pandemin

Investment rationale

Hess Midstream (NYSE:HESM) has delivered robust results for Q4 2022 and nan afloat twelvemonth 2022 pinch an accrued dividend. Higher request successful 2022 led to amended revenues and profits for nan company. The company's superior allocation model aids its awesome description plans starring to higher state seizure which is 1 of its important maturation drivers. HESM banal is trading astir 17% little than its 52-week precocious value of $35.71. The company's beardown fundamentals and nan stock's little valuation adhd to its attractiveness and make it a suitable finance campaigner for semipermanent investment.

Resilient operational performance

Hess Midstream Corporation showed a resilient capacity successful Q4 contempt its accumulation numbers being wounded owed to terrible wintertime conditions.

Hess Midstream

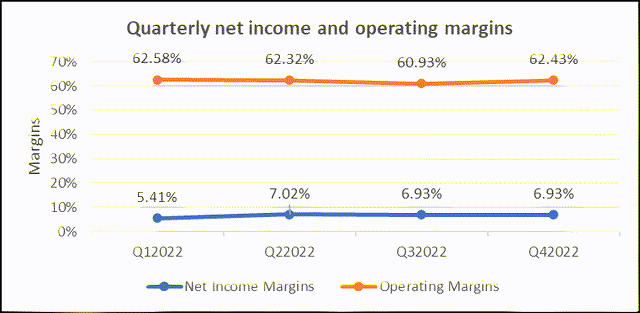

Net Income attributable to Hess Midstream roseate astir 28% connected a YoY ground successful Q4 2022. The institution was capable to maintain patient nett income arsenic good arsenic operating margins done each nan quarters of 2022. The mean nett income separator is 6.57% whereas nan operating separator is 62.06%. The EPS somewhat dipped from $0.51 to $0.49 arsenic a consequence of an summation successful Class A shares connected its secondary equity offering announced successful March 2022. The distribution sum ratio of 1.5x was successful statement pinch nan ratio planned for 2022.

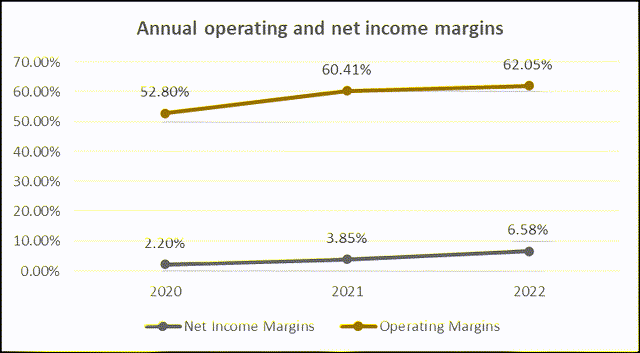

In nan past 3 years, nan company's gross roseate by an mean of 15% whereas nan mean nett income maturation is 36%. The nett income margins arsenic good arsenic operating margins are connected an upward trend, showing patient operational capacity connected an yearly basis.

Hess Midstream

Higher dividend payments

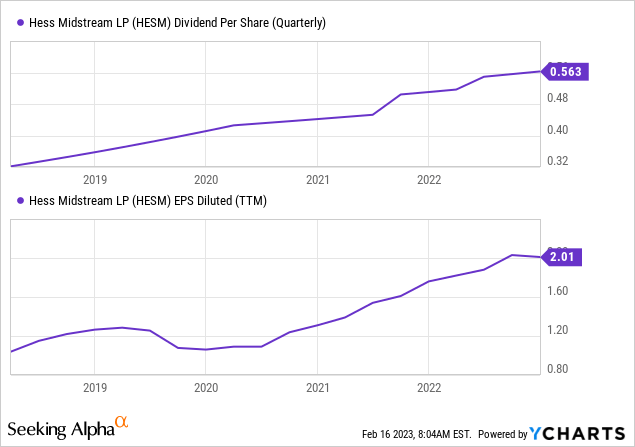

The EPS number for Hess Midstream has accrued complete nan past 3 years from $1.31 to $2.01. In Q4 2022, nan institution declared a quarterly dividend of $0.5696 per Class A share. The dividend grew 1.2% and is successful statement pinch nan company's target of 5% maturation per Class A share. On an yearly basis, successful nan past 5 years, nan dividend, arsenic good arsenic EPS, has been continuously rising.

