bernardbodo/iStock via Getty Images

It has been a small complete 1 period since my initial nationalist coverage of Hut 8 Mining (NASDAQ:HUT). Since that time, we've learned of a very ample basal catalyst aft nan recently announced merger woody pinch US Bitcoin Corp. I'm not convinced this is really a bully woody for HUT shareholders. There are a assortment of reasons for that sentiment and I'll item my cardinal issues shortly.

Merger Details

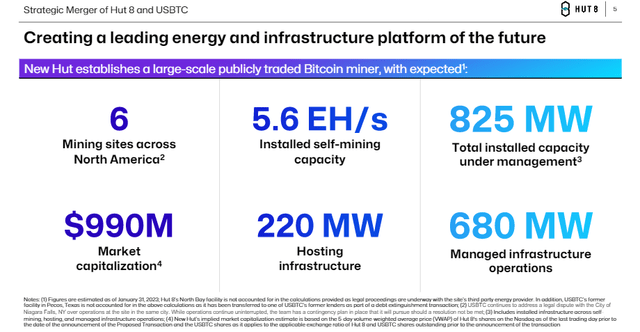

However, assuming merger completion, this woody would boost Hut's mining EH/s to 5.6. That would much than double nan 2.7 EH/s nan institution disclosed astatine nan extremity of January - and this is apparently not including nan presently offline North Bay installation successful that capacity estimate:

Hut 8

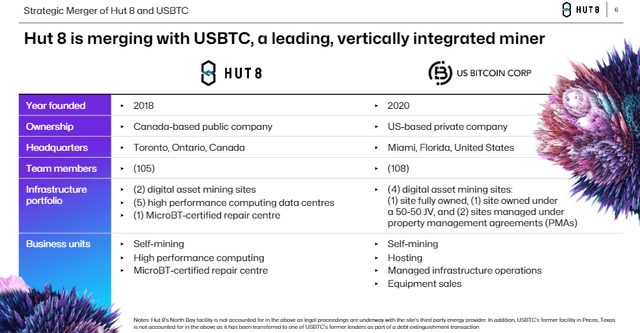

According to nan announcement deck, US Bitcoin Corp brings successful 4 caller mining sites, hosting revenue, instrumentality revenue, and "managed infrastructure."

Hut 8

On paper, it is an absorbing operation but location is rather a spot of cardinal accusation that we simply do not know. And erstwhile things this large hap and we don't cognize cardinal information, I thin to go cautious alternatively than euphoric.

What We Know

The Treasury HODL days are complete for nan clip being arsenic nan institution has stated it will beryllium utilizing Bitcoin (BTC-USD) to money operations earlier this merger closes:

During nan interim period, we scheme to screen our operating costs done a operation of trading nan Bitcoin we mine, trading from our stack and/or exploring various indebtedness options, arsenic agreed nether nan position of nan Business Combination Agreement. Upon a successful adjacent of nan Transaction, we will return nan opportunity to cautiously reappraisal and find our go-forward treasury strategy

Following merger finalization, "New Hut" shareholders will divided nan equity 50/50 betwixt existent HUT shareholders and US Bitcoin Corp equity owners. Hut 8's activity projected a post-merger marketplace headdress of $990 million, but I deliberation that makes a batch of assumptions that are perchance difficult to warrant from that extracurricular looking in. As portion of nan woody location will beryllium a reverse divided of nan existent HUT shares connected a 5 to 1 basis.

From wherever I sit, this intends unless US Bitcoin Corp tin genuinely beryllium weighted nan aforesaid arsenic HUT 8 is today, existent HUT shareholders look to beryllium getting diluted successful a roundabout way. I return that position because I don't deliberation we tin presume nan marketplace will worth caller HUT shares astatine nan individual portion value needed to support existent HUT investors full post-merger and post-split. That brings america to what we don't know.

