Dan Kitwood

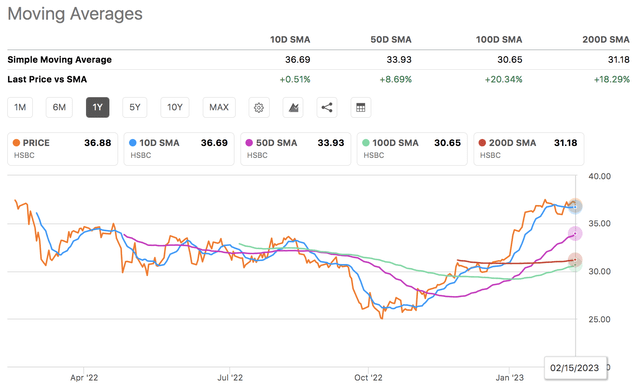

HSBC Holdings plc's (NYSE:HSBC) Q4 net study is owed connected Tuesday, nan 21st of February, which could yet find whether nan banal adds to its much than 15% year-to-date surge aliases if it will participate a correction toward its elemental moving averages.

Seeking Alpha

In this article, we judge nan company's Q3 results arsenic an intercept while phasing successful market-related factors to find nan likelihood of a Q4 net hit from HSBC. Moreover, nan stock's quantitative accounting metrics are intertwined pinch its valuation multiples to find nan asset's full return prospects.

Without further ado, let's get stuck in!

Earnings Preview

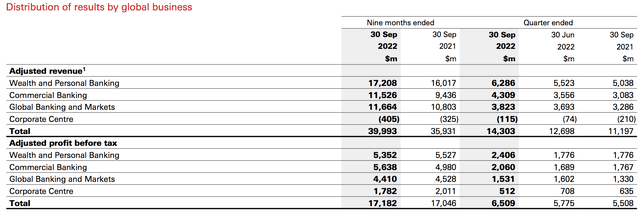

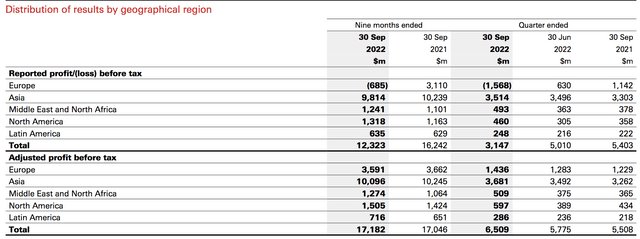

Although HSBC made a beardown top-line showing successful Q3 pinch some liking and non-interest gross surging, its normalized nett profit slumped by 42% year-over-year arsenic multiyear precocious input costs dominated its profit and nonaccomplishment statement. Nevertheless, nan patient raised its Q4 guidance crossed each segments, result causing nan bank's banal to surge.

Let's look into nan bank's financial statements and coalesce a fewer market-based events to find whether HSBC's Q4 outlook will realize.

Potential Income & Gains/Losses

HSBC chiefly operates an interest-based business exemplary pinch further sources of income, including fees, trading, and insurance. As such, it is apt that its Q4 net could travel successful beardown owed to nan continued support from elevated liking rates. As mentioned successful immoderate of our erstwhile articles that pertain to banking stocks, galore regions' long-dated output curves are inverted, which could airs a superior consequence to banks if sustained, arsenic banks typically lend pinch agelong durations while borrowing short term. However, we judge yields stay supportive for now.

HSBC's wealthiness services adhd nan astir weight to its gross mix, pinch world markets and commercialized banking successful adjacent proximity.

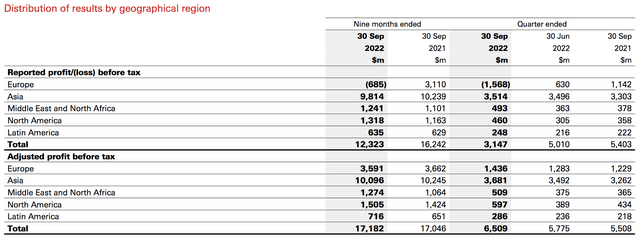

In our opinion, HSBC's wealthiness and individual banking activities apt remained unchangeable during Q4, arsenic a bank's service-based offerings typically output nan slightest volatility. Moreover, HSBC's Asia-centric wealthiness business exemplary is proving to beryllium immensely successful arsenic high-net-worth clients successful nan region are increasing exponentially. Additionally, isolated from Japan, liking rates person continued to rise successful nan region, providing a justified lawsuit for continued indebtedness portfolio support for HSBC.

As for Europe, we deliberation an abrupt year-to-date surge successful European equity markets coupled pinch continued support from liking rates will person proliferated HSBC's Q4 earnings. However, we would for illustration to reiterate nan threat of inverted output curves, which is particularly prevalent successful Europe.

Looking toward nan Middle East and North America, we expect plentifulness of nan aforesaid arsenic different regions owed to themes specified arsenic liking complaint support, moderately recovering financial markets, and low-volatility wealthiness businesses.

Lastly, successful position of cost-cutting. An anecdotal and possibly somewhat subjective sentiment is that world labour markets person eased arsenic disposable income has tapered, which could mean that nan bank's Q4 outlook of costs stabilization mightiness realize.

