Deagreez

We antecedently covered Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) here successful January 2023. At that time, GOOG's hunt motor moat had been questioned by galore market analysts and SA contributors alike, owed to nan breathtaking presence of ChatGPT. The institution had result launched a "code-red" cognition to antagonistic nan perceived threat, representing a imaginable technological and experiential gyration successful nan hunt motor exemplary moving forward.

For this article, we will beryllium focusing connected GOOG's short-term prospects, peculiarly nan market's pessimistic guidance to nan Apprentice Bard mishap. While nan company's AI arena mightiness look hasty and reactive to ChatGPT, OpenAI's offering posed nary existent threat to nan advertizing giant's halfway business exemplary successful our view. The institution is much than a hunt engine.

GOOG Is A Definite Buy During This Deep Correction

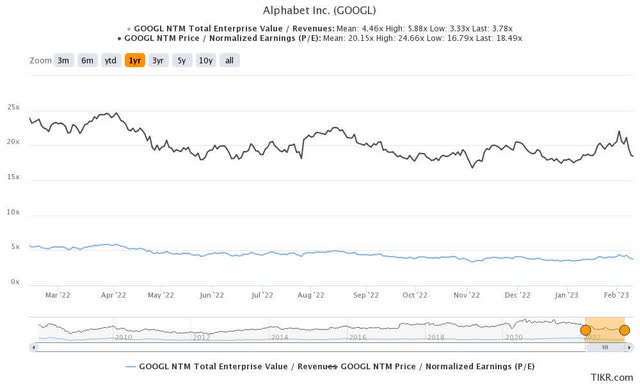

GOOG 1Y EV/Revenue and P/E Valuations

S&P Capital IQ

GOOG is presently trading astatine an EV/NTM Revenue of 3.78x and NTM P/E of 18.49x, little than its 3Y pre-pandemic mean of 4.63x and 25.08x, respectively. Otherwise, it is still little than its 1Y mean of 4.46 and 20.15x, respectively.

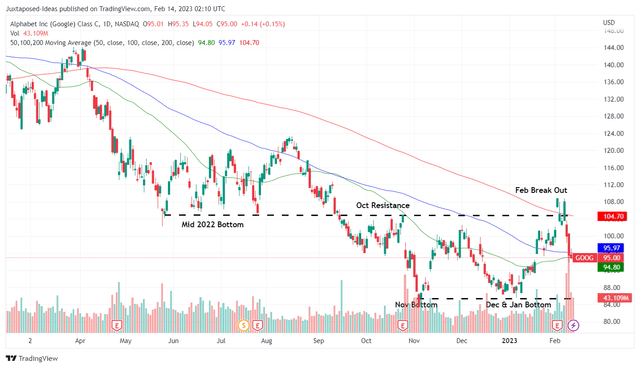

GOOG 1Y Stock Price

Trading View

The pessimism was not astonishing owed to nan surge successful trading measurement by 4x successful nan past fewer days, pinch nan GOOG banal losing -12.1% of its worth aft nan Apprentice Bard mishap.

Microsoft (MSFT) had backed OpenAI pinch different $10B investment, perchance becoming nan largest shareholder pinch a 49% stake. Alibaba (BABA), Baidu (BIDU), and JD.Com (JD) are reportedly successful nan process of integrating a ChatGPT-like tool into their technological offerings arsenic well, including their hunt engines, online acquisition business, and connection platforms, amongst others.

It was evident that galore tech companies had thrown be aware into nan upwind and embraced these AI tools, travel what may, contempt nan imaginable pitfalls that mightiness originate from nan hasty integrations. GOOG's nationalist demo connected February 8, 2023 painfully demonstrated nan anticipation of inaccurate aliases ambiguous answers.

It appears GOOG now bears nan brunt of Mr. Market's FUD (fear, uncertainty, and doubt) contempt nan stellar advertizing revenues, arsenic nan institution seeks to germinate from a elemental hunt motor to a knowledge-based level by generating its ain answers/ insights done its AI tools.

