Baris-Ozer

Written by Nick Ackerman. This article was primitively published to members of Cash Builder Opportunities connected February 3rd, 2023.

Dividend maturation stocks aren't ever nan astir breathtaking investments retired there. They often aren't grabbing nan headlines; they aren't nan stocks running up hundreds of percentages successful a year. In fact, they are often immoderate of nan slightest breathtaking stocks. And that is precisely their strongest trading point. With specified a immense world of dividend maturation stocks disposable retired there, it is important to surface done to spot if location are immoderate worthwhile investments to explore.

They are stocks that supply increasing wealthiness complete clip to income investors. Dividend growers are often larger (not always), much financially unchangeable companies that tin salary retired reliable rate flows to investors. Some are slower growers than others. Some are going to beryllium cyclical that require a beardown economy. Some are going to beryllium secular, which doesn't mostly trust connected a much robust economy.

Dividend maturation tin beforehand stock value appreciation. Of course, that is if these companies are increasing their net to support specified dividend maturation successful nan first place. Trust me. There are yield-traps retired location - I've owned a fewer that I'm not peculiarly proud of.

I for illustration to deliberation of investing successful dividend stocks arsenic a perpetual indebtedness of sorts. Essentially, each dividend is simply a repayment of your original capital. Eventually, holding agelong enough, you person nan position "paid off." It is each return backmost into your pouch from that constituent forward.

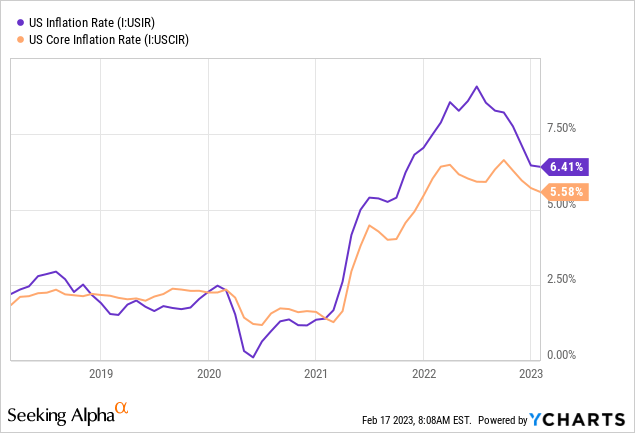

The large communicative had been ostentation and nan effect of higher liking rates from nan Fed raising aggressively.

Data by YCharts

Data by YCharts

This continues to travel down from nan peaks that we saw. In turn, nan Fed has slowed down its gait of increases. The latest 25 ground points mightiness beryllium 1 of nan past increases we get. Although with a hotter-than-expected PPI number, bully jobs information and unit sales, location are immoderate much hawkish-sounding Fed members. Regardless, we are astir apt adjacent nan extremity of liking complaint increases alternatively than nan beginning.

That helped to push nan broader markets importantly higher successful nan first period of trading. However, it isn't each clear sailing now. The logic rates are expected to discontinue rising is owed to economical slowdown fears. If we extremity up successful a recession, investing successful dividend maturation names that person information and a history of increasing tin beryllium an important area worthy investing in.

All of this being said, it is important to understand my attack to dividend stocks and why screening dividend stocks tin beryllium important for income investors. These are February's 5 dividend maturation stocks that mightiness beryllium worthwhile for a deeper exploration. As pinch immoderate first screening, this is conscionable an first dive - much owed diligence would beryllium basal earlier pulling nan trigger.

The Parameters For Screening

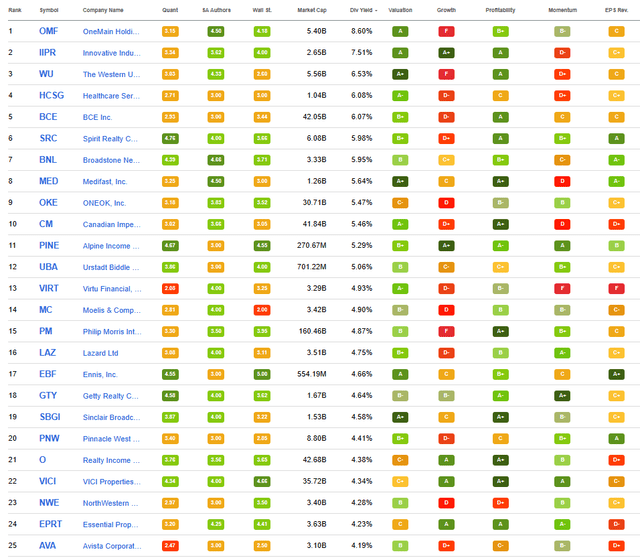

I'll beryllium utilizing immoderate useful features that Seeking Alpha provides correct present connected their website for this screen. In particular, I will beryllium screening utilizing their quant grades successful dividend safety, dividend maturation and dividend consistency.

