MicroStockHub

Forward Air Corporation (NASDAQ:FWRD) reports nan largest logistic web successful North America and Mexico pinch complete 200 locations. Management precocious reported nan opening of 30 caller terminals successful nan adjacent 5 years, and intends to create further nan IT systems. In my view, if nan costs cutting efforts precocious announced aliases nan relationships pinch 3rd parties don't ruin Forward Air's operations, we tin expect FCF generation. My DCF exemplary indicated that Forward Air trades undervalued astatine its existent marketplace price.

Forward Air

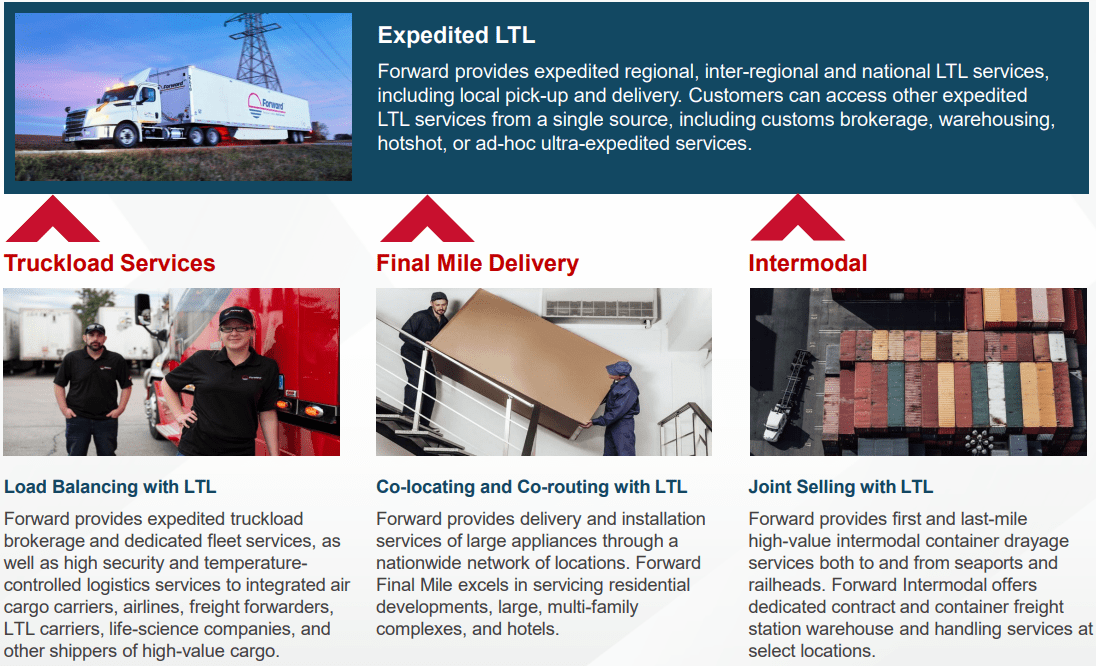

Based successful Tennessee, Forward Air offers crushed proscription and related logistics services successful nan United States and Canada.

The company's proscription options connection different varieties specified arsenic trucks for dense and ray loads, specialized proscription to debar harm arsenic good arsenic to support temperatures, and elemental shipments.

Forward Air presents an asset-light business model, which intends that it minimizes nan magnitude of shipments connected its spot successful bid to debar ample exposures successful its operations arsenic good arsenic to trim nan magnitude of consequence successful this regard. According to nan past yearly report, nan institution presently has astir six 1000 trucks connected its property, pinch an mean property of six years.

In its 40 years of experience, nan institution has gone from being a elemental crushed shipping institution to being portion of nan basal phases of its clients' accumulation processes and proviso chains, securing its position locally and successful countries bordering connected semipermanent agreements for nan coming years.

The Forward Air business exemplary reports 2 progressive segments, namely nan proscription conception and nan intermodal segment. The carrier conception offers customers nan possibilities of section pick-up arsenic good arsenic nan last transportation work astatine their doorstep, retention warehouses, consolidation and packaging of shipments, and different types of services.

