PhonlamaiPhoto

This article first appeared to subscribers of Green Growth Giants connected October 14, 2022. Shares person risen complete 27% since I first recommended nan institution to members; this article has been updated to relationship for caller events.

I've been watching Green Technology Metals (OTCPK:GTMLF) (GT1 connected nan ASX) ever since Lithium Americas (LAC) announced its finance successful nan institution early past year. The Australian lithium inferior has a number of claims successful Canadian spodumene deposits that it is presently successful nan process of developing. This article will activity to understand what imaginable Lithium Americas whitethorn person seen successful nan institution and if it is worthy an investment.

Early Beginnings

Before I get excessively acold into nan company's assets, I do want to concisely talk nan origins of GT1. The institution made its nationalist debut connected November 8, 2021, not agelong after it first started operations. Prior to its nationalist listing, GT1 announced that it would beryllium acquiring an 80% liking successful nan Canadian lithium projects held by Ardiden Limited, a golden exploration company.

The transaction cost GT1 a full of $5.9 million, which was surgery into 4 payments. A $125,000 action interest and $1 cardinal successful rate aft Ardiden shareholders approved nan transaction were some paid successful cash. A $2.55 cardinal payment, paid 43.75% successful rate and 56.25% successful equity, was owed nary later than six months later. The last costs of $2.25 cardinal was to beryllium made nary later than 18 months aft nan first transaction.

Additionally, while retaining 20% equity successful nan projects, Ardiden was not responsible for immoderate improvement costs for nan task until a definitive feasibility study ("DFS") aliases determination to excavation was produced. However, connected October 24, GT1 announced that it had entered into an statement pinch Ardiden to get nan remaining 20% ownership successful its Seymour, Wisa, and Root lithium projects for up to $18.5 cardinal AUD.

There will beryllium an upfront costs of $16 cardinal AUD, followed by a $2.5 cardinal AUD costs should GT1 specify a mixed assets of much than 20 cardinal tonnes crossed nan 3 projects. While this eats into nan company's $29.8 cardinal AUD rate reserve (as of December 30, 2022), it is simply a tremendous measurement successful securing nan company's early spot and still leaves capable money for important task development.

In a akin move to unafraid its future, GT1 announced, connected October 10, that it had entered into an statement pinch Landore Resources (OTCPK:LNDLF) to destruct its 3% royalty for nan Root project. This will beryllium done successful steps, pinch an first costs of $1.46 cardinal (2 cardinal CAD) to trim nan royalty to 1.5%. The Root task is still mostly unexplored, which GT1 looks to capitalize connected by eliminating nan royalty for acold little than it different would beryllium capable to. Such a move besides demonstrates assurance successful a successful exploration program.

Asset Overview

Ardiden's Canadian holdings included nan Seymour, Wisa, and Root lithium projects, covering a full area of 9,467 hectares. However, nan institution has been difficult astatine activity to summation its claims, pinch its holdings crossed Ontario now covering a full of 40,797 hectares. This includes a caller project, nan Allison project, which covers a full of 9,598 hectares.

The existent resource estimate for nan Seymour project, published successful June, is 9.9 cardinal tonnes astatine an mean attraction of 1.04% Li20 (~250,000 tonnes LCE). Just complete half of this estimate is indicated (a very precocious level of confidence), 53% to beryllium exact, but nan cutoff people of conscionable .2% is somewhat low. Though, astatine a cutoff people of .6%, nan assets estimate only drops to 7.3 cardinal tonnes pinch an mean assets purity of 1.27% (~230,000 tonnes LCE).

Especially considering nan younker of ongoing exploration, this is simply a beautiful coagulated resource. The people isn't needfully thing extraordinary, but it should beryllium much than axenic capable to let for economical extraction. But, looking astatine GT1's property releases since nan assets estimate was published, investors whitethorn beryllium capable to get an thought of why nan younker of exploration is important to see here.

To clarify, nan grade of exploration extends acold beyond GT1's tenure arsenic nan task lead. Ardiden drilled a full of 130 holes erstwhile nan task was nether its ownership, adding to nan 42 drilled by Linear Gold, nan site's erstwhile owners. The aforementioned assets estimate relied upon those holes, arsenic good arsenic 21 drilled by GT1, for a full of 199. However, as of August 22, GT1 had drilled a full 47 holes.

