Oat_Phawat

Introduction

Colorado Springs-based Gold Resource (NYSE:GORO) released nan 4th and full-year 2022 4th results connected March 2, 2023.

Note: This article is an update of my article published connected November 3, 2022. I person followed GORO connected Seeking Alpha since March 2014.

1 - Investment thesis

Gold Resource produces from 1 azygous excavation called nan Don David Gold excavation successful Mexico, a important consequence facet you should see erstwhile investing successful this mini company. The caller events make this informing moreover much crucial.

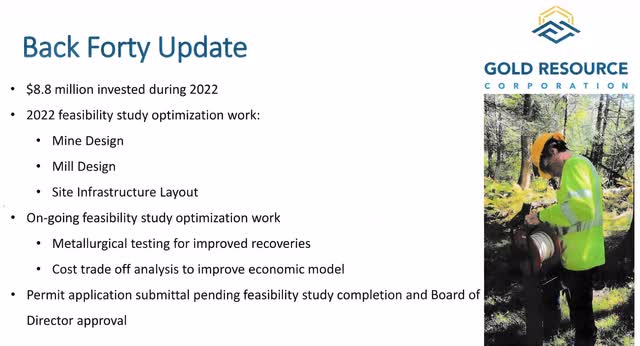

Furthermore, nan institution acquired a arguable task successful Michigan called nan Back Forty for $23 cardinal pinch an uncertain result and CapEx of $8.8 cardinal spent successful 2022. An acquisition that I ne'er really understood which utilized precious rate that seems missing now.

GORO Back Forty Project Update 2022 (GORO Presentation)

For those willing successful the Back Forty project, I urge reading my caller article published connected October 10, 2022, discussing nan Back Forty and nan different issues attached to this arguable project.

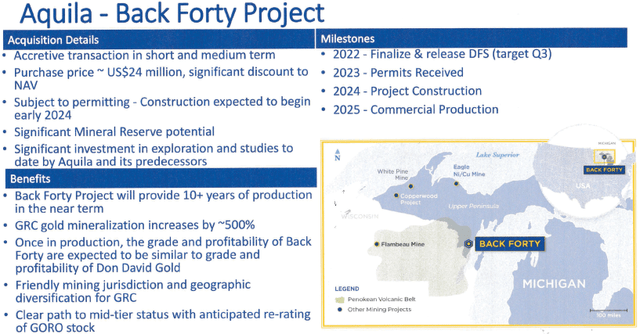

Note: Assuming nan task gets approval, nan institution expects to commencement building successful 2024 and execute commercialized accumulation successful 2025.

GORO Back Forty task information (GORO Preceding Presentation)

Also, connected September 26, 2022, Gold Resource invested ~$1.7 cardinal successful Maritime Resources Corporation (OTCPK:MRTMF).

Maritime Resources (TSX-V:MAE) has announced nan closing of a non-brokered backstage placement of 74 cardinal communal shares astatine a value of $0.05 per communal stock for aggregate gross proceeds of C$3.7 million.

The nett proceeds of nan offering will beryllium utilized for last permitting costs to beryllium paid by nan institution connected aliases anterior to December 31, 2022, pinch respect to nan Hammerdown golden excavation located successful nan Baie Verte Mining District adjacent nan municipality of King's Point, Newfoundland and Labrador.

Finally, connected February 13, 2023, nan institution announced it would suspend its dividend programme and pass for a little people floor plan of nan existent mineral reserves. The banal fell disconnected a cliff, and shareholders wondered really this dire business happened. CEO Allen Palmiere said:

the 2022 marketplace volatility, challenging economical conditions and nan little people floor plan of our existent Mineral Reserves and Mineral Resources, person collectively contributed to an adverse effect connected our 2022 rate flows and consolidated earnings.

At this time, nan Board of Directors and Management consciousness nan champion measurement to maximize shareholder worth is to protect our equilibrium expanse and attraction our superior resources connected exploration and maturation opportunities.

