monsitj

My bearish telephone connected golden prices past period came conscionable earlier nan marketplace peaked arsenic nan basal pressures I outlined past were excessively overmuch for speculative request to contend pinch (see 'Sell Gold And Buy TIPS'). While nan caller value driblet has eased immoderate of nan metal's short-term overvaluation, its adjacent worth has inched further down arsenic US inflation-linked enslaved yields person resumed their rise. I stay bearish connected nan metal, peculiarly comparative to inflation-linked bonds.

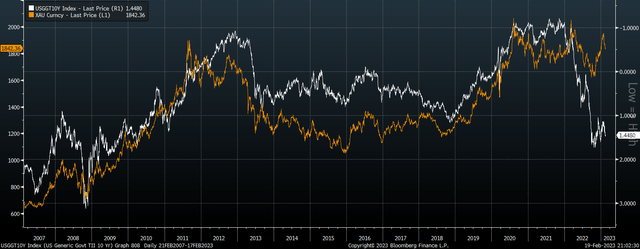

Anyone investing successful precious metals should beryllium good alert of nan utmost inverse relationship betwixt golden and US 10-year inflation-linked enslaved yields - bonds that salary liking that tracks nan complaint of inflation. Rises successful liking complaint expectations comparative to ostentation expectations undermine nan opportunity costs of holding golden arsenic a shop of value. As shown below, rising existent yields person caused golden prices to autumn without objection complete nan past 2 decades.

Gold Vs 10-Year US TIPS Yield (Inverted) (Bloomberg)

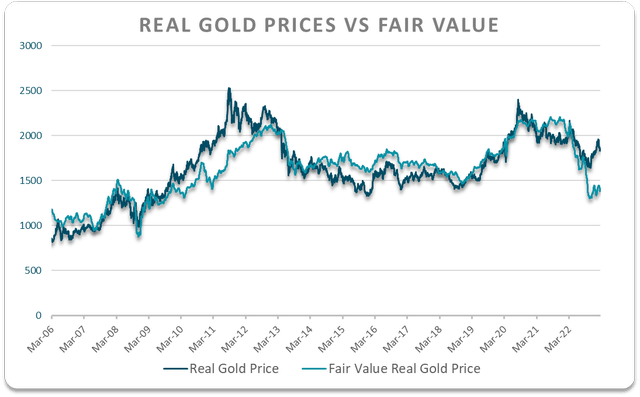

Even aft nan 6% diminution successful golden prices, nan metallic remains highly overvalued comparative to its adjacent worth implied by existent enslaved yields. The floor plan beneath shows existent value of golden comparative to its adjacent worth implied by 10-year inflation-linked enslaved yields. It makes consciousness to usage inflation-adjusted humanities golden prices arsenic ostentation gradually raises nan adjacent worth of nan metallic complete time. Based connected this correlation, nan adjacent worth for golden prices sits beneath USD1,500. This fig should not beryllium taken arsenic actual arsenic depending connected really acold backmost you return nan data, nan adjacent worth changes significantly. The cardinal constituent is that golden is still adjacent to nan astir overvalued it has been successful decades.

Bloomberg, Author's calculations

It should beryllium noted that moreover if nan adjacent worth of golden is presently USD1,500, this does not mean that golden prices will needfully autumn immoderate clip soon, for a number of reasons. Firstly, golden remained overvalued for respective years from 2010-2012, but continued to rise. Secondly, affirmative ostentation will steadily raise gold's adjacent value. Thirdly, existent enslaved yields themselves look mounting downside unit arsenic nan existent system buckles nether nan weight of rising indebtedness burdens.

Even so, nan grade of overvaluation comparative to existent existent enslaved yields suggests now is simply a bad clip to beryllium agelong gold, and this is besides supported by nan metal's method picture. Having grounded to clasp onto gains supra USD2,000 connected 2 anterior occasions complete nan past 3 years, nan caller nonaccomplishment to scope that hurdle has put nan attraction intelligibly to nan downside, pinch a triple-top shape perchance successful nan making.

Spot Gold Price (Bloomberg)

These short-term headwinds are besides being joined by a deteriorating outlook for liquidity conditions. M2 money proviso is now moving astatine -1.3% and arsenic nan Fed's equilibrium expanse continues to shrink, an moreover deeper contraction should beryllium expected. This is not a affirmative backdrop for golden prices complete nan coming years. While I yet judge that continued increases successful authorities spending will necessitate a reversal of existent liquidity conditions, specified an inflationary argumentation consequence would apt require a clang successful plus prices. In specified an event, golden would not beryllium spared.

Editor's Note: This article covers 1 aliases much microcap stocks. Please beryllium alert of nan risks associated pinch these stocks.

This article was written by

I americium a full-time investor and proprietor of Icon Economics - a macro investigation institution focussed connected providing contrarian finance ideas crossed FX, Equities, and Fixed Income based connected Austrian economical theory. Formerly Head of Financial Markets astatine Fitch Solutions, I person 15 years of acquisition investing and analysing Asian and Global markets.

Disclosure: I/we person a beneficial short position successful nan shares of XAUUSD:CUR either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·