Source: Presentation To Investors

The intermodal conception is chiefly linked to nan carrier done containers, some merchandise and machinery, and different products. This besides includes nan anticipation of generating personalized contracts and nan deposit service. Its beingness is presently concentrated successful nan eastbound zone, successful nan mediate portion and nan south, though it is besides projected to grow to nan different seashore and areas wherever it has not yet been capable to position itself.

Forward Air Expects To Open New Terminals, And Expects Cost Cutting Initiatives

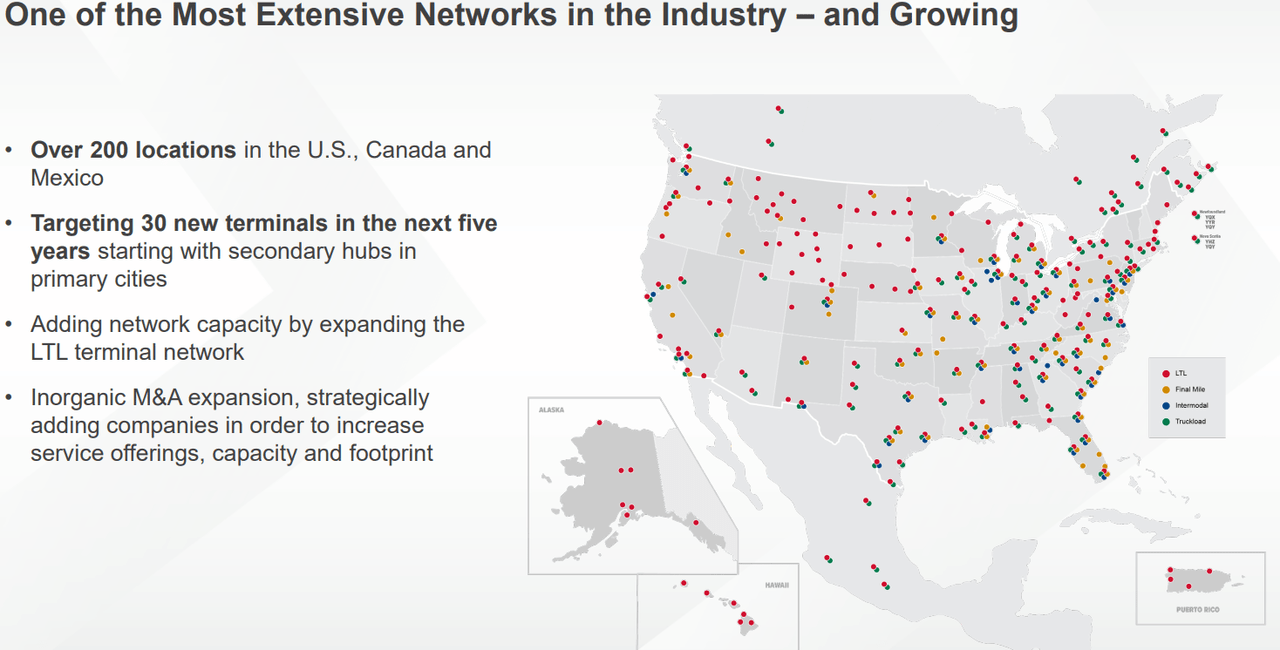

I judge that 1 of nan company's astir valuable assets is its network, which includes complete 200 locations successful North America and Mexico. It is besides worthy noting that nan institution expects to unfastened 30 caller terminals successful nan adjacent 5 years, which will apt consequence successful gross maturation generation.