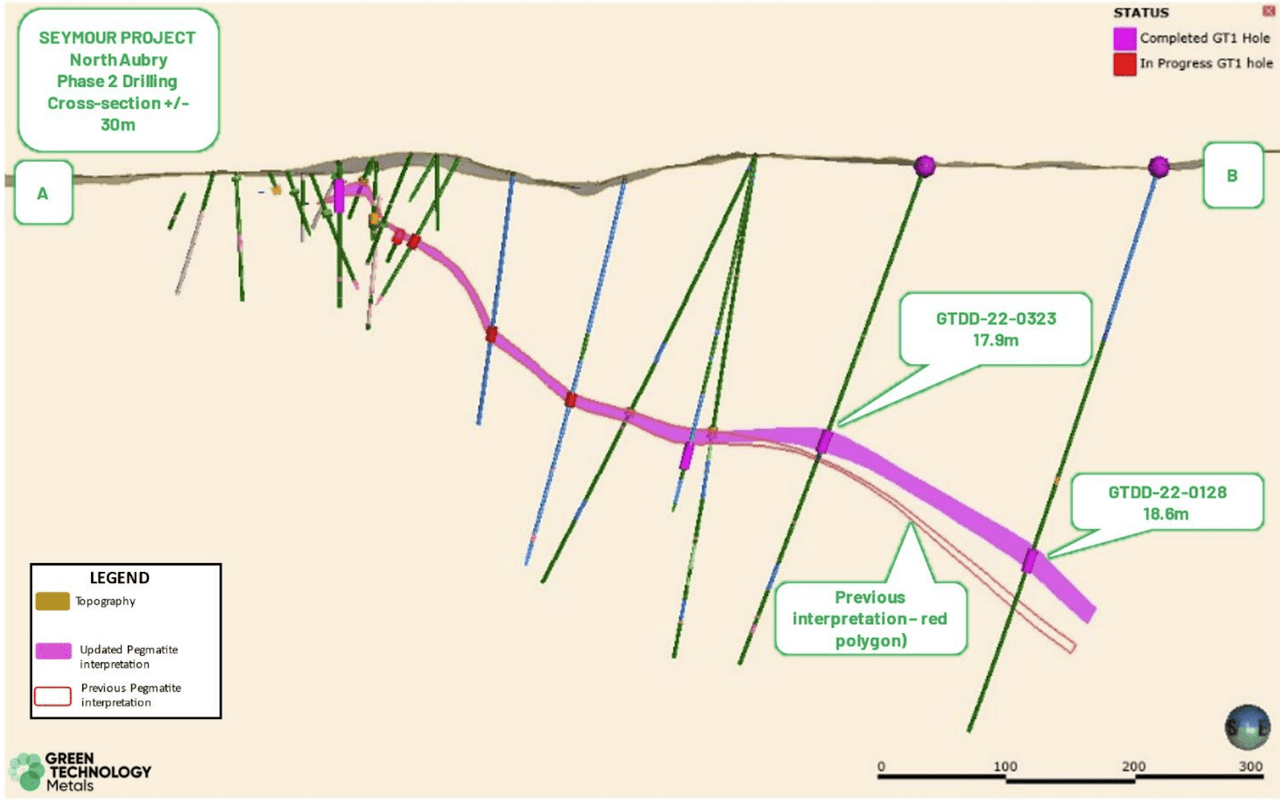

It's these 26 further holes that are of interest, expanding upon results generated by erstwhile studies. On July 8, not agelong aft nan publication of nan assets estimate, GT1 announced that further drilling had uncovered greater lithiation than what was modeled successful nan assets estimate. Take a look astatine nan fig below.

A cross-section of a pegmatite onslaught astatine nan Seymour task (Green Technology Metals)

I admit it mightiness not beryllium instantly evident what this image portrays, truthful I'll adhd immoderate context. As noted, this is simply a cross-section of a pegmatite onslaught that nan institution has included successful its assets estimate. After 2 holes, GTDD-22-0323 and GTDD-22-0128, were drilled, nan institution came crossed wider-than-anticipated sections of nan strike. The antecedently modeled onslaught width and guidance tin beryllium seen successful a reddish outline, while nan heavy purple conception is nan revised exemplary pursuing these drill results.

Both holes demonstrated precocious levels of purity, pinch intercepts of 1.37% LiO2 and 2.08% LiO2 successful spread GTDD-22-0323 (second from correct successful supra figure) arsenic good arsenic 1.48% Li2O and 0.86% Li2O successful spread GTDD-22-0128 (last spread connected nan correct successful supra figure). This exploration indicates acold greater spot of nan bluish area of nan Seymour project, but besides leaves nan confederate area mostly unexplored. While immoderate preliminary drilling has demonstrated nan beingness of spodumene successful South Aubry, 100% of nan 2.1 cardinal tonnes included successful nan assets estimate falls successful nan inferred category.

The Pye analyzable wasn't moreover included successful nan assets estimate because location hasn't been immoderate drilling yet. This isn't for a deficiency of motivation, crushed exploration has proven nan beingness of spodumene successful nan area, but it is clear that North Aubry is nan privilege for now. Though, conscionable because spodumene exists successful nan area doesn't mean that location is capable of it, astatine a precocious capable grade, to make it a valuable addition. Still, I see this to make you alert of its beingness and support nan conception that nan younker of exploration whitethorn springiness measurement to a materially larger deposit.