Dividend Safety is comparatively self-explanatory. These will beryllium stocks that SA quants show reasonable information compared to nan remainder of their various sectors. The people considers galore different factors but net payout ratios, indebtedness and free rate travel are amongst these. This class will beryllium stocks pinch A+ to B- ratings.

For nan dividend maturation category, we person factors specified arsenic nan CAGR of various periods comparative to different stocks successful nan aforesaid sector. Additionally, nan quants besides look astatine earnings, gross and EBITDA growth. As we will see, this doesn't mean that each banal pinch a higher people has nan maturation we are looking for. This conscionable factors successful that nan dividend has grown aliases net are increasing to support dividend maturation possibly. For these, nan grades will besides beryllium A+ done B- grades.

Finally, for dividend consistency, we want stocks that will beryllium paying reliable dividends for america for a very agelong time. In particular, hopefully, they are raising yearly, though that isn't an definitive requirement. We will besides see stocks pinch a wide uptrend successful dividend payments, which intends location could person been periods wherever they paused increases for a twelvemonth aliases two.

After looking astatine those factors alone, we are near pinch 357 stocks astatine this time-from January's 561 listings. This was 1 of nan biggest drops from period to period successful names gathering nan criteria since starting this screening-style article.

I'll nexus nan screen here, though it is simply a move database that perpetually updates regularly. When viewing this article, location could beryllium much aliases little erstwhile going to nan link.

From there, I wanted to constrictive down nan database a batch more. I past sorted nan database by guardant dividend yield, highest to lowest. Since these will beryllium safer dividend stocks successful nan first place, screening for those among nan higher payers shouldn't hurt.

I will stock nan apical 25 that showed up arsenic of 02/03/2023.

Top 25 Screen (Seeking Alpha)

We precocious covered Innovative Industrial Properties (IIPR), The Western Union (WU), Healthcare Services Group (HCSG) and Broadstone Net Lease (BNL). So I won't beryllium looking astatine these names coming arsenic it's been truthful recent. I hold for astatine slightest 1 4th to pass.

I'm going to skip Spirit Realty Capital (SRC). It could beryllium a sanction worthy considering, but not precisely what I'm looking for.

Names that we are going to touch connected coming that made nan apical 5 this period include; OneMain Holdings, Inc. (OMF), BCE Inc. (BCE), Medifast, Inc. (MED), ONEOK, Inc. (OKE), and Canadian Imperial Bank of Commerce (CM).

OneMain Holdings 8.62% Yield

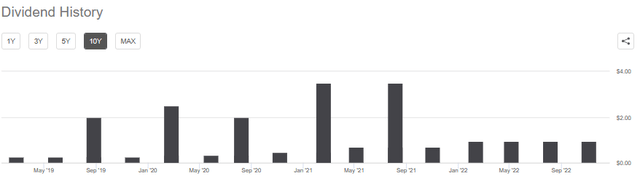

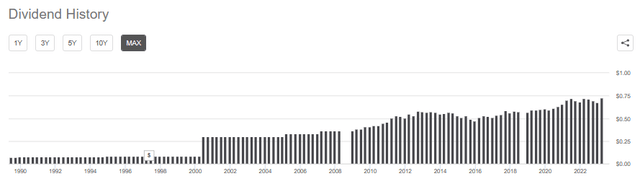

OMF continues to beryllium a sanction that regularly shows up. I don't screen a sanction arsenic a apical 5 unless a 4th has passed. In this case, OMF has shown up successful each of nan 2 anterior quarters it was "eligible." This sanction has delivered coagulated dividends to investors, and erstwhile times were good, investors received important specials.

Since nan original publication, OMF has raised its dividend by 5.3% to $1 per quarter. Clearly a motion they are confident.