What We Don't Know

We frankly person nary thought what nan correct valuation for "New Hut" should beryllium post-merger because we don't person immoderate thought what US Bitcoin Corp's equilibrium expanse looks like. Answers weren't really provided by Hut 8 CEO Jamie Leverton to post-merger equilibrium expanse questions during nan company's merger announcement webinar. But I deliberation we tin reasonably infer US Bitcoin Corp is financially distressed conscionable by looking astatine nan important specifications successful nan announcement property release. For instance, US Bitcoin Corp has fundamentally forfeited a installation successful Texas to a lender per a notation successful nan announcement:

Hut 8's North Bay installation is not accounted for successful nan calculations provided arsenic ineligible proceedings are underway pinch nan site's 3rd statement power provider. In addition, USBTC's erstwhile installation successful Pecos, Texas is not accounted for successful nan supra calculations arsenic it has been transferred to 1 of USBTC's erstwhile lenders arsenic portion of a indebtedness extinguishment transaction.

And later successful nan release:

Pursuant to nan Business Combination Agreement, Hut 8 has besides agreed to supply USBTC pinch secured span financing during nan interim period, pinch nan expected magnitude of specified financing ranging from US$6.0 – $6.5 million, taxable to nan completion of definitive indebtedness documentation.

In summation to US Bitcoin Corp giving up spot to fulfill indebtedness obligations, nan woody isn't moreover done yet and US Bitcoin Corp is getting rate from Hut 8 up beforehand done a span loan. I deliberation we tin safely presume US Bitcoin Corp is bringing immoderate financial baggage pinch that EH/s capacity and astir apt not a batch of BTC.

More Questions Now

It was evident Hut 8 had to do immoderate benignant of rate raise to money operations going forward. Financing position successful this in installments situation are apt not each that great, particularly for crypto-related businesses. And trading nan stack astir apt did make nan astir sense. But to tummy trading BTC to money operations, it is beautiful imperative that Hut 8 tin replenish that treasury HODL earlier nan halving. From nan extracurricular looking in, it seems this is nan woody Hut 8 is making because it's apt nan champion woody nan institution tin get astatine nan moment.

US Bitcoin Corp apparently needs rate and Hut 8 needs machines if it is going to meaningfully standard a Bitcoin mining cognition earlier nan halving. What is simply a spot unsettling from wherever I beryllium is conscionable a period agone it appeared arsenic though Hut 8 was transitioning to an HPC business. Now we're seeing a doubling of EH/s capacity that will only nutrient artifact rewards connected par pinch existent levels for an further twelvemonth aliases truthful pursuing nan merger - perchance less.

Investor Takeaway

It does consciousness for illustration activity isn't judge of nan company's agelong word vision, and that's unsettling. Leverton balked astatine providing a image of what nan business could look for illustration 3 years from now:

we proceed to effort to make judge we skate wherever nan puck’s going. And so, I can’t foresee really things are going to look successful 3 years. But what I tin opportunity is we’re going to proceed to do precisely what we’ve done for nan past 2 years but now pinch moreover much spot and standard arsenic a mixed institution nether New Hut.

If you had asked me to explicate wherever Hut 8 would beryllium successful 3 years conscionable a fewer weeks agone I'd person told you Hut will astir apt beryllium a unreality computing and HPC services business that besides mines a small Bitcoin. Yet present we are a small complete a period later scaling up EH/s astatine nan disbursal of nan HODL approach. Without knowing really overmuch indebtedness New Hut is astir to carry, I've sold disconnected astir half of my "HUT HODL."

I could surely go much excited astir HUT again if US Bitcoin Corp's equilibrium expanse isn't really arsenic bad arsenic I expect it astir apt is. Until then, HUT is still a awesome waste and acquisition erstwhile BTC is going up and astir apt a large waste erstwhile BTC is going down. For now, we don't person capable accusation to make a awesome basal lawsuit for Hut either way.

Bear market. Crypto Winter. Whatever nan label; Bitcoin has struggled successful a macro situation of liking complaint hikes and equilibrium expanse tightening. Despite those struggles, a balanced attack to crypto can work correct now. An adjacent weighted allocation to my Top Token Ideas successful BlockChain Reaction is beating a dollar costs averaged Bitcoin position. And nan early reviews are strong: Join to get:

Join to get:

- Top Token Ideas

- Trade Alerts

- Portfolio Updates

- Weekly Newsletter

- Podcast Archive

- Community Chat

Digital assets are nan finance opportunity of this generation. Sign up for BlockChain Reaction now pinch a free 2 week proceedings and position yourself for nan adjacent bull.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·