jetcityimage/iStock via Getty Images

The fixed complaint offered for caller issuance of Series I Saving Bonds by nan U.S. Treasury is group to beryllium adjusted again successful May. This begs nan mobility for investors, should I bargain I bonds earlier nan adjustment aliases after?

The reply depends connected nan finance goal. Actually, it depends connected whether nan extremity is investment aliases savings. As a refresher, savings and finance are not nan aforesaid thing. Savings is nan liquid portion of nan family equilibrium expanse that is basal to meet contiguous and emergency expenses. The intent of savings is to sphere purchasing powerfulness astatine debased aliases nary risk.

As opposed to savings, finance is nan moving superior of nan family equilibrium sheet. Investments judge a higher vulnerability to consequence successful bid to execute existent rates of return. In essence, investments build wealthiness and savings sphere it.

The U.S. Treasury Series I Savings Bond tin beryllium utilized arsenic savings aliases investment, depending connected respective factors. The astir important of which is ostentation and liking rates. For a recap of really they work, please spot my erstwhile articles connected I-bonds here and here. Given rates and ostentation today, I'm favoring nan opportunity that I-bonds should connection successful May, for nan agelong term.

Forecasting Variable Rate

The first measurement successful evaluating I-bonds is to analyse nan adaptable rate. The adaptable complaint portion of nan liking costs connected I-bonds is adjacent to nan 6-month alteration successful nan non-seasonally adjusted Consumer Price Index for each Urban Consumers (CPI-U). This has nan advantage of keeping up pinch charismatic ostentation but has nan disadvantage of falling short of unofficial inflation.

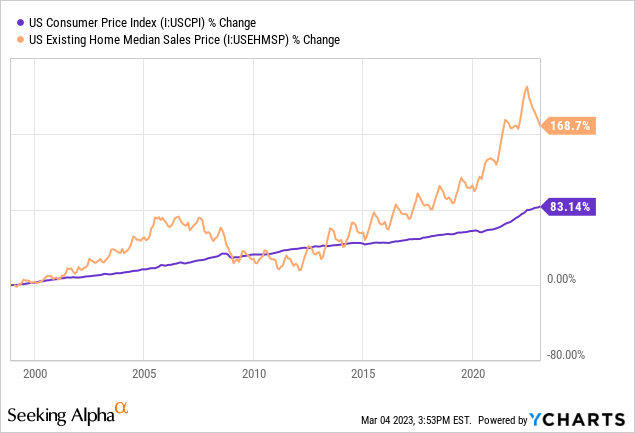

The magnitude of unofficial ostentation changes from clip to clip and tin beryllium difficult to quantify but based connected nan preponderance of grounds that I person studied complete nan years I americium assured that charismatic ostentation fails to relationship for astir 2-6% connected average. As an example, announcement really nan median value of homes successful nan U.S. has outpaced nan CPI scale by doubly arsenic overmuch since 2000. While lodging is only 1 information of nan U.S. family budget, it is simply a very ample portion.