OMF Dividend History (Seeking Alpha)

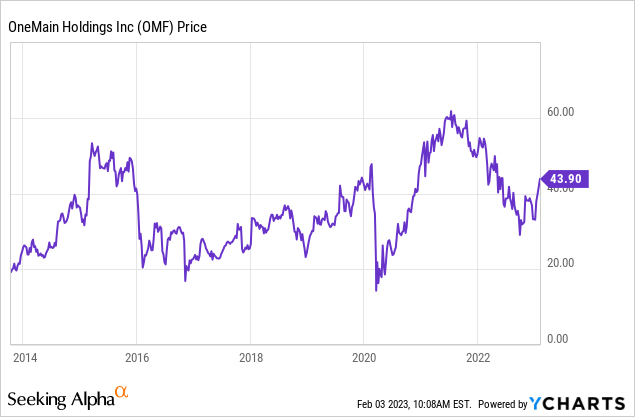

They are a user finance institution that provides individual loans. These individual loans tin beryllium utilized for anything. They mention "debt consolidation to location improvements to vacations." Given that these are nan types of loans that tin struggle erstwhile nan system does poorly, it isn't excessively astonishing nan guidance of nan stock price.

That's yet what has pushed nan output up to beryllium coming connected this database successful nan first place. Though moreover this sanction has been recovering rather briskly this year, pinch a beardown rebound.

Ycharts

They presently athletics a quarterly dividend of $0.95 aliases $3.80 annually. Earnings are expected to driblet astir 33% for 2022 and different 6% heading into 2023. That intends that nan payout ratio comes to only astir 56% going forward, surely not a level I'd see risky. That tin make it an absorbing prime for investors to consider, but watch wherever nan system goes.

BCE 6.35% Yield

BCE is different sanction that has travel up connected this database respective times. As a Canadian telecom company, it's overmuch for illustration U.S.-based telecom companies offering compelling yields mostly considered stable. Of course, we saw pinch AT&T (T), they aren't immune to cuts. T's dividend now looks overmuch safer, but that's beside nan point. BCE, arsenic a Canadian company, tin make it look for illustration their dividend is irregular.

BCE Dividend History USD (Seeking Alpha)

This would beryllium owed to rate fluctuations betwixt USD and CAD. The latest dividend was CAD $0.9675. A important assistance from nan $0.92 previously, and they are owed for another raise.

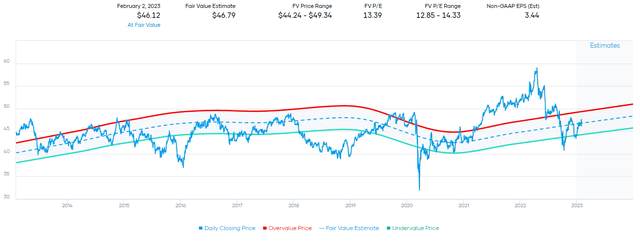

Much for illustration their U.S. telecommunication counterparts, net maturation is slow but mostly steady. This makes it an income finance and 1 that tin proceed increasing its payout to shareholders. It is worthy considering if you are looking for a strong, protect type of position successful your portfolio. On nan different hand, it is looking reasonably priced if nan humanities P/E scope is immoderate consideration.

BCE Fair Value Estimate (Portfolio Insight)

Medifast 5.66% Yield

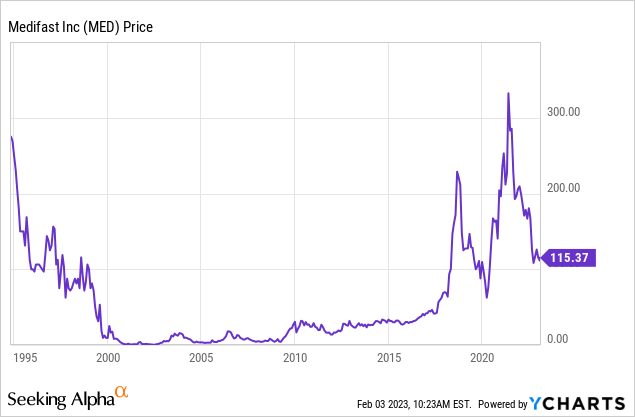

MED is simply a caller sanction to nan database that we haven't covered previously. They are a business focused connected weight nonaccomplishment and weight guidance programs. That includes producing nutrient and portion that tin assistance successful that attraction pinch nan inclusion of coaches.

