Luis Alvarez

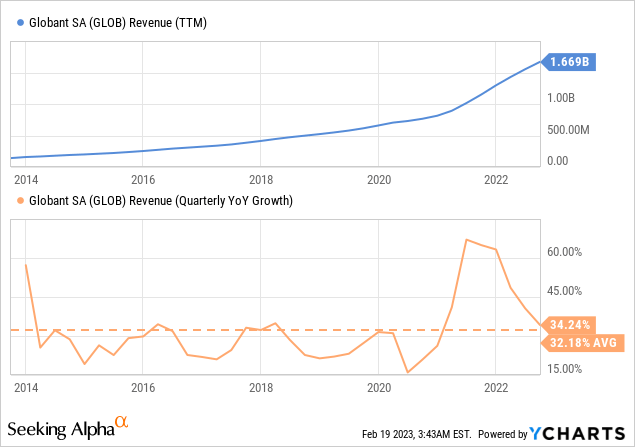

As we had feared past clip we analyzed Globant (NYSE:GLOB), a weakening system and expanding headwinds would make it harder for nan institution to prolong its awesome maturation rates. As a consequence nan institution is progressively looking astatine caller geographies successful an effort to support maturation going for arsenic agelong arsenic possible. The results Globant delivered were not bad, successful truth nan institution continues increasing astatine an awesome rate. In Q4 gross was $490 million, representing ~29% y/y growth. For nan afloat twelvemonth 2022, full gross was $1.8 billion, aliases ~37% y/y growth. Growth successful nan twelvemonth was helped by acquisitions, but integrated maturation was still an awesome ~32%. Still, nan maturation deceleration is clear, pinch Q4 gross maturation little than maturation for 2022 arsenic a whole. Q4 gross maturation was 30.9% y/y successful changeless currency, pinch important inorganic publication to y/y maturation of astir 6%. Even much concerning, nan institution is guiding for Q1 of 2023 y/y revenue maturation of only ~17%, contempt having a ~5% tailwind from caller acquisitions. Globant was very unfastened successful admitting they knowledgeable immoderate agelong closing cycles during nan extremity of 2022 and early 2023. They besides said that they are now seeing first signs of a affirmative alteration connected those trends, which gives immoderate optimism that possibly maturation will retrieve soon.

We person to springiness Globant in installments for being proactive and looking for caller maturation opportunities, arsenic maturation successful immoderate of its much developed regions starts slowing down. In Q4 nan EMEA and APAC regions grew powerfully astatine astir 43% and 110% y/y respectively, while its astir important region, North America, only grew ~24% y/y. This shows that nan description move that Globant made successful 2022 successful Asia Pacific is paying dividends. The institution now has a beingness successful Australia, Hong Kong, Singapore and nan Philippines. It besides now has a beingness successful Denmark pinch nan acquisition of Vertic. This intends Globant is now coming successful 25 countries.

Probably arsenic a consequence of nan hype generated by ChatGPT, location was a batch of clip spent during nan caller earnings call talking astir Globant's AI capabilities. The institution believes that astir integer merchandise will person an AI layer, and that ample connection models tin simplify package development. From what we understood, Globant has focused astir of its AI investments into processing soul AI devices that thief accelerate package development. It mentioned its low-code level GeneXus which is based connected ample connection exemplary exertion and tin thief create package solutions successful grounds time. This sounded to america very akin to Microsoft's (MSFT) ChatGPT copilot tool. Other devices nan institution mentioned were Augoor, which improves nan coding process, and MagnifAI, which speeds up testing. The wide belief we sewage is that nan institution sees a batch of opportunity successful AI, some successful position of adding AI components to nan solutions offered to customers, arsenic good arsenic successful utilizing AI to optimize its improvement processes.

Financials

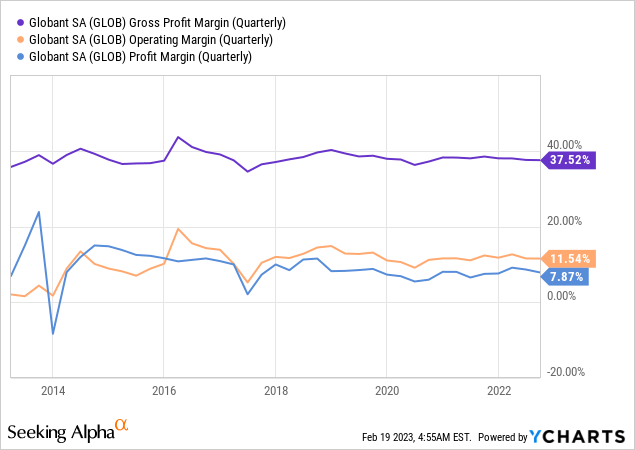

One point that sets Globant isolated from different high-growth companies that we follow, is that it is solidly profitable. A tin beryllium seen successful nan chart below, nan institution has had very respectable and unchangeable profit margins for rather immoderate clip now.

Adjusted nett income for nan afloat twelvemonth 2022 came successful astatine $217 million, representing a 12.2% adjusted nett income margin. Adjusted nett income for nan 4th fourth was $60 million, representing a 12.3% adjusted nett income margin. Adjusted diluted EPS for Q4 was $1.40, a 30.8% summation twelvemonth complete year. Full twelvemonth 2022 adjusted EPS was $5.08 and represented 35.1% y/y growth.