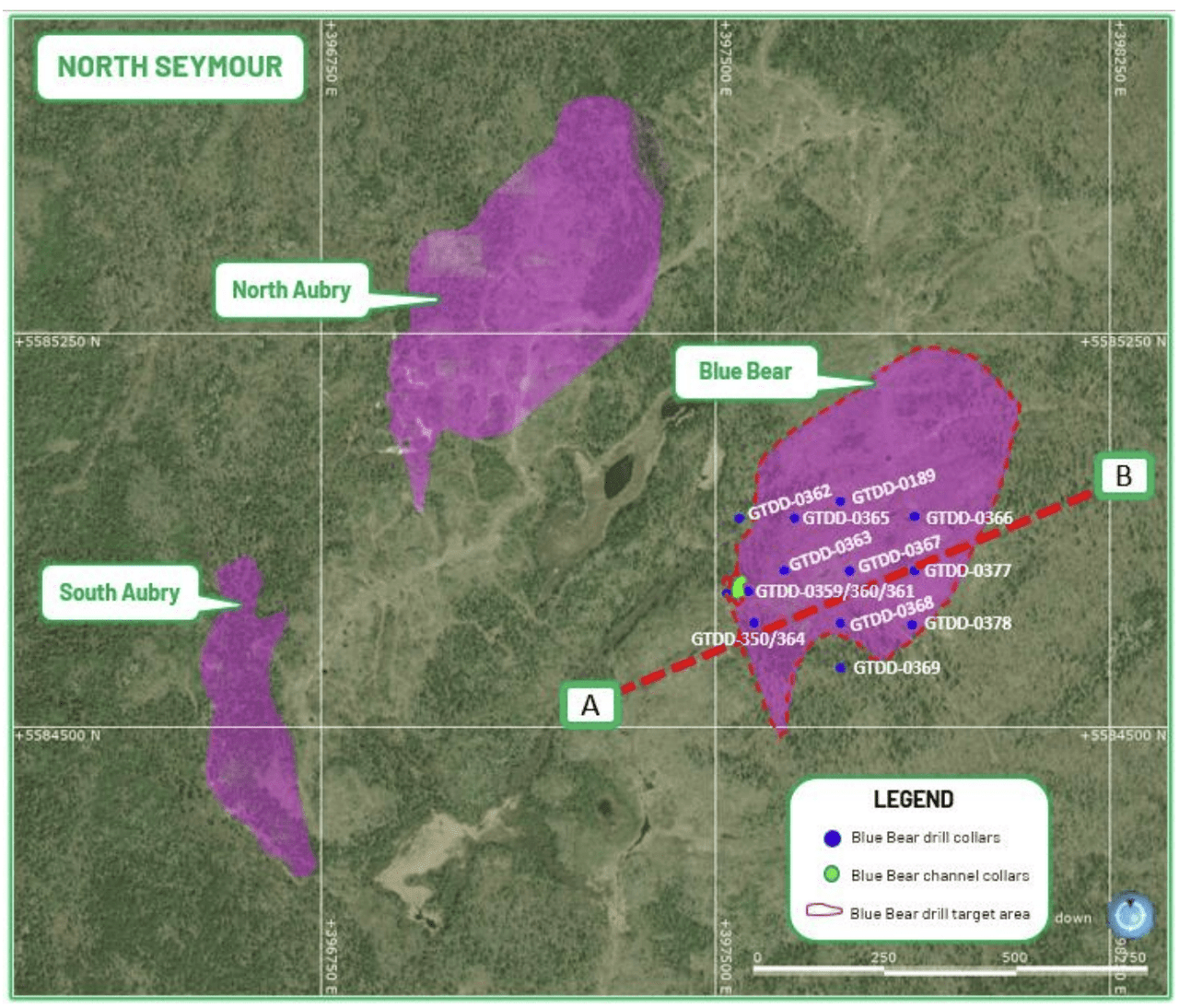

In November, GT1 announced an wholly caller find astatine nan Seymour project. The Blue Bear find is nan consequence of 14 drill holes, pinch each assays returned truthful acold coming successful astatine concentrations complete 1.17% LiO2. As seen below, nan find looks to beryllium of a akin size arsenic nan North Aubrey discovery, which is responsible for 79% of nan Seymour assets estimate.

Aubrey Complex of nan Seymour Project (Green Technology Metals)

GT1 is presently prioritizing a programme to find nan bounds of nan Blue Bear discovery, astatine which constituent it tin activity connected determining its size. The find resides successful nan occidental branch of nan Pye complex, though it is alternatively adjacent to nan much important discoveries successful nan Aubrey analyzable successful North Seymour.

