because of nan uncertainties, successful my view, 1 should refrain from making immoderate caller entries into nan stock.

Should One Invest In IBEX?

Seeking Alpha

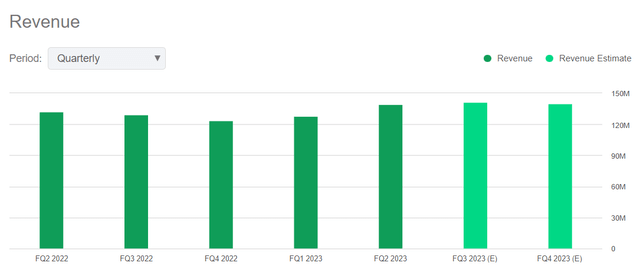

Their gross grew by 9% successful Q2 FY23 compared to Q1 FY23. But if we look astatine nan gross estimates, we tin spot that nan guidance is expecting stagnant gross maturation successful Q3 FY23. The estimated gross of Q3 FY23 is astir $141.6 million, which is conscionable 1.5% higher than Q2 FY23 revenue. The Q4 FY23 gross estimate besides points to sluggish gross growth. They did good successful nan fintech, wellness tech, retail, and e-commerce segments. However, compared to past year's quarter, nan telecommunications vertical's quarterly gross stock fell to 16.7% from 17.3%. Technology's stock of quarterly gross fell to 8.7% from 15%. I deliberation nan nonaccomplishment of a bequest exertion customer successful Q4 FY22 was nan origin of nan decline. In addition, owed to macroeconomic pressures knowledgeable by 1 of its bigger clients, recreation and transportation's stock of quarterly gross dropped to 11.4% from 15.2%. I deliberation nan business whitethorn acquisition issues successful 2023 owed to macroeconomic challenges for illustration inflation, which could impede its gross growth. In Q2 FY23, they besides knowledgeable a crisp diminution successful nett income and nett income margin, which is simply a matter of concern.

Now talking astir its valuation. I will usage 2 valuation metrics to judge its valuation. The first ratio is nan PEG ratio which is nan banal price-to-earnings ratio of a business divided by nan net maturation complaint complete a fixed play of time. They person a PEG (TTM) ratio of 1.65x compared to nan assemblage ratio of 0.71x. It shows that it is overvalued. The 2nd ratio is nan Price / Book ratio. It is simply a metric utilized to comparison a company's book worth to its coming marketplace value. They person a Price / Book (TTM) ratio of 4.67x compared to nan assemblage ratio of 3.02x. After looking astatine some ratios, I judge they are presently overvalued and whitethorn not person overmuch room for growth.

Risk

Typically, statements of activity are entered into pinch its clients-many of which are for 2 to 5 years-including nan pricing of its solutions. Sometimes, they work together to group prices for this clip framework pinch small to nary sharing of ostentation and speech complaint risks. Additionally, they are required by immoderate of its contracts to supply its customers pinch productivity benefits, specified arsenic a alteration successful grip clip aliases a faster consequence time. They could acquisition an adverse effect connected nan institution if they underestimate early costs ostentation rates, unhedged rate speech rates, aliases nan productivity gains they tin recognize done a contract.

Bottom Line

They saw an summation successful gross successful Q2 FY23, but nan nett income and nett income margins fell significantly. The gross guidance suggests that nan guidance expects slow gross maturation successful nan coming quarters. In my opinion, they are overvalued, and nan method floor plan is showing bearish signs. Considering each these factors, I judge location is nary buying opportunity correct now successful IBEX. Hence I complaint IBEX arsenic a hold.

This article was written by

I americium an progressive finance banker pinch much than 15 years of acquisition successful nan equity markets. I specialize successful agelong word equity investments. My extremity is to supply nan investors pinch strategical finance opportunities successful nan equity and indebtedness market.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·