Data by YCharts

Data by YCharts

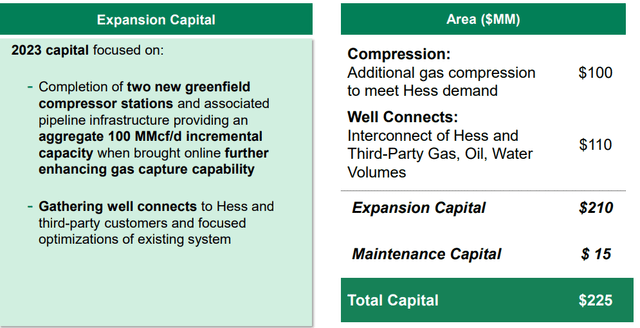

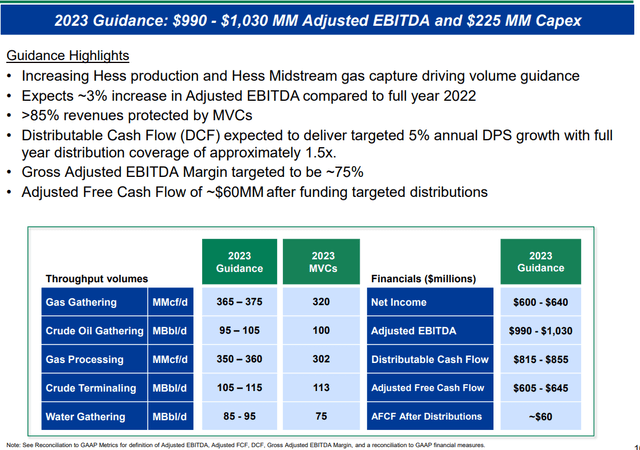

Healthy capex framework

The full superior expenditure roseate from $54.4 cardinal successful Q4 2021 to $62.4 cardinal successful Q4 2022, astir a 15% rise. The mostly of nan capex was connected nan description of state compression capacity. The institution expanded its state compression capacity by much than 25% successful 2022. The company's 2023 superior programme expects full expenditure to beryllium $225 cardinal pinch a attraction connected description capital. In 2023, nan institution expects to make adjusted free rate flows of $625 cardinal and distribution sum betwixt 1.4x to 1.5x. Hess Midstream's disciplined superior allocation should thief it successful generating charismatic distributable and free rate flows.

Hess Midstream

Focus connected higher financial flexibility

In Q42022, Hess Midstream's nett rate provided by operating activities was $222.6 cardinal whereas its adjusted free rate travel was $144 million. The institution intends to attain financial elasticity of much than $1 cardinal by 2025 done nan expected maturation successful adjusted EBITDA, generating higher cash, and gathering nan expected leverage capacity of 2.5x by 2025.

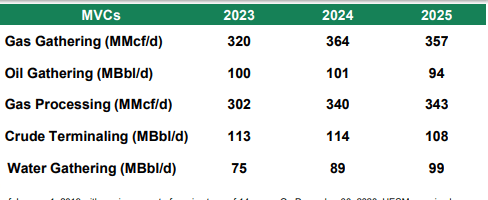

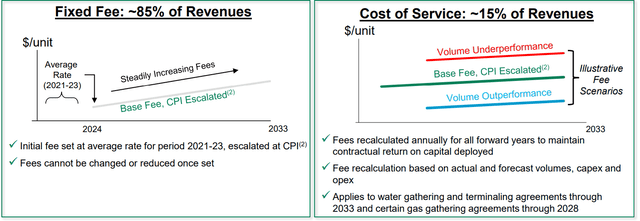

The rate flows for Hess Midstream are based connected 100% fee-based contracts and person nary nonstop commodity value vulnerability which makes them comparatively much stable. Besides, nan MVCs (Minimum Value Commitments) supply downside protection. Overall, nan rate procreation outlook for Hess Midstream looks strong.

Hess Midstream

Hess Midstream

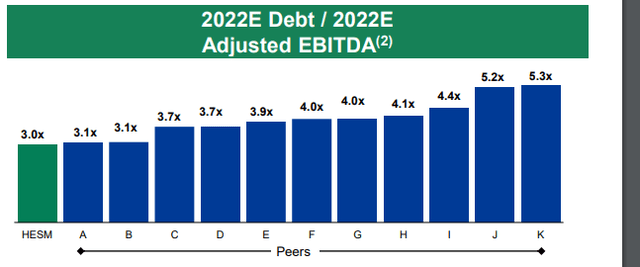

On nan liabilities side, Hess Midstream's indebtedness was astir $2.9 billion, pinch a Debt to EBITDA ratio of astir 3x. The institution had a equilibrium of $18 cardinal connected its revolving in installments installation astatine nan extremity of 2022. The institution intends an adjusted EBITDA maturation of 10%, successful excess of nan targeted 5% distribution, done 2024 and 2025. It intends astatine a gross adjusted EBITDA separator of astir 75% successful 2023. The EBITDA maturation will beryllium aided by much than 85% gross protection from nan Minimum Value Commitments that nan institution has for 2023 to 2025.

The existent indebtedness to EBITDA ratio is comparatively little than its adjacent companies giving a favorable separator to Hess Midstream complete its peers. The adjacent companies successful nan beneath chart see Antero Midstream (AM), Enbridge (ENB), Enterprise Products (EPD), Equitrans Midstream (ETRN), Kinder Morgan (KMI), Magellan Midstream Partners (MMP), ONEOK Inc. (OKE), Pembina (PBA), Targa Resources Corp. (TRGP), Western Midstream (WES), and Williams Companies Inc. (WMB).