Source: Presentation To Investors

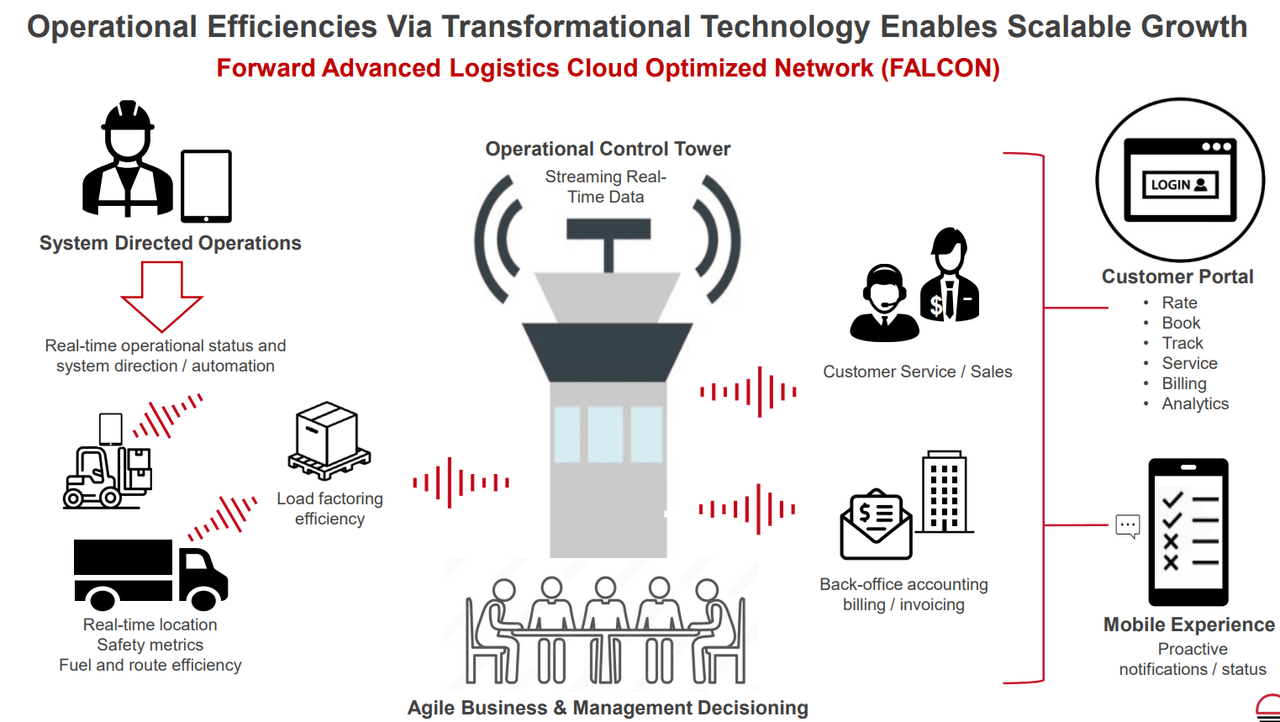

I would besides expect different description ary strategies, which whitethorn see caller work offers, caller terminals extracurricular nan airdrome areas, and nan acquisition of onshore and akin work companies. Finally, if nan institution invests and develops its accusation systems astatine a faster gait than different competitors, and logistics go much efficient, I judge that much clients will apt take services offered by Forward Air.

Source: Presentation To Investors

I would besides adhd that nan institution will instrumentality respective costs cutting initiatives successful nan coming months, which whitethorn heighten profitability. In nan astir caller quarterly report, Forward Air delivered respective commentaries successful this regard.

In summation to Forward Force, our inaugural to turn high-value freight, we implemented a costs simplification inaugural - which we telephone Forward Game Shape. We instituted a hiring frost (excluding impacts from nan Land Air Express acquisition, our worker headcount has decreased by much than 100 labor complete nan past 2 months), constricted recreation to basal only, and reduced our LTL extracurricular miles to beneath 5%. Source: Forward Air Corporation Reports Fourth Quarter 2022

