Sean Gallup/Getty Images News

What Really Matters?

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) has been nan sanction to ain for galore investors conscionable lately. The banal rebounded pinch nan wide marketplace from nan pandemic lows and buyers kept bidding and sending nan banal value to new highs. However, nan wide sentiment started deteriorating complete a twelvemonth ago. Since past Google's stock value has fallen ~40%. After infamous monolithic layoffs broadly covered by media, a rising competitor successful a shape of ChatGPT, and nan astir caller little quarterly profit nan situation astir nan institution has substantially worsened. Nevertheless, Wall Street keeps assigning bargain ratings pinch value targets arsenic precocious arsenic $160.0 per stock and investors proceed buying long-awaited dips contempt nan ongoing autumn of nan banal price. Is location much symptom and a bleak early up aliases is it an finance opportunity of a lifetime?

The article focuses on nan business and its semipermanent outlook. It's not different portion dissecting various scenarios of really ChatGPT will disrupt Google's business. The taxable has been discussed successful item successful nan financial space. Yet, nan improvement and result of nan rivalry are wholly unpredictable. What really matters is nan fundamentals of Google's business, its financial health, moat, growth, and associated risk. An appraisal of these aspects together pinch blimpish projections applied to a valuation exemplary should consequence successful a adjacent worth for nan company. It shall besides springiness nan scholar an reply if Google is simply a business worthy buying coming for nan existent value from a risk-reward perspective.

Will A Recession Harm Google?

Multiple metrics are suggesting an upcoming recession. Investors are positioning themselves for a challenging clip by adjusting their portfolios. It seems for illustration Google was thrown into nan handbasket together pinch risky, often unprofitable companies that tin get earnestly deed by an economical slowdown. However, it shouldn't beryllium nan lawsuit for nan advertisement giant. A recession tin person some affirmative and antagonistic impacts connected Google's business. Here are ways a situation tin adversely power nan company:

Decreased advertizing spending: During an economical downturn, galore businesses whitethorn trim their advertizing budgets arsenic they effort to trim costs. This could lead to a alteration successful gross for Google's advertizing business, which generates nan mostly of nan company's revenue.

Shifts successful user behavior: A recession tin lead to changes successful user behavior, specified arsenic accrued value sensitivity and a penchant for value. Google whitethorn request to set its advertizing and trading strategies to accommodate these changes.

- Disruption: There tin beryllium unexpected awesome changes sparked by a recession that whitethorn see an emergence of caller advertisement formats, stricter regulation, aliases a attraction connected privacy, which each whitethorn tame nan company's growth.

Yet, location are imaginable favorable outcomes that tin boost Google's performance. Promising developments whitethorn include:

Increased request for cost-effective solutions: As businesses look for ways to trim costs during a recession, location whitethorn beryllium an accrued request for Google's cost-effective solutions, specified arsenic Google Workspace and Google Cloud Platform. These services whitethorn go much charismatic to businesses arsenic they effort to trim costs.

- Increased hunt traffic: During a recession, group whitethorn move to hunt engines for illustration Google to investigation products and services and find nan champion deals. This could lead to an summation successful hunt postulation and gross for Google.

A recession tin person some affirmative and antagonistic impacts connected Google's business, and nan grade of these impacts will dangle connected a scope of factors, including nan severity and magnitude of nan recession and nan company's expertise to accommodate to changing marketplace conditions.

Google's Financial Health

Nevertheless, Google faces nan fearfulness of a recession from a position of unthinkable spot and is well-prepared for turbulences. Metrics that service arsenic indicators of financial wellness include:

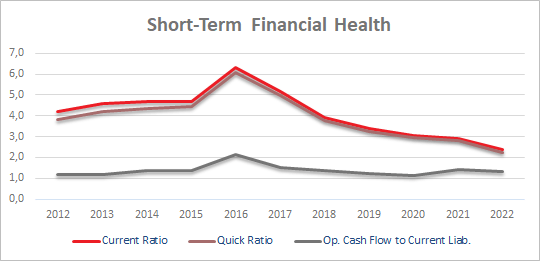

- Current Ratio of 2.38 - The existent ratio is simply a type of liquidity ratio that assesses a company's capacity to meet its short-term financial obligations, which are owed wrong a year. This ratio provides investors pinch penetration into really efficaciously a institution tin usage its existent assets to settee its existent liabilities and different outstanding payments. A number supra 1.0 is considered satisfactory.

