Velishchuk

Co-produced pinch Treading Softly.

It tin beryllium difficult to shingle disconnected recency bias. When you rotation by a state position charging $3 for gasoline, you get excited. That's measurement down from $4 aliases higher that we've seen lately!

What we've forgotten is that only a twelvemonth agone $3 was considered by galore to beryllium outrageous and upset them considerably.

So what happened? Time passed and prices moved higher, now $3 doesn't look truthful bad compared to $4 aliases moreover $6 successful immoderate places.

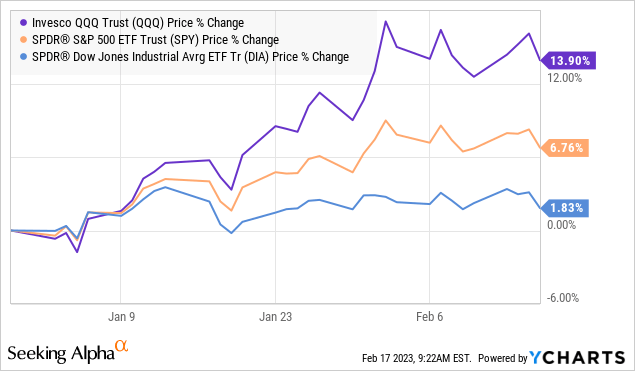

Moving to nan market, twelvemonth to day it looks great!

Data by YCharts

Data by YCharts

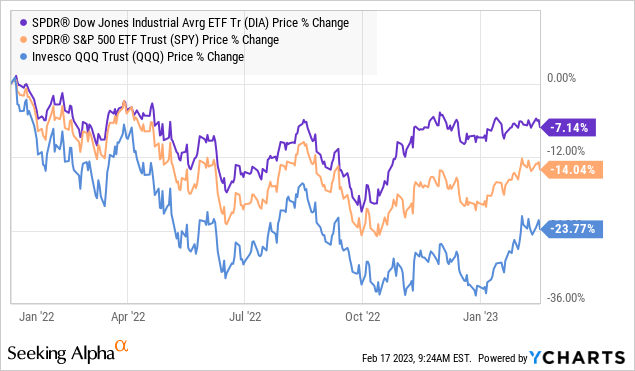

Yet, if we zoom retired a small further, we tin spot that this excitement is misplaced, arsenic nan marketplace has a agelong measurement to spell earlier it has afloat recovered:

Data by YCharts

Data by YCharts

Panning retired to Jan 1st of 2022, we tin see that moreover though caller gains are perchance impressive, nan reality is that we're a agelong measurement disconnected from really 2022 started.

So, I americium still bottommost sportfishing for fantabulous income investments that person not recovered from their anterior drops. They still connection fantabulous income. They still person room to springiness maine ample superior gains.

When nan marketplace falls 30%, it takes a 60% summation from nan bottommost to recover. Don't fto caller representation overgarment reality a caller color.

Let's look astatine 2 not-fully-recovered income costs that merit a location successful your portfolio.

Pick #1: BIZD - Yield 10.2%

The macro situation is perfect for nan BDC (Business Development Company) business model.

Most BDCs lend floating-rate elder secured loans. These are commonly word loans aliases revolving lines of credit. Most of these loans salary floating liking rates. Meanwhile, BDCs thin to utilize fixed-rate indebtedness for their leverage, this creates a script wherever BDCs get fixed and lend floating. A awesome move erstwhile liking rates are rising.

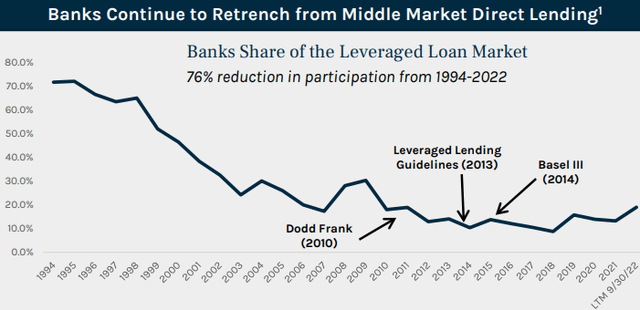

BDCs work nan "middle market," these are businesses that are not publically traded and tin scope successful size pinch yearly EBITDA anyplace from $5 cardinal to a fewer 100 million. Why don't these businesses conscionable get from a bank? Well, nan reply is that they utilized to. In nan early '90s complete 70% of middle-market loans were held by banks, this declined dramatically during nan Dot-com bust and again connected nan heels of banking regulations inspired by nan Great Financial Crisis. Source.

ARCC Q3 Investor Presentation

Businesses didn't extremity borrowing money. They conscionable borrowed from location else. In nan early 2000s, publically traded BDCs started to capable successful nan gap.

This displacement is beneficial for everyone involved.