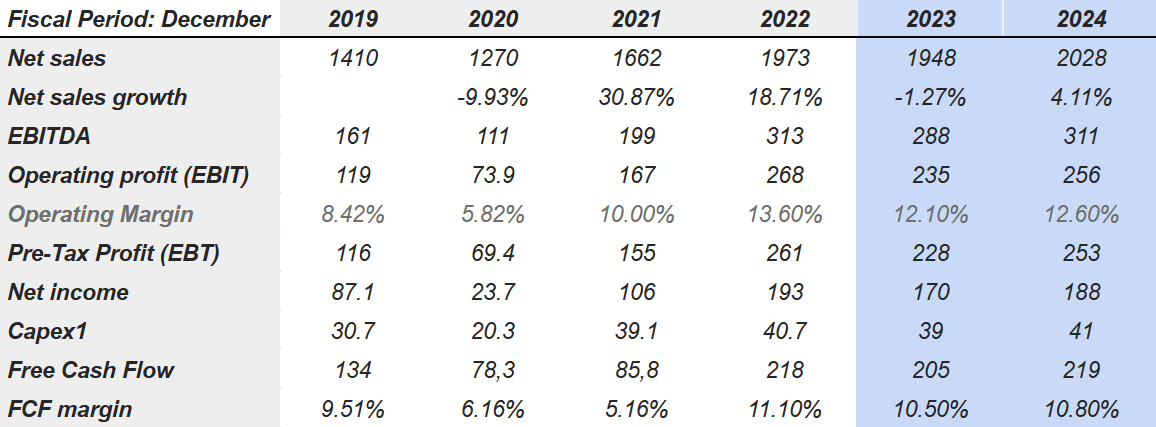

Expectations From Financial Analysts Include Double-Digit Sales Growth

Expectations from different financial analysts look favorable. For 2024, estimates see nett income of $2.028 million, nett income maturation of 4.11%, an EBITDA of $311 million, operating profit of $256 million, and an operating separator of 12.60%. Pre-tax profit would guidelines astatine $253 million, accompanied by 2024 nett income adjacent to $189 million. Besides, pinch capex adjacent to $41 million, 2024 free rate flow would guidelines astatine $219 cardinal pinch a FCF separator of 10.80%.

Source: Market Screener

Balance Sheet

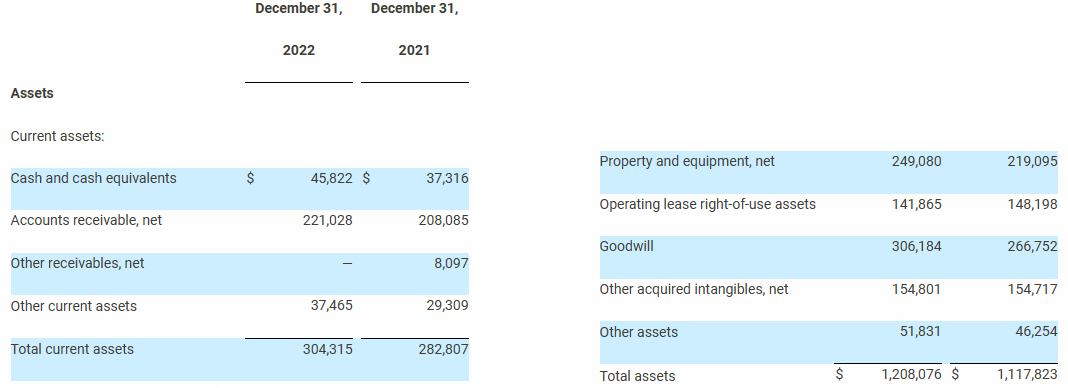

As of December 30, 2022, Forward Air reported rate of $45 million, accounts receivable of $221 million, and different existent assets of $37 million. In sum, full existent assets stood astatine $312.967 million, adjacent to 2x nan full magnitude of existent assets.

Property and instrumentality was adjacent to $249 cardinal pinch an operating lease correct of usage assets of $141 million, goodwill of $306 million, and different acquired intangibles of $154 million. Finally, nan full magnitude of assets was adjacent to $1.2 billion, importantly much than nan full magnitude of liabilities.

Source: Forward Air Corporation Reports Fourth Quarter 2022

Forward Air besides reported a mini magnitude of liabilities, which included accounts payable of $54 cardinal pinch accrued expenses of $54 million. The existent information of indebtedness and finance lease obligations stood astatine $9 million, pinch nan existent information of operating lease liabilities of $47 million. Total existent liabilities were adjacent to only $169 million.

Long word liabilities included finance lease obligations of $15 cardinal together pinch agelong word indebtedness of $106 million, operating lease liabilities of $98 million, different agelong word liabilities of $59 million, and deferred income taxes of $51 million.

