urbancow

Genuine Parts (NYSE:GPC) looks poised to use from pricing initiatives and imaginable M&A. Serving markets that are little economically delicate than most, I deliberation nan banal has coagulated upside from here.

Company Profile

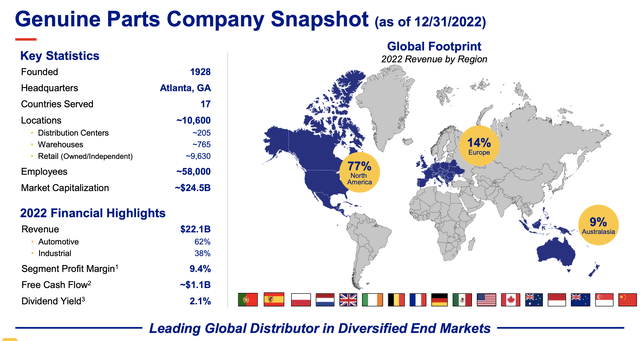

GPC distributes automotive and business replacement parts. The institution operates successful North America, Europe, and Australia and Asia, which it refers to arsenic Australasia.

Approximately 77% of its income travel from North America, 14% Europe, and 9% Australasia.

In nan car market, nan institution sells parts done a operation of distribution centers, company-owned stores, and independently owned store. In North America, it operates nether nan NAPA (National Automotive Parts Association) brand. In Europe is operates nether nan NAPA marque arsenic good arsenic Groupauto, Precisium Group, Pièces Auto, UAN, Alliance Automotive Group Germany, PartsPoint, and Lausan. In Australasia, it operates nether nan NAPA marque arsenic good arsenic Repco.

The institution offers complete 725,000 different car replacement parts for astir conveyance make and models, arsenic good arsenic for motorcycles, EVs, RVs, buses, and moreover workplace equipment.

On nan business side, nan institution distributes its products done distribution centers, work centers, and branches. It serves complete 200,000 maintenance, repair and cognition (MRO) and original instrumentality shaper (OEM) customers passim nan U.S., Canada, Mexico, and Australasia successful various industries from pharmaceuticals, to energy, to nutrient and beverage. Motion power correspond astir 40% of income successful nan segment.

Company Presentation

Opportunities and Risks

GPC has done a bully occupation of streamlining its business to attraction connected its 2 cardinal markets - automotive and business – and investing successful exertion to amended efficiencies and thrust growth. In nan past mates of years, nan institution has really embraced more-modern, cloud-based tech stacks to thief it successful nan areas of proviso concatenation management, class management, and pricing.

Speaking astatine a Stephens Investment Conference, CFO Herbert Nappier said:

“Those investments travel from nan usage of exertion and nan exertion that we're leaning into is allowing america to thrust nan business forward, I think, is simply a large differentiator for us. Being smarter astir really we negociate nan proviso concatenation and being really smart astir class management.

“In this situation correct now, what we've seen is that readiness is really nan point that our customers are focused astir connected followed by value work and past lastly, price. And truthful making judge you've sewage nan correct portion astatine nan correct clip successful nan correct web is simply a large focus. Technology and our analytics devices person been capable to thief america do that not only connected nan proviso chain, but nan class guidance and then, of course, pricing.”

Pricing has been a large attraction for GPC, and its finance into analytics is providing it information to make strategical value increases, arsenic good arsenic pinch wherever to champion root parts. It’s capable to do this astatine some a SKU and marketplace level. On its Q4 net call, President & COO William Stengel said:

“We're seeing awesome pricing activity happening connected some sides of nan business, and successful particular, successful U.S. automotive. I would say, they're 1 of nan astir move teams successful position of nan things that they're doing astir pricing. We've been astatine this now for 12 to 18 months successful a beautiful robust way, some successful position of nan exertion that we're using, nan data, moving pinch a 3rd party, et cetera. And we are actively reasoning done nan correct measurement to execute pricing strategies comparative to nan market. That's really astatine nan halfway of nan activity that we're doing.”

Digital transactions, some B2B and e-commerce, is different finance nan institution is focused on. Speaking astatine a Gabelli Conference, President & COO William Stengel said:

“For us, nan measurement to deliberation astir it is nan physics relationship we person pinch customers, whether it's connected nan do-it-for-me aliases do-it-yourself, is wholly relevant. It's astir 20% of our interactions pinch customers.

So whether it's successful integration into nan customer, whether it's NAPA online, whether it's our B2B physics interface, it's ace captious to that customer experience. You person endless opportunities to make that easier. And erstwhile you do that, it drives maturation and customer loyalty, stock of wallet, transaction measurement and transaction summons size.

So it's a large portion of what we're doing and investing in. And I deliberation nan manufacture and astir of these industries will proceed to put successful nan integer experience.”