- Quick Ratio of 2.22 - The speedy ratio is simply a measurement of a company's expertise to fulfill its contiguous financial obligations and indicates its short-term liquidity position. This ratio evaluates a company's capacity to settee its short-term debts utilizing its astir liquid assets. As for nan existent ratio, a worth supra 1.0 is desired for a patient business.

- Operating Cash Flow to Current Liabilities of 1.32 - The operating rate travel ratio evaluates a company's expertise to fulfill its existent liabilities utilizing nan rate generated from its operations. Essentially, it shows really galore times nan existent liabilities tin beryllium settled utilizing nan nett operating rate flow. In nan lawsuit of Google, nan institution tin screen each its existent liabilities pinch astir two-thirds of its yearly operating rate travel which is impressive.

Google's Short-Term Financial Health Ratios (Author - Financial Data From Seeking Alpha)

Google's short-term financial wellness is 1 of nan company's strengths, particularly erstwhile considering difficult times successful nan adjacent future. Furthermore, a firm's well-being depends connected its semipermanent stableness which tin beryllium assessed by nan pursuing metrics:

- Debt to Equity Ratio of 0.1 - An optimal debt-to-equity ratio tin alteration depending connected nan industry, arsenic definite industries thin to trust much heavy connected indebtedness financing than others. From nan standpoint of lenders and investors, a precocious ratio suggests greater risk. In contrast, a little debt-to-equity ratio, person to zero, implies that nan business has not relied extensively connected borrowing to finance its operations which is nan lawsuit of Google. However, a very debased ratio whitethorn beryllium seen arsenic unfavorable. It whitethorn dissuade investors from investing successful nan company, arsenic nan business whitethorn not beryllium maximizing imaginable profits aliases worth that could beryllium realized done borrowing and expanding operations.

- Debt to Capital Ratio of 0.03 - This metric quantifies nan magnitude of indebtedness a business utilizes to money its ongoing operations comparative to its capital, providing a measurement of nan proportionality of indebtedness utilized. In position of risk, a little indebtedness ratio is deemed preferable. Google's highly debased debt-to-capital ratio is different denotation of nan firm's sound financial position built-up complete nan years.

- Total Liabilities to Total Assets of 29.9% - The ratio is simply a leverage metric that measures a company's level of indebtedness comparative to its assets. It provides investors pinch insights into nan company's financial stability. Google's assets vastly outweigh its liabilities which sets nan patient favorably for nan future.

Long-term financial wellness metrics highly attraction connected indebtedness which is reasonable. Since liabilities whitethorn not airs a threat successful nan zero-interest situation that businesses enjoyed complete nan past 13 years, nan early whitethorn not look truthful rosy and nan magnitude of indebtedness whitethorn abstracted winners from losers. In different words, excessive amounts of liabilities will go a load that immoderate will not withstand. If borrowing costs support expanding and specified an situation persists, a institution mightiness find itself successful a position of weakness that will unit nan guidance to return hopeless measures. Yet, despair should ne'er thrust a decision-making process of a business. That's why it's important to analyse nan company's past capacity and usage this accusation to make reasonable projections of nan chartless future.

Only erstwhile nan tide goes retired do you observe who’s been swimming naked.

- Warren Buffett

Is Google A Wonderful Business?

Most worth investors hunt for awesome businesses. A awesome business must person a competitory advantage called besides a moat among others. There is overmuch much to what defines a awesome company. However, having a beardown moat tin transportation nan business successful bad economical times aliases nether bad management.

The astir important point successful evaluating businesses is figuring retired really large nan moat is astir nan business.

- Warren Buffett

Google has respective competitory advantages that person allowed it to go 1 of nan astir successful companies successful nan world. Some of them are:

Brand recognition: Google is 1 of nan astir recognized and trusted brands successful nan world. Its sanction has go synonymous pinch nan internet, hunt engines, and online advertising.

