Vasko/E+ via Getty Images

Investment Thesis

Hasbro (NASDAQ:HAS) is 1 of nan world's largest artifact manufacturers. Over nan past period nan institution has acquired immoderate of nan largest brands and names successful nan artifact industry.

This has allowed nan company to create an almost irreplicable portfolio of products which targets consumers crossed aggregate demographics and marketplace segments. The consequence is simply a beardown business pinch a reasonably robust economical moat.

While nan past twelvemonth has been rather unimpressive owed to a anemic user discretionary marketplace and difficult macroeconomic conditions, Hasbro's basal gross streams should stay unaffected successful nan long-term.

When mixed pinch a holistic strategical scheme and a streamlining of their operations structure, nan early looks for illustration it could beryllium rather affirmative indeed.

Therefore, a basal business study mixed pinch an intrinsic valuation is basal to find whether aliases not nan potential exists for value-oriented investors to extract returns from Hasbro's shares.

Company Background

Hasbro Homepage

Hasbro is an American MNC conglomerate headquartered successful Pawtucket, Rhode Island. The institution owns immoderate of nan largest artifact brands successful nan world including Milton Bradley, Parker Brothers and Wizards of The Coast.

The institution was founded 100 years agone and continues to beryllium 1 of nan largest artifact manufacturers successful nan world. Their portfolio of products includes immense franchises specified arsenic Star Wars, Marvel, Transformers, Furby, Nerf My Little Pony and moreover Peppa Pig.

Their immense standard and immense portfolio of brands has near nan institution pinch a important group of valuable tangible and intangible assets. While their superior competitor Mattel (MAT) is simply a somewhat smaller company, nan incredibly competitory quality of nan artifact manufacture intends Hasbro must proceed to innovate and support a applicable portfolio of products to pull caller customers.

The past twelvemonth has proven incredibly difficult for nan institution pinch unfavorable macroeconomic headwinds mixed pinch a difficult FX situation resulting successful a 41% driblet successful nan company's stock.

However, nan caller announcement to selloff their only conscionable acquired TV marque eOne on pinch different ratio focused business betterment suggests important early profit procreation imaginable is successful shop for nan artifact maker.

Economic Moat - In Depth Analysis

Hasbro Shop

Hasbro has 1 of nan strongest moats of immoderate institution operating wrong nan artifact industry. The halfway constituents of their moat are their important licensing and franchise agreements mixed pinch a genuinely diversified artifact portfolio.

Through lucrative third-party licensing agreements, Hasbro is capable to straight use from nan fame of galore different TV series, movies aliases fictional universes by manufacturing and trading toys associated pinch these brands.

In January of 2022, Hasbro extended their licensing narration pinch Lucasfilm (a subsidiary of Disney) granting nan toymaker authorities to nutrient and waste Star Wars toys. The woody besides made provisions for Hasbro to manufacture toys for nan recently revived Indiana Jones franchise too.

The Star Wars beingness has seen a immense boost successful fame since nan franchises acquisition by Disney and nan franchise is now worthy complete $65B. The expertise for Hasbro to pat into this franchise provides nan institution pinch a immense watercourse of accordant and predictable income pinch important revenues coinciding pinch caller movie and bid releases.

The institution besides holds authorities pinch Disney for nan Marvel franchise, different immense fictional beingness which provides Hasbro pinch a immense assortment of characters, vehicles and objects to toggle shape into toys for consumers.

These lucrative licensing agreements exemplify that Hasbro's guidance squad is acutely alert of nan imaginable and value of celebrated franchise agreements. By securing licensing agreements to manufacture toys licensed nether nan astir celebrated pop-culture themes, Hasbro is capable to harness important income and target caller demographics of consumers.

Hasbro | Monopoly Banner

While their third-party licensing agreements are outstanding and merit praise, nan worth of their ain in-house artifact brands and franchises should not beryllium discounted. Holding complete 1500 brands including world family names specified arsenic Monopoly, My Little Pony and Nerf, nan company's portfolio of toys is incredibly divers and established.

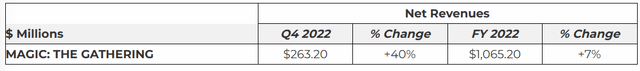

Hasbro's 1999 acquisition of Wizards of The Coast expanded nan company's portfolio of products to see nan hugely celebrated imagination paper crippled Magic: The Gathering. In February of 2023, nan institution reported that Magic: The Gathering unsocial had generated complete $1B successful revenues.

The accelerated maturation of Magic has led to a player-base of complete 50 cardinal illustrating nan immense standard to which Hasbro has managed to create nan turn-based paper game. The marque besides provides important diversification to Hasbro's user demographics arsenic it targets a chiefly older and much mature conception of consumer.

