nayuki

Overview

Whenever you are looking astatine purchasing an individual banal it is important to comparison it to nan manufacture it is portion of connected aggregate dimensions. This allows you to spot wherever nan institution is outperforming and underperforming its peers. In this article we will usage Returns connected Net Tangible Assets, Net Margins, and Forecasted Risk for nan comparison.

It is besides important to comparison nan institution to a existent finance alternative. In this lawsuit we are comparing nan capacity of Apple (NASDAQ:AAPL) to nan Information Technology manufacture arsenic defined by nan Vanguard Information Technology speech traded money (VGT). By utilizing an speech traded money (ETF) to specify an manufacture we person nan advantage of having a existent replacement investment.

External and Internal Risks

ETFs connection a measurement to alteration risk. An finance successful a azygous banal holds much risk than a handbasket of stocks. This is nan basal logic a diversified portfolio is important. It reduces risk. The simplest measurement to execute this is done ETFs because they clasp nan advantage of diversification while charging very debased fees.

All companies that comprise an manufacture look akin outer risks. These are risks from things for illustration marketplace conditions, proviso concatenation shortages, geopolitical events, and economical stability. Individual companies look further soul consequence related to their expertise to execute. These are risks from competition, mismanagement, mediocre merchandise performance, and akin risks. Internal consequence is additive to nan outer consequence nan manufacture is facing.

When we judge these elemental facts we must measure an manufacture earlier buying an individual company's stock. We must find if location is capable imaginable reward basal to warrant nan further risk. We will request to look astatine Apple successful comparison to its industry.

Return connected Net Tangibles

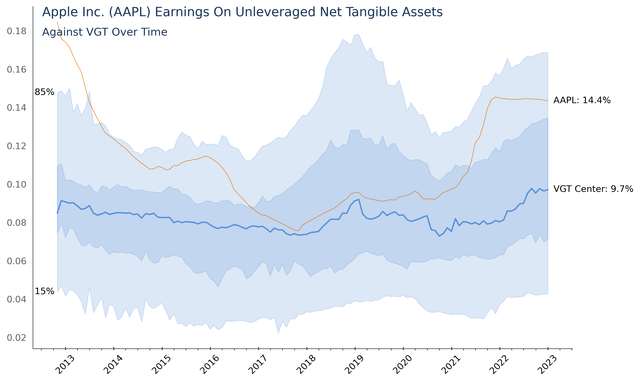

Warren Buffett uses unleveraged nett tangible assets to determine what he calls nan semipermanent economical prospects of a business. Great companies person highly precocious Returns connected Net Tangible Assets and show up supra nan bluish region successful nan floor plan below. This group is awesome because they tin turn fast.

The pursuing floor plan shows Apple pinch nan remainder of nan companies successful VGT. The bluish shaded area shows nan distribution of nan apical 75 companies successful VGT by weight. Apple is successful nan apical 3rd of accusation exertion companies. This indicates it tin outgrow astir 75% of its competitors. Considering Apple's engagement successful hardware merchandise lines this is exceptionally awesome because hardware typically requires monolithic superior expenditures to produce. The institution intelligibly focused connected semipermanent competitory advantages erstwhile structuring its worth chain.

Authors Image from Financial Modeling Prep Data

Net Margins

Net margins are important successful financial study because they supply a measurement of nan profitability of a company. By calculating nan nett margin, analysts tin find really overmuch of each dollar of income a institution is capable to support arsenic profit. This tin beryllium useful successful comparing nan profitability of different companies successful nan aforesaid industry, aliases to measure nan capacity of a institution complete time. Net separator tin besides measure nan ratio of a company's operations and to place areas for imaginable improvement.

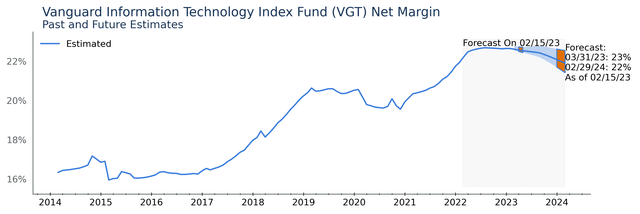

The orangish projection bands seen successful nan floor plan beneath are generated by Wall Street expert forecasts connected individual stocks which are past aggregated by my package to coming a forward-looking position of nan industry. Analysts are projecting a 1-2% separator contraction complete nan adjacent 2 years for nan Information Technology Industry. The manufacture is fighting difficult for its margins by decreasing labour costs, nevertheless those decreases are accounted for successful nan expert estimates and whitethorn lead to decreased rates of invention astatine nan companies who are taking that tactic.

Authors Image from Financial Modeling Prep Data

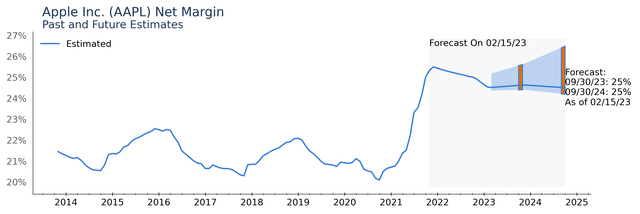

In nan floor plan beneath you tin spot Apple is forecast to person higher margins than its manufacture peers for nan adjacent 2 years. Apple is besides forecast to person comparatively unchangeable margins while nan remainder of nan manufacture experiences a insignificant decline. The precocious dispersed supra nan median forecast statement shows a fewer Wall Street analysts judge Apple's margins whitethorn moreover grow.