Data by YCharts

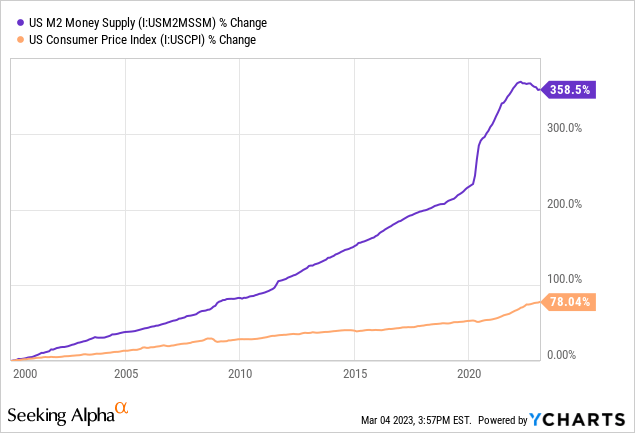

Data by YCharts

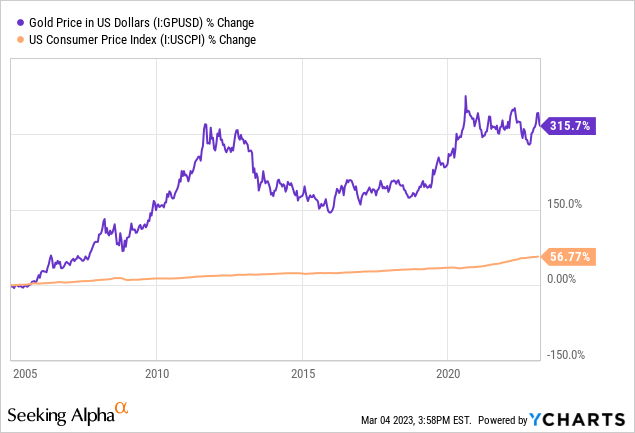

As further evidence, we tin spot that since 2000 nan M2 money proviso maturation has importantly outpaced nan CPI index. In addition, nan value of golden has grown overmuch faster than nan CPI since 2005, aft golden had already begun to emergence successful value from very overvalued levels.

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

What this intends is that nan CPI-linked portion of nan I-bond complaint tin beryllium expected to compensate for overmuch of ostentation but not each of it. This intends that nan fixed liking portion of nan I-bond output is key. A higher fixed complaint will connection much assurances that nan enslaved will support purchasing powerfulness successful nan look of inflation. It will besides supply immoderate use successful times of deflation.

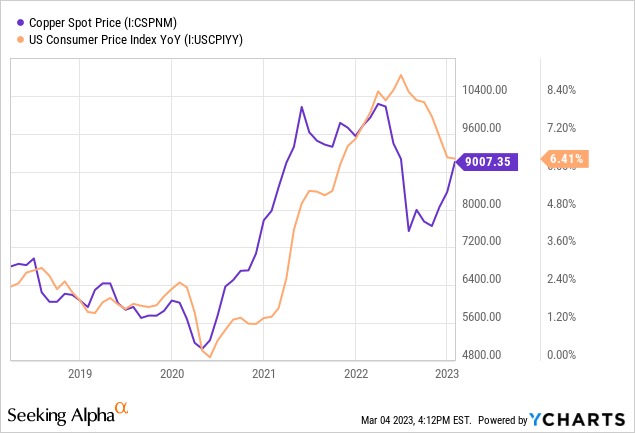

The existent adaptable complaint is 3.24% which is annualized and added to nan existent hole complaint of 0.4% for a composite complaint of 6.89%. New I-bonds issued betwixt now and May 1 will gain that annualized complaint for nan first 6 months and will clasp nan 0.4% fixed complaint for nan life of nan bond. Since nan past adjustment, nan CPI has accrued by 0.8% by January. There are 2 months of CPI information yet to beryllium released earlier nan May adjustment. We tin only conjecture what ostentation will do complete those months. But 1 point indicating higher CPI is nan spot value of copper which has accordant way grounds of starring CPI. The copper value has surged higher recently. Based connected this, I would expect nan adjacent adaptable complaint to beryllium 2-2.4% annualized.

Data by YCharts

Data by YCharts

Forecasting Fixed Rate

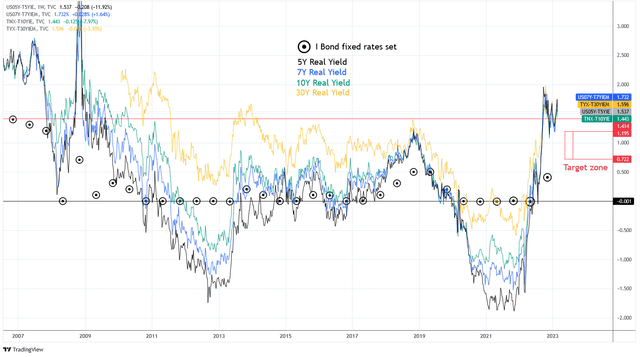

Forecasting nan fixed complaint is much opaque than nan adaptable rate. The U.S. Treasury does not people its methodology for calculating nan fixed complaint but galore analysts propose that it is related to existent yields connected U.S. Treasuries. The floor plan beneath shows nan existent yields for nan 5 year, 7 year, 10 year, and 30 twelvemonth Treasuries compared to wherever each I-bond adaptable complaint was group (as achromatic target dots):