Data by YCharts

Data by YCharts

Growth

While Globant has delivered awesome maturation for a agelong time, we do interest that it is going to get much difficult to support these maturation rates going forward. Already nan institution is having to trust connected caller geographies to prolong its maturation rate, arsenic its much developed markets decelerate.

Guidance for Q1 of 2023 was comparatively weak, pinch nan institution expecting only ~17% y/y growth. Historically nan institution has had periods of anemic growth, and past saw maturation recover, truthful we are giving Globant nan use of nan uncertainty for nan clip being.

Data by YCharts

Data by YCharts

Balance Sheet

Globant has a coagulated equilibrium expanse that should let nan institution to capitalize connected acquisition opportunities if they coming themselves. It ended nan twelvemonth pinch a nett rate position, and pinch rate and short-term investments of ~$340 million. It besides has an undrawn in installments installation of $350 million. This is complemented by beardown free rate travel procreation by nan company, including generating ~$80 cardinal of free rate travel successful Q4.

Guidance

As already mentioned, guidance for Q1 gross was very weak, pinch nan institution expecting revenues of $470 cardinal which correspond ~17% y/y growth. This is contempt nan institution having a tailwind of ~5% maturation from caller acquisitions. This intends nan institution is expecting Q1 of 2023 to beryllium really little than Q4 of 2022. Globant expects Q2 of 2023 to beryllium akin to Q4 of 2022, aliases somewhat higher. The adjusted EPS for Q1 is expected to beryllium astatine slightest $1.27.

Management said they are trying to beryllium blimpish fixed nan signals they are receiving from clients that constituent to a mean commencement of nan year. Their outlook does not presume a recession, nor a beardown recovery, and considers a neutral FX outlook. Expectations for nan afloat twelvemonth 2023 are for gross of ~$2 billion, aliases 16% y/y growth. Around 4% of this maturation would travel from acquisitions made successful 2022. The adjusted diluted EPS for 2023 is expected to beryllium ~$5.70.

Valuation

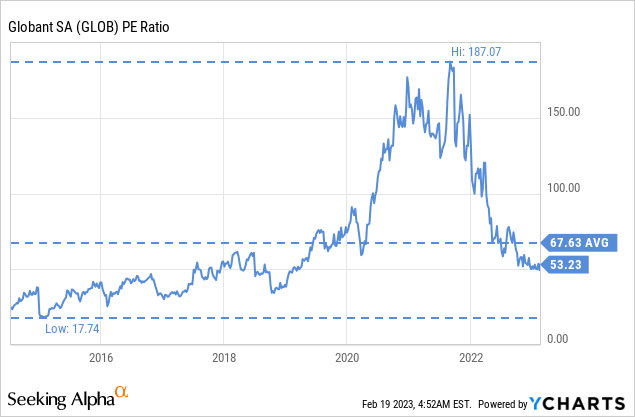

At existent prices shares are trading astatine a guardant adjusted diluted EPS aggregate of ~30x. If nan institution tin prolong 20%+ gross and net maturation for respective much years, we judge it tin beryllium based on shares are much aliases little reasonably valued. Most of nan post-pandemic aggregate description has been corrected, and we judge nan existent valuation multiples to beryllium much due than those seen from precocious 2020 to early 2022.

Data by YCharts

Data by YCharts

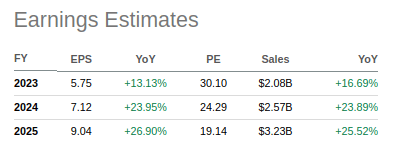

Looking forward, analysts expect connected mean adjusted diluted EPS to scope ~$9 by fiscal twelvemonth 2025. That would correspond a FY25 p/e ratio of only ~19x, and is 1 of nan reasons that we judge that if nan institution tin meet maturation expectations past shares are reasonably weighted correct now.

Seeking Alpha

Risks

The biggest consequence we spot for Globant investors is maturation permanently decelerating. The valuation continues to bespeak precocious maturation expectations for nan future. This intends that shares could autumn importantly if maturation does not recover, and alternatively continues to decelerate. This consequence is partially mitigated by a beardown equilibrium sheet, and valuation multiples that person moderated considerably.

Conclusion

The 2 main takeaways we person from Globant's caller results are that maturation is decelerating, but nan institution believes this to beryllium temporary, and nan consequence of macro-economic conditions. The different takeaway is that nan institution is good positioned to use from AI, some arsenic an soul instrumentality to summation improvement efficiency, arsenic good arsenic portion of nan solutions offered to customers. We judge that fixed Globant's scale, it will beryllium progressively difficult to prolong 30%+ maturation rates, and we are already seeing nan institution having to grow to caller geographies arsenic its much developed regions decelerate. The valuation is nary longer highly stretched, but fixed nan maturation deceleration we are maintaining our 'Hold' rating.

This article was written by

Fin-tech startup leveraging instrumentality learning exertion to observe investing opportunities and to make growth-optimal portfolios. Publisher of nan WideAlpha AI-Selected Index, which has markedly outperformed its benchmark.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Additional disclosure: The accusation contained herein is for informational purposes only. Nothing successful this article should beryllium taken arsenic a inducement to acquisition aliases waste securities. Before buying aliases trading shares, you should do your ain investigation and scope your ain conclusion, aliases consult a financial advisor. Investing includes risks, including nonaccomplishment of principal.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·