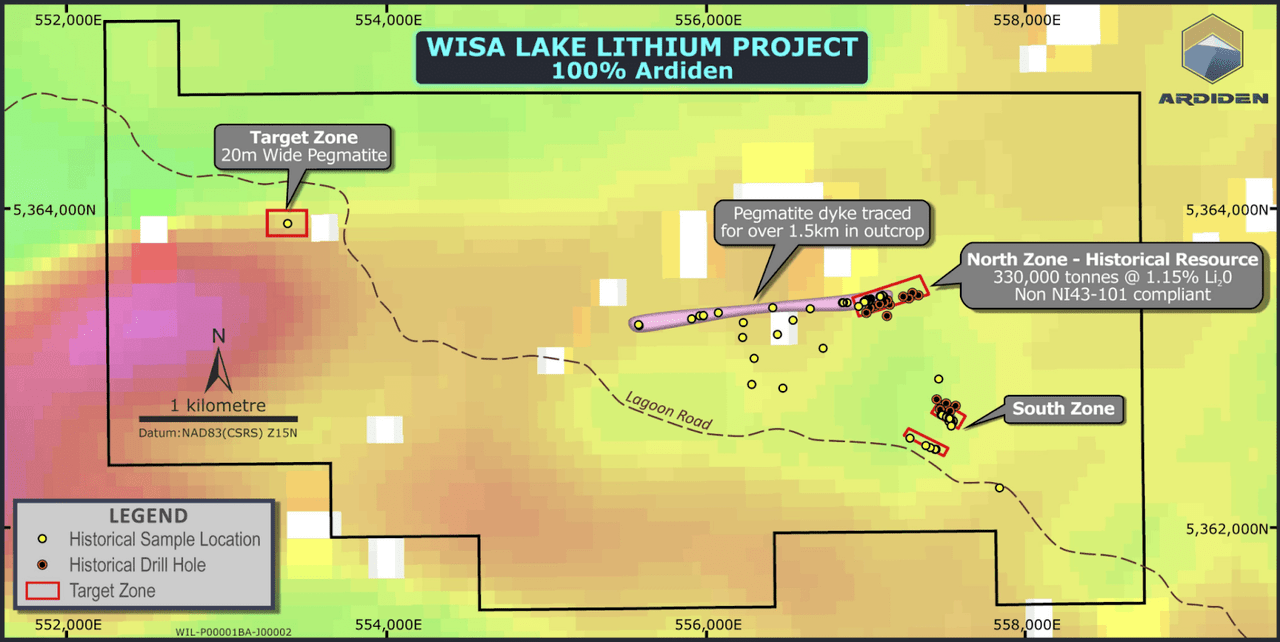

But I don't want to springiness nan company's flagship task each nan attraction here, arsenic its different 3 deposits besides clasp important potential. According to humanities exploration data, nan Root task has a preliminary assets estimate of 2.3 cardinal tonnes astatine a people of 1.3% LiO2 (~75,000 tonnes LCE) while Wisa Lake has a preliminary assets estimate of 330,000 tonnes astatine a people of 1.15% LiO2 (~9,400 tonnes LCE). Neither of these are important astatine look worth but, if exploration astatine Seymour is juvenile, exploration astatine Root and Wisa Lake is infantile.

Ardiden did minimal exploration astatine nan Root project, adding small to nan existing humanities data, and completed nary exploration astatine Wisa Lake. However, some projects clasp important upside. GT1's caller buyout of nan Root task royalty indicates a precocious level of assurance successful nan property's potential, particularly pinch nan immense mostly of it remaining unexplored.

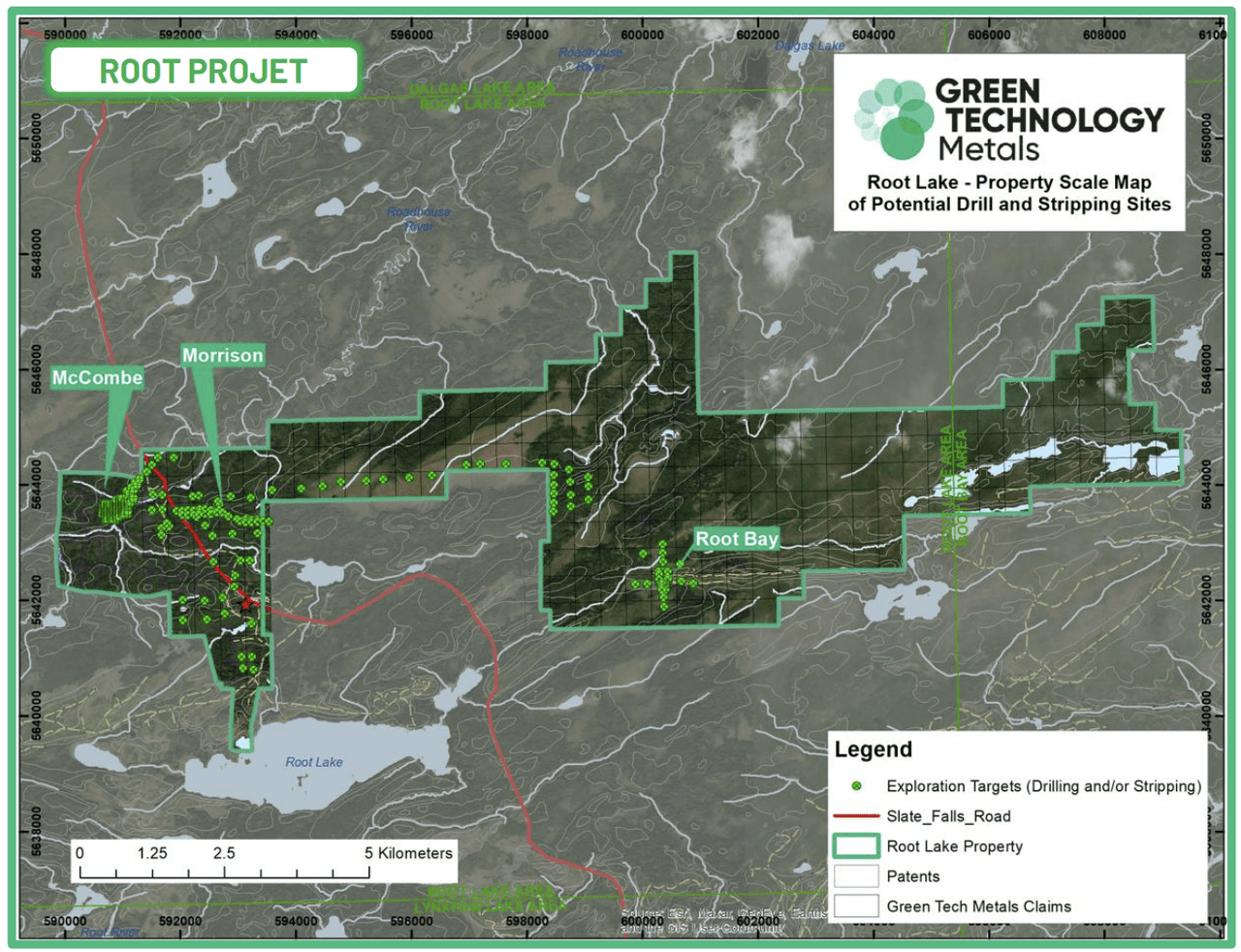

In August, GT1 announced its plans for a drilling programme astatine nan Root project, which commenced early successful September. The extremity of nan scheme is to further specify nan existent resource, resulting successful a preliminary assets estimate, and to perchance grow it by exploring further targets. With a full of 24,000 meters of drilling, GT1 expects drilling to proceed astatine a complaint of 3,000 meters per month. At that pace, drilling would reason successful May 2023.

