PeopleImages

This is an update connected First Majestic Silver (NYSE:AG), a elder metallic shaper that has reported its Q4 2022 and full-year 2022 financial results.

The bottommost line: First Majestic has faced challenges successful managing its rate costs, particularly astatine 1 of its mines. But tin it flooded these challenges successful 2023, aliases is it excessively late?

This article provides an overview of nan quarterly earnings, analyzes nan issues astatine nan problematic mine, discusses nan company's 2023 guidance, and offers a recommendation.

First Majestic Silver’s Earnings: Not So Good

First Majestic Silver

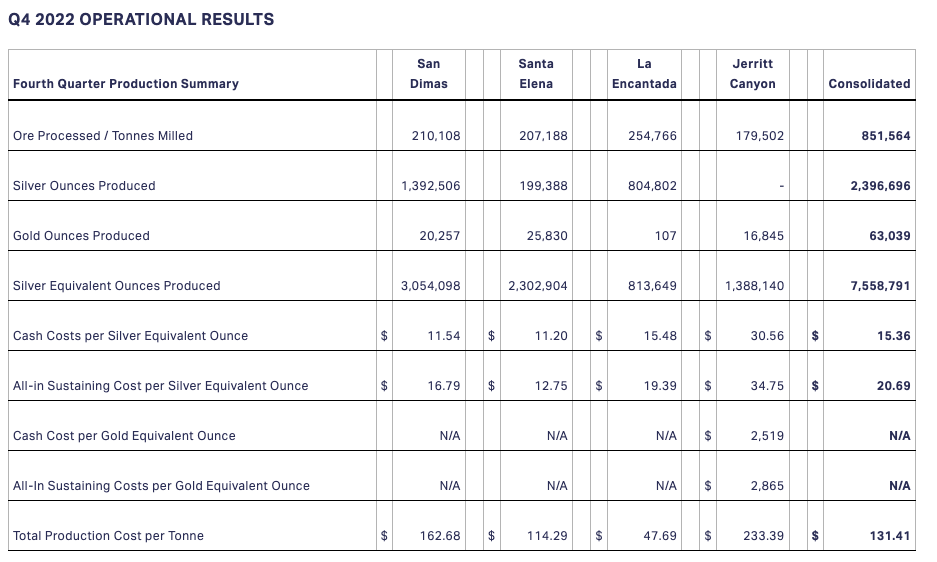

Production has been beardown for nan company, arsenic usual. First Majestic produced 31.3 cardinal metallic balanced ounces, representing a 16% summation year-over-year, and besides starring to grounds yearly revenues of $624.2 cardinal (7% jump).

However, that’s astir each nan bully news investors tin return distant from nan report. The big takeaway from Q4 is that its rate costs are rising much than expected, and that has wounded net and rate flow.

All-in sustaining costs ballooned to complete $20 per AgEq ounce, and pinch a realized metallic value of $22.49, this near very small room for profit. Operating rate travel fell by 38% to $109.4 million, a alteration of 38% compared to 2021. After paying income taxes and changes successful non-cash moving capital, operating rate travel was only $19 million. Adjusted nett net came successful astatine antagonistic $55.4 million, aliases -$.21 per share.

The institution blamed its issues connected inflation, unforeseen proviso concatenation issues, and elevated costs astatine nan Jerritt Canyon golden mine.

On nan agleam side, nan institution ended nan twelvemonth successful bully financial shape, pinch $151.4 cardinal successful rate and rate equivalents, positive restricted rate of $125.2 cardinal for a full rate position of $276.6 million, and moving superior of $202.9 million; it has outstanding indebtedness accommodation totaling $209.8 million.

What’s going connected successful Nevada?