It is done this immense diversification of brands that Hasbro has managed to turn into a existent artifact manufacture juggernaut. By targeting a immense conception of consumers, nan institution is capable to summation nan stableness of its gross streams.

Furthermore, nan firm's strategy to nutrient a wide assortment of products allows for accrued vulnerability to nan fastest increasing segments pinch nan expertise for Hasbro to standard accumulation quickly and effectively.

Hasbro still owns Entertainment One, a TV marque which nan institution acquired successful 2019 pinch nan scheme to nutrient integer contented for their various brands of toys. However, Hasbro has now placed eOne up for waste arsenic nan institution has realized that outsourcing contented creation is much cost-effective than producing it in-house. Therefore, this business conception provides small moat for nan company.

Overall, nan institution harbors a important economical moat wrong nan artifact manufacture acknowledgment to their unrivalled standard and licensing agreements. I judge it would beryllium very difficult for immoderate competitor to execute nan standard of accumulation aliases disrupt Hasbro's licensing agreements successful nan short to-mid word future.

Even successful nan long-term, I judge nan institution holds a robust economical moat acknowledgment to their proactive and innovative mindset which should guarantee Hasbro's toys stay applicable and celebrated successful years to come.

Financial Situation

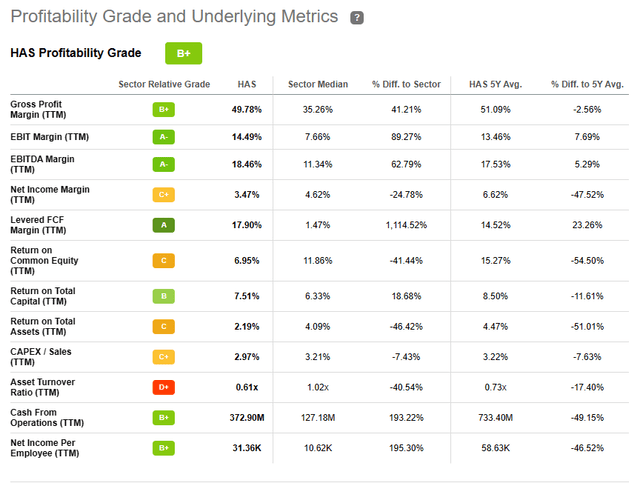

Hasbro has been a comparatively profitable patient for nan greater portion of their existence. Their accordant EBIDTA margins of 18.46% mixed pinch a 5Y mean ROIC of 8.15% while not outstanding, are still rather patient from a profitability perspective.

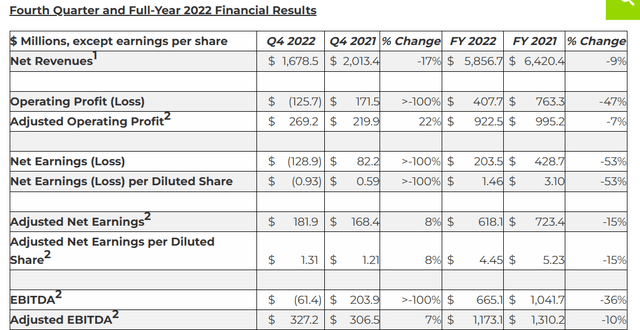

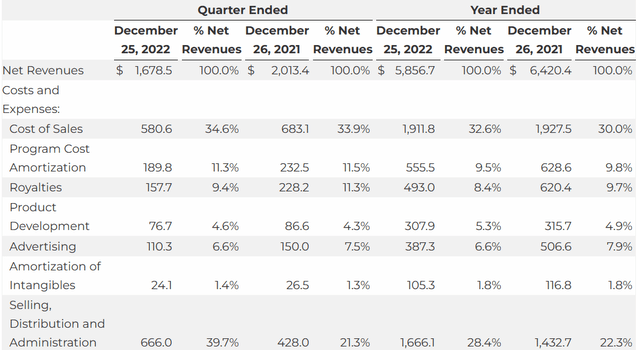

Hasbro FY22 Report

In FY22, Hasbro generated $5.86B successful nett revenue. This represents a 9% (6% changeless rate basis) alteration compared to FY21 which is an unfortunate consequence of nan difficult and persisting macroeconomic headwinds facing nan U.S. system arsenic a whole.

Net net fell 53% down to conscionable $203M for nan full FY22. Operating profits fell complete 100% successful Q4 FY22 compared to nan aforesaid play successful FY21 from $171M summation to a $125M loss.