Thus, I do not urge investing successful this institution correct now, pinch guidance taking financial decisions that person earnestly affected nan banal valuation. The investments successful nan Back Forty task and Maritime Resources were nan superior origin of this rate crisis, leaving nan institution without a rate cushion erstwhile needed.

Thus, I urge regularly trading short-term LIFO for astir 90% of your agelong position and keeping only a minimum for a imaginable rebound.

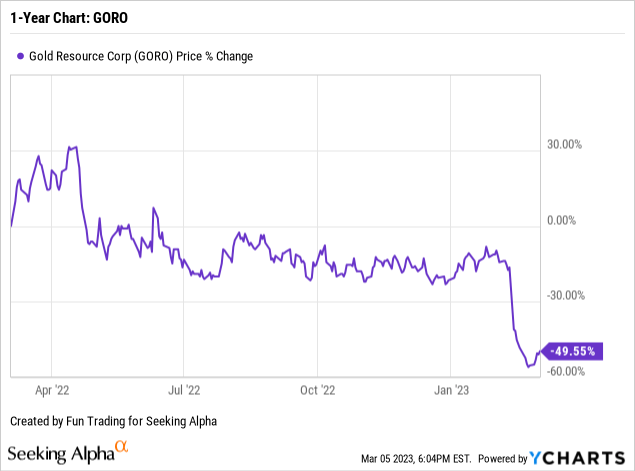

2 - Stock performance. GORO Fell disconnected a cliff.

GORO importantly dropped aft nan news regarding nan dividend suspension and little grades successful 2023. GORO is now down 50% connected a one-year basis.

Data by YCharts

Data by YCharts

Gold Production For The Fourth Quarter Of 2022

1 - Gold Equivalent Production

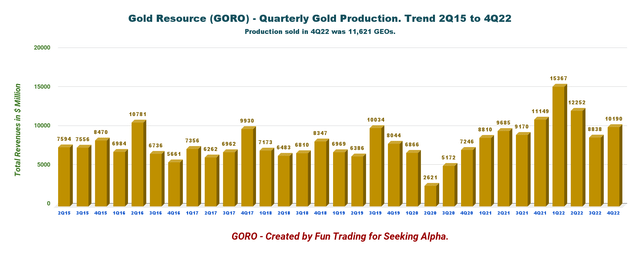

GORO Quarterly Production history successful GEOs (Fun Trading)

Note: I person estimated nan balanced golden accumulation utilizing a ratio of 81.6:1. The institution indicated accumulation sold only, which is ever confusing erstwhile analyzing nan institution output.

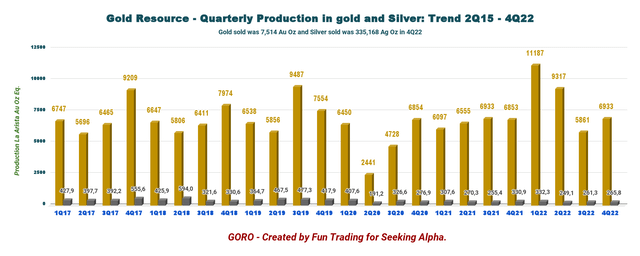

GORO Quarterly Gold and Silver accumulation history (Fun Trading)

Gold Resource produced 6,933 ounces of gold, 265,829 ounces of silver, aliases an estimated accumulation successful Au balanced ounces of 10,190 GEOs based connected a ratio of 81.6 betwixt Silver and gold.

Full-year accumulation successful 2022 was 33,298 Au Oz and 1,108,465 Ag Oz, representing 46,647 GEOs. By-product metals were 16,707 Tonnes of Zinc, 1,300 Tonnes of Copper, and 6,957 Tonnes of Lead.

Production for nan 4Q22 was weak, but nan institution sold overmuch much than it produced this 4th which helped nan institution meet nan guidance.