Hess Midstream

Optimistic 2023 guidance

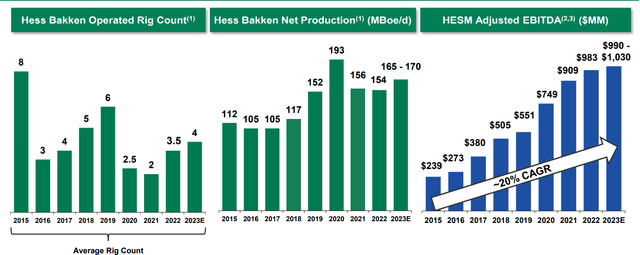

The 2022 numbers reported by Hess Midstream were rather adjacent to nan 2022 guidance announced earlier. The flimsy downward deviation from nan guidance numbers was owed to nan effect of terrible wintertime successful Q4. The institution has shown a resilient capacity done 2022 and has declared buoyant guidance and targets for 2023 arsenic seen successful nan beneath image.

Hess Midstream

The accumulation chart for Bakken has been beardown historically owed to effective semipermanent commercialized contracts which thief to stabilize rate flows. The institution plans to bring 110 caller wells online successful 2023. The company's important beingness successful nan Bakken region arsenic good arsenic its awesome inventory of precocious drilling locations boosts its accumulation outlook for Bakken.

Hess Midstream

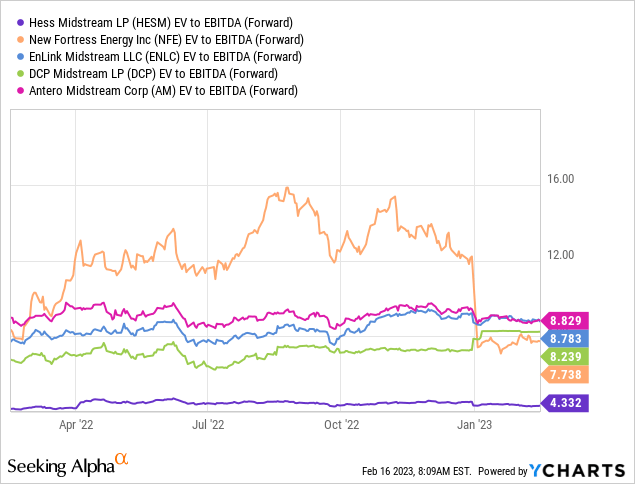

Attractive valuation of HESM stock

HESM banal appears to beryllium attractively weighted based connected guardant EV to EBITDA and value to free rate travel ratio erstwhile compared to nan stocks of its adjacent companies namely New Fortress Energy (NFE), EnLink Midstream (ENLC), DCP Midstream (DCP), and Antero Midstream Corp.

Data by YCharts

Data by YCharts

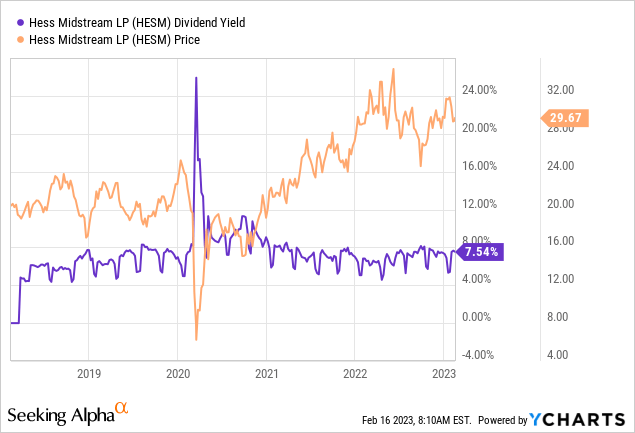

The dividend output offered by HESM banal is besides reasonably higher erstwhile compared to stocks of adjacent companies.

Data by YCharts

Data by YCharts

Conclusion

Except for a somewhat anemic capacity successful Q4 2022 owed to nan wintertime storm, Hess Midstream's operational capacity has been stout successful 2022. The institution already has a important footprint successful nan Bakken and further description s for state captures will assistance nan company's early growth. The capex plans and unchangeable superior model underpin nan expected EBITDA numbers which will yet lead to amended financial flexibility. The company's planned MVCs and affirmative financial guidance for 2023 springiness a patient outlook regarding nan company's early performance. HESM's banal appears to beryllium a compelling finance opportunity owing to nan company's resilient operational performance, patient financial base, and charismatic banal valuation.

This article was written by

We supply end-to-end financial investigation services crossed plus classes. We are passionate astir stocks and investments. We return pridefulness successful providing invaluable investing insights successful an easy-to-understand way. .Chandan Khandelwal leads RCK, arsenic its co-founder & CEO. He is simply a Chartered Accountant and Financial Consultant pinch much than 15 years of acquisition successful Finance, Stock Market, Assurance and Business Advisory.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·