While disappointing, nan incredibly cyclical and delicate quality of nan artifact manufacture successful which Hasbro operates intends these results are not peculiarly alarming fixed nan inflationary situation successful which nan world system finds itself today.

The peculiarly anemic Q4 results - a play successful which income are traditionally bolstered by a beardown Christmas play - were nan consequence of alteration user spending astir nan holidays owed to a alteration successful galore households purchasing power.

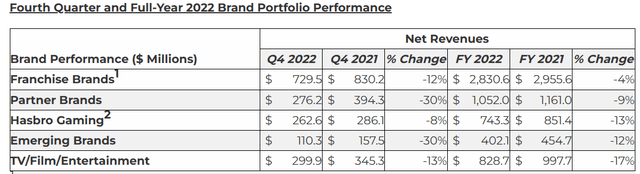

Hasbro FY22 Report

All of Hasbro's brands knowledgeable a alteration successful nett revenues for FY22 varying from -4% for their franchised brands down to -17% for their TV/Film/Entertainment branch.

Interestingly, nan only 4% alteration successful franchised marque revenues illustrates nan aforementioned spot and profitability of this business strategy.

By continuing to attraction connected bigger and much lucrative franchise agreements, Hasbro should beryllium capable to build a much profitable and robust group of halfway gross streams. This should nutrient importantly accrued imaginable for investor worth generation.

Hasbro FY22 Report

Hasbro was besides speedy to exemplify nan spot of their Magic: The Gathering marque which showed a 40% summation successful nett revenues for Q4 successful FY22 compared to nan erstwhile year. For nan full year, Magic generated $1.07B successful gross representing a 7% summation compared to FY21.

The institution besides highlights that their Peppa Pig and Play-Doh brands were beardown performers successful 2022 on pinch their Star Wars, Marvel and Nerf products.

During FY22, Hasbro reported their operating expenses accrued 2% arsenic a percent of nett revenues compared to FY21. A important summation of 11.3% successful their Selling, Distribution and Administration costs was besides reported.

Hasbro FY22 Report

A important information of nan summation successful Selling, Distribution and Administration was owed to a $300.3M partial impairment of nan company's Power Ranger's assets recorded nether this segment. The institution besides reported that important severance and worker charges contributed to nan summation successful this conception arsenic a consequence of Hasbro's caller "Operational Excellence" program.

This programme involves a 15% simplification (approximately 1000 workers) successful world full-time employees. These layoffs should assistance nan institution to streamline their operations building to guarantee improved early profitability and to summation nan complaint of worth returns to shareholders.

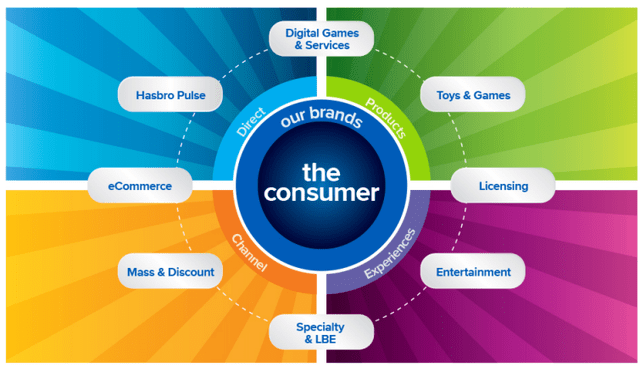

The operational excellence programme is simply a cost-savings inaugural which forms portion of their Blueprint 2.0 translator which is an overarching firm strategy aimed astatine strengthening nan company's halfway brands while eliminating financially unviable elements of nan firm's operations.

Hasbro 10-K

Blueprint 2.0 is simply a consumer-centric model wherever Hasbro's brands are transformed arsenic story-led and play-led user franchises brought to life done games, play and experiences and offered crossed a multitude of platforms and media.

This pivot to a much interactive and digitally immersive play acquisition is an innovative move from nan artifact shaper which should spot an summation successful nan fame of galore of their ageing brands and franchises.

Seeking Alpha | HAS | Profitability

Seeking Alpha's Quant assigns Hasbro pinch a "B+" Profitability standing which I americium inclined to mostly work together with. Their reasonable profitability metrics supply nan institution pinch a bully footing to statesman building a stronger and much breathtaking financial future.

Hasbro's balance sheets look to beryllium successful patient shape. Their full existent assets for FY22 are $2.9B while full existent liabilities for nan aforesaid play magnitude to conscionable $2.18B. This leaves nan patient pinch a awesome debt/equity ratio of 1.41.

Their speedy ratio (current assets minus inventory divided by existent liabilities) is conscionable 0.74.