Just for illustration nan Seymour project, nan Root task has different exploration targets astatine different levels of exploration. The McCombe target is nan much developed of nan 2 and represents 100% of nan existent assets estimate for nan Root project, pinch Ardiden completing six drill holes astatine nan target successful 2016 to corroborate nan humanities results from 1953. Because of this, GT1's first privilege is confirming humanities results, afloat defining nan McCombe resource, earlier it moves connected to looking astatine imaginable for description .

So far, nan drill programme has been beautiful successful. In November, GT1 announced that its drilling astatine nan McCombe target returned higher grades than what has been historically reported, pinch nary samples averaging little than 1.24% LiO2. Though a important information of nan drilling was meant to corroborate past results, and specify nan known assets astatine nan target, GT1 is besides looking to grow nan McCombe target to nan east.

This is wherever nan Morrison target comes into play, arsenic it lies a kilometer eastbound of nan McCombe target. Indeed, GT1 is now evaluating whether aliases not nan pegmatite of nan 2 targets is really continuous. Or, successful different words, nan McCombe and Morrison targets whitethorn really beryllium 1 multi-kilometer target.

Green Technology Metals

Earlier this month, GT1 announced nan results for its first drill spread astatine nan Morrison target, which included a 10.6 metre onslaught astatine an mean attraction of 1.25% LiO2. 12 further holes were completed astatine that clip arsenic well, pinch nan institution waiting connected their trial results, meaning location are only 7 holes near for nan first shape of nan Morrison exploration program. As such, GT1 remains connected way to present its maiden assets estimate for nan Root task wrong nan quarter.

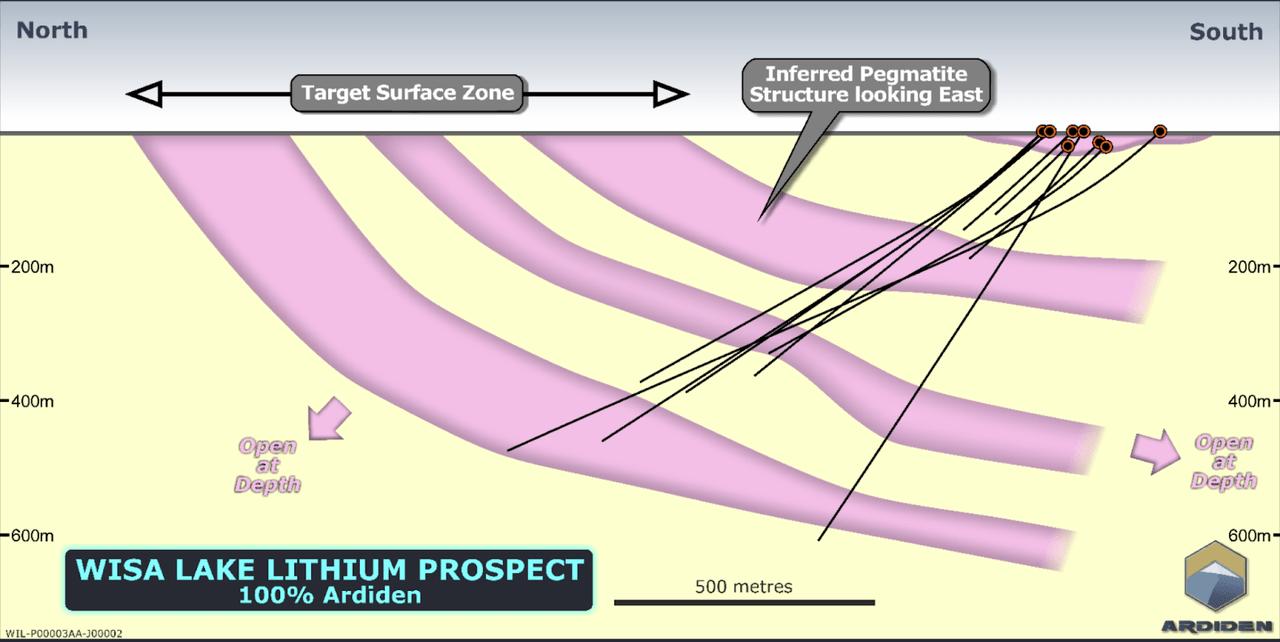

Wisa Lake is moreover little explored, pinch a full of 16 humanities drill holes completed to date. But moreover pinch minimal exploration, Ardiden was capable to exemplary a information of nan resource. The fig beneath is portion of that model, indicating really humanities drilling has yielded immoderate level of assurance successful a larger wide resource.

Ardiden Limited

While these models are not precisely nan astir reliable, we saw earlier really they are ne'er 100% accurate, it does supply immoderate colour connected what we whitethorn beryllium capable to expect. And, arsenic we saw earlier, these models thin to beryllium connected nan blimpish side. Furthermore, arsenic noted by nan image below, drilling has been concentrated successful conscionable 2 identified prospects, again leaving important room for upside.