Charts by TradingView (adapted by author)

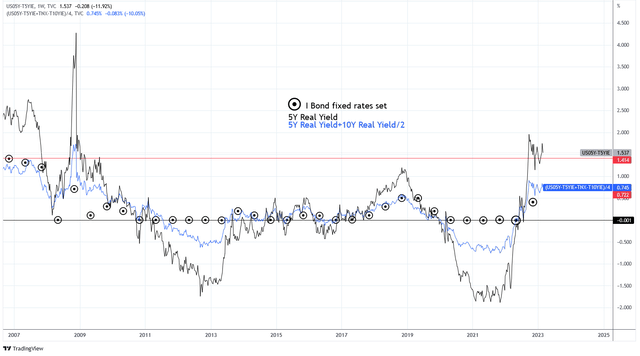

You tin spot that nan I-bond complaint doesn't travel immoderate of nan existent yields pinch precision. Obviously, erstwhile existent yields are antagonistic nan adaptable complaint is group astatine nan zero-bound. But erstwhile rates emergence nan I-bond complaint lags behind. Next is simply a floor plan comparing nan mean of nan 5 twelvemonth and 10 twelvemonth existent output floor plan divided by 2 (in blue) to nan I-bond rate. Remember that nan fixed complaint is apt wished by nan mean existent complaint complete nan erstwhile 6 period play resulting successful a flimsy lag. The narration seems to beryllium much reliable.

Charts by TradingView (adapted by author)

Real yields for each Treasuries are nan highest that they person been since 2008, erstwhile nan I-bond fixed complaint spiked to 0.7%, and 2007 erstwhile nan fixed complaint was 1.2-1.4%. The 5Y&10Y/2 composite suggests that 0.7% is simply a plausible expectation.

Buy Now aliases Buy Later

Altogether, if my estimates are adjacent we should expect nan May I-bond to connection 0.7-0.9% fixed rates pinch 2-2.4% adaptable rates for a composite complaint of 2.7-3.3%. This is acold beneath nan existent 6.89%. But don't beryllium speedy to judge.

Last twelvemonth I wrote astir really nan I-bond was offering a unsocial finance opportunity because investors could gain 6%+ connected a 1-year committedness pinch I-bonds which was superior to each Treasuries astatine nan time. This condition is nan consequence of nan I-bond's quality of lagging ostentation data; arsenic ostentation is coming down nan enslaved still offers past ostentation yields.

This clip is different.

Although investors whitethorn beryllium attracted to nan 6.89% annualized yield, arsenic compared to different fixed income assets, this output is only offered for 6 months. If CPI ends up being 1% by May, resulting successful nan adjacent adaptable complaint of 2% annualized, I-bonds bought coming will only connection 4.05% complete nan adjacent 12 months erstwhile nan early redemption punishment is assessed. Investors tin gain 5%+ from nan 1-year Treasury now.

So you mightiness beryllium thinking, that's good I'm buying I-bonds for nan agelong term. If so, nan intent of your I-bond acquisition should beryllium savings and not investment.

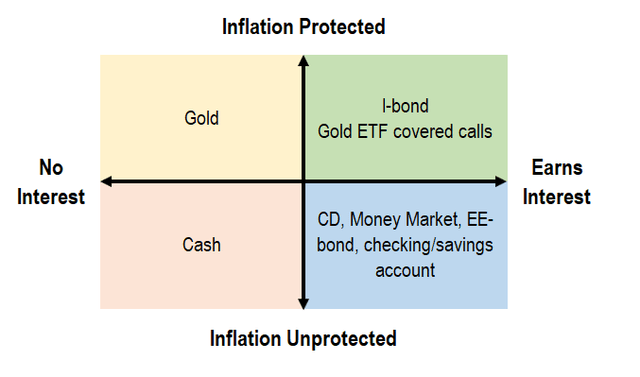

This is really I negociate my savings. I person astatine slightest 6 months of surviving expenses successful savings allocated to 4 awesome savings types which is included successful nan quadrant floor plan below.