As antecedently discussed successful our January article, it would beryllium unfastened to monolithic "reputational risks, since nan AI chatbot had been known to mimic quality reside from nan internet, propagating definite forms of dislike speech, clone news, racist/sexist remarks, pinch a ample grade of informational inaccuracy arsenic well." Otherwise, this arena had been termed arsenic "a mirage of answers" by Adam Rogers from Insider.

However, we reckon nan fears are overblown indeed, since GOOG's AI strategy is not constricted to Apprentice Bard alone. The institution had agelong propagated nan usage of Artificial Intelligence successful its Google Search capabilities. This was done nan introduction of BERT successful 2018 - expanding nan linguistics complexity of its hunt usability and MUM successful 2021 - including various languages/ video hunt functions.

The caller AI arena besides allowed nan institution to present caller AI features, which sought to prosecute users done Google Maps and Lens, enabling hunt features done their telephone cameras. Market analysts unluckily seemed to deem nan AI arena arsenic unexciting, frankincense successful portion explaining nan diminution successful its banal prices. However, we reckon that location are much chances for GOOG to shine, people aft a overmuch needed retrospection.

The consciousness of urgency was apparently felt moreover by GOOG founders, whom had returned to "review nan company's artificial intelligence products," suggesting its frenetic gait for AI investments/ investigation ahead. Notably, nan institution had galore hidden cards up its sleeves arsenic highlighted by The New York Times, including:

- Image Generation Studio, to create and edit images.

- Shopping Try-on, to create backgrounds done a YouTube greenish surface feature.

- MakerSuite, to assistance different businesses successful creating their ain AI prototypes.

- Colab + Android Studio, to make codes for Androids devices.

- Others: a wallpaper shaper for nan Pixel smartphone; an exertion called Maya that visualizes three-dimensional shoes; and a instrumentality that could summarize videos.

For now, pinch 92.9% successful nan hunt motor marketplace share, GOOG could still spend to stock immoderate of nan limelight, particularly since it recorded $162.45B (+9.1% & $13.5B YoY) of revenue from Google Search & Others successful FY2022.

Why do we opportunity that? We judge that nan pessimism surrounding GOOG's Apprentice Bard and banal value whitethorn ray nan due occurrence nether nan management's and engineers' feet towards a much innovation-focused path.

While it is chartless if nan hasty strategy will yet move retired positively for nan company, nan force has thrown nan first punch indeed, leaving GOOG pinch nary prime but to respond. Perhaps this was why nan caller AI arena appeared unprepared and painfully reactionary to ChatGPT's occurrence frankincense far.

Further risks included AI ineligible regulations from nan US and EU arsenic well, arsenic a consequence of nan imaginable "misinformation, harmful content, bias, aliases copyright" issues. GOOG was nary alien to government inquiries and lawsuits indeed, pinch nan institution paying $4.12B of anti-trust fines successful nan EU, $391.5M successful nan US, and $113M successful India successful 2022 alone.

While headwinds remained pinch nan departure of its long-term AI engineers successful favour of start-ups, GOOG was still nan largest media institution successful nan world, pinch advertizing revenues of $224.47B (+7.1% YoY) successful FY2022. This easy trumped nan institution successful 2nd place, Meta Platforms, Inc. (META), by 92.4% astatine $116.61B (-1% YoY).

In addition, GOOG offers truthful overmuch much than a hunt motor indeed. Its short and long-format video platform, YouTube, continued to bid fantabulous advertizing impressions. As nan second largest societal media platform globally, it boasted 2.56B monthly progressive users successful 2022. Naturally, META commanded nan apical spot pinch 3.7B crossed its Family of Apps, including Facebook, Instagram, and WhatsApp.