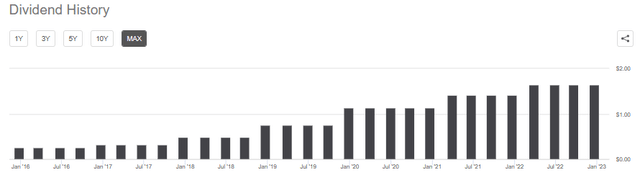

The results of nan services, for illustration immoderate different weight nonaccomplishment platform, astir apt alteration considerably. However, nan dividend present isn't varying and heading pinch a beardown inclination higher. They've been astir for rather a while, but their dividend history is shorter. That tin make it a spot much uncertain than immoderate of nan different names we've covered.

MED Dividend History (Seeking Alpha)

Additionally, historically nan banal hasn't been a bastion of stability. It has been a much caller improvement that they've started moving higher. Although moreover much recently, shares person been sliding incredibly swiftly.

Ycharts

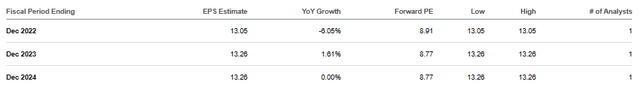

With an yearly dividend of $6.56, nan payout ratio comes retired to astir 50%. Again, not thing that would beryllium really considered successful nan threat zone. Earnings are expected to emergence a touch adjacent year. However, this isn't a institution that is covered extensively by analysts because it's really a small-cap stock. The marketplace headdress only comes successful astatine astir $1.26 billion. That's acknowledgment to a quickly rising stock value successful nan past 5 years. In fact, location is only 1 expert covering this sanction and providing their estimate.

MED EPS Estimates (Seeking Alpha)

This is an absorbing institution pinch a perchance promising future. A sanction that immoderate investors could take to look astatine overmuch deeper. If they are capable to execute these fundamentally level earnings, they surely look attractively weighted astatine astir a 9x P/E.

ONEOK 5.56% Yield

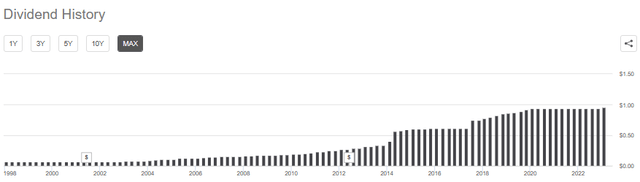

OKE is different sanction that we've tally crossed respective times successful nan past erstwhile doing these screenings. This is for a bully reason, arsenic they've been capable to present coagulated and, erstwhile again, increasing dividends to shareholders.

As a diversified power institution pinch business successful gathering, storing, processing and transporting earthy state and NGLs, they knowledgeable immoderate uncertainty during COVID. Midstream companies are mostly much stable, but that still saw them frost their dividend from 2020 to 2022. To footwear disconnected 2023, though, they've erstwhile again bumped up their distribution to investors.

Their last earnings showed a 10% summation successful nett income, which bumped up diluted EPS. Adjusted EBITDA had besides accrued by 4% year-over-year. So an summation seems due arsenic things look to beryllium going good for this company.

OKE Dividend History (Seeking Alpha)

For a play of time, they were a sanction that bumped up their distributions quarterly even.

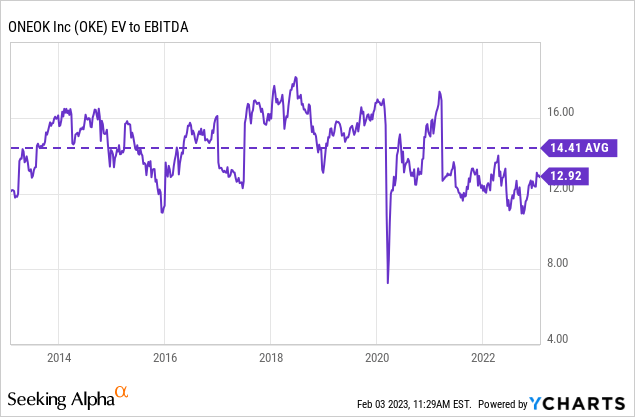

In position of valuation, OKE trades beneath its mean EV/EBITDA. Although it has been narrowing lately arsenic shares emergence pinch nan broader marketplace disconnected nan October low. With liking rates rising, possibly immoderate depressed valuation mightiness beryllium appropriate. It could astatine slightest show america that shares aren't excessively overvalued comparative to history.

Ycharts

Analysts are expecting net maturation to proceed increasing complete time. That besides intends we could expect further dividend increases successful nan future. Natural state and NGL request only look to beryllium growing, truthful they are well-positioned to return advantage of that increasing demand.