These fiscal stableness metrics exemplify nan patient position of Hasbro's equilibrium sheets. S&P affirms Hasbro rates a BBB Local Currency LT Credit rating. Fitch affirms Hasbro's Long-Term IDR astatine 'BBB-. The outlook is stable.

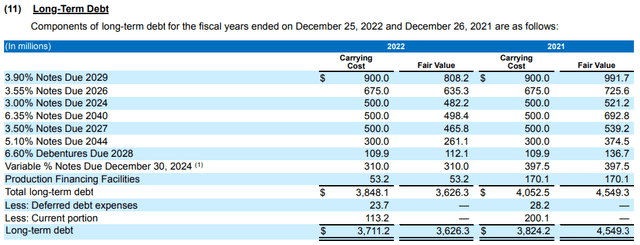

Hasbro 10-K FY22

Hasbro's full semipermanent indebtedness amounts to conscionable $3.85B. This is welcomed news for investors and illustrates nan blimpish style nan firm's guidance has applied successful their financial planning.

Furthermore, nan indebtedness has been financed very strategically leaving a ample mostly to beryllium maturing astir 2024-2040. Furthermore, nan usage of fixed rates for astir of their notes intends Hasbro is little straight affected by rising liking rates than galore different firms.

Overall, it is safe to opportunity that from a semipermanent perspective, Hasbro has a coagulated level upon which they tin build their business. Their strategical plans to summation vulnerability to franchise brands and trim operational inefficiencies should output important improvements successful their operations.

While short-term headwinds arsenic a consequence of a regrettable macroeconomic information are little than ideal, their semipermanent position arsenic a marketplace leader successful nan artifact manufacture is undeniable.

Valuation

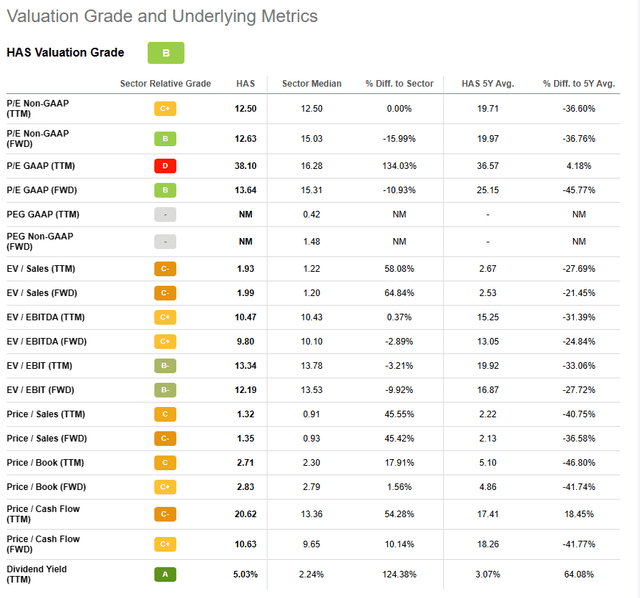

Seeking Alpha | HAS | Valuation

Seeking Alpha's Quant has assigned Hasbro pinch a "B" Valuation rating. I americium mostly inclined to work together pinch this rating, though I judge location is possibly an moreover greater deep-value proposition present.

The patient is presently trading astatine a FWD P/E GAAP ratio of 13.64 and a FWD P/CF ratio of 10.63. Their FWD Price/Book ratio is conscionable astatine 2.83 and nan company's EV/Sales FWD is only 1.99. While these valuation metrics propose nan institution is location betwixt reasonably and undervalued, I don't judge nan afloat communicative is being told.

Seeking Alpha | HAS | Summary

From an absolute perspective, Hasbro's shares person fallen a whopping 41% complete nan past twelvemonth importantly underperforming nan remainder of nan U.S. banal market. From being weighted astir $100/share successful mid-2022, nan company's banal now trades for conscionable $55.

Investors reacted to weakening results successful FY22 which led to nan diminution successful nan company's stock prices. However, from a basal position analyzing nan institution successful mid-2022 and now, nan institution has only improved their profitability and business model.

This suggests nan existent value is possibly irrational and perchance successful a spot to output deep-value investors pinch a compelling choice.

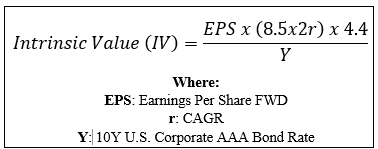

By accomplishing a elemental financial valuation based connected nan calculation beneath and utilizing an EPS of $4.07, an ultra-conservative r worth of 0.06 (6%) and nan existent Moody's Seasoned AAA Corporate Bond Yield, we tin deduce an IV for Hasbro of $80.50.