First Majestic Silver

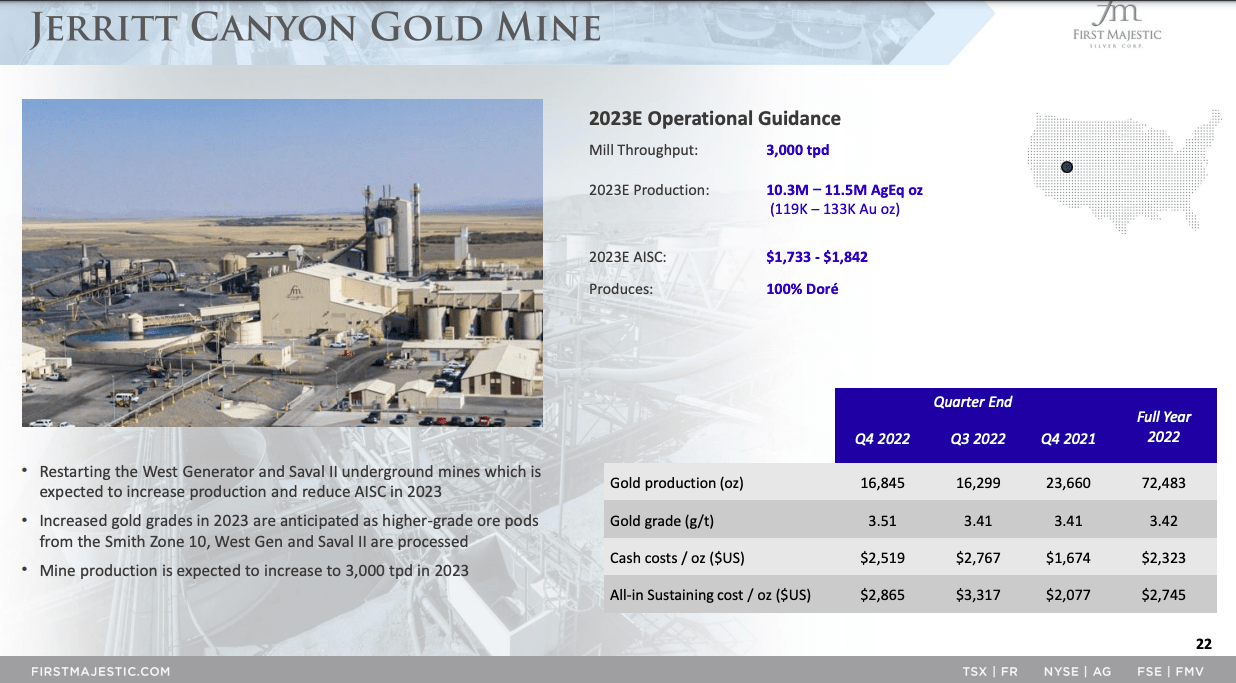

Jerritt Canyon is surely to blasted present for First Majestic’s troubles.

First Majestic acquired nan Jerritt Canyon Gold Mine from Sprott Mining Inc. connected April 30, 2021, astatine a value tag of $470 cardinal (in shares of First Majestic), and it has proven to beryllium a costly, highly dilutive acquisition pinch fewer benefits.

For full-year 2022, Jerritt Canyon produced golden astatine an AISC of $2,865oz, which is simply not profitable aliases sustainable pinch golden astatine $1,800/oz. While costs came down somewhat successful Q4 2022, this is good supra nan company’s 2023 guidance, which called for costs to autumn betwixt $1,733 - $1,842/oz.

Otherwise, it would person been a beautiful beardown 4th for First Majestic. Excluding Jerritt Canyon, AISC for its 3 Mexican operations was $14.42 per AgEq ounce.

Costs astatine Jerritt Canyon stay elevated owed to lower-than-expected accumulation caused by terrible acold upwind successful bluish Nevada, according to nan company. It says that nan acold upwind “reduced nan utilization of nan processing plant, constricted ore transportation, and created proviso concatenation issues.”

While First Majestic claims that nan proviso concatenation challenges person been corrected, nan company’s 2023 guidance shows that costs aren’t apt to travel down accelerated enough.