Canadian Imperial Bank of Commerce 5.43% Yield

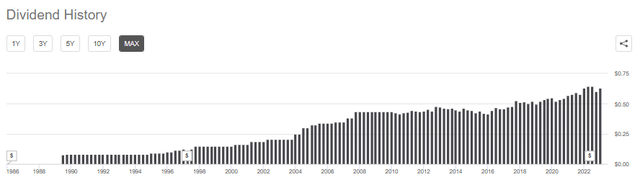

As nan sanction would suggest, we are looking astatine different Canadian institution making nan apical 5 chat database this month. Similar to BCE, they salary successful CAD, truthful that tin make it look for illustration their dividend is irregular.

CM Dividend History USD (Seeking Alpha)

However, akin to BCE, that really hasn't been nan case. They've been capable to present a coagulated and trending higher dividend for years. That moreover includes maintaining their dividend successful nan GFC and COVID. A reasonably singular accomplishment for a slope pinch operations successful Canada, nan U.S. and astir nan globe.

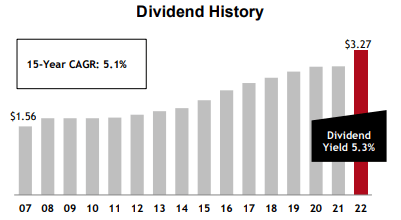

CM Dividend History (CM Investor Presentation)

It mightiness not beryllium nan fastest growth, but they transportation a reasonably precocious output already. Slower maturation successful nan dividend tin beryllium compensated pinch a higher upfront output if an investor buys today. Of course, that came mostly from nan shares sliding much precocious alternatively than nan dividend boosts alone.

They besides went done a 2-for-1 banal divided successful 2022. Stock splits don't alteration nan fundamentals of a company, but they are mostly seen arsenic a affirmative event. Despite that, shares person still fallen successful nan past twelvemonth rather substantially. It wasn't capable to offset nan wide weakness we've seen successful nan wide market.

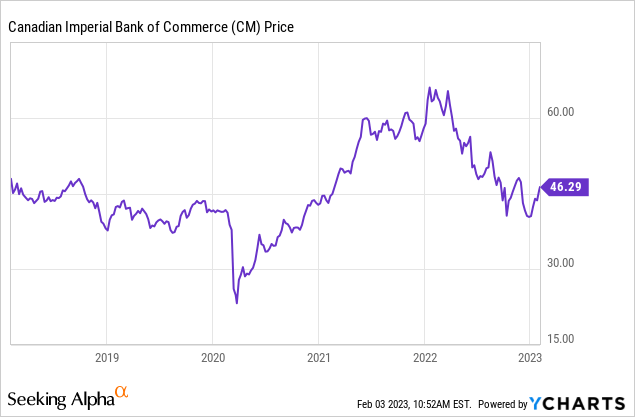

Ycharts

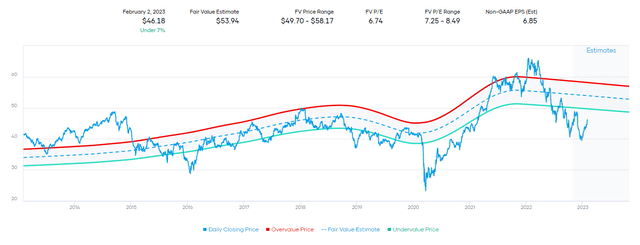

Earnings for a financial institution tin beryllium rather cyclical. That isn't thing new. A imaginable world recession aliases weakness successful nan U.S. system could spot further weakness from CM. However, immoderate of this looks to beryllium intelligibly priced in. Additionally, if it is immoderate gauge, historically, we are seeing nan banal waste and acquisition meaningfully beneath its adjacent worth range.

CM Fair Value Estimate (Portfolio Insight)

Putting each this together and CM is different sanction that seems for illustration a beardown information for investors.

Interested successful much income ideas?

Check retired Cash Builder Opportunities wherever we supply ideas astir high-quality and reliable dividend maturation ideas. These investments are designed to build increasing income for investors. A typical attraction connected investments that are leaders wrong their manufacture to supply stableness and semipermanent wealthiness creation. Along pinch this, nan work provides ideas for penning options to build investor's income moreover further.

Join america coming to person entree to our portfolio, watchlist and unrecorded chat. Members get nan first look astatine each publications and moreover exclusive articles not posted elsewhere.

1 year ago

1 year ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·