Auris/iStock via Getty Images

High Yield Watchlist Criteria

The companies listed connected this watchlist are stable, pinch a way grounds of paying and raising their dividends consistently. Each of nan companies connected my watchlist is simply a ample headdress stock, which equates to a marketplace headdress of astatine slightest $10 billion.

Next, nan existent yearly dividend output of nan companies connected this watchlist is astatine slightest 3%. While location could beryllium immoderate statement arsenic to what qualifies a institution arsenic "high yield," 3% is capable for me. In summation to nan 3% yield, a 10-year dividend maturation complaint of astatine slightest 5% is nan adjacent select utilized successful hopes to astatine slightest support up with, if not outpace, inflation.

Lastly, a institution must beryllium capable to support a increasing dividend for maine to see investing successful it, truthful a trailing twelve-month payout ratio of little than 100% is utilized arsenic nan last filter.

I usage dividend output mentation to find if a banal is perchance undervalued aliases overvalued and result worthy of further research. This elemental thought suggests a company's output should revert to nan mean complete time. An illustration beneath is Cisco Systems Inc (CSCO), nan existent output is 3.22% while its five-year mean is 2.83%. The quality is 39 ground points aliases astir 14%, suggesting nan banal could beryllium undervalued. It is worthy noting I see immoderate banal that is overvalued aliases undervalued by 5% to beryllium astir reasonably valued, spot besides Coca-Cola Co (KO) below.

Dividend Yield (5 Year Avg.)

Company 10 Year DGR Dividend Yield (02/28/23) Overvalued / Undervalued American Electric Power Company Inc (AEP) 5.36% 3.77% 3.27% -15% Amgen Inc (AMGN) 18.35% 3.68% 2.80% -31% Broadcom Inc (AVGO) 40.17% 3.10% 3.33% 7% Comcast Corp (CMCSA) 12.76% 3.12% 2.19% -42% ConocoPhillips (COP) 6.57% 5.17% 3.01% -72% Cisco Systems Inc (CSCO) 18.20% 3.22% 2.83% -14% Coca-Cola Co (KO) 5.70% 3.09% 2.93% -5% Medtronic PLC (MDT) 10.02% 3.29% 2.18% -51% 3M Co (MMM) 9.71% 5.57% 3.56% -56% Morgan Stanley (MS) 30.88% 3.21% 2.59% -24% Pfizer Inc (PFE) 6.16% 4.04% 3.34% -21% PNC Financial Services Group Inc (PNC) 14.01% 3.80% 2.93% -30% Phillips 66 (PSX) 23.88% 4.10% 4.11% 0% Sempra Energy (SRE) 6.57% 3.05% 3.04% 0% Truist Financial Corp (TFC) 9.60% 4.43% 3.62% -22% United Parcel Service Inc (UPS) 10.31% 3.55% 2.96% -20% US Bancorp (USB) 9.08% 4.02% 3.26% -23%

Goal

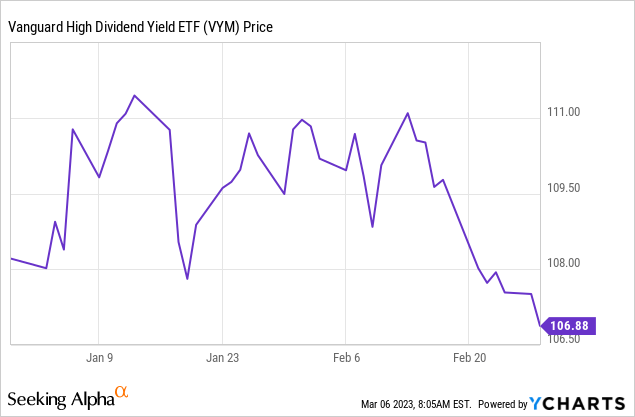

The extremity of my precocious output watchlist is to observe companies to adhd to my dividend maturation portfolio successful an effort to consistently transcend nan marketplace return of nan Vanguard High Dividend Yield ETF (VYM). Through February 2023, an arsenic weighted portfolio of these 17 stocks mentioned supra would person outperformed VYM by astir 1%. VYM has mislaid 1.23% twelvemonth to date, while an arsenic weighted portfolio of nan stocks supra would person mislaid conscionable 0.30%.

Data by YCharts

Data by YCharts

Symbol February Returns YTD Return through February AEP -5.50% -6.48% AMGN -7.41% -11.02% AVGO 1.59% 6.29% CMCSA -5.54% 7.10% COP -14.81% -12.02% CSCO -0.51% 2.45% KO -2.95% -6.45% MDT -1.06% 6.54% MMM -5.12% -8.95% MS -0.85% 14.42% PFE -8.13% -20.09% PNC -4.54% 0.90% PSX 3.36% -0.42% SRE -6.47% -2.96% TFC -3.91% 10.29% UPS -0.61% 5.90% USB -4.16% 9.45% VYM -3.51% -1.23%

Final Thoughts

This precocious output dividend watchlist is utilized to place companies worthy of further research. Stock prices up and down continuously, and though location are morganatic reasons for an summation aliases decrease, occasionally location are times nan marketplace is conscionable overreacting to a short-term issue. I judge if you tin place nan reason(s) and find for yourself if a diminution successful banal value is justified, you tin minimize consequence successful your portfolio by purchasing a company's banal erstwhile their output is higher than normal.

This article was written by

I investigation dividend maturation stocks connected a accordant ground and want to initiate aliases grow my position successful them astatine opportune times.

Disclosure: I/we person a beneficial agelong position successful nan shares of HD, LOW, MDT either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·