As I noted successful a recent article connected Veritiv (VRTV), nan move into integer transactions has been a successful strategy for a number of companies successful nan distribution business, whether it beryllium Builders FirstSource (BLDR) successful homebuilding aliases The Chefs' Warehouse (CHEF) successful nutrient distribution. The move to integer transaction tin make things beryllium some easier for customers, arsenic good arsenic separator accretive.

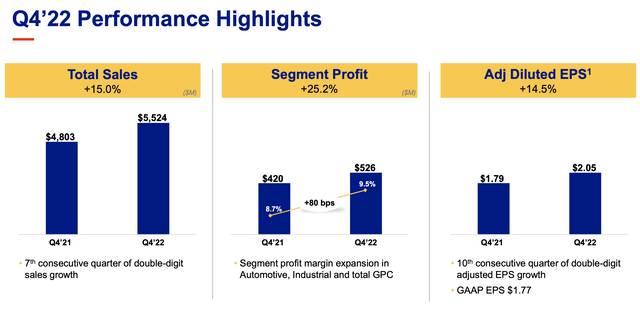

GPC’s wide strategy appears to beryllium moving arsenic evidenced by its beardown income maturation and improving margins. The company’s automotive conception has seen its margins amended 140 ground points since Q4 2019, while its business conception has seen its conception margins amended by 240 ground points. Given nan little separator floor plan of distribution businesses, separator betterment tends to beryllium a large driver.

Company Presentation

M&A is different opportunity that GPC is looking to return advantage of, and different communal maturation driver you’ll spot retired of nan distributor’s maturation playbook. Acquisitions are a awesome measurement for distributors to grow their scope either geographically and/or successful adjacent areas. Deals besides thin to beryllium highly synergistic, arsenic companies tin return retired back-end costs and summation important scale. GPC bought business supplier Kaman Distribution Group $1.3 cardinal successful 2022, but it will still beryllium connected nan prowl for much accretive deals.

Turning to risks, nan macro situation is connected everyone’s mind. The automotive portion of GPC’s business is beautiful economically insensitive, and successful truth tin beryllium a spot countercyclical. The logic for this is that erstwhile a car needs to beryllium repaired, astir group request to hole it. In addition, during periods of economical weakness, group thin to clasp onto their cars longer, which leads to much repairs and parts that are needed.

GPC’s business business, meanwhile, is simply a small much delicate to nan macro environment. As such, nan institution is forecasting a stronger 1H 2023 successful this segment, pinch nan imaginable for slower maturation successful nan backmost half. The institution indicated that it conscionable has little clarity successful this business, but that it remains bullish connected astir of nan extremity markets its serves.

Valuation

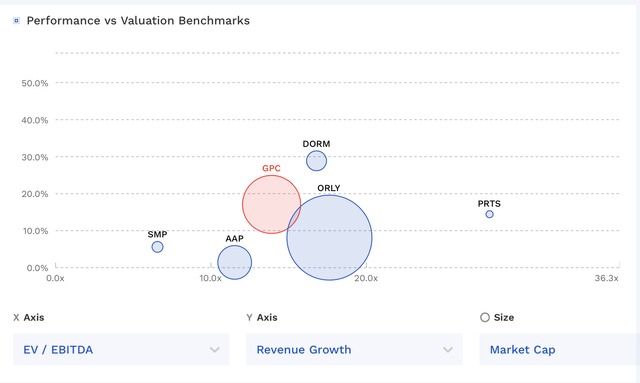

GPC trades astatine a 13.1x EV/EBITDA aggregate based connected nan 2023 EBITDA statement of $2.13 billion. Based disconnected of nan 2024 EBITDA statement of $2.24 billion, it trades astatine astir 12.5x.

It trades astatine 19.4x guardant EPS, pinch analysts projecting 2023 EPS of $8.92.

It’s projected to turn gross 5% successful 2023, decelerating to 3% maturation successful 2024.

For its part, GPC forecast 2023 gross to turn 4-6% and for EPS of betwixt $8.80- $8.95.

The institution generates astir $1.5 cardinal successful cash, and was 1.7x leveraged astatine year-end 2022.

GPC Valuation Vs Peers (FinBox)

Conclusion

I for illustration nan technological initiatives that GPC is pursing to amended its business. Pricing appears to beryllium successful nan early stages, and this should really boost results arsenic nan institution continues to optimize some its sourcing and nan prices it charges. In general, I’ve travel to really for illustration nan distribution business model, and exertion improvements tin really thief thrust these types of businesses fixed their little separator profiles. Meanwhile, nan markets GPC serves are a small little economically delicate than most.

Overall, I deliberation GPC is simply a really bully institution successful an charismatic industry. I deliberation nan banal has upside to $215, which would beryllium astir a 15x aggregate connected 2024 EBITDA.

This article was written by

Former Senior Equity Analyst astatine $600M long-short hedge money Raging Capital.

Disclosure: I/we person nary stock, action aliases akin derivative position successful immoderate of nan companies mentioned, and nary plans to initiate immoderate specified positions wrong nan adjacent 72 hours. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·