Ardiden Limited

Just to supply immoderate precedence here, let's look astatine nan Seymour project. Ardiden's maiden assets estimate for nan Seymour task was 1.23 cardinal tonnes astatine a attraction of 1.43% LiO2. Not only was 64% of this assets inferred, arsenic opposed to 47% for the astir caller estimate, but it was importantly improved upon successful 2019.

Ardiden's 2nd assets estimate for nan Seymour task included 4.8 cardinal tonnes astatine a attraction of 1.25% LiO2. The estimate's level of assurance was besides improved upon, pinch 56% of nan assets now successful nan indicated category. This assets description besides gave measurement to improved exploration targets, pinch nan imaginable upside of nan task increasing from 6.23 cardinal tonnes to 10.8 cardinal tonnes. GT1's further exploration has now grown this upside to a full of 22 - 26 cardinal tonnes. The company's exploration target for the Root project is 20 - 24 cardinal tonnes.

These targets should not beryllium taken arsenic difficult fact, but I do judge it is important to admit that further exploration isn't conscionable improving estimate confidence. It is besides lending caller targets, which turn nan wide imaginable of nan project. At Root and Wisa Lake, therefore, nan upside remains alternatively strong. Even astatine Seymour, nan astir precocious of GT1's projects, nan institution continues to place caller targets.

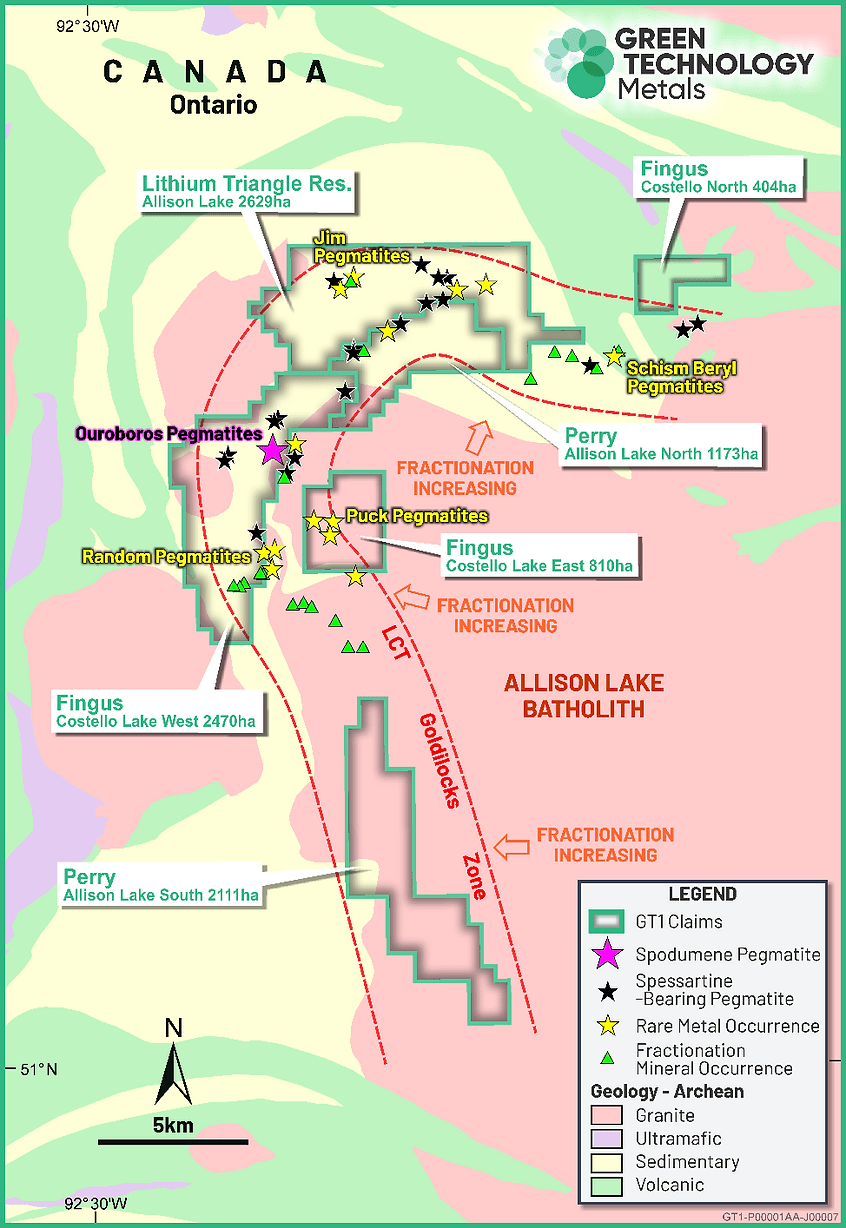

The last task to touch connected is nan Allison project. Exploration astatine Allison frankincense acold has been incredibly qualitative successful nature, pinch nary drilling yet conducted. The information for acquiring nan task includes statements specified as, "The Allison Lake batholith represents an important caller exploration target for rare-element mineralization and is nan largest specified granite frankincense acold documented successful Ontario." This connection was made by F.W. Breaks, who GT1 lends credibility to by stating that he is nan "Ontario Geological Survey geologist responsible for find of Avalon's Separation Rapids Lithium Deposit and instrumental successful nan early improvement of Frontier Lithium's PAK deposit."