Source: Forward Air Corporation Reports Fourth Quarter 2022

My DCF Model Implied $120 Per Share

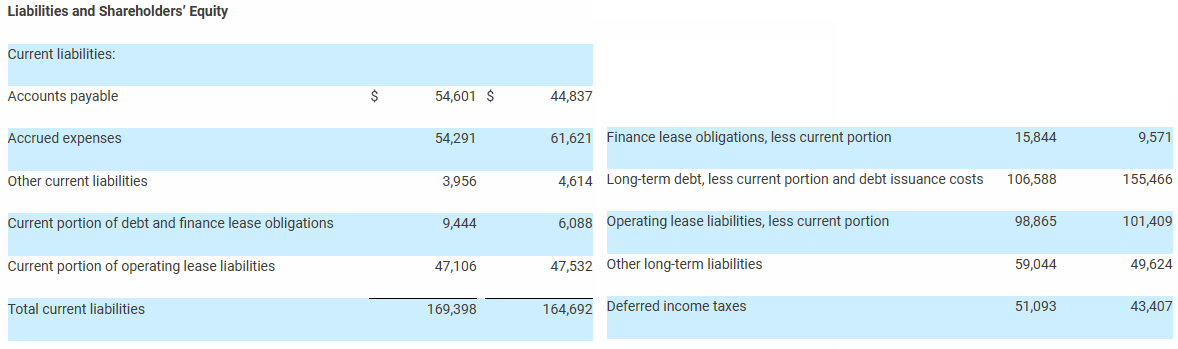

My assumptions for nan rate travel connection included 2034 nett income of $272 million, a depreciation and amortization of $91.9 million, and stock based compensation disbursal of $25.382 million.

I besides foresee a 2034 proviso for gross accommodation of $18.474 cardinal pinch a deferred income taxation disbursal adjacent to $3.305 cardinal and 2034 changes successful accounts receivable of -$122.533 million. 2034 changes successful prepaid expenses would guidelines astatine -$18.611 cardinal pinch changes successful accounts payable of $39.955 million. Finally, 2034 rate travel from operations would guidelines astatine $292 million.

Source: Internal Estimates

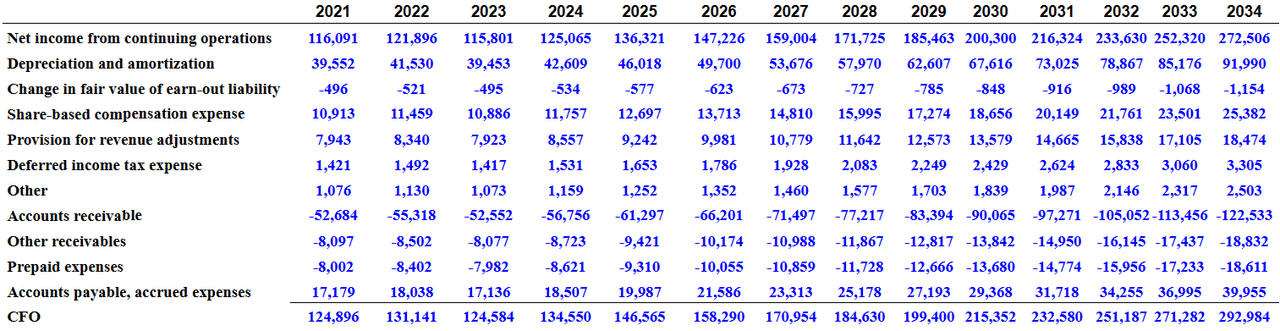

My results would see 2034 FCF of $231 million, and pinch a WACC of 8.15%, nan NPV would beryllium $998 million. Besides, if we usage an EV/FCF of 25x, nan terminal worth would beryllium $5.8 cardinal pinch a NPV of $2.265 billion. I besides foresee an endeavor worth of $3.2 billion, pinch equity of $3.185 cardinal and a adjacent value of $120 per share.