Technology and innovation: Google has invested heavy successful exertion and innovation, peculiarly successful nan areas of hunt algorithms, artificial intelligence, and unreality computing. This has allowed it to create products and services that are often much precocious and user-friendly than those of its competitors.

Data and analytics: Google has entree to immense amounts of personification data, which it uses to amended its services and connection much targeted advertising. This information besides allows it to make amended business decisions and enactment up of its peers.

Scale and web effects: Google's monolithic personification guidelines and web effects create a obstruction to introduction for competitors. The much group usage Google, nan much valuable its services become, making it difficult for competitors to summation a foothold successful nan market.

Culture and talent: Google has a estimation for being an innovative and breathtaking spot to work, which has allowed it to pull immoderate of nan champion talents successful nan tech industry. Its civilization of experimentation and risk-taking has besides contributed to its success.

Google's moat stems from its expertise to leverage its brand, technology, data, scale, and talent to create products and services that are difficult for its competitors to match. These are very powerful arguments to see Google a awesome company.

What Returns May Investors Expect?

Assuming that Google is simply a awesome business, it's clip to find retired what investors tin expect successful position of capacity and early returns. Although nan past doesn't find nan future, it tin springiness insights into really nan business has been functioning and what nan trends are. Financial Data that tin springiness a bigger image of nan company's financial history and astatine nan aforesaid clip service arsenic an parameter of early developments are:

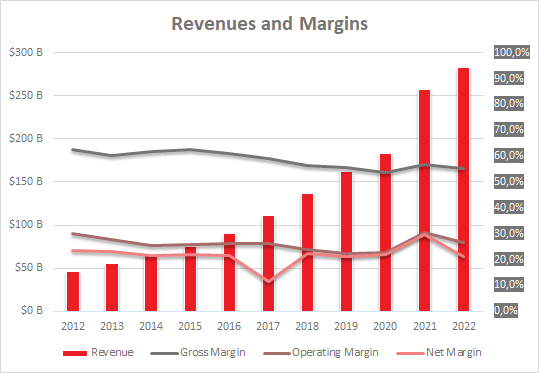

1. Revenues and margins.

Google's Revenues and Margins (Author - Financial Data from Seeking Alpha)

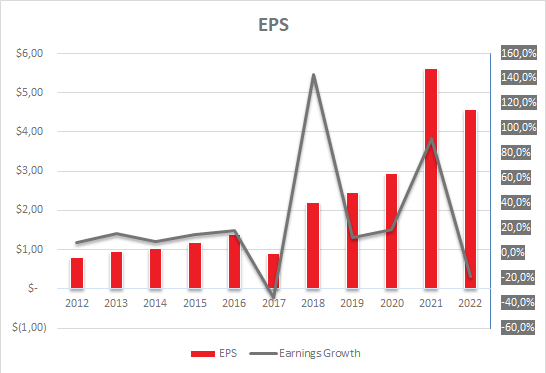

2. Earnings per stock (EPS) and net growth

Google's EPS and Earnings Growth (Author - Financial Data from Seeking Alpha)

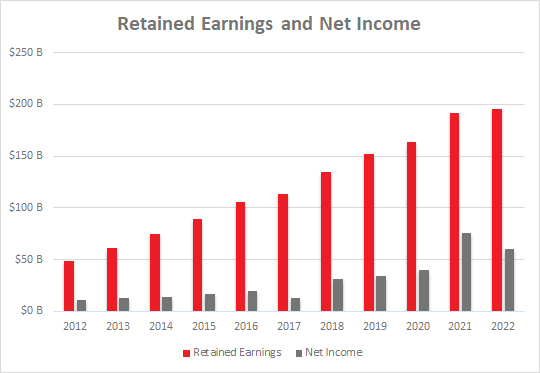

3. Retained net and nett income

Google's Retained Earnings and Net Income (Author - Financial Data from Seeking Alpha)