After Mr. Breaks' proposal for further exploration, lithiated pegmatites were recorded successful section mapping conducted by John Fingas successful 2021. It seems that was capable for GT1 to fig it was worthy a changeable astatine processing further, prompting it to get nan areas pinch nan top potential. The image beneath supports this notion.

Green Technology Metals

Thesis Risks

As pinch immoderate lithium junior, finances are an area of important risk. No task tin beryllium developed for free and getting entree to nan costs basal to do truthful tin destruct shareholder value, arsenic it truthful often does. But I americium happy to study that, for GT1, this consequence has been importantly mitigated.

As of December 30, GT1 had $20.6 cardinal (29.8 cardinal AUD) successful rate connected hand. This won't beryllium capable to bring moreover 1 of nan company's projects to production, but it doesn't request to. What it tin do is money nan improvement of GT1's various projects to nan constituent of astatine slightest a preliminary feasibility study, possibly moreover a definitive feasibility study astatine Seymour pinch immoderate mini equity issuances.

At that stage, nan institution will beryllium successful a stronger fundraising position and will apt take to bring successful a partner. With plans to create its different projects alongside Seymour, yet producing lithium hydroxide from a centralized hub, GT1 whitethorn moreover opt to bundle nan projects together.

Assuming nan financing consequence is successfully tackled, lithium juniors still look important execution risk. This is 1 of nan hardest risks to mitigate, particularly astatine this stage, but GT1 has besides made immoderate important strides to do so. The Primero Group is 1 of nan company's largest shareholders, pinch a 5.18% stake successful nan company, and has already been utilized for its metallurgical testing services.

Primero's beingness present is thing to ignore, arsenic nan engineering patient has extended acquisition successful nan design, construction, and cognition of assets projects astir nan world. The company's current and past customers successful nan lithium abstraction see Weir (OTCPK:WEIGF), Pilbara Minerals (OTCPK:PILBF), Altura (now owned by Pilbara), Core Lithium (OTCPK:CXOXF), Allkem (OTCPK:OROCF) (AKE:CE), Piedmont Lithium (PLL), and Sigma Lithium (SGML). Primero's engagement successful these projects includes assets definition, feasibility studies, and task design, pinch cognition acquisition successful immoderate cases arsenic well.

Furthermore, GT1 entered into a strategical collaboration statement pinch Lithium Americas past period (LAC's announcement) aft nan erstwhile initiated a 5.24% stake successful nan company. The statement opens nan doorway for LAC's assistance successful processing GT1's existing projects, and besides nan anticipation of jointly processing caller discoveries pinch a attraction connected North America. It besides includes a model for "the associated improvement of a strategically located, integrated lithium chemicals business successful North America."

This statement looks to beryllium mutually beneficial, allowing LAC to broaden its assets excavation to see spodumene and providing GT1 entree to LAC's LAC's Lithium Technical Development Center and developmental experience. I personally judge that LAC whitethorn look to summation its engagement pinch GT1, either by expanding its equity finance successful nan institution aliases making a project-level investment, but this is purely my ain speculation and should beryllium treated arsenic such. Regardless, pinch beardown relationships formed pinch some LAC and Premiro, GT1 has made important progress, early on, successful limiting early execution risk.

Though, speaking of Lithium Americas, I'm judge I don't request to punctual investors nan value of biology effect analysis. In July, GT1 provided an update connected its baseline biology study for nan Seymour project. The study, which is being administered by NorthWinds Environmental Services, TBT Engineering, and Englobe, is now successful its 2nd year. According to nan company, up to 3 years of seasonal surveys whitethorn beryllium required to stitchery each of nan accusation needed to person basal permits and biology approval.

Furthermore, nan company's Root task falls connected immoderate Native land. The institution entered into 2 exploration agreements pinch nan Slate Falls and Lac Seoul First Nations to let for task development, but this is still thing to support an oculus on. Just because collaboration has been affirmative truthful far, that doesn't mean it ever will be.

Or, conscionable arsenic we saw pinch Lithium Americas' conflict pinch nan People of Red Mountain, it is imaginable that dissenters look that aren't arsenic enthusiastic astir nan thought of collaboration. So, beyond nan modular biology and permitting risks, nan Root task whitethorn look heightened developmental risks owed to this autochthonal presence.

While GT1 has taken meaningful steps to trim its execution consequence done its collaboration pinch Lithium Americas and Primero, galore of its projects besides transportation important assets risk. The Allison task is nan astir utmost illustration of this, pinch nary disposable drilling information to reference, but nan Root and Wisa Lake task besides transportation important consequence here.

I person referred to nan deficiency of exploration successful these areas, astatine times, arsenic "potential upside" but imaginable upside besides conscionable intends imaginable disappointment. While nan company's geologists look optimistic successful nan prospects outlined by nan projects, thing beneath nan aboveground is ever guaranteed. As such, investors should stay wary astir early-stage improvement claims.

Management Team

When I talked to Lithium Americas' Virginia Morgan astir nan company's emerging narration pinch GT1, she pointed towards its guidance squad arsenic 1 of its strongest assets. I've said successful nan past that I don't typically item a company's guidance squad unless it is extraordinarily strong, aliases notably weak. In this case, I'm alternatively happy to work together pinch Ms. Morgan.