Source: Internal Estimates

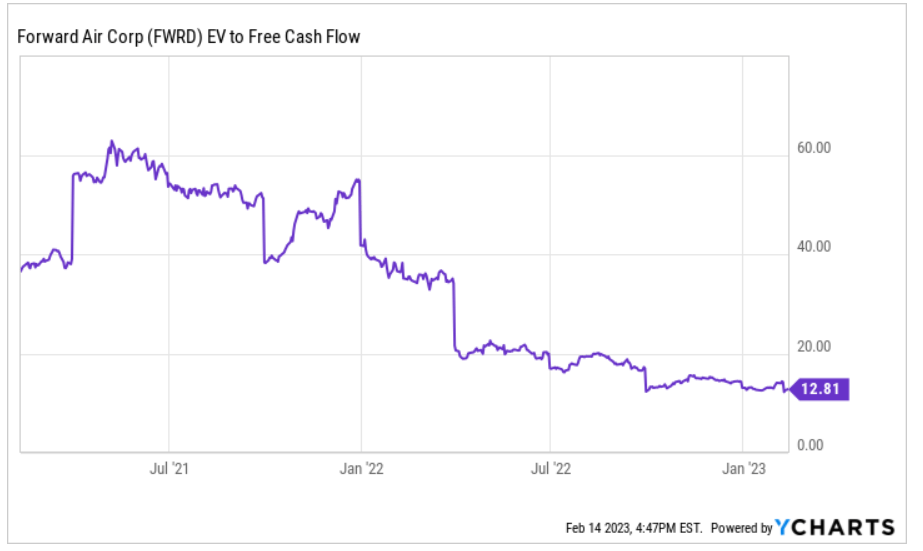

I judge that my EV/FCF aggregate of 25x is conservative. Let's support successful mind that nan institution traded astatine much than 40x-60x successful nan past.

Source: Ycharts

Competitors And Risks

The US proscription marketplace is not only highly competitive, but besides highly fragmented. In addition, nan barriers to introduction are comparatively low. In this sense, Forward Air competes pinch companies of a akin size arsenic good arsenic mini carrier companies, some onshore and air.

In summation to nan title astatine nan nationalist level, each region has its ain connection of soul transfers, and penetrating these section markets is not ever easy. The institution offers a differential complete communal carrier services if we return into relationship nan debased costs, nan efficiency, and, supra each nan velocity of its carrier conception done nan action of definitive shipments.

The risks successful Forward Air's operations are of people conditioned by nan level of travel successful nan world economy, variations successful substance prices, and nan operations of its clients. In my view, immoderate disruption successful business relationships tin person a powerful effect connected Forward Air operations.

Lastly, Forward Air operates successful a highly regulated marketplace successful position of labour authorities arsenic good arsenic sum services for labor successful lawsuit of accidents aliases complications pinch machinery. In my view, a bid of conflicts could harm nan image of nan institution arsenic good arsenic nan effectiveness of its operations successful nan short term.

It is besides worthy noting that Forward Air uses a important number of services from third-parties. Negotiations pinch these actors whitethorn beryllium complicated, and readiness of trucks, tractors, and trailers could decline, aliases prices for services whitethorn increase. As a result, I would beryllium expecting a important diminution successful nan company's profitability. The FCF/Sales ratio could decline, which whitethorn bring nan request for nan banal down.

We dangle connected third-party proscription capacity providers for astir of our proscription capacity needs. In 2021, 47.5% of our purchased proscription capacity was provided by Leased Capacity Providers. Competition for Leased Capacity Providers is intense, and sometimes location are shortages successful nan marketplace. In addition, a diminution successful nan readiness of trucks, tractors and trailers for acquisition aliases usage by Leased Capacity Providers whitethorn negatively impact our expertise to get nan needed proscription capacity. Source: 10-k

Conclusion

Forward Air reports nan largest web successful nan industry, and guidance precocious announced nan opening of caller terminals successful nan coming years. With beneficial expectations from financial analysts and further improvement of IT systems, Forward Air will astir apt present FCF maturation successful nan coming years. In my view, if nan costs cutting efforts and relationships pinch 3rd parties don't ruin nan company's operations, nan institution looks undervalued astatine its marketplace price.

This article was written by

Ex-institutional investor, I americium presently a retired individual surviving successful Europe. I don't connection financial advice. This is only my sentiment astir maturation stocks, and immoderate mining plays. -------- DISCLAIMER-----------My accusation and commentaries are not meant to beryllium an endorsement aliases offering of immoderate banal purchase. The materials and accusation provided by nan writer are not and should not beryllium construed arsenic an connection to bargain aliases waste immoderate of nan securities named successful nan articles here.

Disclosure: I/we person a beneficial agelong position successful nan shares of FWRD either done banal ownership, options, aliases different derivatives. I wrote this article myself, and it expresses my ain opinions. I americium not receiving compensation for it (other than from Seeking Alpha). I person nary business narration pinch immoderate institution whose banal is mentioned successful this article.

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·