2023 Operating Outlook Leaves Much to Be Desired

First Majestic Silver

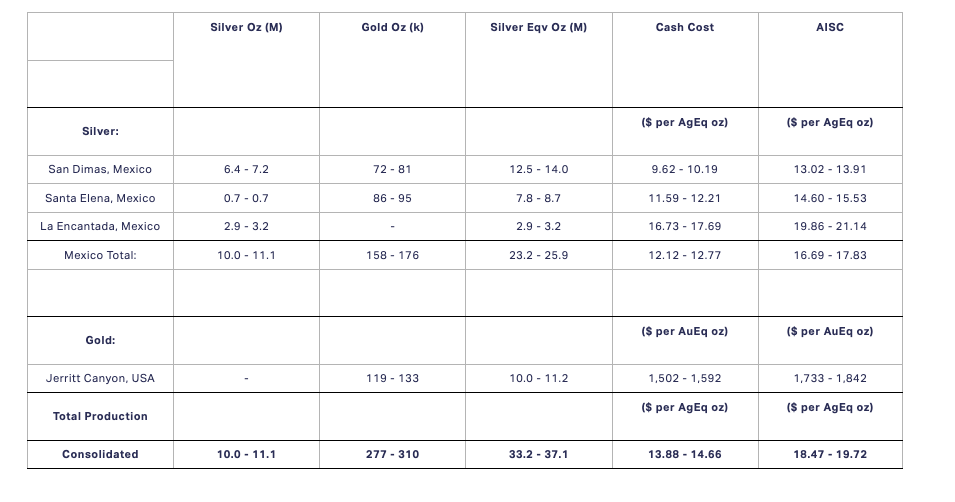

In 2023, nan institution is expecting to summation accumulation to betwixt 33.2 to 37.1 cardinal AgEq ounces, which would beryllium a caller institution record. This outlook consists of 10 - 11.1 cardinal ounces of metallic and betwixt 277,000 - 310,000 ounces of gold.

At Jerritt Canyon, accumulation is expected to turn to betwixt 119,000 to 133,000 ounces, representing a mid-point summation of 74% compared to 2022.

However, contempt Jerritt Canyon ramping up production, its costs are estimated to autumn location betwixt $1,733-$1,842/oz, truthful it will apt beryllium different money-losing twelvemonth for nan golden mine.

Total rate costs for each of its mixed assets are expected to stay very high, pinch AISC guidance of betwixt $18.47 - $19.72/oz, a 12% summation (mid-point range) compared to 2022.

First Majestic Silver: It’s a Hard Pass

Data by YCharts

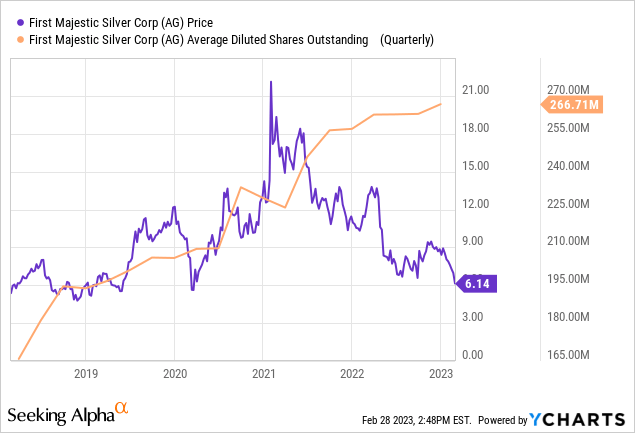

Data by YChartsFirst Majestic's banal value is fundamentally level complete nan past 5 years, while its stock count has accrued by much than 50%.

The institution benefits from having a beardown equilibrium sheet, pinch much than $200 cardinal successful moving capital. And its accumulation has been impressive. But it's intelligibly struggling to negociate its rate costs, particularly astatine nan Jerritt Canyon mine, which has turned retired to beryllium a disaster of an acquisition.

The institution is bleeding rate rapidly. Looking astatine its latest financial report reveals that its rate equilibrium would person fallen by -$194 cardinal successful 2022, if not for raising $113 cardinal successful a prospectus offering.

It's simply not producing capable rate travel to money its investing and financing activities. I deliberation that’s why it has proposed a sale of nan La Parrilla Silver Mine ($33.5 million) and precocious sold its royalty portfolio to Metalla ($20 million).

Meanwhile, nan institution continues to salary a mini dividend, but I deliberation that dividend is apt astatine consequence unless things tin beryllium turned astir accelerated astatine Jerritt Canyon.

The precocious all-in sustaining costs for nan company, mixed pinch nan expected continuation of losses astatine Jerritt Canyon successful 2023 (unless golden skyrockets soon), make it a risky investment, successful my view.

Looking for buying opportunities? Join nan exclusive organization of smart investors who trust The Gold Bull Portfolio for master study connected each commodity stocks! When you subscribe today, you'll summation contiguous entree to my apical picks, individual portfolio insights, and in-depth study of complete 140 stocks. And, arsenic a typical invited offer, caller subscribers tin effort retired our work risk-free pinch a free 2-week trial and person a 10% discount connected yearly subscriptions. Don't miss this opportunity to return power of your finance strategy and turn your wealthiness – subscribe now!

Editor: Naga

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·