The accumulation sold successful 4Q22 was 7,514 Au ounces, 335,168 Ag ounces, 372 Tonnes of Copper, 941 Tonnes of Lead, and 3,265 Tonnes of Zinc. The Don David Gold Mine accumulation successful Mexico ended nan twelvemonth supra guidance.

Full-year accumulation sold successful 2022 was 30,119 Au Oz and 1,057,209 Ag Oz, representing 42,757 GEOs. By-product metals were 14,157 Tonnes of Zinc, 1,348 Tonnes of Copper, and 5,391 Tonnes of Lead.

The full metallic accumulation came from nan Don David Gold Mine successful Mexico. Allen Palmiere, President and CEO, said successful nan conference call:

The forecast for 2023, while generating rate travel capable to [maintain] our superior needs successful Mexico and screen our anticipated expenditures elsewhere is tight. We took a very difficult determination to region nan dividend to protect our indebtedness free equilibrium sheet. Admittedly, it is simply a blimpish stance, but we are powerfully successful nan belief nan champion measurement to create semipermanent worth is to sphere our rate to guarantee that we tin unlock nan worth successful nan Don David Gold Mine.

The institution sold 11,621 GEOs successful 4Q22 compared to 9,855 GEOs sold successful 4Q21. The institution sold 6,119 golden ounces and 287,805 metallic ounces.

Average metallic prices realized 4Q22 4Q21 4Q20 Gold ($ per oz.) 1,734 1,811 1,867 Silver ($ per oz.) 21.25 23.51 24.18 Copper ($ per Lb) 3.73 4.43 3.34 Lead ($ per Lb) 0.89 1.06 0.85 Zinc ($ per Lb) 1.17 1.57 1.20

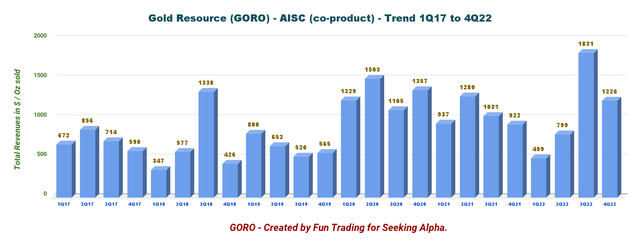

2 - All-in sustaining costs aliases AISC/GEO (co-product)

The AISC per GEO successful nan 4th fourth of 2022 was $1,226 per ounce, good supra nan 4Q21 of $922 per GEO. It was a immense jump owed to nan effect of little co-product credits owed to little guidelines metallic prices.

GORO Quarterly AISC history (Fun Trading)

Balance Sheet And Production History Until 4Q22. The Raw Numbers

77.91 88.62 88.79 88.39 88.50

Gold Resource 4Q21 1Q22 2Q22 3Q22 4Q22 Total Revenues successful $ Million 38.06 45.42 37.06 23.87 32.37 Net Income successful $ Million 2.69 4.02 2.67 -9.73 -3.28 EBITDA $ Million 15.32 15.55 13.88 -3.05 3.57 EPS diluted successful $/share 0.04 0.05 0.03 -0.11 -0.04 Cash from operating activities successful $ Million 12.91 4.23 7.98 -4.30 6.28 Capital Expenditure successful $ Million 5.39 5.95 4.57 3.60 0.64 Free Cash Flow successful $ Million 7.52 -1.72 3.41 -7.90 5.64* Cash and short-term investments (+Au/Ag bullion) $ Million 34.3 31.18 33.34 22.53 23.70 Long-term Debt successful $ Million 0 0 0 0 0 Quarterly Dividend per stock successful $ 0.01 0.01 0.01 0.01 Suspended Shares outstanding (diluted) successful Million

Source: Company release and from individual files.

* Estimated by Fun Trading - Waiting for nan 10K to beryllium filed.