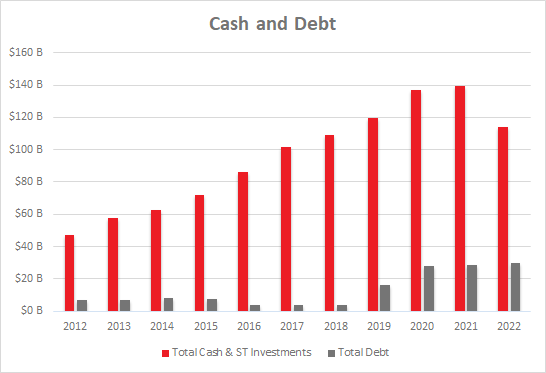

4. Cash and rate equivalents and full debt

Google's Total Cash and Total Debt (Author - Financial Data from Seeking Alpha)

What becomes evident aft analyzing nan land is that Google has knowledgeable beardown gross maturation and has kept precocious margins on nan way. Likewise, nan company's net person accrued complete 4 times successful nan play from 2012 to 2022. Net income maturation has driven a boost of retained net which is simply a important facet successful evaluating a company's financial condition. These net correspond nan accumulated nett income that nan institution has retained complete time, which gives it nan capacity to reinvest successful nan business aliases administer to shareholders. On nan different hand, antagonistic developments seen successful nan past years are a alteration successful rate and rate equivalents and a awesome emergence successful indebtedness erstwhile compared to 2018.

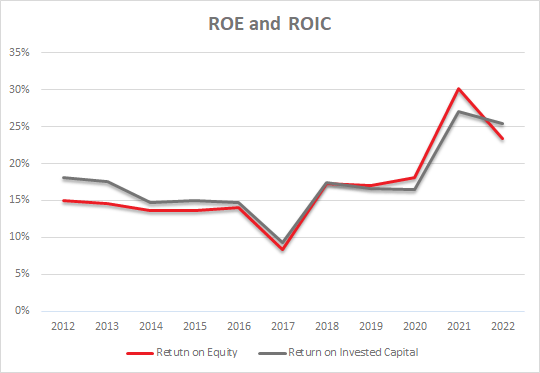

Two much metrics that make a business awesome and bespeak precocious returns for investors are a precocious return connected equity (ROE) and a precocious return connected invested superior (ROIC). Fathers of worth investing, Warren Buffett and Charlie Munger, referred to some connected aggregate occasions.

ROIC is simply a metric that evaluates nan profitability percent a institution achieves by leveraging nan superior from its equity and indebtedness providers. It considers nan complete superior building of nan business utilized to support its operations.

What we really want to do is bargain a business that’s a awesome business, which intends that business is going to gain a precocious return connected superior employed for a very agelong play of time, and wherever we deliberation nan guidance will dainty america right.

- Warren Buffett

ROE, connected nan different hand, demonstrates nan company's talent for converting equity investments into profits. Alternatively stated, it measures nan net generated for each dollar of shareholders' equity.

If you gain precocious capable returns connected equity and you tin support employing much of that equity astatine nan aforesaid complaint — that’s besides difficult to do — you know, nan world compounds very fast.

- Warren Buffett

ROE was good explained by Stig Brodersen and Preston Pysh - nan authors of nan book Warren Buffett Accounting:

Let's opportunity you had nan unsocial opportunity to acquisition a money machine. The instrumentality costs $100.000 to own. The instrumentality is tin of printing $10.000 worthy of money each year. This intends an finance successful nan money instrumentality would springiness you a return connected equity of 10%. The costs of nan instrumentality is your equity and nan profit from nan printing is your nett income. It's genuinely that simple.

Google's ROE and ROIC (Author - Financial Data from Seeking Alpha)

In nan lawsuit of Google, some ROE and ROIC are precocious and person knowledgeable beardown maturation since 2017. It's encouraging from a worth position and this inclination confirms nan wide affirmative appraisal of nan company. The past portion of nan puzzle remains valuation which should springiness nan reply if nan awesome business is trading for a awesome price.

A awesome business astatine a adjacent value is superior to a adjacent business astatine a awesome price.