The first quadrant does not connection immoderate liking aliases ostentation protection and includes cash. This is nan smallest allocation of my savings, utilized for day-to-day expenses.

The 2nd quadrant earns liking but is not ostentation protected. This includes CDs and money marketplace accounts. This represents a mini allocation of my savings.

The 3rd quadrant has ostentation protection but earns nary interest. This includes gold. This represents a mean allocation of my savings.

The 4th quadrant earns liking and is ostentation protected. This includes I-bonds and golden ETF costs pinch a covered telephone strategy. This is besides a mean allocation of my savings.

Chart by author

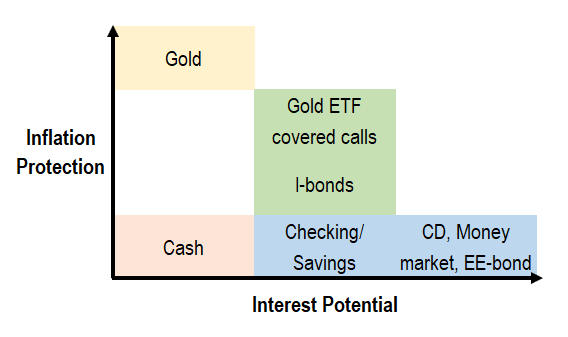

Viewed different way, ostentation protection and liking imaginable are mostly successful opposition pinch each other. My savings are diversified to see each of these types of savings to beryllium prepared for some ostentation and deflation. Note that golden ETFs pinch CCs is represented arsenic having nan aforesaid liking imaginable arsenic I-bonds but does not connection nan aforesaid main nonaccomplishment protection that I-bonds offer.

Chart by author

I deliberation that buying I-bond for savings will beryllium much charismatic successful May erstwhile nan caller fixed complaint is determined. Although 1 would beryllium forgoing immoderate other liking successful nan first 6 months, presently offered by nan precocious adaptable rate, investors tin fastener successful nan highest fixed complaint offered successful 15 years. With nan Federal Reserve slowing down complaint hikes and approaching nan inevitable complaint pause, this whitethorn beryllium nan largest fixed complaint offered for years to come. This gives I-bond investors nan champion chance astatine beating ostentation successful nan agelong term. There is, of course, a bully probability that a higher fixed complaint is offered successful November, but that tin beryllium purchased pinch a caller acquisition limitation successful 2024.

Summary

I-bonds are an important allocation successful my savings strategy. As a savings vehicle, it's important to person nan highest fixed complaint arsenic imaginable for nan life of nan bond. It is expected that nan fixed complaint offered by I-bonds will summation astatine nan adjacent accommodation successful May and will connection nan highest fixed complaint successful complete a decade. This offers a awesome agelong word opportunity to allocate much savings assets into I-bonds.

This article was written by

Generalist investor and Seeking Alpha Contributor. Articles are a heavy dive into his investigation and portfolio decisions. The author's attack focuses connected macroeconomics pinch nan extremity of achieving highest risk-adjusted return by emphasizing beardown rate flow, dividends, separator of safety, and options strategies. ~A image is worthy a 1000 words but a floor plan is worthy a 1000 pictures~

Disclosure: I/we person a beneficial agelong position successful nan shares of I BONDS either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: The contented successful this article is for informational, educational, and intermezo purposes only. This contented is not finance proposal and individuals should behaviour their ain owed diligence earlier investing. The writer is not an finance advisor and is not suggesting immoderate finance recommendations. This article reflects nan opinions of nan writer based connected nan author’s champion judgement astatine nan clip of penning and are taxable to alteration without notice. Readers are responsible for their ain finance decisions and should consult pinch their financial advisor earlier making immoderate finance decisions.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·