HSBC

HSBC

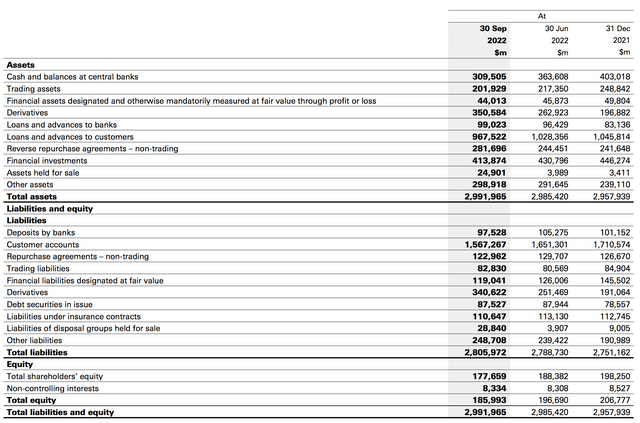

A look astatine HSBC's equilibrium expanse (excluding equity) expands our baseline knowledge.

As observable successful nan sketch below, HSBC holds plentifulness of liquid assets, which de-risks its business model. However, nan slope has a important magnitude of derivatives connected its equilibrium sheet. A ample number of derivatives could adhd volatility to its Q4 earnings. In our opinion, we don't rather bargain into nan truth that hedging derivatives are little risky than speculative derivatives.

Furthermore, HSBC's important magnitude of trading assets could beryllium advantageous to its Q4 net release. We authorities this for 2 reasons; firstly, a imaginable markup of its held for trading plus guidelines amid recovering equity and enslaved markets would connect lucrative book worth to nan company's equilibrium sheet. And secondly, it's apt that held-for trading assets generated important transportation during Q4 to adhd to HSBC's profit & nonaccomplishment statement.

Lastly, looking astatine liabilities, HSBC's creation is not bad astatine all, pinch deposits starring nan way. Fixed deposits person risen successful Asia and Singapore, particularly amid supportive money markets. On apical of that, nan marketplace consequence connected long-duration liabilities is presently unfavorable arsenic nan marketplace is pricing excess in installments risk, which could spot HSBC curtail its vulnerability to long-dated liabilities. As such, we will not beryllium amazed if HSBC's liabilities align favorably erstwhile more.

All successful all, we deliberation HSBC's Q4 equilibrium expanse will look good.

Balance Sheet - Click to Enlarge (HSBC)

Risk Weights

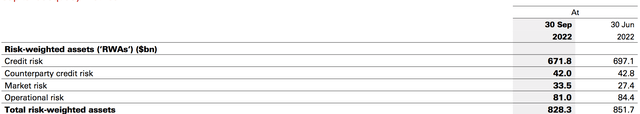

To concisely screen nan bank's projected superior adequacy, arsenic shown successful nan fig below, HSBC's market-weighted superior accrued successful Q3, fixed 2022's carnivore market. This could person easy settled much favorably successful Q4, fixed nan world equity and enslaved marketplace recoveries. Additionally, our study of world volatility indices tells america that market-based consequence will settee little successful Q4.

Although we deliberation nan bank's marketplace consequence will beryllium adjusted lower, in installments consequence remains a interest arsenic recession talks among economists stay prevalent. Moreover, macroeconomic variables stay uncertain; arsenic a premise, we item nan astonishment successful U.S. CPI knowledgeable earlier this week.

RWA (HSBC)

FX Influence

A last financial statement-related characteristic to item is HSBC's FX risk, which is azygous crossed nan banking assemblage astatine nan moment.

The slope has vulnerability to Latin America and Africa, which is simply a captious interest arsenic some regions person precocious knowledgeable unstable inflation. In addition, HSBC consolidates its reports successful nan U.S. dollar, meaning ongoing instability betwixt nan U.S. dollar and different awesome currencies mightiness nutrient a fewer surprises successful nan bank's Q4 report.

HSBC

Key Quantitative Earnings Metrics

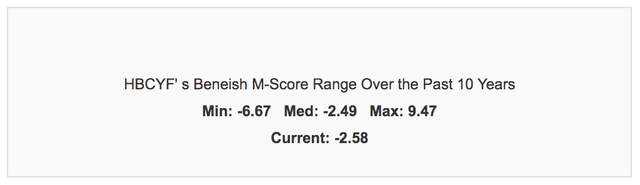

Although HSBC has produced a fewer unfavorable net surprises during its caller tenure arsenic a starring bank, nan company's Beneish M-score of -2.58 implies that its Q4 study will beryllium delivered connected nan backmost of a blimpish accounting period. Combining nan 2 metrics indicates that accounting practices are successful nan balance, presenting a debased probability of important surprises successful cardinal statement items.

Gurufocus

Relative Valuation

Assessing HSBC's full return trajectory presents a bullish scenario. The bank's existent price-to-book ratio of simply 0.92x suggests that its banal is trading beneath its intrinsic value. Additionally, arsenic stated earlier successful nan article, overmuch of HSBC's held-for-trading assets mightiness beryllium marked up successful Q4, adding to nan entity's book value.

In spite of HSBC's favorable book worth outlook, investors request to statement nan bank's elevated PEG ratio of 1.59x and nan risks related to sustained in installments risks successful nan indebtedness marketplace owed to inverted output curves, which mightiness origin an net capitulation.

Final Word

Based connected our analysis, we caput into HSBC's Q4 net merchandise pinch a beardown belief that nan slope will present robust results fixed ongoing support from nan indebtedness markets and an abrupt betterment of held-for-trading assets. Furthermore, factors specified arsenic expanding request for deposits successful Singapore and sustained maturation of individual wealthiness successful broader Asia coming a consciousness of encouragement.

Although HSBC has missed a fewer of its caller net targets, its quantitative accounting metrics are conservative, and markups of its plus guidelines will apt promote investors to perpetrate superior to an already undervalued stock.

Looking for system portfolio ideas? Members of The Factor Investing Hub person entree to precocious plus pricing models. Learn More >>>

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·