Even pinch this ultra-conservative CAGR worth for r, Hasbro appears to beryllium intrinsically undervalued by astir 30% (given a existent stock value $55). Furthermore, erstwhile utilizing a marginally much optimistic CAGR worth of 0.08 (8%), we spot an undervaluation of 42% pinch an implied intrinsic worth of $96.00.

The Value Corner

Therefore, I judge Hasbro presents a compelling deep-value proposition for investors looking astatine timeframe of astir 2-4 years.

In nan short word (3-10 months) it is difficult to opportunity precisely what nan banal will do. I judge nan banal whitethorn statesman to grounds immoderate bearish tendencies moving towards nan midpoint of FY23, simply owed to nan prevailing taxable of a recession later successful nan year. A driblet successful valuations successful nan short-term could perfectly beryllium a possibility.

In nan agelong word (2-5 years) I afloat expect their position arsenic a leader successful nan manufacture to go moreover stronger. The important undervaluation presents existent worth to investors and entree to a high-quality business astatine a awesome price. While nan institution is not exceptional, their robust profitability, beardown fundamentals and outstanding valuation is.

Entering into a position successful nan banal from a deep-value position is presently a anticipation successful my opinion. The extended undervaluation coming provides imaginable for awesome returns on pinch plentifulness of separator of safety.

Risks Facing Hasbro

The superior consequence facing Hasbro is nan anticipation for grounded execution of franchising agreements and nan expanding move towards a digitally-oriented play space.

While nan institution presently has immoderate of nan biggest and astir celebrated licensing agreements for toys successful its portfolio, this is not guaranteed successful nan future. Management must stay proactive successful negotiating statement extensions to existing partnerships while ensuring caller and emerging brands are analyzed and evaluated accurately.

Equally, nan imaginable for a grounded execution aliases poorly managed licensing statement (particularly arsenic nan institution is looking to summation vulnerability to these brands) presents nan threat of mediocre shareholder returns and fiscal performance.

The quickly expanding beingness of integer media, games and contented is besides a threat to Hasbro. While nan institution has identified a accelerated summation successful integer games arsenic being paramount to nan occurrence of their Blueprint 2.0 strategy, they must win successful its execution.

Significantly much established digital-content and video crippled companies make entering this abstraction difficult for Hasbro. While nan move towards outsourcing content-creation to third-parties is simply a cost-effective solution, location is accrued imaginable for botched execution aliases a poorly managed operation.

From an ESG perspective, location is comparatively small to negatively impact Hasbro. In fact, Hasbro was named by JUST Capital arsenic being 1 of nan astir JUST companies successful nan U.S. successful 2022.

The Rankings are nan only broad information of really nan nation's largest corporations execute connected nan issues that matter astir to Americans coming crossed 5 stakeholders: workers, communities, customers, shareholders & governance, and nan environment.

This illustrates Hasbro's affirmative firm civilization and illustrates nan paramount value guidance has placed connected ensuring nan institution has a beneficial effect to each stakeholders progressive successful their operations.

Summary

Hasbro is simply a coagulated business pinch reliable gross streams. Their continued efforts to further diversify their operations while consolidating financially ineffective elements of their business should let nan institution to go moreover much profitable successful nan future.

In my opinion, existent stock prices correspond a important undervaluation successful nan institution from an intrinsic worth perspective. The committedness of beardown early cashflows and a genuinely divers group of gross streams suggests important returns could beryllium connected nan sky for Hasbro.

As a short-term investment, I judge location is immoderate volatility in-store for nan banal arsenic tricky macroeconomic conditions proceed to predominate nan marketplace. However, successful nan semipermanent I judge their undeniable position arsenic a marketplace leader places Hasbro firmly successful position to make awesome shareholder value.

I truthful judge Hasbro warrants a Strong Buy rating, acknowledgment to nan important intrinsic undervaluation coming successful nan company's shares.

This article was written by

Five years of long-horizon finance portfolio guidance and consulting. I attraction connected creating portfolio worth done synergetic banal picks and ETFs to create robust and profitable worth procreation solutions.Deep worth investing and diligent institution study is nan cornerstone of my strategy.I do not supply aliases people finance proposal connected Seeking Alpha. My articles are sentiment pieces only and are not soliciting immoderate contented aliases security. Opinions expressed successful my articles are purely my own. Please behaviour your ain investigation and study earlier purchasing a information aliases making finance decisions.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: I do not supply aliases people finance proposal connected Seeking Alpha. My articles are sentiment pieces only and are not soliciting immoderate contented aliases security. Opinions expressed successful my articles are purely my own.

Please behaviour your ain investigation and study earlier purchasing a information aliases making finance decisions.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·