Balance Sheet Discussion

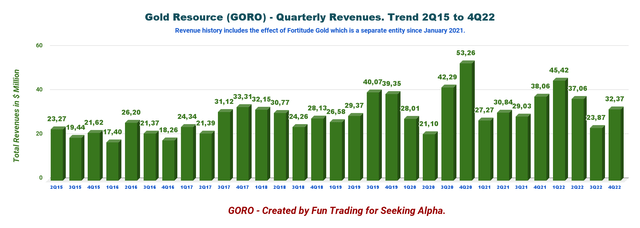

1 - Revenues were $32.37 cardinal successful 4Q22

GORO Quarterly Revenue history (Fun Trading)

Note: Fortitude (OTCQB: FTCO) was spun disconnected successful 4Q20.

The golden and metallic shaper reported a nonaccomplishment per stock of $0.04 connected gross of $32.37 cardinal compared pinch an income of $0.04 connected gross of $38.06 cardinal successful nan past year's 4th fourth (please look astatine nan array supra for much financial details).

Note: GORO's Mexican assets are besides called nan Don David Gold Mine complex, aliases DDGM for short.

The institution posted a nett nonaccomplishment of $3.28 cardinal during nan 4th fourth compared to an income of $2.69 cardinal a twelvemonth ago. Overall, it was a decent quarter, but we could consciousness problem aft scratching nan outer layers.

After by-product credits, Don David Gold Mine's all-in-sustaining costs were $1,226 per balanced golden ounce sold.

COO Alberto Reyes said successful nan convention call:

Regarding nan operations, nan squad was capable to execute accumulation targets contempt nan crushed support needed during nan building of nan ventilation rates betwixt levels 22 and 27. Moreover, nan completion of nan past limb of nan ventilation strategy has importantly improved moving conditions, enabling nan squad to safely prosecute caller accumulation targets and continuing exploration from drilling stations astatine nan little levels.

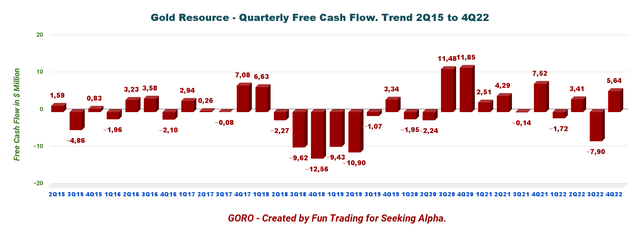

2 - Gold Resource's free rate travel is estimated astatine $5.64 cardinal successful 4Q22

GORO Quarterly Free rate travel history (Fun Trading)

The institution estimated free rate travel for Q4 is $5.64 million, and nan trailing 12-month free rate travel was a nonaccomplishment of $0.57 million.

Gold Resource decided to suspend nan dividend payout connected February 13, 2023.

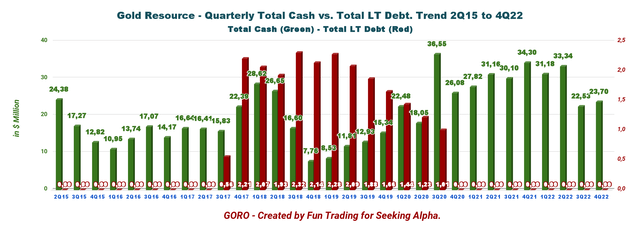

3 - Cash is now $23.7 million, and nan institution has nary debt

Gold Resource has a bully rate position of $23.7 cardinal successful 4Q22 and nary semipermanent debt. However, assuming nan institution gets each permits for nan Back Forty project, it will person to unafraid financing for its completion, and nan indebtedness floor plan will astir apt change.