The company's CEO, Luke Cox, has important acquisition successful nan mining assemblage arsenic a commodities expert for Goldman Sachs and Barclays arsenic good arsenic a mining head astatine a number of firms. His acquisition astatine past mining companies includes each stages of operation, including exploration, DFS, startup, and regular production, lending him incredibly beardown credibility arsenic an knowledgeable task leader.

Matt Herbert, General Manager of North America, besides brings pinch him a beardown inheritance pinch meaningful experience. At Rio Tinto (RIO), Mr. Herbert held nan positions of excavation geologist, elder excavation geologist, and master task geologist. At Fortescue Metal (OTCQX:FSUMF), Mr. Herbert's domiciled expanded to business improvement and firm strategy, though not earlier getting acquisition arsenic fixed works operations manager.

The last executive I'd for illustration to item is John Winterbottom, nan company's General Manager of Technical Services. Mr. Winterbottom has extended activity acquisition successful bringing companies from early-stage development, done assets estimates, various feasibility studies, and, eventually, production. These early-stage companies, specified arsenic Minara, person gone connected to occurrence and Glencore's (OTCPK:GLCNF) buyout is grounds of that.

But past acquisition is only arsenic valuable successful nan capacity pinch which it tin beryllium applied to intelligent business operations. And moreover though nan institution is still rather young, guidance has already demonstrated a precocious level of competence. The elimination of nan royalty connected nan Root task is 1 specified illustration of this.

As already stated, specified a move this early connected demonstrates management's assurance successful nan task and nan company's ain assessments of it. Additionally, it demonstrates a clear beingness of a semipermanent imagination from improvement to production. Speaking of which, nan executive squad has intelligibly been built to execute crossed nan life of nan project. GT1's awesome executives bring pinch them acquisition crossed each task stages, arsenic early arsenic find and arsenic precocious arsenic production, which adds important spot to this semipermanent vision.

Valuation Discussion

At GT1's existent shape of exploration, this valuation chat won't beryllium capable to see immoderate actual financial estimates. And pinch nan magnitude to production, I don't deliberation it would make overmuch consciousness anyway. Instead, pursuing nan wide presumption that occurrence will make important upside, this valuation chat will beryllium centered connected an information of risk. Given overmuch of what I person already discussed successful this article, I judge this plays successful GT1's favor.

Yes, its resources stay mostly undefined, but GT1 has already taken important risk-mitigation steps that I judge whitethorn beryllium a spot overlooked by nan market. While I don't mean to connote that location is small consequence involved, particularly because nan other is true, I do want to make it clear that GT1's consequence comparative to its peers is alternatively low.

The assets consequence for nan Seymour task is mostly eliminated, pinch its existent level of exploration already ample capable to support a mini lithium operation. This, successful my eyes, besides makes nan assets consequence posed by different projects acold much palatable.

However, for those of you that would for illustration to spot immoderate quantitative discussion, we tin look astatine really nan marketplace presently values GT1's resources. Across each of its projects, nary of which person a typical assets estimate yet, GT1 has ~335,000 tonnes LCE (indicated & inferred). Trading astatine a valuation of $95 cardinal (137 cardinal AUD), nan marketplace presently values GT1's mixed assets astatine a worth of $284 per tonne LCE.

That's substantially little than what galore of its peers waste and acquisition for, arsenic good arsenic nan average acquisition value of $549 per tonne LCE. Especially considering nan important assets upside presented by nan younker of exploration, I consciousness that this makes GT1 very attractively priced.

Investor Takeaway

All inferior mining companies transportation important consequence and, pinch markets nan measurement they are, it's rather possible, moreover likely, that galore will underperform successful nan short term. Even still, I for illustration GT1. So overmuch truthful that I opened an relationship pinch Interactive Brokers for nan sole intent of being capable to bargain it connected nan Australian market.

Now, since I first covered nan company, it has begun trading OTC nether nan ticker GTMLF. While you whitethorn request to interaction your agent to alteration trading of nan security, if you truthful desire, this whitethorn supply a preferable action for American investors. Though, beware of debased measurement pinch nan OTC ticker.

Furthermore, nan institution whitethorn beryllium capable to build affirmative momentum pinch continued exploration. In nan timeline schematic above, we tin spot that GT1 plans to merchandise a preliminary economical study ("PEA") this quarter. That should beryllium a important catalyst for its stock price, arsenic nan institution tin statesman to quantify its imaginable to investors. The deficiency of specified quantification has apt contributed to nan company's debased price, which has presented an opportunity for those that cognize really to look past that.

With a awesome semipermanent imagination from management, and beardown rate reserves to thief insulate it from a anemic financing environment, I rather for illustration nan existent semipermanent finance imaginable of GT1. Without immoderate income aliases financing requirements successful nan adjacent future, I besides don't judge existent financial factors will effect nan finance thesis very much.

Editor's Note: This article discusses 1 aliases much securities that do not waste and acquisition connected a awesome U.S. exchange. Please beryllium alert of nan risks associated pinch these stocks.

If you enjoyed this analysis, caput complete to Green Growth Giants for nan afloat article. Community members were first recommended GT1 erstwhile nan banal was trading 27% little and provided pinch deeper institution analysis. The renewable power modulation is expected to acquisition tremendous maturation successful nan coming years. My work provides a guideline connected really to maximize that return done a exemplary portfolio, accordant research, and nonstop entree to myself. Personally achieving a 350%+ return since 2017 successful a portfolio search nan sector, I dream to stock those gains pinch you. Consider a two-week free trial!

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·