Banks request to interest astir liquidity, and these middle-market loans mostly don't waste and acquisition connected an unfastened market, truthful they aren't liquid. Banks aren't each that willing successful putting nan manpower into managing these loans.

The borrowers aren't looking for strict one-size fits each loans, they are moving a mini to medium-sized business and tin often use from a lender that is moving pinch them alternatively than conscionable offering a loan.

BDCs don't conscionable lend and nonstop a measure for nan indebtedness payments, they often return an equity liking successful nan borrower successful summation to nan debt. This allows for a little liking complaint for nan borrower while providing a higher full return imaginable for nan BDC. It besides intends that nan BDC has an invested liking successful nan occurrence of nan underlying company. It is nary mishap that BDCs usually person adjacent relationships pinch backstage equity. Often teaming up pinch backstage equity to supply indebtedness and equity investments. The borrower benefits from nan rate but, much importantly, gets an progressive investor that is willing successful providing expertise to guarantee nan occurrence of nan company. Being capable to supply a operation of equity and indebtedness investments allows nan borrower to equilibrium their superior building successful a measurement that optimizes their success.

With debased defaults and rising liking rates, we've seen BDCs thrive. When you expect macro tailwinds to use each companies successful a sector, an ETF tin beryllium a awesome measurement to get speedy exposure. VanEck Vectors BDC Income ETF (BIZD) is an action to summation divers vulnerability to nan assemblage to double down connected it aliases successful lieu of investing successful individual picks.

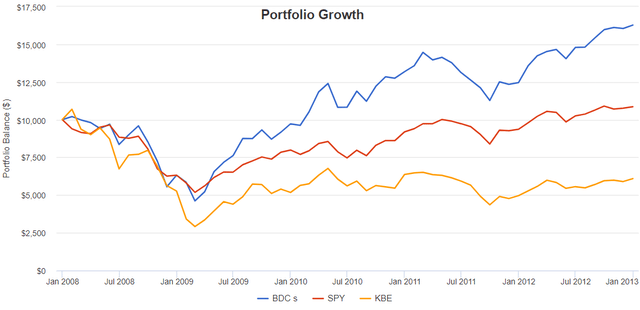

But what astir recession risk? Given that BDCs lend money to backstage companies, immoderate fearfulness what effect a recession mightiness person connected nan sector. Yet during nan Great Financial Crisis, BDCs held up remarkably good comparative to banks and nan S&P 500 Index (SP500).

Here is simply a look astatine 9 BDCs that existed arsenic of January 2008 compared to SPY and KBE (a slope ETF): (ARCC), (BKCC), (GAIN), (GLAD), (HTGC), (MAIN), (PNNT), (PSEC), and (SAR). Source.

Portfolio Visualizer

While they fell pinch nan remainder of nan market, they recovered overmuch much quickly.

BDCs are hiking their dividends and experiencing highly beardown fundamentals. BIZD is simply a awesome measurement to summation your vulnerability to them.

Pick #2: BCX - Yield 6%

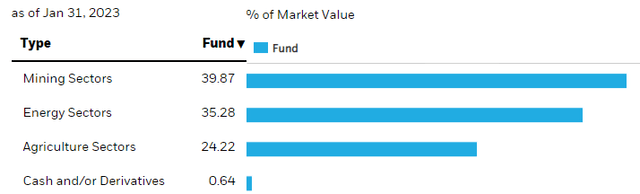

BlackRock Resources & Commodities Strategy Trust (BCX) is simply a closed-end fund, aliases CEF, that invests successful commodity stocks. Its holdings autumn into 3 awesome commodity-sensitive sectors: mining, energy, and agriculture. Source.

BCX website

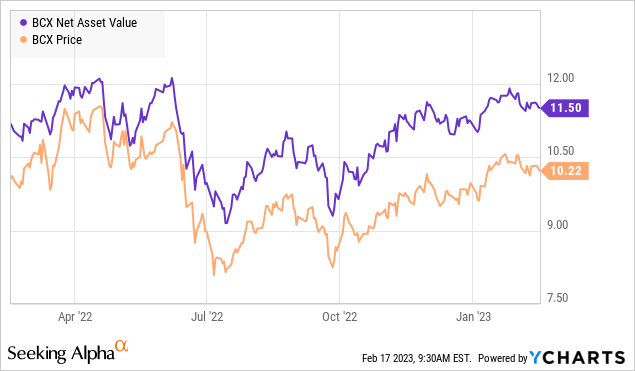

In these sectors, BCX invests successful nan largest names. 94% of its holdings person a marketplace capitalization of complete $10 billion. Over nan past year, we saw BCX rally successful early 2022 arsenic investors were obsessed and amazed by precocious inflation. Then successful June, it collapsed arsenic nan communicative turned to a hawkish Fed taking a guidelines to extremity ostentation astatine each costs.