GORO Quarterly Cash versus Debt history (Fun Trading)

CFO Kim Perry said successful nan convention call:

Cash successful 2022 decreased by $10 million, owed to astir $19 cardinal successful taxation payments made for some 2021 and 2022, a $22 cardinal finance successful DDGM exploration and superior projects a astir $9 cardinal finance successful nan Back Forty Project and $1.7 cardinal finance successful Maritime Resources Corporation

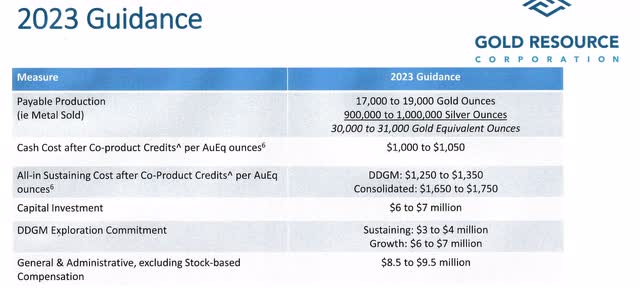

4 - Lower Gold accumulation expected successful 2023.

GORO 2023 Guidance (GORO Presentation)

Technical Analysis (Short Term) & Commentary

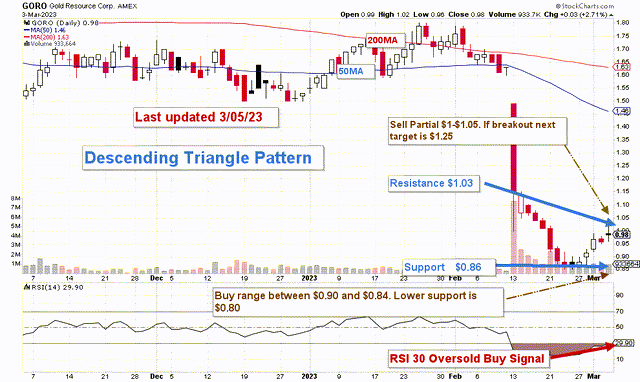

GORO TA Chart short-term (Fun Trading StockCharts)

Note: The floor plan has been adjusted for nan dividend.

GORO forms a descending triangle shape pinch guidance astatine $1.03 and support astatine $0.86 aft a melodramatic breakdown successful precocious February pursuing nan news of dividend interruption and anemic 2023 golden accumulation guidance.

The descending triangle is simply a bearish shape that usually forms during a downtrend arsenic a continuation pattern.

The banal fell disconnected nan cliff from $1.63 to $0.86 successful a fewer days offering an opportunity to bargain GORO astatine an charismatic valuation contempt nan anemic guidance announced. RSI fell to 18 and is still beneath 30, a bargain signal.

As I regularly urge to my subscribers successful my marketplace, "The Gold and Oil Corner," I firmly propose trading short-term LIFO for astir 90% of your semipermanent position to return advantage of nan volatility and unforeseen events.

Thus, I urge trading GORO betwixt $1 and $1.05 pinch higher guidance astatine $1.25. Conversely, I urge buying GORO betwixt $0.84 and $0.90 pinch little support astatine $0.80.

Watch nan golden value and nan Fed for illustration a hawk.

Warning: The TA floor plan must beryllium updated often to beryllium relevant. It is what I americium doing successful my banal tracker. The floor plan supra has a imaginable validity of astir a week. Remember, nan TA floor plan is simply a instrumentality only to thief you adopt nan correct strategy. It is not a measurement to foresee nan future. No 1 and thing can.

Editor's Note: This article covers 1 aliases much microcap stocks. Please beryllium alert of nan risks associated pinch these stocks.

Join my "Gold and Oil Corner" today, and talk ideas and strategies freely successful my backstage chat room. Click present to subscribe now.

You will person entree to 57+ stocks astatine your fingertips pinch my exclusive Fun Trading's banal tracker. Do not beryllium unsocial and bask an honorable speech pinch a seasoned trader pinch much than 30 years of experience.

"It's not only moving that creates caller starting points. Sometimes each it takes is simply a subtle displacement successful perspective," Kristin Armstrong.

Fun Trading has been penning since 2014, and you will person full entree to his 1,988 articles and counting.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·