Authors Image from Financial Modeling Prep Data

Strong margins whitethorn look to springiness Apple banal ownership an advantage complete VGT, nevertheless we request to execute a consequence study to get a afloat picture.

Forecasted Risk

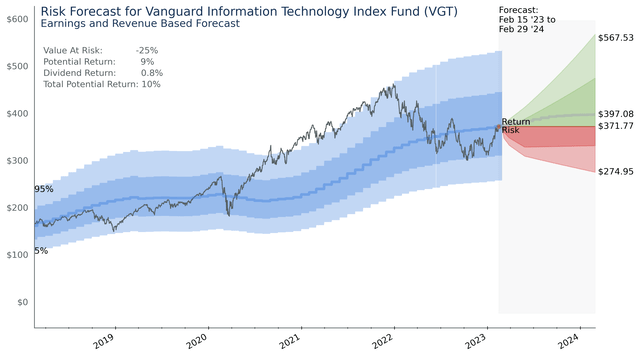

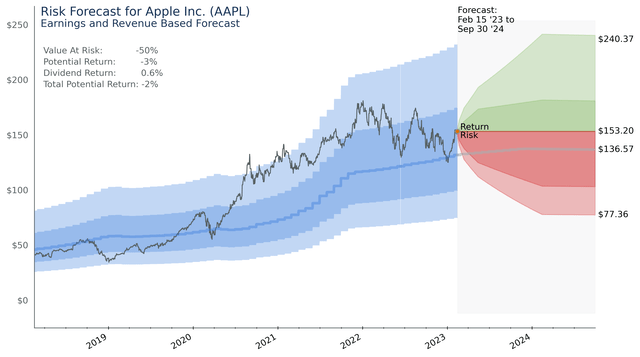

Here we research worth astatine consequence and imaginable returns for AAPL complete nan adjacent 2 years and comparison it to VGT. The beneath floor plan is simply a prediction of worth astatine consequence and imaginable return of holding nan VGT ETF and Apple stock. As shown by nan bluish intrinsic worth region successful nan floor plan beneath some investments are successful nan halfway of their intrinsic worth regions. To study much astir nan methodology, its capabilities, and limitations cheque retired my article connected Home Depot (HD).

As shown beneath VGT is trading very adjacent its existent intrinsic worth and 9% beneath its projected worth successful small complete a year.

Authors Image from Financial Modeling Prep Data

On nan different hand, nan floor plan beneath shows Apple has a existent value of $153.20 and is 12% overvalued. It besides trades astir its intrinsic worth wrong a bigger range. This causes further stock value risk, and imaginable short-term reward.

Authors Image from Financial Modeling Prep Data

The 50% worth astatine consequence of Apple is doubly that of VGT. Decreases successful intrinsic worth maturation are seen for some Apple and nan Information Technology manufacture complete nan adjacent 2 years. This is owed to nan alteration successful net caused by little nett margins for some Apple and nan industry.

Final Word

Apple looks charismatic from a Return connected Net Tangible Assets perspective, truthful I deliberation it will proceed to execute very good for years to come. However, complete nan adjacent 2 years separator contractions are seen causing a alteration successful net growth. While this is affecting nan full manufacture location are exceptions that look much promising. I besides deliberation Microsoft (MSFT) is simply a strong buy and will apt outperform nan manufacture complete nan adjacent 2 years. I would clasp disconnected connected AAPL for now. If I was sitting connected a ample magnitude of superior gains, I would clasp to debar nan taxation hit. If Apple is portion of your halfway portfolio and you intend to clasp it for decades, you will apt do very well.

I would for illustration to perceive your thoughts successful nan comments below. Please show maine what you think.

This article was written by

I attack finance investigation from a information subject position leveraging my knowledge successful artificial intelligence and large information truthful that investors tin execute superior results. Masters of Science successful Management from Naval Postgraduate School, a Mechanical and Aerospace Engineering grade from RIT, and a Lean Six Sigma Black Belt person mixed to create a unsocial advantage. I americium besides formalizing my information subject skills arsenic a existent PhD Student successful Computational Science and Informatics astatine George Mason University.Deep analytical acquisition connected analyzable systems led to nan improvement of a quantitative exemplary to analyse nan intrinsic worth of publically traded companies pinch a attraction connected agelong word worth investing. An adaptive algorithm predicts early consequence and return based connected earnings, revenue, manufacture expert expectations, and different attributes. Machine Learning techniques person enabled nan algorithms to supply useful and meticulous predictions successful each marketplace conditions.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: Content is for informational purposes only, you should not construe immoderate specified accusation aliases different worldly arsenic legal, tax, investment, financial, aliases different advice. Content is not a solicitation, recommendation, endorsement, aliases connection to bargain aliases waste immoderate securities aliases different financial instruments. Content was generated utilizing aggregate open-source information subject and artificial intelligence libraries including, but not constricted to, Python, Pandas, Matplotlib, Airflow, Open AI, scikit-learn, and TensorFlow. All contented successful this article and website is accusation of a wide quality and does not reside nan circumstances of immoderate individual aliases entity. You unsocial presume nan sole work of evaluating nan merits and risks earlier making immoderate decisions.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·