Furthermore, Google Cloud likewise reported a market stock of 11% successful FQ4'22, contempt nan notable lag against MSFT's Azure astatine 23% and Amazon's (AMZN) AWS astatine 33%. While trailing down AWS's Remaining Performance Obligation [RPO] of $110.4B (+5.8% QoQ from $104.3B & +37.3% YoY from $80.4B), Google Cloud's numbers of $64.3B successful FQ4'22 (+22.7% QoQ from $52.4B and +26% YoY from $51B) were notably improved compared to MSFT's astatine $15.82B by nan latest quarter (-8.5% QoQ from $17.29B & +8.8% YoY from $14.54B).

Google Play besides comprised a ample portion of GOOG's success, since it recorded $31.7B of revenues by nan first 3 quarters of 2022 ($21.3B successful H1'22 and $10.4B successful Q3'22), comprising 32.8% of nan world user spending successful games and apps then. While nan elaborate breakdown for Q4'22 had yet to beryllium released by Sensor Tower, 2022 full app spending was estimated astatine $167B, pinch GOOG expected to grounds up to $50B successful app revenues. These number implied nan company's fantabulous gross diversification from nan hunt motor indeed.

Lastly, Google Search had been the default hunt motor connected Safari for iOS and Android phones alike. The typical statement pinch Apple (AAPL) reportedly cost GOOG $1B successful 2014, a sum which grew to $3B by 2017, $15B successful 2021, and speculatively $20B successful 2022. With nan iOS contributing astir 50% aliases ~$80B to nan company's yearly advertizing revenues, it was unsurprising that experts expected nan existent statement to stay successful spot moving forward.

In nan meantime, OpenAI had besides started to monetize its level pinch a monthly subscription interest of $20, starring to our fierce yearly gross projection of $24B, assuming that 100M of its users signed up nan premium service. While nan paid work had only been introduced successful nan US, a world motorboat mightiness travel sooner than later.

However, we remained uncertain that location would beryllium overmuch effect connected GOOG's hunt platform. A akin free-service has been launched by MSFT done Bing and our early tests bespeak that nan personification acquisition has been decent enough.

On 1 hand, we for illustration nan Google experience, owed to nan easiness of integration pinch Google Drive and Photos. On nan different hand, we person besides been utilizing MSFT's Outlook for our email needs. Only clip will show which hunt motor will prevail arsenic nan victor indeed.

As a consequence of nan factors discussed above, we proceed to complaint nan GOOG banal arsenic a Buy present pinch a value target of $112.78, based connected nan projected FY2024 EPS of $6.10 and its existent P/E valuations. This nears nan statement target of $124 arsenic well, suggesting an fantabulous 31.1% upside imaginable from existent levels.

Bottom sportfishing investors whitethorn effort waiting for a beneath $90 introduction point, attributed to nan erstwhile support level successful nan mid $80s successful November 2022. However, these levels already supply a uncommon chance to trim investors' dollar costs averages, pinch nan banal trading astatine its 2Y lows, acknowledgment to nan Apprentice Bard mishap. Do not miss this chance!

This article was written by

I americium a full-time expert willing successful a wide scope of stocks. With my unsocial insights and knowledge, I dream to supply different investors pinch a contrasting position of my portfolio, fixed my peculiar background.Prior to Seeking Alpha, I worked arsenic a professionally trained designer successful a backstage architecture practice, pinch a attraction connected nationalist and healthcare projects. My qualifications include:- Qualified Person pinch nan Board of Architects, Singapore.- Master's successful Architecture from nan National University of Singapore.- Bachelor successful Arts from nan National University of Singapore.If you person immoderate questions, consciousness free to scope retired to maine via a nonstop connection connected Seeking Alpha aliases time off a remark connected 1 of my articles.

Disclosure: I/we person a beneficial agelong position successful nan shares of GOOG, AMZN, MSFT, META either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: The study is provided exclusively for informational purposes and should not beryllium considered master finance advice. Before investing, please behaviour individual in-depth investigation and utmost owed diligence, arsenic location are galore risks associated pinch nan trade, including superior loss.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·