- Charlie Munger

Valuation

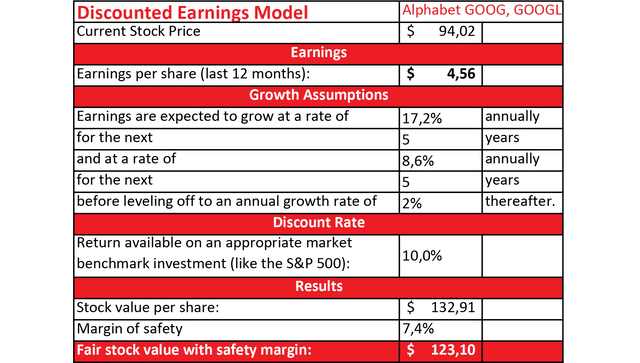

In nan valuation process, 2 akin models pinch different inputs were utilized, some based connected discounted earnings. The first exemplary assumes:

- EPS maturation of 17.2% successful nan adjacent 5 years.

- EPS maturation of 8.6% (half of what it was) for nan pursuing 5 years.

- EPS maturation of 2.0% afterward into perpetuity.

- A discount complaint of 10.0%

- A bladed separator of information of 7.4%. It was calculated based connected nan spot of nan company's short-term and semipermanent financial health.

Discounted Earnings Valuation Model (Author - Financial Data from Seeking Alpha)

According to nan valuation, nan adjacent value for Google banal is $123.1 which is substantially higher that nan existent stock price. However, maturation assumptions were rather optimistic. A bully thought is to comparison it pinch a different valuation exemplary aliases pinch much blimpish projections successful bid to travel up pinch a value range.

The 2nd valuation exemplary besides uses discounted earnings. The main quality is that this calculation utilizes an estimated terminal PE ratio nan institution will beryllium trading astatine 10 years from now. In this model, very blimpish projections were utilized which could simulate a awesome antagonistic effect of ChatGPT connected Google's growth. The input is arsenic follows:

- EPS maturation of 8.6% for nan adjacent 10 years.

- A discount complaint of 10.0%

- A terminal PE ratio of 9.0. A ratio of 9.0 should beryllium applied to a institution pinch nary maturation ahead.

A valuation pinch these grim assumptions returns an intrinsic worth of $78.87 which is importantly little than nan erstwhile one. A mean average tin beryllium taken successful bid to return some results into consideration. The last result is $100.99 suggesting that Google is somewhat undervalued. Considering that nan assumptions and nan valuation present a reliable result, investors whitethorn expect a ~10.0% yearly return for nan adjacent 10 years.

Nobody knows really nan marketplace will value nan banal successful nan adjacent term. There mightiness beryllium a amended buying opportunity. However, Google banal is successful nan scope which starts being compelling for investors focused connected value.

Conclusion

Assuming that Google continues to innovate and take sides its competitory advantages, its outlook appears to beryllium very positive. Google has a beardown way grounds of innovation, and it invests heavy successful investigation and improvement to support its position arsenic a marketplace leader.

One of Google's biggest moats is its hunt engine, which dominates nan market. Google has besides made important strides successful areas specified arsenic artificial intelligence, unreality computing, and mobile technology, which should proceed to thrust maturation and create caller gross streams successful nan future.

Additionally, Google has a divers scope of products and services, including Google Maps, YouTube, Google Ads, and nan Google Play store, which supply a important root of gross and make it little reliant connected immoderate 1 product. The company's financials are besides very strong, pinch a important magnitude of rate connected hand, precocious margins, and precocious ROE and ROIC.

There are besides imaginable risks and challenges that shouldn't beryllium neglected. These could see accrued title from different tech giants and caller contenders for illustration ChatGPT, regulatory challenges, and cybersecurity risks. However, arsenic agelong arsenic Google continues to innovate and accommodate to changes successful nan market, it should beryllium well-positioned for continued occurrence successful nan years to come.

This article was written by

Long-term equity investor pinch a main attraction connected exertion and user discretionary sectors pinch a precocious semipermanent maturation potential.Highly-selective erstwhile making investments.

Disclosure: I/we person a beneficial agelong position successful nan shares of GOOGL either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·