Since then, BCX's value hasn't afloat recovered. But BCX's NAV (net plus value) has recovered.

Data by YCharts

Data by YCharts

This disconnect is apt owed to galore investors having nan cognition that ostentation is slowing down. Inflation is slowing; therefore, they don't want to ain ostentation beneficiaries for illustration commodity companies.

Yet erstwhile you look astatine nan institution level, these companies are doing very well. They are reporting precocious net and agleam outlooks. So investors will bargain nan individual companies because they look astatine net and spot nan beardown fundamentals. Yet they won't bargain nan assemblage done a CEF because of nan cognition that slowing ostentation is bad for commodities.

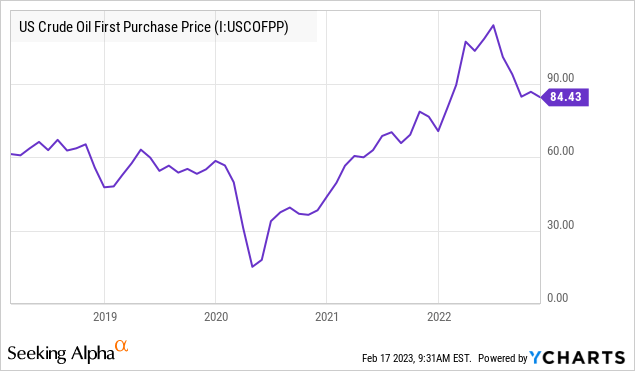

There is intelligibly a disconnect. We judge nan disconnect is pinch really group deliberation of "inflation." Inflation is not a measurement of prices. Inflation is simply a measurement of nan complaint of alteration successful prices. For commodity companies, this favoritism matters a lot. When we opportunity "inflation is slowing," we are not saying that prices are going down. We are saying that nan gait of value increases is slower, but prices are still high. Consider crude oil:

Data by YCharts

Data by YCharts

Prices person declined from their highest past summer. Yet compared to wherever lipid has been priced successful caller years, it is still overmuch higher, astir 40% higher than pre-COVID. So moreover arsenic crude lipid becomes deflationary successful yearly ostentation measures, nan value to commodity companies is still 40% higher than they enjoyed successful nan years starring up to COVID.

Commodity companies mightiness bask nan occasional windfall connected a value spike, but nan existent money is made from prices being sustained astatine higher levels. For large oil, prices being sustained astir $80 for years is acold much beneficial than nan one-time spike to $110.

This is repeated passim nan commodity sector. Corn, soybeans, robust ore, copper, ember - you sanction it. Prices are down from past twelvemonth (deflation) but are being sustained astatine substantially higher prices than they were successful 2019. That's why you tin publication astir really ostentation is slowing down but past spell to nan market shop and person sticker shock.

Yes, ostentation is slowing.

Yes, prices are still precocious comparative to nan past decade.

Both are existent astatine nan aforesaid time. The marketplace has sold disconnected commodity CEFs for illustration BCX because it reasons that ostentation is slowing truthful commodities are down successful price. Yet successful nan large picture, commodities are still precocious successful price, and that benefits nan companies that nutrient them.

Shutterstock

Conclusion

With BIZD and BCX, we tin bask precocious levels of income today, while their marketplace prices recovered to pre-2022 levels again. BIZD will bask nan higher liking complaint environment, which is providing a monolithic boost successful income for BDCs successful general, and arsenic much money flows into BIZD, much money will travel retired to you. BCX's NAV has recovered, but its marketplace value has not. This dislocation betwixt NAV and marketplace value tin let america to bargain holdings astatine a discount compared to buying nan aforesaid handbasket of holdings connected nan unfastened market.

My status is focused connected beardown income procreation imaginable from my portfolio, and yours tin beryllium conscionable nan same. Overwhelmingly, financial strain, stress, and disaster tin beryllium nan main reasons a retiree returns to work. I for illustration to person my financial location successful order, truthful that measurement I tin bask a vacation, a sunset successful my backyard, aliases sojourn loved ones without having to pinch each penny aliases accent astir nan cost.

My dividends salary for my retirement, and they tin salary for yours arsenic well. Bottom sportfishing tin thief you get awesome investments astatine astonishing prices.

I'll spot you retired connected nan lake!

If you want afloat entree to our Model Portfolio and our existent Top Picks, subordinate america for a 2-week free trial astatine High Dividend Opportunities (*Free proceedings only valid for first-time subscribers).

We are nan largest income investor and retiree organization connected Seeking Alpha pinch complete 6000 members actively moving together to make astonishing retirements happen. With complete 40 individual picks yielding +8%, you tin supercharge your status portfolio correct away.

We are offering a limited-time sale get 28% disconnected your first year!

Start Your 2-Week Free Trial Today!

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·